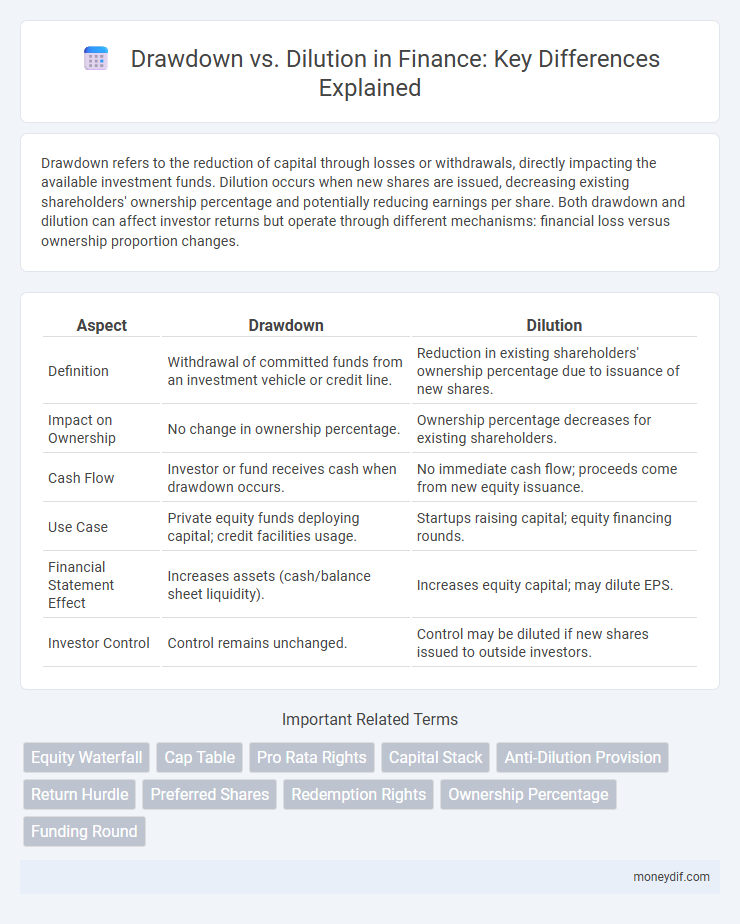

Drawdown refers to the reduction of capital through losses or withdrawals, directly impacting the available investment funds. Dilution occurs when new shares are issued, decreasing existing shareholders' ownership percentage and potentially reducing earnings per share. Both drawdown and dilution can affect investor returns but operate through different mechanisms: financial loss versus ownership proportion changes.

Table of Comparison

| Aspect | Drawdown | Dilution |

|---|---|---|

| Definition | Withdrawal of committed funds from an investment vehicle or credit line. | Reduction in existing shareholders' ownership percentage due to issuance of new shares. |

| Impact on Ownership | No change in ownership percentage. | Ownership percentage decreases for existing shareholders. |

| Cash Flow | Investor or fund receives cash when drawdown occurs. | No immediate cash flow; proceeds come from new equity issuance. |

| Use Case | Private equity funds deploying capital; credit facilities usage. | Startups raising capital; equity financing rounds. |

| Financial Statement Effect | Increases assets (cash/balance sheet liquidity). | Increases equity capital; may dilute EPS. |

| Investor Control | Control remains unchanged. | Control may be diluted if new shares issued to outside investors. |

Understanding Drawdown in Finance

Drawdown in finance refers to the peak-to-trough decline during a specific period of an investment, highlighting the loss experienced from the highest value to the lowest point. It is a critical risk metric used by investors to evaluate the potential downside and resilience of an asset or portfolio. Understanding drawdown helps in managing investment risk and making informed decisions about asset allocation and risk tolerance.

What is Dilution and How Does It Occur?

Dilution occurs when a company issues additional shares, reducing existing shareholders' ownership percentages and earnings per share. It often happens during equity financing rounds, stock option exercises, or convertible securities conversion, impacting shareholder value. Monitoring dilution is crucial for investors to understand potential decreases in their investment control and value.

Key Differences Between Drawdown and Dilution

Drawdown refers to the reduction in the value of an investment portfolio or trading account, usually expressed as a percentage from its peak to subsequent trough, indicating potential losses during a specific period. Dilution occurs when a company issues additional shares, decreasing existing shareholders' ownership percentage and potentially impacting earnings per share (EPS) and voting power. Key differences include drawdown measuring investment performance risk, while dilution relates to changes in equity structure and shareholder value.

Impact of Drawdown on Investors

Drawdown directly reduces an investor's capital base by reflecting the peak-to-trough decline in portfolio value, highlighting the potential risk exposure and temporary losses during market downturns. This contraction impacts investor confidence and may influence withdrawal decisions or adjustments in investment strategy. Understanding drawdown severity and duration is critical for assessing risk tolerance and long-term portfolio resilience.

Effects of Dilution on Shareholder Value

Dilution reduces the ownership percentage of existing shareholders, leading to a decrease in their voting power and claim on future earnings. This erosion of shareholder value often results from issuing new shares to raise capital or convert convertible securities. Dilution can also impact earnings per share (EPS), potentially lowering stock prices and investor confidence.

