Fungible assets, such as stocks or currencies, are interchangeable and can be exchanged on a one-to-one basis without loss of value. Non-fungible assets, like real estate or NFTs, possess unique characteristics that make each item distinct and irreplaceable. Understanding the differences between fungible and non-fungible assets is crucial for effective portfolio diversification and risk management.

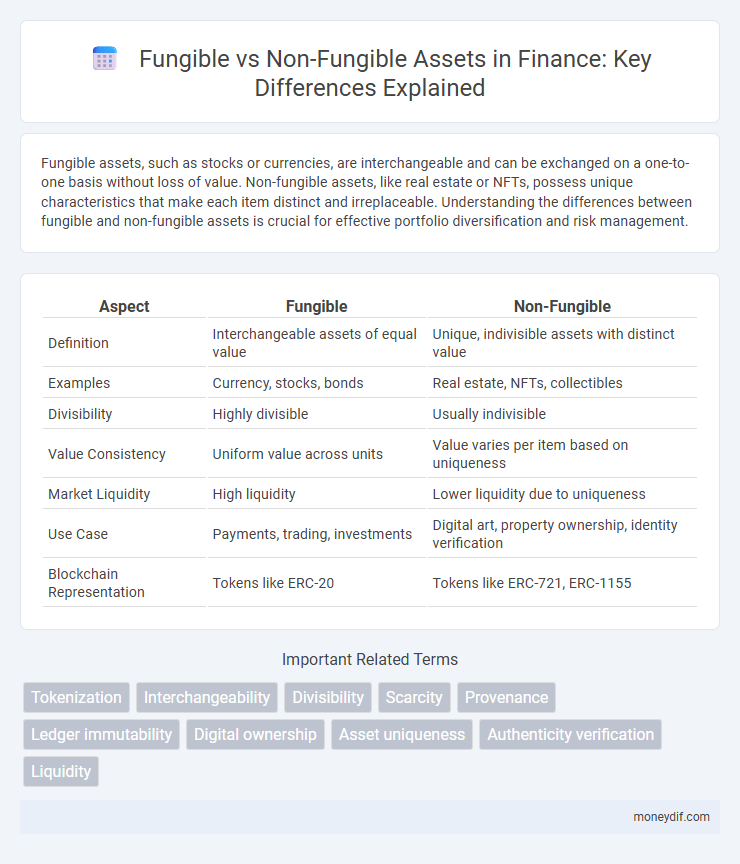

Table of Comparison

| Aspect | Fungible | Non-Fungible |

|---|---|---|

| Definition | Interchangeable assets of equal value | Unique, indivisible assets with distinct value |

| Examples | Currency, stocks, bonds | Real estate, NFTs, collectibles |

| Divisibility | Highly divisible | Usually indivisible |

| Value Consistency | Uniform value across units | Value varies per item based on uniqueness |

| Market Liquidity | High liquidity | Lower liquidity due to uniqueness |

| Use Case | Payments, trading, investments | Digital art, property ownership, identity verification |

| Blockchain Representation | Tokens like ERC-20 | Tokens like ERC-721, ERC-1155 |

Understanding Fungibility in Finance

Fungibility in finance refers to assets that are interchangeable and identical in value, such as currency, stocks, or bonds, enabling seamless trading and valuation. Non-fungible assets, like real estate, collectibles, or NFTs, possess unique characteristics that prevent direct substitution, impacting liquidity and market dynamics. Recognizing the difference between fungible and non-fungible assets is crucial for portfolio diversification, risk assessment, and investment strategies.

What Makes an Asset Non-Fungible?

A non-fungible asset possesses unique attributes or characteristics that distinguish it from other assets, making it irreplaceable and not interchangeable on a one-to-one basis. In finance, these assets often include collectibles, real estate, or digital tokens such as NFTs, where individuality and provenance drive value. The lack of standardization and identical counterparts is what fundamentally defines an asset as non-fungible.

Key Differences: Fungible vs Non-Fungible Assets

Fungible assets, such as cash or stocks, possess uniform value and are interchangeable, allowing each unit to be exchanged equivalently with another. Non-fungible assets, including real estate or NFTs, are unique and cannot be exchanged on a one-to-one basis due to distinct characteristics and varying valuations. The key difference lies in fungibility, where fungible assets enable seamless liquidity and standardization, whereas non-fungible assets require individualized appraisal and carry distinct ownership proofs.

Real-World Examples of Fungible Assets

Fungible assets such as stocks, bonds, and gold bars demonstrate interchangeability, where each unit holds identical value and can be exchanged seamlessly. For instance, one share of Apple stock is equivalent to another share of the same class, making trading straightforward on financial markets. Similarly, commodities like crude oil barrels and U.S. Treasury bonds serve as fungible assets, enabling liquidity and standardization in investment portfolios.

Real-World Examples of Non-Fungible Assets

Non-fungible assets in finance include unique properties such as real estate, individual artworks, and rare collectibles, each possessing distinct characteristics that prevent direct interchange. Unlike fungible assets like stocks or currencies, non-fungible assets hold unique value based on factors such as location, provenance, and rarity. Real-world examples like historic buildings, limited-edition art pieces, and vintage cars demonstrate how ownership and valuation of non-fungible assets are determined by their exclusivity and market demand.

The Role of Fungibility in Liquidity and Trade

Fungibility plays a critical role in enhancing liquidity by allowing assets like stocks or currencies to be easily interchangeable and tradable without loss of value. Non-fungible assets, such as unique real estate or NFTs, have individualized characteristics that limit their ability to be quickly exchanged, impacting market liquidity. The degree of fungibility directly influences transaction efficiency, price stability, and the speed of trade execution in financial markets.

