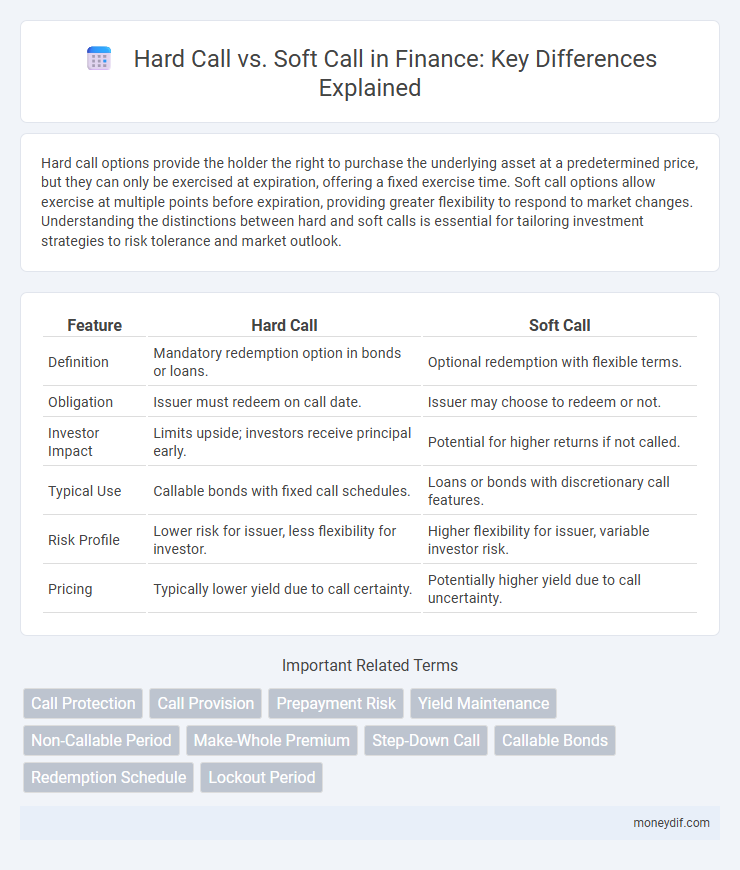

Hard call options provide the holder the right to purchase the underlying asset at a predetermined price, but they can only be exercised at expiration, offering a fixed exercise time. Soft call options allow exercise at multiple points before expiration, providing greater flexibility to respond to market changes. Understanding the distinctions between hard and soft calls is essential for tailoring investment strategies to risk tolerance and market outlook.

Table of Comparison

| Feature | Hard Call | Soft Call |

|---|---|---|

| Definition | Mandatory redemption option in bonds or loans. | Optional redemption with flexible terms. |

| Obligation | Issuer must redeem on call date. | Issuer may choose to redeem or not. |

| Investor Impact | Limits upside; investors receive principal early. | Potential for higher returns if not called. |

| Typical Use | Callable bonds with fixed call schedules. | Loans or bonds with discretionary call features. |

| Risk Profile | Lower risk for issuer, less flexibility for investor. | Higher flexibility for issuer, variable investor risk. |

| Pricing | Typically lower yield due to call certainty. | Potentially higher yield due to call uncertainty. |

Understanding Hard Call and Soft Call Provisions

Hard call provisions restrict a bond issuer from redeeming the bond before a specified date, protecting investors by ensuring a fixed period of interest payments. Soft call provisions allow early redemption under certain conditions, such as exceeding a specific price or after a call protection period, offering issuers flexibility while balancing investor returns. Understanding the distinctions between hard call and soft call provisions helps investors assess risk, yield potential, and timing of cash flows in fixed income portfolios.

Key Differences: Hard Call vs. Soft Call

Hard call in finance refers to a mandatory redemption or action on a callable security, where the issuer exercises the right to call the bond before maturity at a predetermined price. Soft call allows the issuer to call the bond only under specific conditions or after a specified period, often providing investors with partial protection against early redemption. Key differences include the rigidity of exercise, investor protection level, and impact on yield and investment strategy.

Importance of Call Provisions in Finance

Call provisions in finance determine the issuer's right to redeem bonds before maturity, significantly impacting investment risk and return profiles. Hard calls prohibit bond redemption until a specified date, providing investors with stable cash flow expectations, while soft calls allow early redemption after a certain period with conditions, offering issuers flexibility in managing debt costs. Understanding the distinction between hard call and soft call features is crucial for assessing bond valuation, yield premiums, and portfolio risk management.

How Hard Call Provisions Impact Investors

Hard call provisions limit investors' ability to redeem bonds before maturity by imposing strict call restrictions and fixed call dates, reducing liquidity and potentially exposing investors to reinvestment risk if interest rates decline. These provisions often result in higher yields to compensate investors for the increased risk and reduced flexibility compared to soft call provisions. Investors must carefully evaluate hard call terms to balance potential yield benefits against the constraints on early bond redemption.

Effects of Soft Call Provisions on Issuers

Soft call provisions reduce the likelihood of early bond redemption, allowing issuers to benefit from extended interest payments and enhanced cash flow stability. These provisions often result in lower yields demanded by investors, decreasing the overall cost of borrowing for issuers. By delaying the call option's exercisability, issuers maintain greater financial flexibility while managing refinancing risks in volatile markets.

