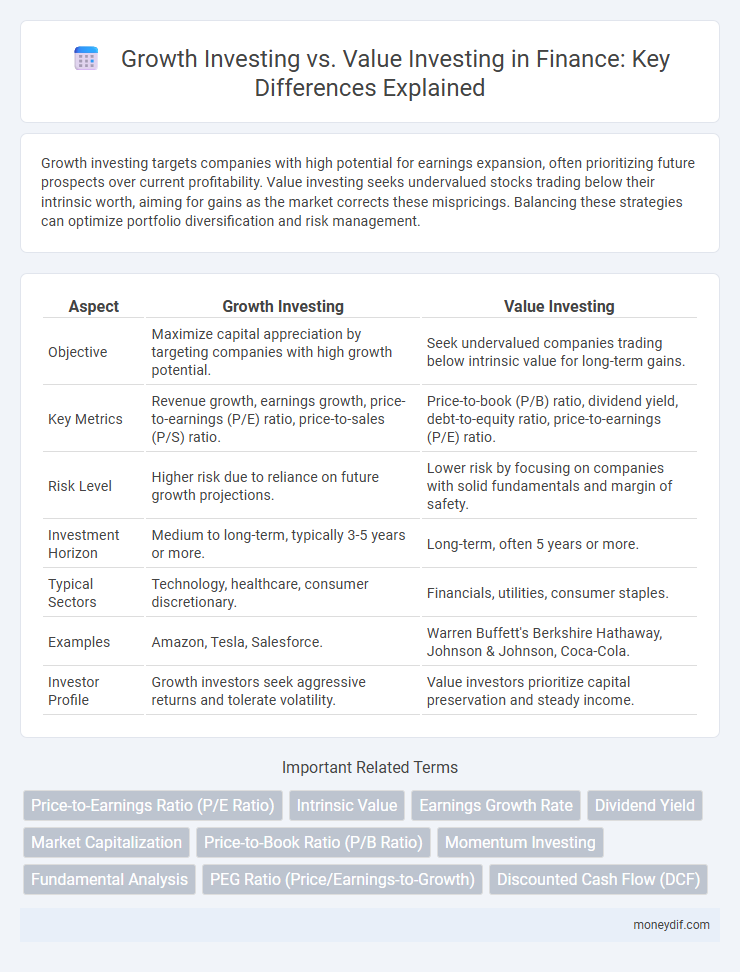

Growth investing targets companies with high potential for earnings expansion, often prioritizing future prospects over current profitability. Value investing seeks undervalued stocks trading below their intrinsic worth, aiming for gains as the market corrects these mispricings. Balancing these strategies can optimize portfolio diversification and risk management.

Table of Comparison

| Aspect | Growth Investing | Value Investing |

|---|---|---|

| Objective | Maximize capital appreciation by targeting companies with high growth potential. | Seek undervalued companies trading below intrinsic value for long-term gains. |

| Key Metrics | Revenue growth, earnings growth, price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio. | Price-to-book (P/B) ratio, dividend yield, debt-to-equity ratio, price-to-earnings (P/E) ratio. |

| Risk Level | Higher risk due to reliance on future growth projections. | Lower risk by focusing on companies with solid fundamentals and margin of safety. |

| Investment Horizon | Medium to long-term, typically 3-5 years or more. | Long-term, often 5 years or more. |

| Typical Sectors | Technology, healthcare, consumer discretionary. | Financials, utilities, consumer staples. |

| Examples | Amazon, Tesla, Salesforce. | Warren Buffett's Berkshire Hathaway, Johnson & Johnson, Coca-Cola. |

| Investor Profile | Growth investors seek aggressive returns and tolerate volatility. | Value investors prioritize capital preservation and steady income. |

Introduction to Growth Investing and Value Investing

Growth investing targets companies with high potential for earnings expansion, emphasizing capital appreciation through stocks exhibiting strong revenue and profit growth rates. Value investing focuses on identifying undervalued stocks trading below their intrinsic value, leveraging financial metrics like low price-to-earnings (P/E) ratios and high dividend yields for long-term wealth accumulation. Both strategies utilize fundamental analysis but differ in risk tolerance, investment horizon, and market conditions suitability.

Core Principles of Growth Investing

Growth investing centers on identifying companies with above-average revenue and earnings expansion potential. Investors prioritize market leaders and innovators in sectors such as technology and healthcare, expecting capital appreciation through substantial business scalability. Emphasis lies on reinvestment of profits to fuel ongoing development rather than immediate dividend payouts.

Fundamental Concepts of Value Investing

Value investing centers on identifying undervalued stocks by analyzing fundamental metrics such as low price-to-earnings (P/E) ratios, strong book values, and consistent dividend payouts. This strategy relies on the belief that the market often misprices securities, presenting opportunities to purchase shares at a discount to their intrinsic value. Investors using value investing prioritize companies with stable earnings, solid balance sheets, and long-term growth potential rather than chasing short-term market trends.

