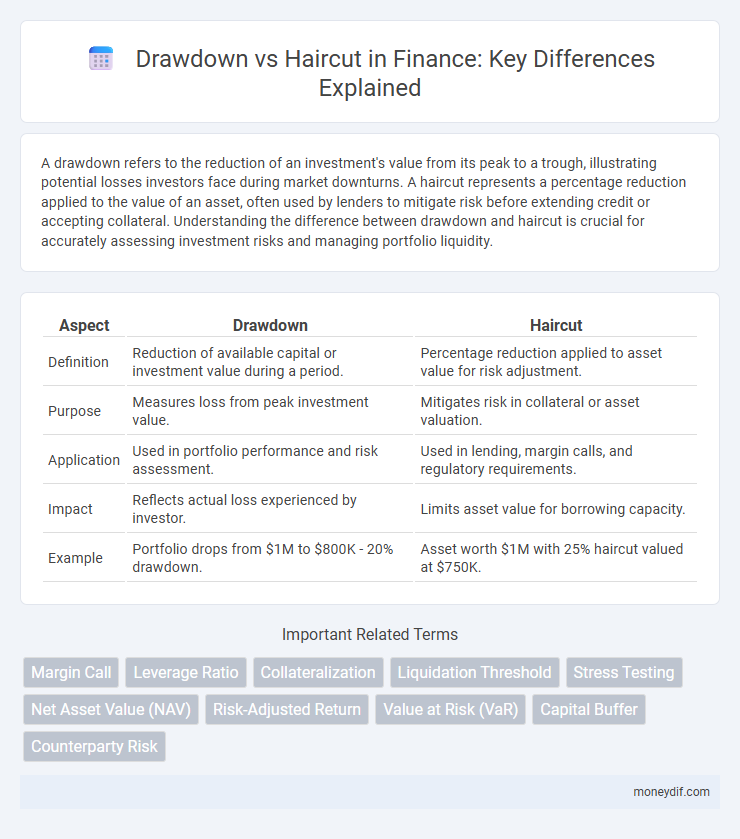

A drawdown refers to the reduction of an investment's value from its peak to a trough, illustrating potential losses investors face during market downturns. A haircut represents a percentage reduction applied to the value of an asset, often used by lenders to mitigate risk before extending credit or accepting collateral. Understanding the difference between drawdown and haircut is crucial for accurately assessing investment risks and managing portfolio liquidity.

Table of Comparison

| Aspect | Drawdown | Haircut |

|---|---|---|

| Definition | Reduction of available capital or investment value during a period. | Percentage reduction applied to asset value for risk adjustment. |

| Purpose | Measures loss from peak investment value. | Mitigates risk in collateral or asset valuation. |

| Application | Used in portfolio performance and risk assessment. | Used in lending, margin calls, and regulatory requirements. |

| Impact | Reflects actual loss experienced by investor. | Limits asset value for borrowing capacity. |

| Example | Portfolio drops from $1M to $800K - 20% drawdown. | Asset worth $1M with 25% haircut valued at $750K. |

Understanding Drawdown and Haircut in Finance

Drawdown in finance refers to the peak-to-trough decline during a specific period of an investment, measuring the loss from the highest value to the lowest point. A haircut represents the percentage reduction applied to the market value of an asset, often used as a risk control measure by lenders to account for potential asset devaluation. Understanding the distinction between drawdown and haircut is crucial for effective risk management and accurate valuation in portfolio and collateral assessment.

Key Differences Between Drawdown and Haircut

Drawdown refers to the reduction in the value of an investment or portfolio from its peak, highlighting actual losses experienced over a period. Haircut is a percentage reduction applied to the value of collateral or assets to account for risk before lending or trading, serving as a risk management tool. The key difference lies in drawdown measuring realized or unrealized losses, whereas haircut represents a preventive adjustment to asset value for margin or credit purposes.

Causes of Drawdown vs Causes of Haircut

Drawdowns in finance primarily arise from market volatility, asset price declines, or unfavorable investment performance, reflecting a reduction in an account's peak value. Haircuts occur due to risk management practices, collateral valuation adjustments, or regulatory requirements that reduce the stated value of assets to reflect potential losses. While drawdowns result from actual losses, haircuts address potential credit risk and liquidity concerns within financial transactions.

Measuring Drawdown: Methods and Metrics

Measuring drawdown involves evaluating the peak-to-trough decline in an investment's value, typically expressed as a percentage to quantify the loss from the highest point to the lowest during a specific period. Common methods include maximum drawdown, which highlights the largest drop, and average drawdown metrics that assess overall risk exposure over time. These metrics provide investors with critical insights into downside risk, helping to manage portfolio volatility and inform strategic asset allocation decisions.

Calculating Haircuts: Financial Techniques

Calculating haircuts involves assessing the risk exposure of collateral assets by applying percentage reductions to their market value, ensuring protection against market volatility and credit risk. Financial techniques such as stress testing, historical price analysis, and scenario modeling help determine appropriate haircut percentages based on asset liquidity, volatility, and credit quality. These methods contrast with drawdown calculations, which measure the decline in investment value over time rather than adjusting collateral value for risk management.

