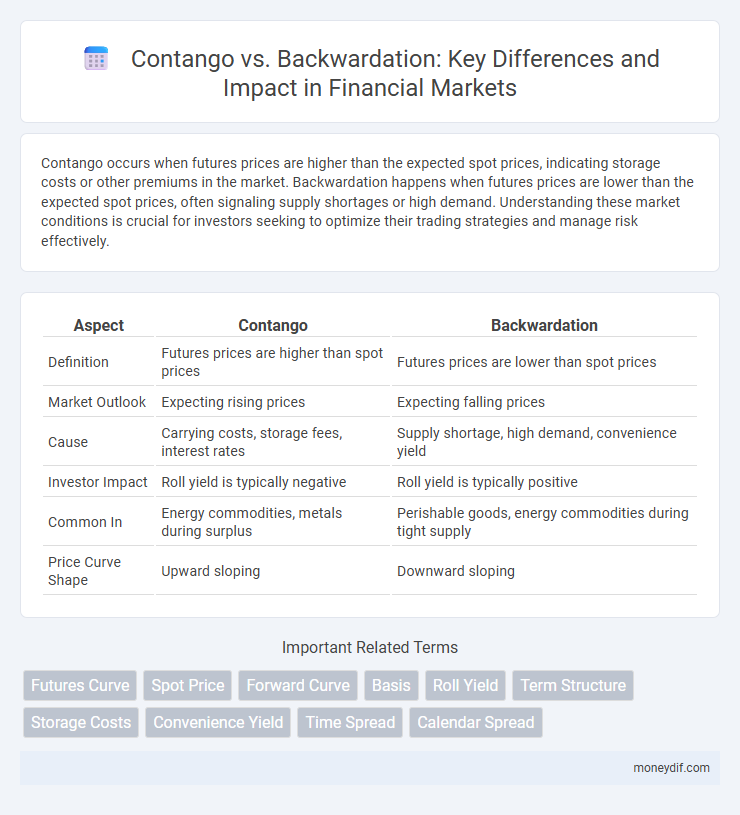

Contango occurs when futures prices are higher than the expected spot prices, indicating storage costs or other premiums in the market. Backwardation happens when futures prices are lower than the expected spot prices, often signaling supply shortages or high demand. Understanding these market conditions is crucial for investors seeking to optimize their trading strategies and manage risk effectively.

Table of Comparison

| Aspect | Contango | Backwardation |

|---|---|---|

| Definition | Futures prices are higher than spot prices | Futures prices are lower than spot prices |

| Market Outlook | Expecting rising prices | Expecting falling prices |

| Cause | Carrying costs, storage fees, interest rates | Supply shortage, high demand, convenience yield |

| Investor Impact | Roll yield is typically negative | Roll yield is typically positive |

| Common In | Energy commodities, metals during surplus | Perishable goods, energy commodities during tight supply |

| Price Curve Shape | Upward sloping | Downward sloping |

Understanding Contango and Backwardation

Contango describes a market condition where futures prices are higher than the expected future spot prices, often due to carrying costs such as storage and interest rates. Backwardation occurs when futures prices are lower than the expected future spot prices, typically driven by supply shortages or high convenience yields. Understanding contango and backwardation is crucial for investors managing commodity portfolios, as these conditions impact hedging strategies and the roll yield of futures contracts.

Key Differences Between Contango and Backwardation

Contango occurs when the futures price of a commodity exceeds its expected spot price at contract maturity, reflecting carrying costs such as storage and insurance. Backwardation arises when futures prices are lower than the expected spot prices, often driven by immediate demand or supply shortages. These contrasting market conditions significantly influence hedging strategies and investment decisions in commodity trading.

Causes of Contango in Financial Markets

Contango in financial markets occurs primarily due to carrying costs such as storage, insurance, and financing expenses that increase the futures price above the spot price. Market expectations of rising prices and supply shortages can also drive contango as traders anticipate higher future costs. Additionally, high demand for hedging with futures contracts pushes prices forward, maintaining the contango structure.

Factors Leading to Backwardation

Backwardation occurs when spot prices exceed futures prices, often driven by immediate demand surpassing supply, causing investors to pay a premium for prompt delivery. Seasonal fluctuations, geopolitical tensions, and storage costs can exacerbate backwardation by tightening available inventory and elevating short-term scarcity risk. Market expectations of declining future prices, often influenced by anticipated oversupply or technological advancements, also contribute to the persistence of backwardation in commodity markets.