Key Metrics for Evaluating Growth Stocks

Growth investing prioritizes companies demonstrating high earnings growth potential, often evaluated through metrics like revenue growth rate, earnings per share (EPS) growth, and price-to-earnings-to-growth (PEG) ratio. Investors analyze return on equity (ROE) to assess management effectiveness in generating profits from reinvested earnings. High price-to-earnings (P/E) ratios are common but must be weighed against growth forecasts to avoid overvaluation in growth stock selection.

Essential Indicators for Assessing Value Stocks

Key indicators for assessing value stocks include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and dividend yield, which signal undervaluation and potential income generation. Low P/E and P/B ratios compared to industry averages often highlight companies trading below their intrinsic worth, while a stable or growing dividend yield suggests financial health and shareholder return. Analyzing debt-to-equity ratio and free cash flow further enhances evaluation by revealing balance sheet strength and operational efficiency critical for value investing decisions.

Risk and Reward Comparison: Growth vs Value

Growth investing typically involves higher risk due to exposure to volatile high-growth sectors and often overvalued stocks, but offers the potential for significant capital appreciation. Value investing prioritizes undervalued companies with solid fundamentals, presenting lower risk and more consistent dividend yields yet possibly slower capital gains. The risk-reward balance contrasts aggressive upside potential in growth stocks with the defensive stability and margin of safety favored by value investors.

Historical Performance and Market Trends

Growth investing often outperforms during bullish market cycles due to its focus on companies with high revenue and earnings growth potential, such as technology and innovative sectors. Value investing historically excels in volatile or bearish markets by targeting undervalued stocks with strong fundamentals, exemplified by sectors like finance and energy. Market trends indicate cyclical shifts where growth outpaces value in expansive economies, while value gains prominence during economic recoveries and downturns.

Notable Examples: Growth and Value Stocks in Action

Amazon exemplifies growth investing with its rapid revenue expansion and reinvestment strategy, while Berkshire Hathaway represents value investing by focusing on undervalued assets and long-term stability. Apple and Tesla are prominent growth stocks known for innovation and market leadership, contrasting with companies like Johnson & Johnson and Coca-Cola, which are classic value stocks prized for steady dividends and reliable earnings. These examples highlight the distinct approaches investors use to capitalize on market opportunities based on growth potential versus intrinsic value.

Portfolio Diversification Strategies

Growth investing targets companies with high potential for revenue and earnings expansion, emphasizing innovation-driven sectors such as technology and healthcare. Value investing focuses on undervalued companies with strong fundamentals, often in established industries like finance and consumer goods, seeking stocks trading below intrinsic value. Combining growth and value stocks within a portfolio enhances diversification by balancing high-growth opportunities with stable, income-generating assets, reducing overall risk exposure.

Determining the Right Approach for Your Financial Goals

Growth investing targets companies with high potential for rapid revenue and earnings expansion, often leading to capital gains but with increased volatility. Value investing focuses on identifying undervalued stocks trading below their intrinsic worth, aiming for long-term appreciation and dividend income. Assessing risk tolerance, investment horizon, and financial objectives is essential to align the choice between growth and value investing with your portfolio strategy.

Important Terms

Price-to-Earnings Ratio (P/E Ratio)

Growth investing typically targets high Price-to-Earnings (P/E) ratios signaling expected earnings growth, while value investing seeks lower P/E ratios indicating undervalued stocks with potential for price correction.

Intrinsic Value

Intrinsic value measures a company's true worth based on fundamentals, guiding growth investors to prioritize future earnings potential and value investors to focus on current undervaluation.

Earnings Growth Rate

Earnings growth rate is a key metric that growth investors prioritize to identify companies with rapidly increasing profits, while value investors focus more on current undervaluation and stable earnings.

Dividend Yield

Dividend yield typically attracts value investors seeking stable income, while growth investors prioritize lower yields in favor of capital appreciation.

Market Capitalization

Market capitalization influences growth investing by targeting high market cap companies with rapid earnings expansion, while value investing focuses on undervalued stocks often with lower market capitalization and stable fundamentals.

Price-to-Book Ratio (P/B Ratio)

The Price-to-Book Ratio (P/B Ratio) is a key metric where growth investors often tolerate higher values anticipating future earnings, while value investors seek lower P/B ratios to identify undervalued stocks with stable assets.

Momentum Investing

Momentum investing capitalizes on continuing price trends by buying stocks exhibiting strong recent performance, contrasting growth investing's focus on high-potential earnings expansion and value investing's emphasis on undervalued stocks trading below intrinsic value.

Fundamental Analysis

Fundamental analysis evaluates a company's financial health and growth prospects, enabling investors to distinguish between growth investing, which targets high-potential earnings expansion, and value investing, which seeks undervalued stocks with strong intrinsic value.

PEG Ratio (Price/Earnings-to-Growth)

The PEG Ratio, which measures a stock's price-to-earnings ratio relative to its earnings growth rate, is a crucial metric for growth investing by identifying undervalued high-growth companies, whereas value investing typically focuses on low P/E ratios without emphasizing growth potential.

Discounted Cash Flow (DCF)

Discounted Cash Flow (DCF) analysis is crucial for growth investing to project future cash flows from expanding businesses, whereas value investing uses DCF primarily to identify undervalued stocks by comparing intrinsic value to market price.

Growth Investing vs Value Investing Infographic

moneydif.com

moneydif.com