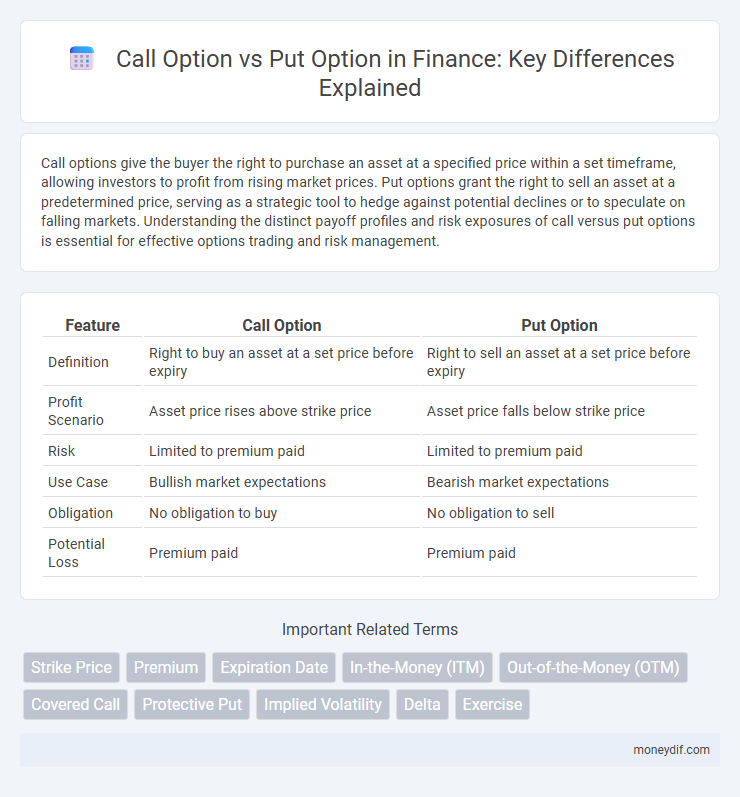

Call options give the buyer the right to purchase an asset at a specified price within a set timeframe, allowing investors to profit from rising market prices. Put options grant the right to sell an asset at a predetermined price, serving as a strategic tool to hedge against potential declines or to speculate on falling markets. Understanding the distinct payoff profiles and risk exposures of call versus put options is essential for effective options trading and risk management.

Table of Comparison

| Feature | Call Option | Put Option |

|---|---|---|

| Definition | Right to buy an asset at a set price before expiry | Right to sell an asset at a set price before expiry |

| Profit Scenario | Asset price rises above strike price | Asset price falls below strike price |

| Risk | Limited to premium paid | Limited to premium paid |

| Use Case | Bullish market expectations | Bearish market expectations |

| Obligation | No obligation to buy | No obligation to sell |

| Potential Loss | Premium paid | Premium paid |

Introduction to Call and Put Options

Call options grant the holder the right to buy an underlying asset at a predetermined strike price before the expiration date, making them beneficial in bullish market conditions. Put options provide the right to sell the underlying asset at the strike price, offering protection or profit opportunities during bearish trends. Both call and put options are essential derivatives used for hedging, speculation, and income generation in financial markets.

Key Differences Between Call and Put Options

Call options grant the buyer the right to purchase an asset at a predetermined price before expiration, while put options provide the right to sell the asset at a set price within a specific timeframe. The payoff for call options profits from an increase in the underlying asset's price, whereas put options gain value when the asset's price declines. Key differences also include their use in hedging strategies and market outlooks, with calls typically used for bullish expectations and puts for bearish or protective positions.

How Call Options Work in Financial Markets

Call options give investors the right to buy an underlying asset at a predetermined strike price before or at expiration, allowing them to profit from price increases. These instruments serve as leverage, enabling traders to control more shares with less capital while limiting potential losses to the premium paid. Market participants use call options for speculation, hedging against price surges, or generating income through strategies such as covered calls.

Understanding the Mechanics of Put Options

Put options grant the holder the right to sell an underlying asset at a predetermined strike price before or at expiration, serving as a strategic tool for hedging or speculating on price declines. The buyer pays a premium for this contract, which increases in value as the underlying asset's price falls below the strike price, allowing profit from downward market movements. Understanding the mechanics of put options involves analyzing intrinsic and extrinsic value, time decay, and the impact of volatility on option pricing models like Black-Scholes.

