Block trades involve large volumes of securities traded off-exchange between institutional investors, enabling significant transactions without affecting market prices. Odd lot trades consist of smaller quantities, typically fewer than 100 shares, often executed by retail investors and may face higher transaction costs or less favorable pricing. Understanding the difference between block trades and odd lot trades helps optimize trading strategies and manage market impact effectively.

Table of Comparison

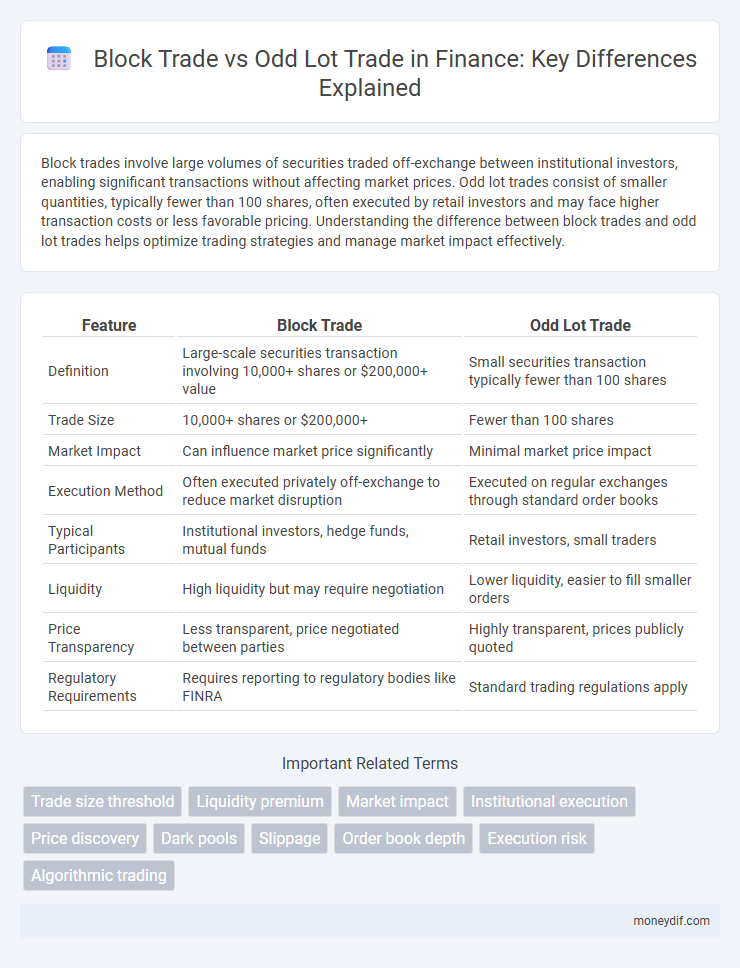

| Feature | Block Trade | Odd Lot Trade |

|---|---|---|

| Definition | Large-scale securities transaction involving 10,000+ shares or $200,000+ value | Small securities transaction typically fewer than 100 shares |

| Trade Size | 10,000+ shares or $200,000+ | Fewer than 100 shares |

| Market Impact | Can influence market price significantly | Minimal market price impact |

| Execution Method | Often executed privately off-exchange to reduce market disruption | Executed on regular exchanges through standard order books |

| Typical Participants | Institutional investors, hedge funds, mutual funds | Retail investors, small traders |

| Liquidity | High liquidity but may require negotiation | Lower liquidity, easier to fill smaller orders |

| Price Transparency | Less transparent, price negotiated between parties | Highly transparent, prices publicly quoted |

| Regulatory Requirements | Requires reporting to regulatory bodies like FINRA | Standard trading regulations apply |

Introduction to Block Trade and Odd Lot Trade

Block trade refers to the sale or purchase of a large quantity of securities, typically exceeding 10,000 shares or valued at over $200,000, executed privately between institutional investors to minimize market impact. Odd lot trade involves buying or selling security quantities less than the standard trading unit, usually fewer than 100 shares, often affecting retail investors and sometimes leading to less favorable pricing. Understanding the distinction between block trades and odd lot trades is crucial for optimizing trade execution strategies in financial markets.

Key Definitions: Block Trade vs Odd Lot Trade

Block trade refers to the purchase or sale of a large number of securities, typically exceeding 10,000 shares or valued at over $200,000, executed privately to minimize market impact. Odd lot trade involves transactions of securities in quantities smaller than the standard trading unit, often less than 100 shares, which can incur higher transaction costs and less favorable pricing. Understanding these distinctions is crucial for investors managing liquidity, transaction costs, and market impact in equity trading.

Main Differences between Block and Odd Lot Trades

Block trades involve large quantities of securities, typically exceeding 10,000 shares or $200,000 in value, executed privately to minimize market impact and price fluctuations. Odd lot trades consist of small quantities, usually less than 100 shares, often executed through standard exchanges and subject to higher per-share transaction costs. The primary differences lie in trade size, execution method, market impact, and transaction costs, with block trades catering to institutional investors and odd lot trades more common among retail investors.

Trade Size and Volume: Block vs Odd Lot

Block trades typically involve large volumes, often exceeding 10,000 shares or $200,000 in value, allowing institutional investors to execute substantial orders without significantly impacting market prices. Odd lot trades consist of smaller quantities, usually fewer than 100 shares, commonly executed by retail investors and often resulting in higher per-share transaction costs. The difference in trade size and volume directly influences liquidity, price discovery, and execution efficiency in financial markets.

