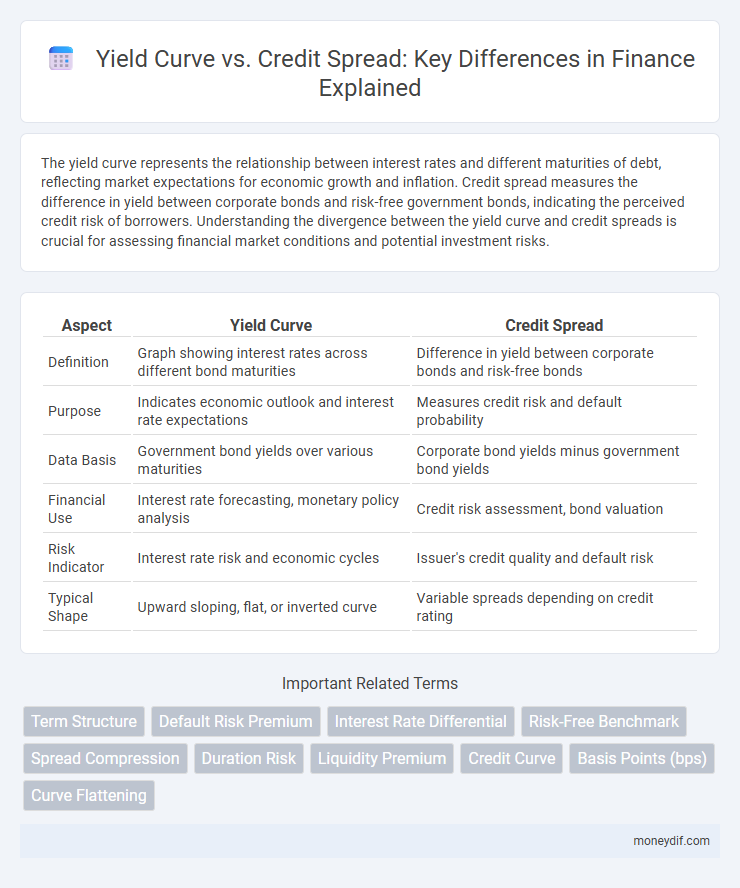

The yield curve represents the relationship between interest rates and different maturities of debt, reflecting market expectations for economic growth and inflation. Credit spread measures the difference in yield between corporate bonds and risk-free government bonds, indicating the perceived credit risk of borrowers. Understanding the divergence between the yield curve and credit spreads is crucial for assessing financial market conditions and potential investment risks.

Table of Comparison

| Aspect | Yield Curve | Credit Spread |

|---|---|---|

| Definition | Graph showing interest rates across different bond maturities | Difference in yield between corporate bonds and risk-free bonds |

| Purpose | Indicates economic outlook and interest rate expectations | Measures credit risk and default probability |

| Data Basis | Government bond yields over various maturities | Corporate bond yields minus government bond yields |

| Financial Use | Interest rate forecasting, monetary policy analysis | Credit risk assessment, bond valuation |

| Risk Indicator | Interest rate risk and economic cycles | Issuer's credit quality and default risk |

| Typical Shape | Upward sloping, flat, or inverted curve | Variable spreads depending on credit rating |

Understanding the Yield Curve in Finance

The yield curve represents the relationship between interest rates and bond maturities, serving as a crucial indicator in finance for predicting economic conditions and interest rate trends. It typically slopes upward, reflecting higher yields for longer-term bonds due to increased risk and inflation expectations, while an inverted yield curve may signal recession risks. Understanding the yield curve helps investors assess credit risk and guides decisions on bond pricing and portfolio management relative to credit spreads, which measure the additional yield over risk-free benchmarks.

Defining Credit Spread and Its Importance

Credit spread represents the difference in yield between a corporate bond and a comparable maturity government bond, reflecting the additional risk premium investors demand for credit risk. It is a crucial indicator of a borrower's creditworthiness and the perceived default risk in the financial markets. Monitoring credit spreads helps investors assess relative value, identify market sentiment, and manage portfolio risk effectively.

Key Differences: Yield Curve vs Credit Spread

The yield curve represents the relationship between interest rates and different maturities of government bonds, reflecting overall market expectations for future interest rates and economic growth. Credit spread measures the yield difference between corporate bonds and government bonds of similar maturity, indicating the perceived credit risk and default probability of corporate issuers. Key differences include that the yield curve is primarily influenced by macroeconomic factors like inflation and monetary policy, while credit spreads are driven by issuer-specific credit risk and market sentiment toward corporate debt.