Impact of Contango on Investors and Traders

Contango creates a situation where futures prices are higher than the spot price, leading investors to incur a negative roll yield when they continuously roll over contracts. This condition increases carrying costs for traders, reducing potential profits and incentivizing alternative strategies like short selling or hedging. The persistent price premium in contango markets can erode returns, especially for long-term commodity investors holding futures contracts.

Backwardation's Effects on Commodity Prices

Backwardation occurs when commodity futures prices are lower than the spot prices, indicating a market expectation of declining prices over time. This condition often leads to higher spot prices due to immediate demand pressures, incentivizing producers to sell commodities quickly rather than storing them. As a result, backwardation can reduce storage costs and impact inventory levels, influencing overall commodity market dynamics.

Contango vs Backwardation: Practical Examples

Contango occurs when futures prices are higher than the expected future spot price, often seen in commodity markets like oil, where storage costs push futures prices above current spot prices. Backwardation arises when futures prices are lower than the expected future spot price, typical in markets with immediate demand shortages, such as natural gas during peak seasons. Practical examples include crude oil futures in contango during periods of oversupply and gold futures in backwardation when demand for immediate delivery outweighs future supply expectations.

Risk Management Strategies in Contango and Backwardation

In contango markets, risk management strategies emphasize minimizing losses through rolling futures contracts to avoid negative roll yields and employing hedging techniques to protect against price declines during contract expirations. Backwardation risk management typically involves capitalizing on positive roll yields while maintaining liquidity to exploit spot price advantages and mitigate short-term supply shocks. Both structures require dynamic adjustments in portfolio hedging to navigate volatility and ensure effective commodity price exposure control.

Contango and Backwardation in Futures Trading

Contango occurs in futures trading when the futures price is higher than the expected spot price at contract maturity, often due to carrying costs such as storage and insurance for the underlying asset. Backwardation is the opposite market condition where futures prices are lower than the expected spot price, typically driven by scarcity or high demand for immediate delivery. Understanding the dynamics of contango and backwardation is essential for investors in commodity futures, as these conditions impact the roll yield and trading strategies.

Implications for Portfolio Diversification

Contango occurs when futures prices are higher than the expected future spot price, leading to potential rollover losses in commodity investments, which can reduce portfolio diversification benefits. Backwardation, where futures prices are below the expected spot price, often results in positive roll yields that enhance returns and improve diversification by offsetting weaknesses in equity or bond holdings. Understanding the implications of contango and backwardation helps investors adjust asset allocation strategies to optimize risk-adjusted returns across commodity, equity, and fixed-income markets.

Important Terms

Futures Curve

The futures curve illustrates market expectations where contango indicates futures prices rising above spot prices, while backwardation reflects futures prices below spot prices.

Spot Price

Spot price reflects the current market value of a commodity, influencing whether futures markets exhibit contango, where futures prices exceed spot prices due to carrying costs, or backwardation, where futures prices are lower than spot prices signaling immediate demand or supply shortages.

Forward Curve

The forward curve illustrates market expectations by displaying futures prices, where contango occurs when futures prices exceed spot prices indicating higher future supply or costs, and backwardation occurs when futures prices are below spot prices signaling tighter future supply or demand.

Basis

Basis measures the price difference between a futures contract and its underlying spot asset, often indicating contango when futures prices exceed spot prices and backwardation when futures prices are below spot prices.

Roll Yield

Roll yield is the profit or loss generated when rolling futures contracts in contango markets, typically resulting in negative returns, whereas in backwardation, roll yield tends to be positive due to the upward adjustment in spot prices relative to futures.

Term Structure

Term structure of futures prices shows contango when longer-term prices exceed spot prices, indicating storage costs and convenience yield, whereas backwardation occurs when future prices are lower than spot, reflecting scarcity or negative carry.

Storage Costs

Storage costs increase in contango markets due to higher future prices incentivizing inventory holding, whereas in backwardation, lower future prices reduce storage demand and costs.

Convenience Yield

Convenience yield reflects the non-monetary benefits of holding a physical commodity, influencing whether futures markets exhibit contango (low convenience yield) or backwardation (high convenience yield).

Time Spread

Time spread trading profits from differences between futures prices at different maturities, with contango indicating higher prices for longer-term contracts and backwardation reflecting lower prices for longer-term contracts.

Calendar Spread

A calendar spread profits from differences in futures contract prices caused by market conditions like contango, where long-term contracts are priced higher than near-term ones, or backwardation, where near-term contracts are priced higher than long-term ones.

Contango vs Backwardation Infographic

moneydif.com

moneydif.com