Mark-to-market accounting values assets based on current market prices, providing real-time transparency and accuracy in financial statements. Mark-to-model, on the other hand, relies on theoretical models to estimate asset values when market prices are unavailable or illiquid. This approach introduces subjectivity and potential valuation risk but is essential for pricing complex or infrequent instruments.

Table of Comparison

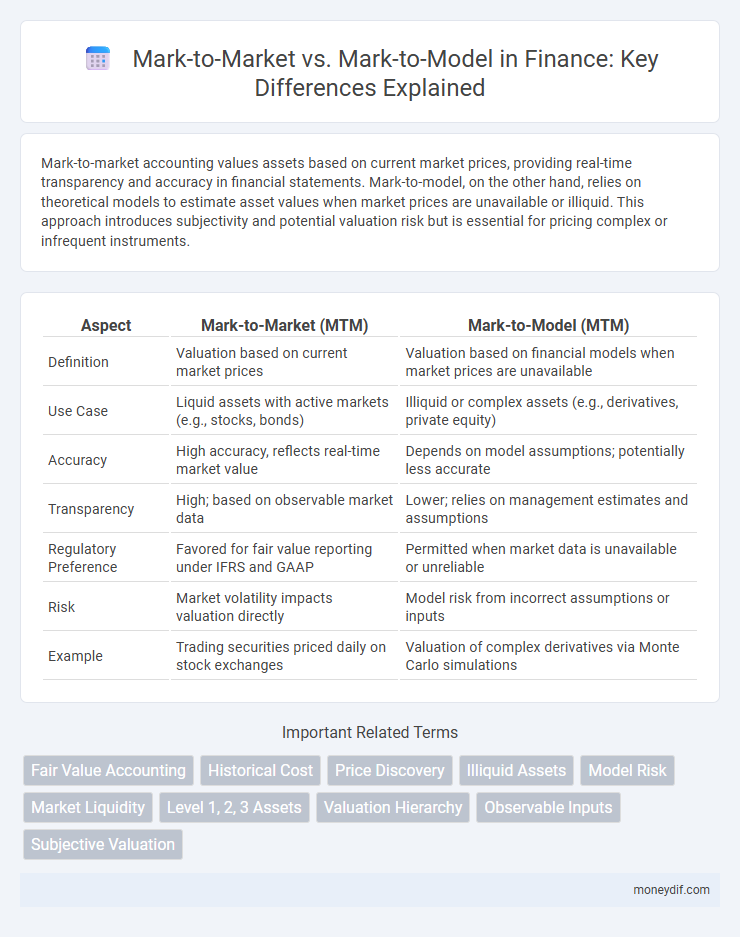

| Aspect | Mark-to-Market (MTM) | Mark-to-Model (MTM) |

|---|---|---|

| Definition | Valuation based on current market prices | Valuation based on financial models when market prices are unavailable |

| Use Case | Liquid assets with active markets (e.g., stocks, bonds) | Illiquid or complex assets (e.g., derivatives, private equity) |

| Accuracy | High accuracy, reflects real-time market value | Depends on model assumptions; potentially less accurate |

| Transparency | High; based on observable market data | Lower; relies on management estimates and assumptions |

| Regulatory Preference | Favored for fair value reporting under IFRS and GAAP | Permitted when market data is unavailable or unreliable |

| Risk | Market volatility impacts valuation directly | Model risk from incorrect assumptions or inputs |

| Example | Trading securities priced daily on stock exchanges | Valuation of complex derivatives via Monte Carlo simulations |

Understanding Mark-to-Market Accounting

Mark-to-market accounting values assets based on current market prices, providing transparent and up-to-date financial statements. It relies on observable market data, enhancing accuracy and reducing estimation risk compared to mark-to-model methods. Financial institutions use mark-to-market to reflect real-time asset values, crucial for risk assessment and regulatory compliance.

What is Mark-to-Model Valuation?

Mark-to-model valuation estimates an asset's value using financial models and assumptions when direct market prices are unavailable or illiquid. It relies on inputs such as projected cash flows, volatility, and discount rates to derive theoretical prices, often applied in complex derivatives or private equity. This method introduces subjective judgment, increasing the risk of valuation discrepancies compared to market-based mark-to-market approaches.

Key Differences Between Mark-to-Market and Mark-to-Model

Mark-to-market valuation reflects the current market price of an asset based on actual trades, ensuring transparency and real-time accuracy, while mark-to-model relies on financial models and assumptions to estimate the asset's value in the absence of an active market. Mark-to-market provides a more objective and market-driven measure, whereas mark-to-model introduces subjectivity and potential valuation risk due to model limitations and parameter uncertainty. The choice between these methods significantly impacts financial reporting, risk management, and regulatory compliance in portfolio valuation.

Advantages of Mark-to-Market Methods

Mark-to-market valuation offers enhanced transparency by reflecting current market prices, enabling accurate and timely assessment of asset values. This method improves risk management by providing real-time data, which supports informed decision-making and regulatory compliance. It reduces the likelihood of valuation manipulation, fostering greater trust among investors and stakeholders in financial reporting.

