Risk parity allocates portfolio weights by balancing risk contributions from asset classes to achieve diversification across different sources of volatility. Risk budgeting, on the other hand, assigns specific risk limits or budgets to each asset or strategy based on investor preferences and targeted risk exposures. Both approaches aim to optimize portfolio risk, but risk parity emphasizes equal risk distribution, while risk budgeting allows for customized risk allocations aligned with investment goals.

Table of Comparison

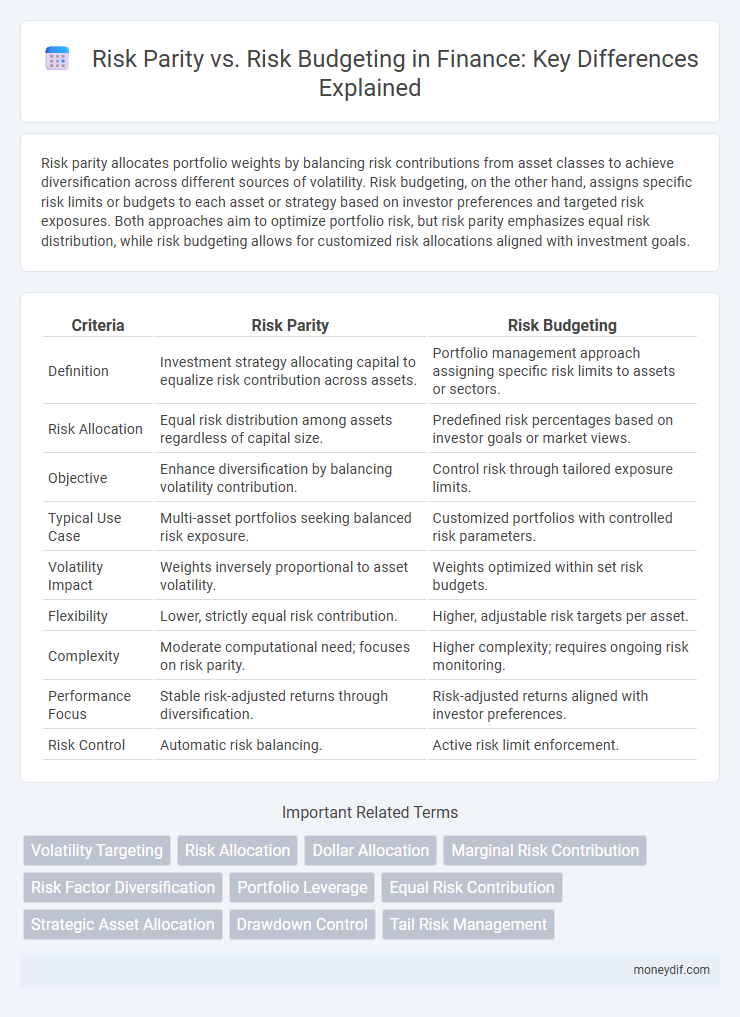

| Criteria | Risk Parity | Risk Budgeting |

|---|---|---|

| Definition | Investment strategy allocating capital to equalize risk contribution across assets. | Portfolio management approach assigning specific risk limits to assets or sectors. |

| Risk Allocation | Equal risk distribution among assets regardless of capital size. | Predefined risk percentages based on investor goals or market views. |

| Objective | Enhance diversification by balancing volatility contribution. | Control risk through tailored exposure limits. |

| Typical Use Case | Multi-asset portfolios seeking balanced risk exposure. | Customized portfolios with controlled risk parameters. |

| Volatility Impact | Weights inversely proportional to asset volatility. | Weights optimized within set risk budgets. |

| Flexibility | Lower, strictly equal risk contribution. | Higher, adjustable risk targets per asset. |

| Complexity | Moderate computational need; focuses on risk parity. | Higher complexity; requires ongoing risk monitoring. |

| Performance Focus | Stable risk-adjusted returns through diversification. | Risk-adjusted returns aligned with investor preferences. |

| Risk Control | Automatic risk balancing. | Active risk limit enforcement. |

Introduction to Risk Parity and Risk Budgeting

Risk parity and risk budgeting are sophisticated investment strategies designed to optimize portfolio risk allocation by balancing contributions from different asset classes. Risk parity emphasizes equalizing risk contributions to minimize portfolio volatility, typically leading to diversified allocations across equities, bonds, and alternative assets. Risk budgeting assigns specific risk limits to each asset or strategy, allowing managers to systematically control exposure while seeking improved risk-adjusted returns.

