Front-running involves executing trades based on advance knowledge of large pending orders to capitalize on expected price movements, often considered unethical or illegal. Tailgating occurs when traders mimic the actions of successful investors shortly after their trades become public, aiming to ride the price momentum. Both strategies impact market fairness and transparency, with front-running posing significant regulatory concerns and tailgating reflecting opportunistic behavior.

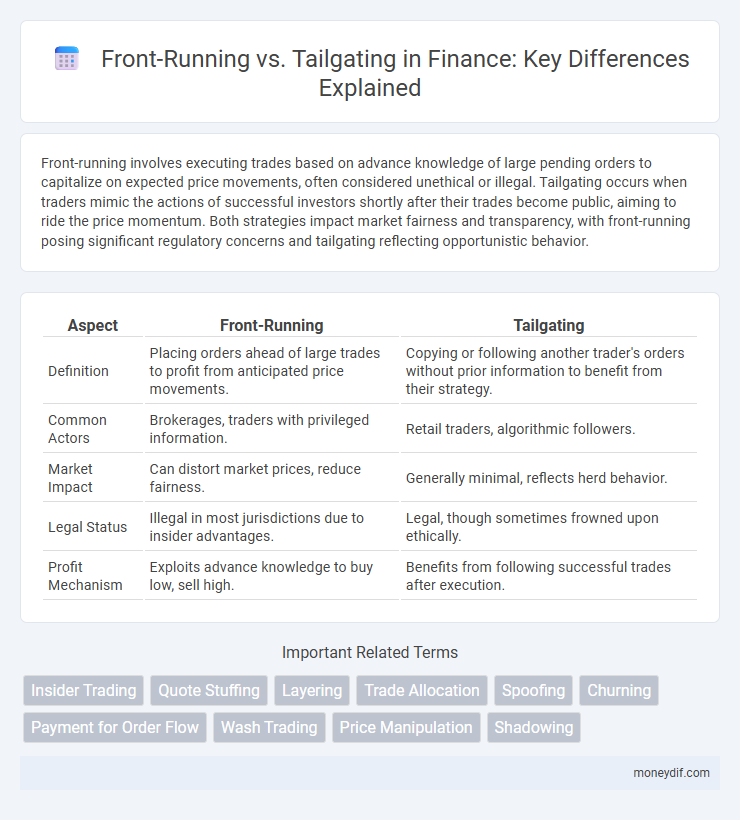

Table of Comparison

| Aspect | Front-Running | Tailgating |

|---|---|---|

| Definition | Placing orders ahead of large trades to profit from anticipated price movements. | Copying or following another trader's orders without prior information to benefit from their strategy. |

| Common Actors | Brokerages, traders with privileged information. | Retail traders, algorithmic followers. |

| Market Impact | Can distort market prices, reduce fairness. | Generally minimal, reflects herd behavior. |

| Legal Status | Illegal in most jurisdictions due to insider advantages. | Legal, though sometimes frowned upon ethically. |

| Profit Mechanism | Exploits advance knowledge to buy low, sell high. | Benefits from following successful trades after execution. |

Understanding Front-Running in Financial Markets

Front-running in financial markets refers to the unethical practice where a broker or trader executes orders based on advance knowledge of pending large client transactions, aiming to profit from the expected price movement. This behavior undermines market integrity by exploiting non-public information, leading to unfair advantages and potential regulatory violations under securities laws. Differentiating front-running from tailgating, where orders follow market trends rather than insider knowledge, is crucial for maintaining transparent and equitable trading environments.

What is Tailgating? A Clear Definition

Tailgating in finance refers to the unethical practice where a trader places orders immediately after a large, impactful trade to capitalize on the resulting market movement. This approach exploits non-public information or anticipates price changes triggered by the initial trade, often disadvantaging uninformed market participants. Unlike front-running, which occurs before the significant order, tailgating benefits from the price momentum following that trade execution.

Key Differences Between Front-Running and Tailgating

Front-running involves a broker executing orders based on advance knowledge of a client's pending large transactions to profit from subsequent price movements, whereas tailgating consists of traders following large trades after they occur, attempting to capitalize on momentum. Front-running is illegal due to its manipulative and non-transparent nature, while tailgating operates in a gray area but can lead to market distortions. The key difference lies in the timing and access to non-public information, where front-running exploits privileged information and tailgating relies on observable market activity.

Legal Implications of Front-Running and Tailgating

Front-running, the illegal practice of trading based on non-public information about impending orders, carries severe legal penalties including fines, disgorgement of profits, and potential imprisonment under securities laws such as the Securities Exchange Act of 1934. Tailgating, often considered a less explicit form of front-running, involves placing orders immediately after a large trade to benefit from anticipated price movements but can attract regulatory scrutiny if it exploits material non-public information. Enforcement agencies like the SEC rigorously investigate both practices to uphold market integrity and prevent insider trading violations.

Detecting and Preventing Front-Running

Detecting front-running involves monitoring trading patterns that indicate an entity is executing trades based on advance knowledge of pending orders, often identified through anomalous timing and volume spikes preceding large market moves. Advanced algorithms and machine learning models analyze order book data and transaction timestamps to flag suspicious activities suggestive of front-running. Preventing front-running requires implementing strict regulatory frameworks, enforcing pre-trade surveillance systems, and employing encryption and anonymization techniques to obscure order intentions and protect market integrity.