How Blockchain Technology Influences Fungibility

Blockchain technology enhances fungibility by providing a transparent, immutable ledger that ensures each unit of a digital asset is identical and interchangeable, as seen with cryptocurrencies like Bitcoin. Smart contracts automate the verification process, maintaining uniformity and reducing counterfeiting risks. In contrast, non-fungible tokens (NFTs) leverage blockchain to establish uniqueness and provenance, highlighting the contrast in asset fungibility.

Investment Implications: Fungible vs Non-Fungible Tokens

Fungible tokens, such as cryptocurrencies like Bitcoin and Ethereum, offer high liquidity and ease of trading, making them attractive for investors seeking diversified portfolios and quick asset turnover. Non-fungible tokens (NFTs) represent unique digital assets with distinct value propositions, often linked to art, collectibles, or intellectual property, appealing to investors focused on long-term appreciation and exclusivity. Understanding the liquidity risks and market volatility differences between fungible tokens and NFTs is critical for developing balanced investment strategies in the evolving digital asset landscape.

Risks and Challenges of Non-Fungible Assets

Non-fungible assets present significant risks including liquidity challenges due to their unique nature and limited market demand, making valuation and resale difficult. They often face regulatory uncertainty and potential for fraud, as ownership verification and provenance tracking require robust authentication methods. Furthermore, market volatility and lack of standardized frameworks increase the complexity and risk exposure for investors holding non-fungible tokens (NFTs) or similar digital assets.

Future Trends: Will Non-Fungible Assets Transform Finance?

Non-fungible assets, powered by blockchain technology, are poised to revolutionize finance by enabling unique ownership and provenance verification for digital and physical assets. Future trends indicate increased integration of non-fungible tokens (NFTs) in decentralized finance (DeFi) platforms, unlocking innovative financial products such as NFT-based collateral and fractional ownership. This transformation challenges traditional fungible asset models by introducing scarcity and uniqueness, creating new opportunities for asset liquidity and investment diversification.

Important Terms

Tokenization

Tokenization divides assets into digital tokens, distinguishing fungible tokens that are interchangeable and identical in value, such as cryptocurrencies, from non-fungible tokens (NFTs) that represent unique, indivisible assets with distinct ownership rights, commonly used for digital art and collectibles. This differentiation enables diverse applications in digital ownership, trading, and asset management across blockchain platforms.

Interchangeability

Interchangeability refers to the ability to replace one asset with another of the same kind without loss of value, a key characteristic of fungible items like cryptocurrencies and fiat money. Non-fungible assets, such as NFTs and unique collectibles, lack interchangeability due to their distinct attributes and individual value.

Divisibility

Divisibility in digital assets allows fungible tokens like cryptocurrencies to be broken into smaller units for flexible transactions, whereas non-fungible tokens (NFTs) are indivisible, representing unique items or collectibles. This fundamental difference impacts liquidity and use cases, with fungible tokens enabling microtransactions and non-fungible tokens preserving singular ownership and provenance.

Scarcity

Scarcity in economics refers to the limited availability of resources, which directly influences the value of fungible and non-fungible assets; fungible items like currency are interchangeable and valued equally, while non-fungible assets such as unique digital tokens or artwork derive value from their uniqueness and limited supply. This scarcity principle drives market demand and pricing, with non-fungible tokens (NFTs) leveraging digital scarcity to create exclusive ownership and distinct asset value.

Provenance

Provenance establishes the authenticated history and ownership lineage of both fungible and non-fungible assets, ensuring transparency and trust in asset verification. While fungible assets like cryptocurrencies share interchangeable provenance records, non-fungible tokens (NFTs) require unique, irrefutable provenance to confirm their distinct identity and value.

Ledger immutability

Ledger immutability ensures that once recorded, transactions involving fungible assets like cryptocurrencies or non-fungible tokens (NFTs) cannot be altered or deleted, preserving the integrity and traceability of digital ownership. This unchangeable record is crucial for distinguishing identical units in fungible tokens and unique identifiers in non-fungible assets, enabling secure decentralized trading and provenance verification.

Digital ownership

Digital ownership in the context of fungible assets refers to interchangeable items like cryptocurrencies, where each unit holds equal value and can be exchanged seamlessly. In contrast, non-fungible digital ownership involves unique, indivisible assets such as NFTs (Non-Fungible Tokens) that represent distinct digital items with provable scarcity and provenance on blockchain networks.

Asset uniqueness

Asset uniqueness differentiates non-fungible tokens (NFTs) by their indivisible, distinct properties, unlike fungible assets such as cryptocurrencies that are interchangeable and identical in value.

Authenticity verification

Authenticity verification ensures the genuineness of assets by distinguishing fungible tokens, which are identical and interchangeable, from non-fungible tokens (NFTs) that are unique and represent distinct digital or physical items. Blockchain technology plays a critical role in this process by providing immutable records that certify provenance and ownership, enhancing trust in both fungible cryptocurrencies and exclusive NFTs.

Liquidity

Liquidity varies significantly between fungible and non-fungible assets; fungible assets like cryptocurrencies or fiat money offer high liquidity due to their identical and easily exchangeable units, whereas non-fungible assets such as NFTs or unique collectibles have lower liquidity because each item is distinct and requires a specific buyer. The market efficiency and transaction speed of fungible assets enhance their liquidity, contrasting with the specialized and often slower market dynamics of non-fungible assets.

Fungible vs Non-fungible Infographic

moneydif.com

moneydif.com