Managing Drawdown Risks in Portfolios

Managing drawdown risks in portfolios involves closely monitoring peak-to-trough declines to limit potential losses and preserve capital. Employing risk mitigation strategies such as diversification, stop-loss orders, and position sizing helps control drawdowns while maintaining growth potential. Understanding the distinction between drawdown and dilution enables investors to focus on downside risk without confusing it with ownership percentage reduction from new equity issuance.

Strategies to Minimize Shareholder Dilution

Implementing anti-dilution provisions such as weighted-average or full-ratchet clauses protects shareholders during new funding rounds by adjusting conversion prices. Opting for debt financing over equity issuance limits share dilution while maintaining capital influx. Strategic use of stock buybacks reduces outstanding shares, effectively minimizing shareholder dilution and preserving ownership percentages.

Case Studies: Drawdown vs Dilution in Real Finance Scenarios

Case studies in finance reveal that drawdown refers to the peak-to-trough decline in investment value, often assessed during market downturns to measure risk exposure. In contrast, dilution occurs when a company issues additional shares, reducing existing shareholders' ownership percentage and potentially impacting stock valuation. Real-world examples include tech startups opting for dilution through new equity rounds, while hedge funds analyze drawdown metrics to strategize portfolio adjustments in volatile markets.

Financial Metrics to Monitor for Drawdown and Dilution

Key financial metrics to monitor for drawdown include peak-to-trough decline percentages, liquidity ratios, and cash flow stability to assess the extent and impact of capital reduction. For dilution, focus on earnings per share (EPS) dilution rate, ownership percentage changes, and market capitalization fluctuations to evaluate shareholder value erosion. Tracking debt-to-equity ratio and return on equity (ROE) provides insights into the broader financial effects of both drawdown and dilution events.

Best Practices for Investors Facing Drawdown or Dilution

Investors encountering drawdown should implement disciplined risk management strategies such as setting stop-loss limits and diversifying portfolios across asset classes to mitigate potential losses. When facing dilution, prioritizing pro-rata rights and actively participating in follow-on funding rounds helps maintain ownership percentages and protect equity value. Continuous monitoring of market conditions and company performance enables informed decisions that safeguard long-term investment returns.

Important Terms

Equity Waterfall

Equity waterfall models allocate returns among investors based on priority tiers, where drawdowns represent capital calls to fund investments while dilution occurs when new shares reduce existing ownership percentages. Understanding the balance between drawdown timing and dilution impact is crucial for maximizing investor equity while managing funding needs effectively.

Cap Table

A cap table details ownership stakes in a company and is crucial for understanding the impact of drawdown on available capital and investor equity. Drawdown reduces available funds without immediately affecting ownership percentages, while dilution decreases existing shareholders' ownership percentages by increasing the total number of outstanding shares.

Pro Rata Rights

Pro rata rights ensure investors maintain their ownership percentage by allowing them to participate in future funding rounds during drawdowns, thereby preventing dilution of their equity stake. When companies execute drawdowns, investors with these rights can inject additional capital proportionate to their initial investment, preserving their control and value against dilution risks.

Capital Stack

Understanding the capital stack is crucial for evaluating how drawdowns can increase ownership dilution risk in equity financing structures.

Anti-Dilution Provision

An Anti-Dilution Provision protects investors from equity dilution during subsequent funding rounds by adjusting the conversion price of preferred shares, ensuring their ownership percentage remains stable despite new Drawdowns. This mechanism counteracts the dilutive effects of issuing additional shares at a lower valuation, preserving investor value in venture capital and private equity deals.

Return Hurdle

Return hurdle represents the minimum acceptable return that compensates investors for the risk of drawdown, ensuring performance surpasses potential losses before dilution occurs. Balancing drawdown control with dilution minimization is crucial, as excessive drawdown can erode capital while high dilution reduces ownership value and final returns.

Preferred Shares

Preferred shares provide investors with priority over common shareholders in dividend payments and asset liquidation, minimizing the risk of dilution during drawdowns by maintaining fixed equity stakes. Drawdowns can trigger dilution for common shareholders as companies issue new shares to raise capital, but preferred shares often include anti-dilution provisions to protect investor value.

Redemption Rights

Redemption rights protect investors by allowing them to exit or reclaim their investment before dilution occurs during subsequent funding rounds or drawdowns. These rights are critical in managing ownership percentage, ensuring investors can mitigate the impact of dilution while enabling companies to access additional capital through drawdown mechanisms.

Ownership Percentage

Ownership percentage decreases during drawdown as capital is withdrawn but experiences dilution when new shares are issued, impacting investor control and equity value.

Funding Round

A funding round impacts startups by balancing drawdown--the amount of capital accessed against investor commitments--and dilution, which reduces existing shareholders' ownership percentage. Effective management of the drawdown schedule minimizes unnecessary dilution while ensuring sufficient capital for growth milestones.

Drawdown vs Dilution Infographic

moneydif.com

moneydif.com