A liquidity trap occurs when interest rates are low and savings rates remain high, rendering monetary policy ineffective in stimulating economic growth. In contrast, a credit crunch involves a sudden reduction in the availability of loans or credit, often due to tighter lending standards by financial institutions. Both scenarios restrict economic activity but differ in their underlying causes and impacts on credit markets.

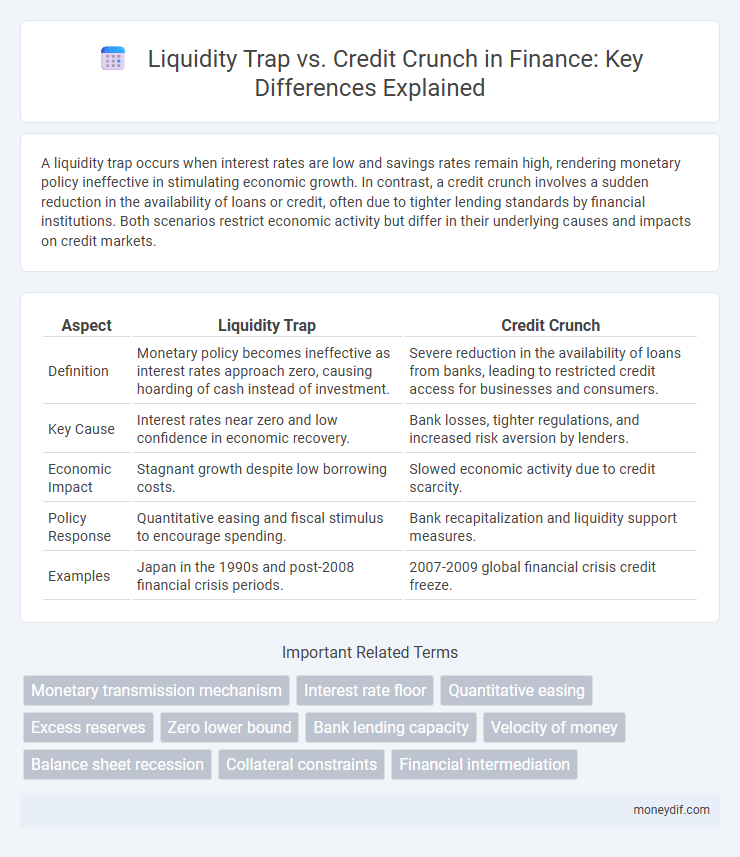

Table of Comparison

| Aspect | Liquidity Trap | Credit Crunch |

|---|---|---|

| Definition | Monetary policy becomes ineffective as interest rates approach zero, causing hoarding of cash instead of investment. | Severe reduction in the availability of loans from banks, leading to restricted credit access for businesses and consumers. |

| Key Cause | Interest rates near zero and low confidence in economic recovery. | Bank losses, tighter regulations, and increased risk aversion by lenders. |

| Economic Impact | Stagnant growth despite low borrowing costs. | Slowed economic activity due to credit scarcity. |

| Policy Response | Quantitative easing and fiscal stimulus to encourage spending. | Bank recapitalization and liquidity support measures. |

| Examples | Japan in the 1990s and post-2008 financial crisis periods. | 2007-2009 global financial crisis credit freeze. |

Understanding Liquidity Traps in Modern Finance

Liquidity traps occur when interest rates approach zero, rendering monetary policy ineffective as individuals and businesses hoard cash instead of borrowing or spending, even with abundant liquidity. In contrast, a credit crunch involves a sudden reduction in the availability of loans, typically triggered by tighter lending standards and increased risk aversion among banks. Modern finance recognizes that liquidity traps can stall economic recovery despite central bank interventions, highlighting the need for fiscal policies to stimulate demand.

Credit Crunch: Causes and Consequences

A credit crunch occurs when lenders significantly reduce the availability of loans, often triggered by declining asset prices, rising default rates, and tightening regulatory policies. This contraction in credit supply constrains business investment and consumer spending, leading to slower economic growth and increased financial instability. The aftermath frequently includes higher borrowing costs, reduced access to capital, and prolonged economic recovery periods.

Key Differences Between Liquidity Trap and Credit Crunch

A liquidity trap occurs when interest rates are near zero and monetary policy becomes ineffective because people hoard cash instead of investing or spending. In contrast, a credit crunch is characterized by a sudden reduction in the availability of loans or credit, usually due to banks tightening lending standards during financial distress. Key differences include the liquidity trap's reliance on monetary policy failure versus the credit crunch's origin in banking sector constraints and credit market disruptions.

Economic Indicators: Spotting Liquidity Traps

Liquidity traps are characterized by near-zero interest rates and stagnant monetary policy effectiveness despite increased money supply, often evidenced by declining velocity of money and persistently high savings rates. Key economic indicators include widening bond yield spreads, flattening or inverted yield curves, and weak inflation expectations, signaling subdued demand despite abundant liquidity. Unlike credit crunches, where tightening bank lending standards and reduced credit availability lead to contracting credit growth, liquidity traps reflect a scenario where monetary policy loses traction amid low consumer confidence and investment activity.

Credit Crunch Warning Signs in Financial Markets

A credit crunch warning manifests through tightened lending standards, a surge in non-performing loans, and declining bank capital ratios, indicating reduced credit availability. Market indicators such as widening credit spreads, falling bond prices, and increased volatility in interbank lending rates highlight growing risk aversion among financial institutions. Monitoring these signs enables early detection of credit market stress that can lead to a contraction in economic activity.