Core Principles of Risk Parity

Risk parity emphasizes balancing risk contributions across diverse asset classes to achieve stable portfolio volatility, rather than allocating capital based on expected returns alone. Its core principles include equalizing risk exposure, leveraging low-volatility assets to enhance diversification, and minimizing concentration in high-risk investments. This approach contrasts with risk budgeting, which assigns pre-determined risk limits to each asset class, focusing on customized risk allocation aligned with specific investment goals.

Fundamentals of Risk Budgeting

Risk budgeting allocates portfolio risk based on predefined limits for different asset classes, ensuring controlled exposure and improved diversification. Unlike risk parity, which equalizes risk contributions, risk budgeting incorporates investor preferences and market conditions to customize risk allocation. This approach enhances portfolio resilience by balancing risk contributions in alignment with strategic investment objectives.

Key Differences Between Risk Parity and Risk Budgeting

Risk parity allocates portfolio capital based on equalizing risk contributions from each asset class, aiming for balanced volatility across investments, while risk budgeting assigns specific risk limits to each component according to pre-defined risk targets. Risk parity emphasizes diversification by adjusting leverage to equalize risk, contrasting with risk budgeting's focus on controlling total portfolio risk through targeted risk expenditure. Key differences include risk contribution methodology, leverage usage, and portfolio constraints tailored to risk exposure management.

Portfolio Construction: Approaches and Methodologies

Risk parity constructs portfolios by allocating risk equally across asset classes, aiming for balanced volatility contribution and improved diversification. Risk budgeting assigns predefined risk limits to each asset class, enabling targeted risk control aligned with investment objectives and constraints. Both methodologies optimize portfolio construction by managing risk contributions to enhance return stability and downside protection.

Asset Allocation Strategies in Practice

Risk parity emphasizes equalizing risk contributions across asset classes, promoting diversification and reducing portfolio volatility. Risk budgeting allocates predefined risk levels to assets based on strategic priorities, allowing for targeted exposure adjustments. Both strategies enhance portfolio resilience but differ in their approach to balancing risk and return in asset allocation.

Advantages and Limitations of Risk Parity

Risk parity offers the advantage of balancing risk contributions across asset classes, promoting diversification and reducing portfolio volatility compared to traditional allocation methods. It enhances risk-adjusted returns by avoiding overweighting high-volatility assets, but its reliance on historical volatility and correlations introduces sensitivity to market regime changes. Limitations include potential underperformance during prolonged bull markets for equities and challenges in accurately estimating future risk parameters, which can lead to unintended concentration in low-volatility assets like bonds.

Pros and Cons of Risk Budgeting

Risk budgeting allows investors to allocate risk more precisely across assets, enhancing portfolio diversification and potentially improving risk-adjusted returns compared to traditional allocation methods. However, it requires accurate risk estimation and frequent rebalancing, which can increase transaction costs and complexity. The flexibility in adjusting risk targets per asset class promotes adaptability but may lead to concentration risk if not carefully managed.

Performance Comparison: Historical Insights

Risk parity portfolios typically offer more stable returns by balancing risk contributions across asset classes, leading to reduced volatility in historical performance data. In contrast, risk budgeting allows for flexible allocation of risk based on forecasted returns and risk assessments, often resulting in higher performance during favorable market conditions but with increased variability. Historical insights indicate that risk parity outperforms in turbulent markets, while risk budgeting can capture greater upside in bullish environments through dynamic risk exposure adjustments.

