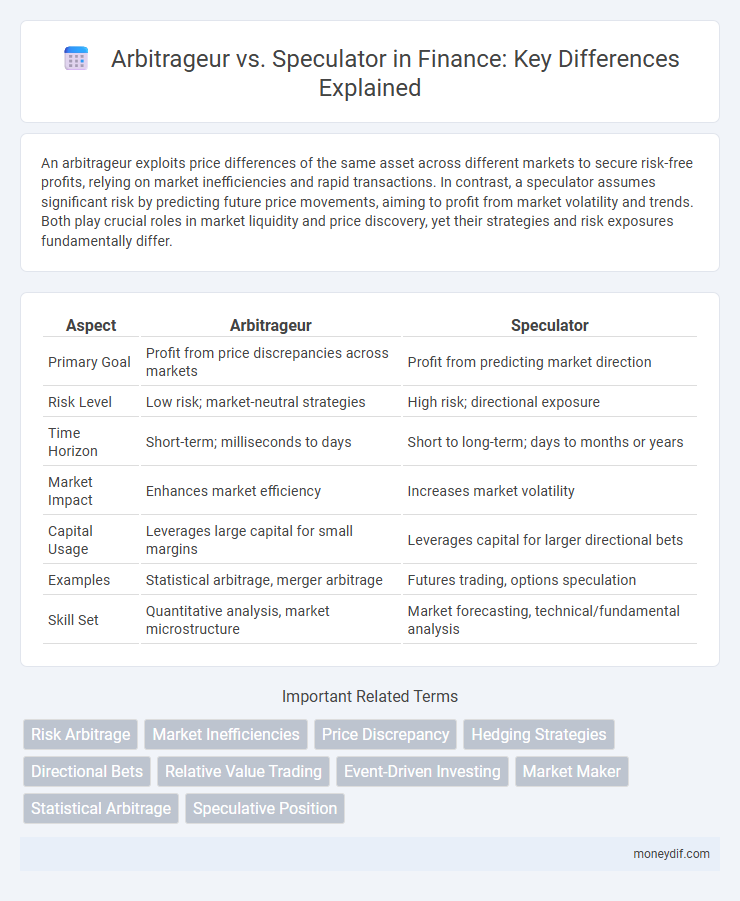

An arbitrageur exploits price differences of the same asset across different markets to secure risk-free profits, relying on market inefficiencies and rapid transactions. In contrast, a speculator assumes significant risk by predicting future price movements, aiming to profit from market volatility and trends. Both play crucial roles in market liquidity and price discovery, yet their strategies and risk exposures fundamentally differ.

Table of Comparison

| Aspect | Arbitrageur | Speculator |

|---|---|---|

| Primary Goal | Profit from price discrepancies across markets | Profit from predicting market direction |

| Risk Level | Low risk; market-neutral strategies | High risk; directional exposure |

| Time Horizon | Short-term; milliseconds to days | Short to long-term; days to months or years |

| Market Impact | Enhances market efficiency | Increases market volatility |

| Capital Usage | Leverages large capital for small margins | Leverages capital for larger directional bets |

| Examples | Statistical arbitrage, merger arbitrage | Futures trading, options speculation |

| Skill Set | Quantitative analysis, market microstructure | Market forecasting, technical/fundamental analysis |

Understanding Arbitrageurs and Speculators

Arbitrageurs exploit price discrepancies between markets to earn risk-free profits by simultaneously buying and selling assets, maintaining market efficiency. Speculators assume higher risks by predicting future price movements, aiming for substantial returns through market timing and analysis. Both play crucial roles in liquidity provision and price discovery, yet differ fundamentally in risk exposure and strategy.

Core Differences Between Arbitrage and Speculation

Arbitrageurs exploit price discrepancies across different markets to secure risk-free profits by simultaneously buying low and selling high, ensuring minimal market exposure. Speculators, in contrast, assume significant market risk by predicting future price movements to achieve high returns, often leveraging volatility and market sentiment. The core difference lies in arbitrage's focus on riskless profit through price inefficiencies, while speculation involves risk-taking based on anticipated asset price trends.

Roles of Arbitrageurs in Financial Markets

Arbitrageurs play a crucial role in financial markets by exploiting price discrepancies across different venues to ensure price convergence and market efficiency. They provide liquidity and reduce price volatility by executing simultaneous buy and sell orders, effectively narrowing bid-ask spreads. Unlike speculators who take on directional risk for profit, arbitrageurs engage in low-risk strategies that facilitate accurate asset pricing and enhance market stability.

The Speculator’s Function in Market Dynamics

Speculators provide essential liquidity and risk absorption in financial markets by actively buying and selling assets based on anticipated price movements, which helps facilitate smoother market operations. Their willingness to assume risk enables price discovery and efficient allocation of capital across different market segments. Unlike arbitrageurs who exploit price discrepancies with minimal risk, speculators drive dynamic price adjustments through their prediction-driven trades.

Risk Profiles: Arbitrageurs vs. Speculators

Arbitrageurs maintain a low-risk profile by exploiting price inefficiencies across markets without taking significant directional risks, relying on simultaneous buying and selling to achieve risk-free profits. Speculators accept high-risk exposure by betting on price movements in anticipation of future market trends, aiming for substantial returns through market timing and volatility. The fundamental difference lies in arbitrageurs' focus on minimizing risk and locking in arbitrage profits, whereas speculators actively seek risk to maximize potential gains.