Central Bank Responses: Liquidity Trap Strategies

Central banks facing a liquidity trap often implement quantitative easing and forward guidance to stimulate borrowing and spending when traditional interest rate cuts are ineffective. They increase money supply and signal prolonged low rates to restore confidence and encourage investment despite demand stagnation. These strategies contrast with credit crunch responses where central banks aim to stabilize financial institutions and restore credit flow through emergency lending facilities and regulatory easing.

Policy Solutions for Credit Crunch Scenarios

Policy solutions for credit crunch scenarios emphasize targeted fiscal interventions and regulatory reforms to restore lending flow and stabilize financial markets. Central banks may implement capital injections and liquidity support while easing credit standards to encourage bank lending. Enhancing credit guarantees and reducing borrower risk through government-backed programs help mitigate credit scarcity and revive economic activity effectively.

Impact on Investment and Consumer Behavior

A liquidity trap severely restricts monetary policy effectiveness by causing near-zero interest rates, leading consumers to hoard cash instead of spending, which dampens investment incentives. In contrast, a credit crunch tightens lending standards, reducing businesses' access to external financing and forcing cuts in capital expenditures, thereby directly curbing investment. Consumer behavior in a credit crunch shifts toward reduced borrowing and delayed purchases due to constrained credit availability, amplifying the economic slowdown.

Historical Examples: Liquidity Trap vs. Credit Crunch

The Great Depression of the 1930s exemplifies a liquidity trap, where zero interest rates failed to stimulate borrowing or spending despite expansive monetary policy. In contrast, the 2008 Financial Crisis demonstrated a credit crunch, characterized by a sudden tightening of credit and collapse of major financial institutions like Lehman Brothers, severely restricting access to loans. Both scenarios critically impacted economic recovery but required different policy responses due to their distinct underlying mechanisms.

Preventive Measures and Risk Management Strategies

Implementing robust monetary policies and ensuring ample central bank liquidity support are critical preventive measures against a liquidity trap, helping maintain market confidence and avoid stagnation. Credit crunch risk management involves strengthening bank capital reserves, enhancing credit risk assessments, and promoting transparent lending standards to sustain credit flow during economic stress. Diversifying funding sources and stress-testing financial institutions further mitigate risks, ensuring resilience against sudden credit market contractions or liquidity shortfalls.

Important Terms

Monetary transmission mechanism

The monetary transmission mechanism weakens during a liquidity trap as interest rates approach zero, limiting central banks' ability to stimulate borrowing and spending despite increased liquidity. In contrast, a credit crunch restricts credit supply due to tighter lending standards and bank capital constraints, directly impairing the transmission of monetary policy to the real economy.

Interest rate floor

An interest rate floor can exacerbate a liquidity trap by preventing rates from falling below a threshold, thereby limiting monetary policy effectiveness, whereas in a credit crunch, it may help stabilize lending by ensuring minimum returns for banks.

Quantitative easing

Quantitative easing increases money supply to alleviate liquidity traps where traditional monetary policy fails, contrasting with credit crunches that restrict lending despite ample liquidity.

Excess reserves

Excess reserves rise during a liquidity trap as banks hoard cash despite low interest rates, whereas a credit crunch occurs when banks restrict lending due to heightened risk concerns.

Zero lower bound

The zero lower bound (ZLB) on nominal interest rates limits central banks' ability to stimulate the economy in a liquidity trap, where conventional monetary policy becomes ineffective despite ample liquidity and low borrowing costs. Unlike a credit crunch, characterized by tightened lending standards and reduced bank credit availability, a liquidity trap at the ZLB reflects suppressed demand for loans even when interest rates approach zero.

Bank lending capacity

Bank lending capacity diminishes significantly during a credit crunch as financial institutions face tightened capital requirements and increased default risks, constraining credit supply despite available liquidity. In contrast, a liquidity trap presents ample liquidity but minimal lending demand due to low interest rates and borrower pessimism, limiting the efficacy of monetary policy in stimulating loans.

Velocity of money

Velocity of money decreases sharply during both liquidity traps and credit crunches as consumers and businesses hold onto cash rather than spending or investing. In a liquidity trap, low interest rates fail to stimulate borrowing, while in a credit crunch, tightened lending standards restrict credit flow, both leading to reduced money circulation in the economy.

Balance sheet recession

A balance sheet recession occurs when widespread debt overhang forces firms and households to prioritize deleveraging, intensifying a credit crunch while weakening monetary policy effectiveness and deepening the liquidity trap.

Collateral constraints

Collateral constraints exacerbate liquidity traps by limiting borrowers' ability to obtain financing despite low-interest rates, reducing aggregate demand and deepening economic stagnation. In a credit crunch, tightened collateral requirements restrict credit supply, causing a sharp contraction in lending that hampers investment and growth.

Financial intermediation

Financial intermediation plays a critical role during a liquidity trap by channeling idle funds into productive credit, yet its effectiveness diminishes when borrowers reduce demand despite low-interest rates. In contrast, a credit crunch directly impairs financial intermediation as banks tighten lending standards, restricting credit flow and exacerbating economic contraction.

liquidity trap vs credit crunch Infographic

moneydif.com

moneydif.com