Hard Call vs. Soft Call: Risk Assessment

Hard call risk assessment involves making definitive investment decisions based on concrete financial data and strict criteria, minimizing ambiguity in credit evaluations. Soft call risk assessment allows for flexibility and subjective judgment, incorporating qualitative factors and market sentiment, which may introduce higher uncertainty. Understanding the distinction between hard call and soft call risk assessments is essential for balancing precision and adaptability in portfolio management and credit risk analysis.

Call Protection: Benefits for Bondholders

Call protection shields bondholders from early redemption risk, ensuring stable interest income during the protected period. Hard calls prevent issuers from redeeming bonds before a specified date, enhancing price stability and predictable returns. Soft calls allow issuer redemption after a certain period but often require a premium, balancing issuer flexibility with bondholder compensation.

Typical Scenarios for Hard and Soft Calls

Hard calls typically occur in high-stakes investment situations requiring immediate and full capital commitment, such as private equity fund capital calls or margin calls in leveraged trading. Soft calls are common in scenarios with flexible capital requirements, like subscription-based mutual funds or optional contributions in venture capital funds. Understanding the distinction aids investors in managing liquidity and meeting financial obligations without incurring penalties.

Evaluating Returns: Investment Strategies

Hard call strategies require a fixed call date, ensuring investors can predict exact return timelines, which benefits those prioritizing liquidity and precise exit planning. Soft call approaches offer flexible redemption options, allowing issuers to call bonds after a lock-up period, potentially enhancing returns through reinvestment at higher rates while providing investors a premium for early redemption risk. Evaluating returns in these investment strategies involves assessing yield to worst scenarios and analyzing call price premiums to optimize portfolio income and risk exposure.

Industry Practices and Trends in Call Provisions

Hard call provisions require issuers to wait a specified period, typically 5 to 10 years, before redeeming callable bonds, ensuring greater protection for investors against early redemption risks. Soft call provisions increasingly appear in high-yield bonds and leveraged loans, allowing issuers to redeem debt earlier if certain financial triggers, such as debt-to-EBITDA ratios, are met. Industry trends reveal a growing preference for soft calls due to their flexibility and alignment with borrower credit improvement, influencing market demand and pricing in primary and secondary debt markets.

Important Terms

Call Protection

Call protection in bond investments refers to the period during which a bond cannot be called by the issuer, ensuring investors receive scheduled interest payments without early redemption risk. Hard call protection prohibits any early redemption before a set date, while soft call protection allows calls under specific conditions, typically requiring a premium payment to investors.

Call Provision

Call provision in bonds determines whether the issuer can redeem the bond before maturity, with hard calls enforcing mandatory early redemption at a specified date and soft calls allowing optional redemption under certain conditions.

Prepayment Risk

Prepayment risk increases with hard call bonds because they restrict issuer call options until maturity, unlike soft call bonds that allow early redemption with penalties, affecting investor returns and yield calculations.

Yield Maintenance

Yield maintenance is a prepayment penalty designed to compensate lenders for lost interest when a borrower prepays a loan, commonly enforced through hard call or soft call options. Hard call provisions prohibit prepayment without penalty during a set period, while soft call structures allow prepayment after a specified timeframe, often with reduced penalties to balance borrower flexibility and lender protection.

Non-Callable Period

The non-callable period refers to the initial phase of a bond's life when the issuer cannot redeem the bond before maturity, distinguishing between hard call periods, during which the bond is strictly non-callable, and soft call periods, where limited call options may exist under specific conditions. Hard call periods provide investors with guaranteed coupon payments without redemption risk, while soft call provisions allow issuers flexibility to refinance debt under favorable market conditions after the initial lockout.

Make-Whole Premium

Make-whole premiums typically apply in hard call provisions, requiring issuers to pay a specified amount to redeem bonds early, unlike soft calls which often allow redemption with minimal or no premium.

Step-Down Call

A Step-Down Call reduces the call price at predetermined dates, often starting with a Hard Call period where the issuer cannot redeem the bond, followed by a Soft Call period allowing redemption with a premium. This structure balances investor protection during the Hard Call phase and issuer flexibility during the Soft Call phase, optimizing yield and call risk management.

Callable Bonds

Callable bonds grant issuers the right to redeem the bond before maturity, with hard call provisions forbidding calls during a specified initial period, ensuring investor protection, while soft call provisions allow early redemption under certain conditions, often requiring a premium payment. The distinction between hard and soft calls impacts bond pricing, yield calculations, and investor risk assessment in corporate finance.

Redemption Schedule

A redemption schedule outlines the timeline and conditions under which bonds or preferred shares can be repurchased by the issuer, distinguishing between hard calls, which prohibit redemption before a fixed date, and soft calls, which allow early redemption subject to specific conditions like market price thresholds or issuer discretion. Investors favor hard call provisions for guaranteed holding periods, while issuers prefer soft calls to retain flexibility in managing refinancing strategies.

Lockout Period

The lockout period defines the timeframe during which a bond cannot be called, distinguishing hard calls, which prohibit any calls before a certain date, from soft calls that allow calls only under specified conditions after the lockout expires. Understanding the lockout period is crucial for investors assessing call risk and yield potential in callable bond structures.

Hard call vs Soft call Infographic

moneydif.com

moneydif.com