Impacts of Drawdown on Portfolio Performance

Drawdown significantly affects portfolio performance by measuring the peak-to-trough decline, highlighting the risk and recovery duration investors face during market downturns. Unlike a haircut, which represents a reduction in asset value for collateral or loan purposes, drawdown impacts the realized portfolio returns and investor confidence in risk management strategies. Managing drawdowns effectively through diversification and strategic asset allocation can enhance long-term portfolio resilience and growth potential.

Effects of Haircut on Asset Value

Haircuts directly reduce the valuation of collateral assets, lowering the effective borrowing capacity in financial transactions. This adjustment ensures lenders account for potential market volatility and credit risk, safeguarding against asset devaluation during loan default. The resulting decrease in asset value can increase the cost of capital and impact liquidity management strategies for financial institutions.

Risk Management: Drawdown vs Haircut Strategies

Drawdown and haircut strategies serve distinct roles in risk management by measuring potential losses and adjusting asset valuations. Drawdown quantifies the peak-to-trough decline in investment value, providing a dynamic risk metric for portfolio performance analysis. Haircut applies a predetermined percentage reduction to asset values to mitigate credit and market risk exposure during collateral valuation and margin requirements.

Regulatory Perspective: Drawdown and Haircut Guidelines

Regulatory frameworks mandate specific drawdown and haircut guidelines to manage financial risks and maintain capital adequacy, requiring institutions to apply conservative haircuts on collateral valuations and monitor drawdowns meticulously. These guidelines ensure compliance with Basel III and other prudential measures, emphasizing stress testing and liquidity coverage ratios. Accurate drawdown reporting and adherence to prescribed haircut percentages mitigate systemic risk and enhance transparency within financial markets.

Real-World Examples: Drawdown vs Haircut in Practice

A drawdown in finance represents the peak-to-trough decline during a specific period for an investment, exemplified when a hedge fund's portfolio value drops by 20% amid market volatility. A haircut refers to the percentage reduction applied to the asset's market value, such as a 15% haircut on collateral in repo transactions to mitigate credit risk. Real-world use cases include banks applying haircuts on securities to determine effective loan values while portfolio managers monitor drawdowns to manage risk exposure and performance benchmarks.

Important Terms

Margin Call

Margin call arises when account equity falls below the maintenance margin requirement, often triggered by a significant drawdown in asset value. The haircut, representing a percentage reduction applied to the asset's market value to determine its lending value, directly influences the margin call threshold by adjusting the buffer against price fluctuations.

Leverage Ratio

Leverage ratio quantifies the amount of borrowed funds used relative to equity, critically influencing the drawdown tolerance before triggering a margin call or forced deleveraging, while the haircut represents the percentage discount applied to collateral value to mitigate risk. A higher leverage ratio increases sensitivity to drawdowns, reducing the effective collateral value through larger haircuts and amplifying the possibility of liquidation during market stress.

Collateralization

Collateralization reduces drawdown risk by applying a haircut to asset value, ensuring sufficient margin coverage and minimizing potential losses.

Liquidation Threshold

The liquidation threshold represents the critical value of collateral-to-debt ratio at which liquidation occurs, balancing between drawdown--the amount the asset price can fall--and haircut, the safety margin applied to collateral valuation. A lower liquidation threshold increases risk by triggering liquidation earlier during drawdowns, while a higher haircut reduces the effective collateral value, requiring more over-collateralization to avoid liquidation.

Stress Testing

Stress testing evaluates the potential impact of extreme market conditions on a portfolio by simulating severe drawdowns, which represent peak-to-trough declines in asset values. Haircut measures the percentage reduction applied to asset values for risk mitigation, often intensified during stress testing to reflect potential liquidity constraints and market volatility.

Net Asset Value (NAV)

Net Asset Value (NAV) represents the per-share value of a fund's assets minus liabilities, serving as a critical metric for assessing investment performance and pricing. In risk management, drawdown quantifies the peak-to-trough decline in NAV, reflecting potential losses, while a haircut applies a conservative percentage deduction to asset valuations to mitigate market or liquidity risk in calculating adjusted NAV.

Risk-Adjusted Return

Risk-adjusted return measures investment performance by considering both returns and associated risks, with drawdown quantifying the peak-to-trough decline in asset value, while haircut represents the percentage reduction applied to asset value for risk management purposes. Evaluating risk-adjusted return in relation to drawdown and haircut enables investors to better assess portfolio resilience and optimize capital allocation under stressed market conditions.

Value at Risk (VaR)

Value at Risk (VaR) quantifies potential portfolio losses over a specific time horizon under normal market conditions, while drawdown measures the actual peak-to-trough decline experienced by the portfolio. Haircut involves the percentage reduction applied to asset values in collateral valuation to mitigate risk, complementing VaR by providing additional protection against liquidity and market fluctuations during drawdowns.

Capital Buffer

Capital buffer represents the additional equity banks hold to absorb losses during financial stress, minimizing the impact of drawdowns on their solvency. Haircuts apply to asset valuations by reducing their market value, directly affecting drawdown calculations and the size of the required capital buffer to maintain regulatory compliance.

Counterparty Risk

Counterparty risk increases significantly when drawdowns exceed established haircuts, as collateral value may no longer cover potential losses in financial transactions. Effective risk management requires dynamic adjustment of haircuts to reflect market volatility and protect against counterparty default during substantial drawdowns.

drawdown vs haircut Infographic

moneydif.com

moneydif.com