Carry trade exploits interest rate differentials by borrowing in low-yield currencies and investing in high-yield assets, aiming to profit from the spread and currency appreciation. Pair trade, a market-neutral strategy, involves simultaneously buying undervalued securities and shorting overvalued ones within the same sector to capitalize on relative price movements. Both strategies manage risk differently, with carry trade exposed to currency volatility and pair trade minimizing market risk through hedging.

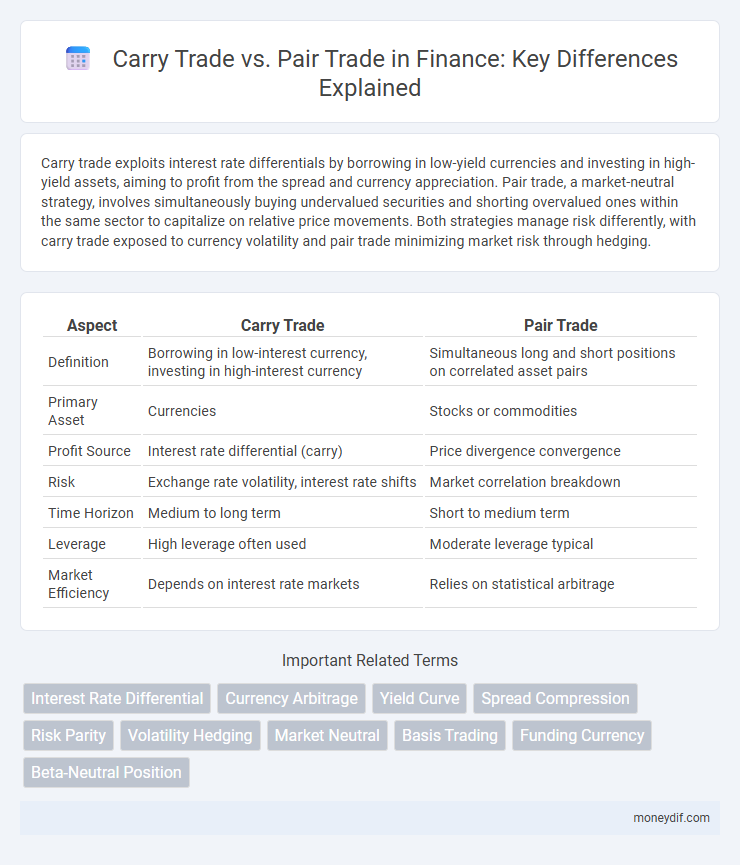

Table of Comparison

| Aspect | Carry Trade | Pair Trade |

|---|---|---|

| Definition | Borrowing in low-interest currency, investing in high-interest currency | Simultaneous long and short positions on correlated asset pairs |

| Primary Asset | Currencies | Stocks or commodities |

| Profit Source | Interest rate differential (carry) | Price divergence convergence |

| Risk | Exchange rate volatility, interest rate shifts | Market correlation breakdown |

| Time Horizon | Medium to long term | Short to medium term |

| Leverage | High leverage often used | Moderate leverage typical |

| Market Efficiency | Depends on interest rate markets | Relies on statistical arbitrage |

Introduction to Carry Trade and Pair Trade

Carry trade exploits interest rate differentials between currencies by borrowing low-interest currencies and investing in high-yield ones, aiming for profit through the spread. Pair trade involves simultaneous long and short positions in two correlated financial instruments to capitalize on price divergence while minimizing market risk. Both strategies are fundamental in Forex and equity markets, offering diverse risk and return profiles suited to different investment objectives.

Fundamental Concepts: How Carry Trade Works

Carry trade involves borrowing in a low-interest-rate currency to invest in a high-interest-rate currency, profiting from the interest rate differential. The strategy relies on stable exchange rates to maintain gains from the interest spread while minimizing currency risk. In contrast, pair trade focuses on exploiting relative price movements between two correlated financial instruments without significant exposure to interest rate differentials.

Key Principles Behind Pair Trading

Pair trading relies on the principle of market-neutral strategies by simultaneously taking long and short positions in two historically correlated securities to exploit pricing inefficiencies. The strategy depends on statistical arbitrage, using mean reversion to identify divergences in price spreads that are expected to revert to the historical norm. Risk management in pair trading involves constant monitoring of correlation stability and spread behavior to minimize exposure to market-wide movements.

Risk and Reward in Carry Trade vs Pair Trade

Carry trade involves borrowing in low-interest-rate currencies to invest in higher-yield assets, exposing investors to significant currency risk and potential for large reward when exchange rates remain stable. Pair trade mitigates market risk by simultaneously taking long and short positions in correlated assets, offering lower but more consistent returns with reduced exposure to systemic market fluctuations. The risk in carry trade is largely driven by interest rate differentials and currency volatility, whereas pair trade risk centers on asset correlation breakdowns and execution costs.

Market Conditions Favoring Each Strategy

Carry trade thrives in stable or low-volatility markets with predictable interest rate differentials between currencies, allowing investors to profit from yield spreads. Pair trade performs best during periods of market uncertainty or increased volatility, capitalizing on relative price movements and mean reversion between correlated assets. Understanding liquidity conditions and macroeconomic factors is crucial for selecting the optimal strategy under prevailing market dynamics.