Advantages of Mark-to-Model Approaches

Mark-to-model approaches offer enhanced flexibility in valuing complex or illiquid financial instruments when market prices are unavailable, allowing firms to incorporate proprietary valuation models and assumptions tailored to specific assets. This method enables risk managers and analysts to estimate fair value based on underlying factors, improving decision-making in opaque markets. Furthermore, mark-to-model supports forward-looking valuations that can incorporate anticipated market changes, providing a strategic advantage over sole reliance on observable market prices.

Potential Risks and Drawbacks of Each Method

Mark-to-market valuation exposes firms to significant volatility due to reliance on current market prices, which can fluctuate rapidly during periods of illiquidity or market stress, potentially leading to distorted financial statements. Mark-to-model, while useful when market prices are unavailable, carries risks of subjective assumptions and model errors, often resulting in valuation manipulation or lack of transparency. Both methods can impact risk management accuracy and investor confidence, necessitating robust controls and disclosures to mitigate potential financial misstatements.

Real-World Examples: Mark-to-Market vs Mark-to-Model

Mark-to-market accounting values assets based on current market prices, exemplified by investment funds marking stock portfolios daily using exchange prices, ensuring transparency and real-time risk assessment. Mark-to-model, used when market prices are unavailable or illiquid, relies on financial models and assumptions, such as valuing complex derivatives or private equity holdings, but introduces potential estimation biases and model risk. During the 2008 financial crisis, discrepancies between mark-to-market and mark-to-model valuations highlighted challenges in asset liquidity and fair value reporting.

Regulatory Perspectives and Compliance Considerations

Regulatory frameworks increasingly emphasize mark-to-market accounting for its transparency and reliance on observable market prices, which strengthens compliance by reducing subjectivity and valuation risk. Mark-to-model methods, while necessary for illiquid or complex assets, face heightened scrutiny due to potential manipulation and model risk, prompting regulators to demand robust validation, stress testing, and detailed disclosures. Ensuring adherence to standards like IFRS 13 and ASC 820 is critical for maintaining consistency, auditability, and investor confidence in financial reporting.

Impact on Financial Statements and Investor Decision-Making

Mark-to-market accounting reflects the current market value of assets and liabilities, providing transparent and timely financial statements that enhance investor confidence through real-time valuation. Mark-to-model relies on valuation models and estimates, introducing subjectivity and potential bias that can obscure true asset values and increase uncertainty in investor decision-making. The choice between these methods significantly affects reported earnings, risk assessment, and market perception, influencing investment strategies and regulatory scrutiny.

Choosing the Right Valuation Method for Your Portfolio

Choosing the right valuation method for your portfolio hinges on the availability and reliability of market data. Mark-to-market valuation provides real-time, transparent pricing based on current market prices, ideal for liquid assets with active trading. In contrast, Mark-to-model relies on complex financial models to estimate value when market prices are unavailable or illiquid, requiring rigorous validation to minimize model risk and ensure accurate portfolio assessment.

Important Terms

Fair Value Accounting

Fair value accounting uses mark-to-market to value assets using current market prices while mark-to-model estimates fair value based on financial models when market prices are unavailable.

Historical Cost

Historical cost records asset values based on original purchase price, offering consistency but lacking real-time valuation like mark-to-market, which reflects current market prices for greater accuracy in financial reporting. Mark-to-model uses valuation models when market prices are unavailable, introducing estimation risks compared to the objective data in historical cost and mark-to-market methods.

Price Discovery

Price discovery relies on mark-to-market for real-time asset valuation based on current market prices, while mark-to-model uses theoretical models to estimate prices when market data is unavailable or illiquid.

Illiquid Assets

Illiquid assets pose significant challenges for valuation due to the absence of active markets, making mark-to-market methods unreliable and often necessitating mark-to-model approaches that rely on complex financial models and assumptions. This reliance increases valuation uncertainty and potential estimation errors, impacting financial reporting and risk assessment for portfolios dominated by illiquid instruments.

Model Risk

Model risk arises from relying on mark-to-model valuations when market prices are unavailable or illiquid, potentially leading to inaccurate asset valuations and financial statements. Mark-to-market methods use observable market prices, reducing model risk but may be impractical in markets with low liquidity or during financial crises.

Market Liquidity

Market liquidity significantly impacts the accuracy of mark-to-market valuations, as highly liquid markets provide continuous price data for precise asset pricing. In contrast, mark-to-model valuations become essential in illiquid markets where observable prices are scarce, requiring financial models to estimate fair value based on assumptions and inputs.

Level 1, 2, 3 Assets

Level 1 assets are marked-to-market using direct market prices, Level 2 assets rely on observable inputs for mark-to-market valuation, while Level 3 assets require mark-to-model techniques based on unobservable inputs and complex financial models.

Valuation Hierarchy

The Valuation Hierarchy prioritizes Level 1 inputs using observable market prices (Mark-to-market) over Level 3 inputs derived from unobservable assumptions (Mark-to-model) to enhance financial reporting accuracy.

Observable Inputs

Observable inputs are market-based data points used in mark-to-market valuations, reflecting real-time transaction prices and quoted market rates to ensure objective asset pricing. Mark-to-model valuations rely on unobservable inputs derived from internal models, estimating asset values in the absence of active market data, which may introduce greater subjectivity and valuation risk.

Subjective Valuation

Subjective valuation, often influenced by mark-to-model methods, introduces estimation uncertainty compared to the objective, market-based pricing of mark-to-market accounting.

Mark-to-market vs Mark-to-model Infographic

moneydif.com

moneydif.com