Underwriting involves an underwriter guaranteeing the sale of securities by purchasing the entire issue before reselling it to investors, ensuring the issuer raises the desired capital. Book-building is a dynamic process where underwriters collect investor bids to determine the optimal price and demand for a new issue, balancing supply and market appetite. Both methods are crucial for accurate pricing and successful capital raising in equity and debt markets.

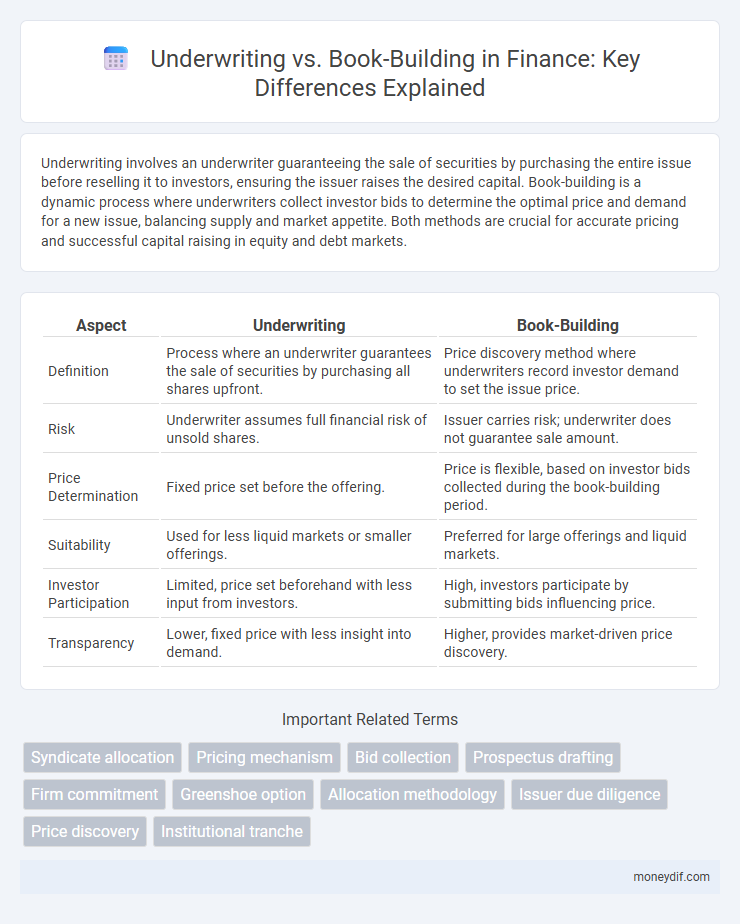

Table of Comparison

| Aspect | Underwriting | Book-Building |

|---|---|---|

| Definition | Process where an underwriter guarantees the sale of securities by purchasing all shares upfront. | Price discovery method where underwriters record investor demand to set the issue price. |

| Risk | Underwriter assumes full financial risk of unsold shares. | Issuer carries risk; underwriter does not guarantee sale amount. |

| Price Determination | Fixed price set before the offering. | Price is flexible, based on investor bids collected during the book-building period. |

| Suitability | Used for less liquid markets or smaller offerings. | Preferred for large offerings and liquid markets. |

| Investor Participation | Limited, price set beforehand with less input from investors. | High, investors participate by submitting bids influencing price. |

| Transparency | Lower, fixed price with less insight into demand. | Higher, provides market-driven price discovery. |

Introduction to Underwriting and Book-Building

Underwriting involves a financial institution guaranteeing the sale of a new security issue by purchasing it outright and reselling it to investors, which mitigates the issuer's risk of unsold shares. Book-building is a price discovery process where underwriters solicit bids from institutional investors to determine the optimal offer price based on demand for the securities. Both methods are essential in capital markets, with underwriting providing certainty of capital and book-building optimizing pricing through market feedback.

Definition and Key Concepts

Underwriting in finance involves a financial institution guaranteeing the purchase of an entire securities issuance, absorbing risk by committing capital upfront. Book-building is a price discovery process where underwriters collect investor demand and price indications to determine the optimal offering price before the public issuance. Underwriting ensures security sale certainty, while book-building optimizes pricing based on market response.

Historical Evolution in Capital Markets

Underwriting emerged in the early 20th century as a principal method for investment banks to guarantee capital raising by purchasing entire securities issues, providing issuers with price certainty and risk mitigation. Book-building developed later in the 1980s as a dynamic market-driven approach, enabling price discovery through investor demand, enhancing price efficiency in equity offerings. Both mechanisms evolved to address market liquidity and information asymmetry, shaping modern capital market issuance strategies.

Underwriting Process Explained

The underwriting process involves assessing the risk and determining the appropriate price for securities before they are issued to investors. Underwriters, typically investment banks, commit to purchasing the entire issue, guaranteeing the issuer a fixed amount of capital regardless of market demand. This contrasts with book-building, where underwriters gauge investor interest to set the final price without guaranteeing full subscription.

Book-Building Process Explained

Book-building is a price discovery mechanism used in securities issuance, where underwriters gather investor demand to determine the optimal price range for the offering. This process involves soliciting bids from qualified investors, which helps establish market interest and price sensitivity before finalizing the issue price. Unlike traditional underwriting, book-building offers flexibility in pricing and allocation, improving capital raising efficiency and aligning share valuation with real-time investor sentiment.