Market Participants in Block and Odd Lot Trades

Institutional investors and hedge funds typically dominate block trades due to their need to execute large-volume transactions without substantially impacting market prices. Retail traders and small investors primarily engage in odd lot trades, involving smaller quantities below standard trading sizes that often result in higher transaction costs. Market makers and brokers facilitate both trade types, ensuring liquidity and efficient price discovery across varying trade sizes.

Execution Methods for Block and Odd Lot Trades

Block trades are executed through private negotiations between institutional investors or via specialized brokers to minimize market impact and ensure large-volume transactions are completed efficiently. Odd lot trades involve smaller quantities, typically less than 100 shares, executed directly on the exchange through standard order types, often incurring higher transaction costs per share. Execution methods for block trades prioritize discretion and price stability, while odd lot trades emphasize accessibility and speed in retail trading environments.

Liquidity Impact: Block Trade vs Odd Lot

Block trades typically involve large volumes of securities that can significantly affect market liquidity by temporarily absorbing substantial supply or demand, often requiring negotiated transactions outside the public order book. Odd lot trades consist of smaller, irregular share quantities that generally exert minimal impact on liquidity, as their size is too small to influence market price or volume noticeably. Consequently, block trades can lead to short-term price volatility, whereas odd lot trades usually reflect routine retail activity without disturbing market equilibrium.

Regulatory Considerations for Block and Odd Lot Trades

Regulatory considerations for block trades often involve stringent reporting requirements and pre-trade notifications to ensure market transparency and prevent manipulation, as these large-volume transactions can significantly impact market prices. Odd lot trades, typically smaller and below standard trading units, face fewer regulatory burdens but are scrutinized to detect potential market abuse or layering practices. Both trade types must comply with SEC rules and exchange-specific regulations designed to maintain fair trading environments and protect investor interests.

Typical Use Cases: When to Choose Block or Odd Lot

Block trades are typically chosen by institutional investors and hedge funds for executing large-volume transactions efficiently without significantly impacting market prices, making them ideal for portfolio rebalancing or large asset acquisitions. Odd lot trades are favored by retail investors for smaller, irregular quantities of shares that do not meet standard trading unit sizes, often used for dollar-cost averaging or fractional investing strategies. Selecting between block and odd lot trades depends on trade size, liquidity needs, and price sensitivity in execution.

Risks and Advantages: Block Trade vs Odd Lot Trade

Block trades offer advantages such as reduced market impact and the ability to negotiate prices directly, minimizing slippage for institutional investors. However, block trades carry risks including lower transparency and potential regulatory scrutiny due to their size and off-exchange execution. Odd lot trades, while providing flexibility for retail investors and enabling smaller transaction sizes, pose higher risks of wider bid-ask spreads and increased transaction costs due to lower liquidity.

Important Terms

Trade size threshold

Trade size thresholds distinguish block trades, typically exceeding 10,000 shares or valued over $200,000, from odd lot trades, which involve fewer than 100 shares and often incur different pricing and execution rules.

Liquidity premium

Liquidity premium reflects the higher return investors demand for trading less liquid securities, such as odd lot trades, compared to block trades which usually involve large volumes and benefit from tighter bid-ask spreads. Block trades typically have lower liquidity premiums due to their ease of execution, whereas odd lot trades incur higher costs and price concessions, increasing the liquidity premium demanded by market participants.

Market impact

Block trades, involving large volumes of securities executed outside the open market, typically result in significant price movements due to their scale and potential market absorption challenges. Odd lot trades, consisting of smaller, irregular quantities, generally have minimal market impact as they represent a fraction of average daily trading volumes and do not substantially influence price discovery.

Institutional execution

Institutional execution typically involves block trades, which are large transactions executed outside regular market hours to minimize price impact, whereas odd lot trades consist of smaller quantities often processed through standard exchanges with higher relative transaction costs. Block trades provide liquidity for institutions by allowing substantial asset transfers discreetly, while odd lot trades are more common among retail investors with limited market influence.

Price discovery

Price discovery in block trades typically involves large volumes that can significantly impact market prices due to the substantial liquidity and institutional participation. Odd lot trades, often smaller than a standard trading unit, contribute less to immediate price adjustments but provide granular insights into retail investor behavior and market sentiment.

Dark pools

Dark pools facilitate block trades by enabling large institutional investors to buy or sell substantial quantities of securities anonymously, minimizing market impact and price disruption. In contrast, odd lot trades involve smaller trade sizes below the standard trading unit and typically occur on lit exchanges, making them less relevant to the strategic advantages offered by dark pools.

Slippage

Slippage refers to the difference between the expected price of a trade and the actual executed price, which often occurs in block trades due to their large order sizes causing market impact and price movements. In contrast, odd lot trades, involving smaller quantities, typically experience minimal slippage as they execute more easily without significantly affecting market prices.

Order book depth

Order book depth indicates the volume of buy and sell orders at various price levels, crucial for understanding market liquidity during block trades and odd lot trades. Block trades typically impact deeper order book levels due to large volume execution, whereas odd lot trades, involving smaller quantities, generally affect shallower order book depth with minimal price disturbance.

Execution risk

Execution risk in block trades is significantly higher due to the large volume of shares involved, which can cause noticeable price slippage and market impact. In contrast, odd lot trades, involving smaller quantities typically under 100 shares, generally face lower execution risk and minimal influence on market prices, allowing for quicker, more discrete transaction completion.

Algorithmic trading

Algorithmic trading efficiently executes block trades by breaking large orders into smaller odd lot trades to minimize market impact and reduce price slippage. This technique leverages advanced algorithms and real-time market data to optimize trade execution and improve liquidity management in high-frequency trading environments.

block trade vs odd lot trade Infographic

moneydif.com

moneydif.com