Factors Influencing the Yield Curve

Interest rate expectations, inflation forecasts, and monetary policy decisions are primary factors influencing the yield curve's shape and slope. Economic growth projections and market liquidity conditions also play significant roles in impacting yield curve dynamics. Changes in investor risk appetite and demand for long-term versus short-term securities affect the overall credit spread environment.

Drivers Behind Credit Spread Movements

Credit spread movements are primarily driven by changes in credit risk perception, economic conditions, and market liquidity, which influence investor demand for risk premiums over benchmark yields reflected in the yield curve. Macro factors such as GDP growth, corporate earnings, and monetary policy shifts impact credit spreads by altering default probabilities and recovery rates. Market sentiment and supply-demand dynamics for corporate bonds also modulate credit spreads independently from yield curve fluctuations, highlighting the divergent drivers between these two credit cost measures.

Yield Curve and Credit Spread: Economic Indicators

The yield curve represents the relationship between interest rates and bond maturities, serving as a crucial economic indicator for market expectations about future interest rates and economic growth. Credit spreads measure the difference in yield between corporate bonds and comparable government bonds, reflecting perceived credit risk and economic conditions. Monitoring both yield curves and credit spreads provides valuable insights into financial market sentiment and potential shifts in the economic cycle.

Impact on Fixed Income Investments

The yield curve shape directly influences fixed income investment strategies by signaling interest rate expectations and economic outlook, affecting bond prices and durations. Credit spreads, representing the risk premium over government securities, impact investment decisions by reflecting credit risk and liquidity conditions in the bond market. Wider credit spreads typically indicate higher perceived risk, leading to increased yields demanded by investors and consequently affecting fixed income portfolio returns.

Yield Curve Inversion vs Widening Credit Spreads

Yield curve inversion occurs when short-term interest rates exceed long-term rates, signaling potential economic recession and tightening monetary policy expectations. Widening credit spreads reflect increased risk premiums demanded by investors due to deteriorating credit quality or heightened market uncertainty. Both indicators serve as critical signals for assessing financial market stress and predicting economic downturns.

Interpreting Market Signals for Portfolio Strategy

Yield curve analysis reveals investor expectations on interest rates and economic growth, guiding fixed-income portfolio duration decisions. Credit spread fluctuations indicate shifts in perceived credit risk, essential for adjusting bond selection between investment-grade and high-yield securities. Integrating yield curve shape with credit spread movements enhances risk assessment and tactical allocation to optimize portfolio returns under varying market conditions.

Historical Trends: Yield Curves and Credit Spreads

Historical trends reveal that yield curves and credit spreads exhibit distinct behavior during economic cycles, with yield curves often flattening or inverting preceding recessions while credit spreads typically widen due to increased credit risk. Analysis of past decades shows that steep yield curves correlate with economic expansion, whereas rising credit spreads signal deteriorating corporate credit quality and investor risk aversion. These patterns provide critical insights for investors and policymakers in assessing market conditions and forecasting financial stability.

Important Terms

Term Structure

Term structure illustrates the relationship between bond yields and maturities, highlighting how the yield curve reflects market expectations for interest rates over time. Credit spread, the difference between yields on bonds with varying credit qualities, interacts with the yield curve to indicate perceived credit risk and investor sentiment.

Default Risk Premium

Default risk premium increases the credit spread on bonds compared to risk-free yields, causing a steeper yield curve in higher-risk corporate or sovereign debt.

Interest Rate Differential

Interest Rate Differential influences the Yield Curve's slope and impacts Credit Spread by reflecting changes in market risk perception and debt instrument liquidity.

Risk-Free Benchmark

The risk-free benchmark yield curve serves as a foundational reference for evaluating credit spreads, which measure the additional yield investors demand for bearing credit risk beyond the risk-free rate.

Spread Compression

Spread compression occurs when the credit spread narrows relative to the yield curve, indicating reduced perceived credit risk or improved issuer creditworthiness.

Duration Risk

Duration risk increases as yield curve shifts impact bond prices more significantly than credit spread changes, highlighting the importance of managing interest rate sensitivity versus credit risk exposure.

Liquidity Premium

Liquidity premium increases yield curve steepness by compensating investors for lower marketability, thereby widening credit spreads on less liquid bonds.

Credit Curve

Credit Curve represents the credit spreads over the Yield Curve, illustrating the risk premium investors demand for bearing credit risk compared to risk-free rates.

Basis Points (bps)

Basis points (bps) quantify yield curve shifts and credit spread changes, where a 100 bps increase typically signals a 1% rise in bond yields or credit risk premiums affecting fixed-income valuations.

Curve Flattening

Curve flattening occurs when the yield curve's slope decreases while credit spreads widen, indicating increased risk perception and potential economic slowdown.

Yield Curve vs Credit Spread Infographic

moneydif.com

moneydif.com