Profit and Loss Potential: Call vs Put Options

Call options offer unlimited profit potential as the underlying asset's price rises above the strike price, while losses are limited to the premium paid. Put options provide significant profit opportunities when the asset's price declines below the strike price, with maximum profit realized if the underlying falls to zero, and losses similarly capped at the premium. Both options involve defined risk limited to the premium but differ in directional profit outlooks aligned with bullish calls and bearish puts.

Risk Factors in Call and Put Option Strategies

Call option strategies carry the risk of losing the entire premium paid if the underlying asset's price does not rise above the strike price before expiration. Put option strategies expose investors to risk when the underlying asset's price fails to fall below the strike price, rendering the premium worthless. Both options involve risk related to time decay and volatility fluctuations, which can significantly impact option premiums and potential returns.

Common Use Cases for Call and Put Options

Call options are commonly used by investors aiming to capitalize on anticipated price increases in underlying assets, enabling potential profit with limited initial investment. Put options serve as effective tools for hedging against potential declines in asset prices, offering downside protection for portfolios. Both options facilitate strategic flexibility in managing risk and enhancing returns through leverage and insurance.

Option Pricing: Valuation of Calls and Puts

Option pricing models, such as the Black-Scholes and Binomial models, are essential for accurately valuing call and put options by calculating their theoretical premiums based on factors like underlying asset price, strike price, time to expiration, volatility, interest rates, and dividends. Call options generally increase in value as the underlying asset price rises above the strike price, while put options gain value when the asset price falls below the strike price, reflecting their intrinsic value and time value components. Understanding the interplay of these variables helps traders and investors optimize strategies by identifying mispriced options and managing risk effectively.

Factors Influencing Call and Put Option Prices

Call and put option prices are primarily influenced by factors such as the underlying asset's current price, strike price, time to expiration, volatility, interest rates, and dividends. Higher volatility typically increases both call and put premiums due to the greater probability of favorable price movements. Time decay impacts option value differently, generally reducing the premium as expiration approaches, with interest rates and dividends also playing significant roles in pricing models like Black-Scholes.

Which Option Type Suits Your Investment Goals?

Call options suit investors seeking to capitalize on anticipated stock price increases, offering leveraged exposure with limited downside risk. Put options are ideal for those aiming to hedge against potential declines or profit from falling markets, providing downside protection and speculative opportunities. Assessing market outlook, risk tolerance, and investment objectives determines which option type aligns best with your financial goals.

Important Terms

Strike Price

The strike price determines the fixed price at which a call option buyer can purchase the underlying asset or a put option buyer can sell it, directly impacting the option's intrinsic value and potential profitability.

Premium

Premium represents the price paid by the buyer to the seller for acquiring a call option or put option, reflecting the option's intrinsic value, time value, and market volatility.

Expiration Date

The expiration date of a call option and a put option is the specific day on which the right to buy (call) or sell (put) the underlying asset expires, determining the option's value and exercise potential.

In-the-Money (ITM)

In-the-Money (ITM) for a call option occurs when the underlying asset's price is above the strike price, while ITM for a put option occurs when the underlying asset's price is below the strike price.

Out-of-the-Money (OTM)

Out-of-the-Money (OTM) Call Options have a strike price above the underlying asset's current market price, while OTM Put Options have a strike price below the underlying asset's current market price.

Covered Call

A covered call involves selling a call option on an asset owned to generate income, contrasting with a put option which grants the right to sell the asset at a predetermined price.

Protective Put

A protective put strategy involves buying a put option to hedge against potential losses in an owned stock, contrasting with call options which provide the right to buy shares at a specific price.

Implied Volatility

Implied volatility measures the market's expected future price fluctuations and typically differs between call options and put options due to factors like demand, supply, and skewness in the options market.

Delta

Delta measures the sensitivity of a call option's price to changes in the underlying asset's price, typically ranging from 0 to 1, while for a put option, delta ranges from -1 to 0, reflecting the inverse price relationship.

Exercise

Exercise of a call option grants the right to buy the underlying asset at the strike price, while exercise of a put option grants the right to sell the underlying asset at the strike price.

Call Option vs Put Option Infographic

moneydif.com

moneydif.com