Risks and Consequences of Tailgating

Tailgating in finance involves unauthorized or unethical trading that exploits information from preceding legitimate trades, leading to distorted market prices and potential losses for uninformed investors. The risks include regulatory penalties, reputational damage, and increased market volatility due to compromised transparency. Consequences often extend to legal actions by securities regulators and erosion of investor trust, which can severely impact financial institutions' credibility and stability.

Case Studies: Front-Running vs Tailgating

Case studies of front-running reveal instances where traders exploit non-public information to execute orders ahead of client trades, often resulting in regulatory penalties and loss of investor trust. Tailgating involves placing orders immediately after large institutional trades to capitalize on anticipated price movements, with documented cases highlighting its impact on market fairness and liquidity. Comparative analyses demonstrate that front-running carries higher legal risks due to its explicit regulatory violations, whereas tailgating operates in a more ambiguous ethical landscape but can still degrade market integrity.

Impact on Market Integrity and Investor Trust

Front-running compromises market integrity by allowing traders to exploit non-public information for unfair gains, undermining investor confidence and skewing price discovery. Tailgating, or piggybacking on large trades, can distort order flow and increase market volatility, eroding trust in fair trading practices. Both practices reduce market transparency, leading to decreased investor participation and heightened regulatory scrutiny.

Regulatory Measures and Compliance Guidelines

Front-running involves traders executing orders based on advance knowledge of pending transactions, violating market fairness and triggering strict regulatory scrutiny under bodies like the SEC and FINRA. Tailgating, or late trading, breaches compliance by placing orders after information cutoff times, prompting enforcement of strict audit trails and order timestamping to ensure transparency. Regulatory frameworks mandate robust surveillance systems and swift reporting protocols to detect and prevent these manipulative practices, safeguarding market integrity.

Best Practices to Avoid Unethical Trading Behaviors

Implement strict compliance protocols and continuous monitoring systems to detect and prevent front-running and tailgating in trading activities. Enforce clear separation of trading roles and maintain transparent audit trails to mitigate risks associated with insider information misuse. Provide regular training on ethical trading standards and implement robust reporting mechanisms to encourage accountability and early identification of suspicious behavior.

Important Terms

Insider Trading

Insider trading involves trading based on non-public, material information, while front-running and tailgating are specific unethical trading practices exploiting order flow; front-running occurs when a trader executes orders ahead of a large pending transaction to capitalize on imminent price movements, whereas tailgating involves mimicking trades immediately after a large order to benefit from the market impact. Both front-running and tailgating undermine market integrity by leveraging privileged timing information, distinct from insider trading's reliance on confidential company knowledge.

Quote Stuffing

Quote stuffing involves rapidly placing and canceling large volumes of orders to create market confusion, enabling front-runners to exploit the information advantage by reacting faster to genuine trades. Tailgating, in contrast, refers to placing orders immediately after observing large trades, without the same manipulative intent behind quote stuffing.

Layering

Layering in trading involves placing multiple buy or sell orders at different price levels to manipulate market perception and can be exploited through front-running, where traders anticipate and act on these orders before execution. Tailgating differs by having traders closely follow large orders, using real-time information to profit from predictable price movements without directly placing deceptive orders.

Trade Allocation

Trade allocation processes aim to ensure fair and transparent distribution of executed orders, mitigating risks associated with front-running, where traders exploit advance knowledge to gain unfair advantage. Tailgating, a less aggressive practice, involves following large trades to benefit from market impact, but robust allocation policies and surveillance systems help prevent abuses and maintain market integrity.

Spoofing

Spoofing manipulates market dynamics by placing false buy or sell orders to mislead other traders, often linked with front-running where traders exploit prior knowledge to trade ahead of large orders, gaining unfair profits. Tailgating, or order anticipation, occurs when traders mimic large orders after detecting market signals, but unlike spoofing, it involves genuine order placement without the intent to cancel.

Churning

Churning in financial markets involves excessive trading to generate commissions, often exacerbated by front-running, where brokers execute orders ahead of client transactions to capitalize on anticipated price movements. Tailgating, a similar unethical practice, occurs when brokers place orders immediately after large client trades to benefit from the resulting price changes, both undermining market integrity and client trust.

Payment for Order Flow

Payment for Order Flow (PFOF) involves brokers receiving compensation from market makers for directing client orders, which can create conflicts related to front-running and tailgating practices. Front-running occurs when trades are executed ahead of a client's order to capitalize on expected price movements, while tailgating involves placing orders immediately after a client's trade to benefit from the price impact, both potentially disadvantaging retail investors in PFOF arrangements.

Wash Trading

Wash trading manipulates market prices by simultaneously buying and selling securities to create misleading volume, contrasting with front-running where traders exploit advance knowledge of pending orders, and tailgating where they copy large trades after execution.

Price Manipulation

Price manipulation involves artificially influencing securities' prices through deceptive practices such as front-running, where traders execute orders ahead of large pending transactions to capitalize on anticipated price movements. Tailgating, by contrast, entails placing orders immediately after a large trade to exploit the price change triggered by the initial order, both strategies undermining fair market integrity and investor confidence.

Shadowing

Shadowing in cybersecurity involves closely following a transaction or data flow to exploit timing or sequence vulnerabilities, often seen in front-running attacks where attackers intercept and act on information before it is finalized. Tailgating, in contrast, involves unauthorized physical access by following an authorized individual, focusing on social engineering rather than data interception.

front-running vs tailgating Infographic

moneydif.com

moneydif.com