Choosing the Right Strategy for Institutional Investors

Institutional investors prioritizing portfolio diversification should assess risk parity for its equal risk allocation across asset classes, enhancing risk-adjusted returns in volatile markets. Risk budgeting allows tailored risk limits per asset class, aligning with specific investment objectives and regulatory constraints. Selecting between risk parity and risk budgeting depends on the institution's risk tolerance, target volatility, and return expectations to optimize capital efficiency.

Important Terms

Volatility Targeting

Volatility targeting adjusts portfolio exposures based on market volatility to enhance risk parity by equalizing risk contributions, while risk budgeting allocates predefined risk limits across assets to optimize overall portfolio risk.

Risk Allocation

Risk allocation in investment strategies involves distributing risk across assets to optimize portfolio performance, where risk parity aims for equal risk contribution from each asset, enhancing diversification and reducing volatility. In contrast, risk budgeting assigns predefined risk levels based on strategic priorities or constraints, allowing tailored risk exposure to meet specific investment goals.

Dollar Allocation

Dollar allocation in risk parity involves distributing investments based on equalizing risk contributions across assets, enhancing portfolio diversification and stability. In contrast, risk budgeting assigns explicit risk limits to each asset or strategy, optimizing dollar allocation to balance targeted risk exposures with return objectives under varying market conditions.

Marginal Risk Contribution

Marginal Risk Contribution quantifies each asset's incremental impact on portfolio risk, enabling effective allocation in risk parity strategies by equalizing risk contributions, whereas risk budgeting assigns specific risk limits to assets based on predefined criteria.

Risk Factor Diversification

Risk Factor Diversification enhances portfolio stability by spreading exposure across independent risk sources, a principle underlying risk parity strategies that allocate capital to equalize risk contributions. Risk budgeting, by contrast, assigns predefined risk limits to each factor, optimizing portfolio performance while controlling total risk exposure.

Portfolio Leverage

Portfolio leverage in risk parity strategies often involves scaling risk contributions equally across assets to achieve balanced volatility, enhancing diversification and return consistency. Risk budgeting, by contrast, allocates specific risk targets to portfolios without necessarily employing leverage, focusing on optimizing risk-return trade-offs within predefined limits.

Equal Risk Contribution

Equal Risk Contribution (ERC) allocates portfolio weights so each asset contributes identically to total risk, bridging risk parity and risk budgeting frameworks by emphasizing balanced risk exposure rather than equal capital allocation. Unlike traditional risk parity that targets equal volatility, ERC integrates asset correlations and individual volatilities to optimize diversification and enhance risk-adjusted returns.

Strategic Asset Allocation

Strategic Asset Allocation balances portfolio risk and return by setting target weights across asset classes, with risk parity focusing on equalizing risk contributions rather than capital allocation, while risk budgeting allocates risk based on predefined risk limits for each asset. Employing risk parity can lead to more diversified risk exposure, whereas risk budgeting allows tailored risk management aligned with specific investment constraints and objectives.

Drawdown Control

Drawdown control in risk parity strategies focuses on maintaining balanced asset allocation to minimize portfolio losses during market downturns, whereas risk budgeting allocates risk based on predefined limits for each asset class to optimize overall portfolio volatility. Risk parity emphasizes equal risk contribution from all assets, while risk budgeting actively manages drawdowns by setting maximum risk thresholds and adjusting exposures accordingly.

Tail Risk Management

Tail risk management focuses on minimizing extreme losses in investment portfolios, often prioritizing strategies like risk budgeting that allocate capital based on specific risk contributions rather than equalizing risk exposure as in risk parity. Risk budgeting enhances control over tail risk by dynamically adjusting allocations to mitigate potential severe market downturns, whereas risk parity may overlook disproportionate tail risks due to its equal-risk approach across asset classes.

risk parity vs risk budgeting Infographic

moneydif.com

moneydif.com