Currency Pair Selection Criteria

Currency pair selection for carry trade emphasizes interest rate differentials and stable economic conditions to maximize yield from borrowing low-rate currencies and investing in high-rate currencies. In contrast, pair trade criteria prioritize currency pairs with strong historical cointegration and mean-reverting price patterns to capitalize on relative value discrepancies. Risk management considerations include liquidity, volatility, and correlation to ensure effective execution and minimize adverse currency exposure.

Leverage and Capital Requirements

Carry trade typically involves higher leverage, allowing investors to amplify returns by borrowing in a low-interest-rate currency to invest in a higher-yielding asset, which increases capital efficiency but also risk exposure. Pair trade strategies generally require more balanced capital allocation and lower leverage since they involve taking simultaneous long and short positions in correlated assets to hedge market risk. Understanding the differing leverage and capital requirements is crucial for managing risk and optimizing portfolio performance in carry versus pair trading approaches.

Common Pitfalls and Risk Management Techniques

Carry trade often involves significant currency risk due to interest rate differentials, with common pitfalls including exposure to sudden exchange rate fluctuations and leverage amplification. Pair trade risks stem from model misspecification and convergence failures between correlated assets, requiring robust statistical arbitrage strategies and strict stop-loss settings. Effective risk management techniques include diversification, dynamic hedging, and constant monitoring of market conditions to mitigate adverse price movements.

Historical Performance Comparison

Carry trade strategies historically deliver consistent returns by exploiting interest rate differentials between currencies, often outperforming pair trading in stable economic environments. Pair trading, relying on mean reversion between correlated asset pairs, tends to show resilience during market volatility but may yield lower average returns compared to carry trade. Empirical studies highlight that carry trades generated annualized returns of approximately 8-10% over the past two decades, whereas pair trades averaged closer to 4-6%, reflecting differing risk-reward profiles and market sensitivities.

Choosing the Right Strategy for Your Portfolio

Carry trade exploits interest rate differentials between currencies to generate profit, ideal for portfolios seeking steady income with moderate risk tolerance. Pair trade involves simultaneously buying one asset and selling another correlated asset, offering market-neutral exposure to reduce volatility. Selecting the right strategy depends on your risk appetite, market outlook, and diversification goals within your portfolio.

Important Terms

Interest Rate Differential

Interest Rate Differential (IRD) measures the gap between interest rates of two countries, which is a critical factor in carry trades where investors borrow in low-interest currencies to invest in higher-yielding ones. In contrast, pair trades focus on relative price movements between two correlated assets rather than exploiting IRD for profit through currency exchange rate differentials.

Currency Arbitrage

Currency arbitrage exploits price discrepancies between different foreign exchange markets to generate risk-free profits by simultaneously buying and selling currency pairs. Carry trade focuses on profiting from interest rate differentials between currencies by borrowing low-yield currencies and investing in high-yield ones, while pair trade involves taking long and short positions in highly correlated currency pairs to capitalize on their relative value movements.

Yield Curve

The yield curve influences carry trade strategies by exploiting interest rate differentials between currencies, while pair trade strategies focus on relative asset valuation regardless of yield curve shape.

Spread Compression

Spread compression in carry trade and pair trade strategies refers to the narrowing difference between asset yields or price spreads, reducing potential profit margins. This phenomenon intensifies risk management challenges as diminishing spreads decrease arbitrage opportunities and increase sensitivity to market volatility.

Risk Parity

Risk Parity allocates capital by balancing risk contributions across assets, often enhancing diversification compared to traditional carry trades, which exploit interest rate differentials for yield. Pair trades focus on relative value between correlated assets, while Risk Parity's broad risk-adjusted approach mitigates drawdowns by diversifying exposure beyond just interest rate or currency disparities.

Volatility Hedging

Volatility hedging in carry trade involves mitigating risks from sudden currency fluctuations by employing options or stop-loss orders, whereas pair trade strategies focus on exploiting relative value disparities between correlated assets to minimize exposure to market-wide volatility. Carry trades typically face higher vulnerability to sharp volatility spikes due to interest rate differentials, while pair trades achieve more stable hedge positions through balanced long and short asset holdings.

Market Neutral

Market neutral strategies aim to eliminate market risk by balancing long and short positions, with carry trade focusing on profiting from interest rate differentials between currencies, while pair trade involves exploiting relative price discrepancies between two correlated assets. Carry trade captures returns through interest rate arbitrage, whereas pair trade profits from mean reversion between asset pairs, both seeking uncorrelated alpha in volatile markets.

Basis Trading

Basis trading exploits price differentials between the spot and futures markets, focusing on the convergence of asset prices to capture arbitrage profits. Unlike carry trade, which profits from interest rate differentials by borrowing low-yield currencies to invest in higher-yield ones, pair trade involves simultaneously buying undervalued and selling overvalued correlated assets to exploit relative price movements.

Funding Currency

Funding currency in carry trade typically involves borrowing low-interest-rate currencies to invest in higher-yielding assets, contrasting with pair trading where currency pairs are traded based on relative price movements without relying on interest rate differentials.

Beta-Neutral Position

A beta-neutral position minimizes systematic market risk by balancing long and short exposures to offset beta, commonly used in pair trades where two correlated assets are traded simultaneously to exploit relative value differences. In contrast, carry trade focuses on earning returns from interest rate differentials between currencies, making beta-neutral strategies more effective in isolating alpha through market-neutral pair trades rather than directional carry bets.

carry trade vs pair trade Infographic

moneydif.com

moneydif.com