Major Differences: Underwriting vs Book-Building

Underwriting involves an underwriter guaranteeing the sale of securities by purchasing the entire issue from the issuer, ensuring capital raising with reduced risk to the issuer, while book-building is a price discovery process where bids by institutional investors determine the offer price without guaranteed purchase by underwriters. In underwriting, the underwriter assumes full financial risk and holds the securities if unsold, contrasting with book-building where demand insights from institutional investors shape pricing but the issuer's risk depends on final subscription. The underwriting method prioritizes risk transfer and capital guarantee, whereas book-building emphasizes market-driven pricing and investor-driven allocation strategies.

Advantages and Disadvantages of Underwriting

Underwriting guarantees capital raising by ensuring the issuer receives the entire amount of the securities offered, reducing market uncertainty and providing immediate liquidity. However, underwriting involves higher costs and risks for underwriters, who may suffer losses if the securities are not fully subscribed. Compared to book-building, underwriting lacks pricing flexibility and may lead to mispriced securities due to fixed pricing commitments.

Benefits and Limitations of Book-Building

Book-building enables issuers to gauge investor demand and price securities dynamically through market-driven bids, enhancing price discovery and reducing underpricing risks in equity offerings. Its flexibility benefits companies by allowing adjustments in the offer price based on real-time investor feedback, fostering transparency and efficient capital allocation. However, book-building may involve higher costs and complexity compared to fixed-price methods, and its success heavily depends on the underwriters' market reputation and investor participation.

Selection Criteria: Which Method to Choose?

Underwriting involves issuing securities with a firm commitment from underwriters who assume the risk, ideal for companies seeking guaranteed capital and price stability. Book-building enables price discovery through investor demand, suitable for those prioritizing market-driven pricing and flexibility. Selection criteria depend on factors such as risk tolerance, market conditions, investor confidence, and the issuer's capital requirements.

Impact on Investors and Issuers

Underwriting provides issuers with guaranteed capital by transferring risk to underwriters, ensuring immediate fund access but potentially limiting pricing flexibility for investors. Book-building allows price discovery through investor demand, benefiting issuers with potentially higher proceeds and offering investors transparency but with increased price uncertainty. These mechanisms balance risk and reward differently, influencing capital costs and investment confidence in financial markets.

Important Terms

Syndicate allocation

Syndicate allocation in underwriting involves distributing shares among underwriters based on their commitment and participation, optimizing risk and capital deployment. In book-building, allocation focuses on investor demand and pricing feedback, enabling underwriters to set optimal offer prices and allocate shares efficiently to maximize market reception.

Pricing mechanism

Pricing mechanisms in underwriting involve setting a fixed price for securities before the public offering, ensuring guaranteed capital for issuers, whereas book-building relies on collecting investor demand bids to determine a market-driven price. Underwriting provides price certainty but less flexibility, while book-building enhances price discovery and allocation efficiency based on real-time investor feedback.

Bid collection

Bid collection in underwriting involves gathering investor commitments to purchase securities at predetermined prices, ensuring guaranteed capital for issuers, whereas book-building is a market-driven process that collects bids at various price levels to determine the optimal offering price through demand assessment. Efficient bid collection enhances price discovery and allocation accuracy, directly impacting underwriting risk and the success of the book-building process.

Prospectus drafting

Prospectus drafting requires precise disclosure of underwriting commitments and book-building processes to ensure transparent capital market offerings.

Firm commitment

Firm commitment underwriting involves the underwriter purchasing the entire issue of securities from the issuer and reselling them to the public, assuming full financial risk. In contrast, book-building is a price discovery process where underwriters gauge investor demand and set the final offering price, often without immediately underwriting the entire issue.

Greenshoe option

The Greenshoe option enhances underwriting flexibility by allowing underwriters to sell up to 15% more shares during book-building to stabilize share price.

Allocation methodology

Allocation methodology in underwriting prioritizes predetermined criteria and investor commitments, whereas book-building relies on dynamic market demand and price discovery to allocate shares.

Issuer due diligence

Issuer due diligence in underwriting involves a thorough assessment of the issuer's financial health, legal standing, and business prospects to ensure accurate risk evaluation and pricing of securities. In book-building, issuer due diligence focuses on gathering market feedback and investor demand to optimize price discovery and allocation strategies during the offering process.

Price discovery

Price discovery in underwriting involves setting a fixed price for securities before the offering, limiting market input, while book-building dynamically gathers investor demand and price feedback during the subscription period to efficiently determine an optimal issue price based on real-time market conditions. The book-building process enhances price discovery accuracy by reflecting actual investor valuation, often resulting in better alignment of offer price with market demand compared to the static pricing in traditional underwriting.

Institutional tranche

Institutional tranche refers to the portion of a securities offering allocated to institutional investors during underwriting, where underwriters guarantee the sale of the entire tranche by purchasing securities upfront. In contrast, book-building involves underwriters collecting bids from investors to determine the final price and allocation within the institutional tranche, optimizing demand and pricing accuracy.

underwriting vs book-building Infographic

moneydif.com

moneydif.com