Strategies Employed by Arbitrageurs

Arbitrageurs employ strategies that exploit price discrepancies across different markets or financial instruments, aiming for risk-free or low-risk profits by simultaneously buying undervalued assets and selling overvalued ones. They utilize high-frequency trading algorithms and leverage information asymmetry to capture fleeting arbitrage opportunities in equities, commodities, and currency markets. Unlike speculators, whose strategies often involve directional bets based on market forecasts, arbitrageurs focus on market inefficiencies to secure consistent returns with minimized exposure to market volatility.

Speculation Techniques and Approaches

Speculators employ techniques such as trend following, momentum trading, and technical analysis to capitalize on price movements in financial markets. They often use leverage and derivative instruments like options and futures to amplify potential gains, accepting higher levels of risk. Unlike arbitrageurs who exploit price discrepancies, speculators rely on market forecasts and sentiment shifts to generate profits.

Impact on Market Efficiency

Arbitrageurs enhance market efficiency by exploiting price discrepancies across different markets, thereby driving prices toward equilibrium and reducing mispricings. Speculators, motivated by profit from price movements, contribute to market liquidity but can sometimes increase volatility by taking on higher risk positions. The interplay between arbitrageurs and speculators helps maintain a dynamic balance in financial markets, promoting price discovery and resource allocation.

Regulatory Considerations for Arbitrageurs and Speculators

Arbitrageurs typically face stringent regulatory oversight due to their role in exploiting price inefficiencies across markets, requiring compliance with reporting standards and transaction limits to prevent market manipulation. Speculators, while also regulated, encounter different scrutiny focused on risk disclosure and margin requirements to mitigate excessive leverage and systemic risk. Both must adhere to anti-fraud regulations but are subject to distinct frameworks reflecting their market impact and trading strategies.

Choosing Your Path: Arbitrage or Speculation?

Arbitrageurs exploit price discrepancies across markets to generate risk-free profits by simultaneously buying and selling assets, relying on market efficiency and speed. Speculators accept higher risk by betting on future price movements, aiming for substantial returns through market predictions and leverage. Understanding the trade-off between low-risk arbitrage strategies and high-risk speculative tactics is crucial for aligning investment goals and risk tolerance in finance.

Important Terms

Risk Arbitrage

Risk arbitrage involves an arbitrageur exploiting price discrepancies during mergers or acquisitions by purchasing target company shares before deal closure, aiming for a relatively low-risk profit based on deal completion probabilities. Unlike speculators who seek high-risk, high-reward opportunities driven by market fluctuations, arbitrageurs focus on situations with identifiable event-driven risks and statistical probabilities to minimize exposure.

Market Inefficiencies

Market inefficiencies arise when prices deviate from their true value due to factors like information asymmetry or transaction costs, creating opportunities for arbitrageurs to exploit price discrepancies across markets. Speculators, unlike arbitrageurs, take on increased risk by betting on future price movements rather than seeking riskless profits, thereby adding liquidity but not necessarily correcting inefficiencies immediately.

Price Discrepancy

Price discrepancy arises when arbitrageurs exploit differences between asset prices in separate markets to earn risk-free profits, aligning prices through buying low in one market and selling high in another. Speculators, by contrast, accept higher risk seeking future price movements instead of guaranteed price convergence, often causing temporary price deviations due to their anticipatory trading strategies.

Hedging Strategies

Hedging strategies involve minimizing risk exposure by securing assets or positions, commonly used by arbitrageurs who exploit price discrepancies across markets with low risk. Speculators employ hedging selectively to protect high-risk investments aimed at profiting from market volatility rather than guaranteed returns.

Directional Bets

Directional bets involve taking positions based on anticipated market movements, contrasting with arbitrageurs who exploit price discrepancies across markets for risk-free profits. Speculators engage in directional bets to profit from price volatility, assuming higher risk compared to arbitrageurs' low-risk strategies.

Relative Value Trading

Relative value trading involves identifying price discrepancies between related financial instruments to exploit mispricings, with arbitrageurs seeking risk-neutral profits through simultaneous buying and selling to capture risk-free returns. Speculators, in contrast, assume market risk by betting on price movements and inefficiencies, aiming for higher returns but exposing themselves to greater potential losses.

Event-Driven Investing

Event-driven investing exploits market inefficiencies caused by corporate events, where arbitrageurs focus on risk-managed strategies targeting predictable spreads, while speculators seek high-risk, high-reward opportunities based on event outcomes.

Market Maker

Market makers provide liquidity by continuously quoting buy and sell prices, facilitating efficient trading and minimizing spreads, while arbitrageurs exploit price discrepancies across markets to secure risk-free profits. Speculators assume higher risks by betting on price movements to generate profits, contrasting with arbitrageurs' low-risk strategies and the market makers' focus on maintaining market stability.

Statistical Arbitrage

Statistical arbitrage employs quantitative models to exploit pricing inefficiencies, focusing on low-risk, short-term trades that distinguish arbitrageurs' strategy from speculators' higher-risk market predictions.

Speculative Position

Speculative positions involve traders taking on risk to profit from price changes, while arbitrageurs exploit price discrepancies between markets to earn risk-free returns.

arbitrageur vs speculator Infographic

moneydif.com

moneydif.com