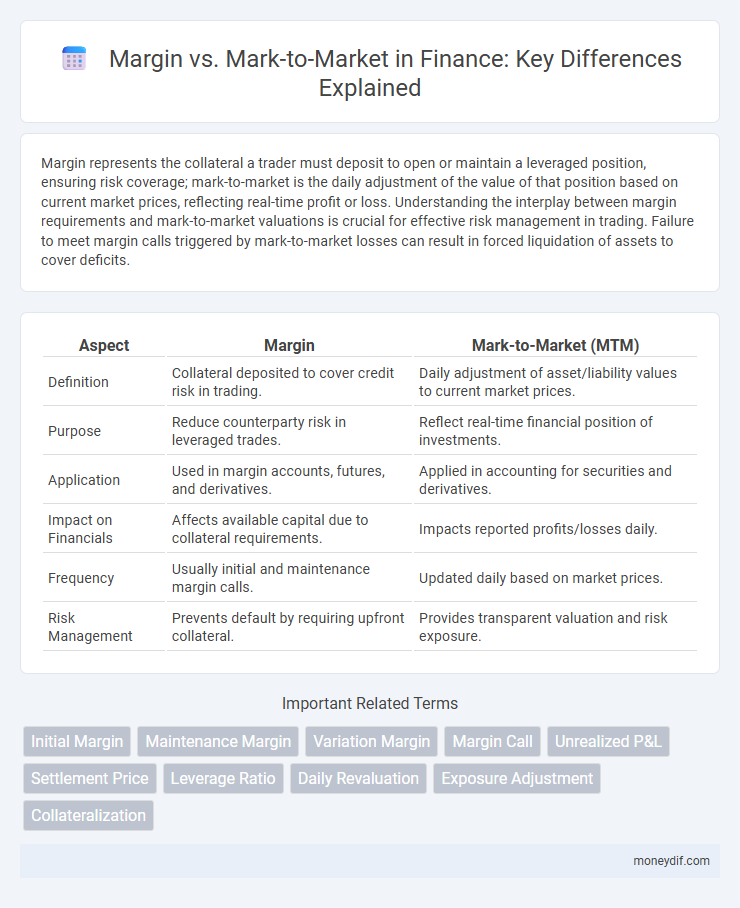

Margin represents the collateral a trader must deposit to open or maintain a leveraged position, ensuring risk coverage; mark-to-market is the daily adjustment of the value of that position based on current market prices, reflecting real-time profit or loss. Understanding the interplay between margin requirements and mark-to-market valuations is crucial for effective risk management in trading. Failure to meet margin calls triggered by mark-to-market losses can result in forced liquidation of assets to cover deficits.

Table of Comparison

| Aspect | Margin | Mark-to-Market (MTM) |

|---|---|---|

| Definition | Collateral deposited to cover credit risk in trading. | Daily adjustment of asset/liability values to current market prices. |

| Purpose | Reduce counterparty risk in leveraged trades. | Reflect real-time financial position of investments. |

| Application | Used in margin accounts, futures, and derivatives. | Applied in accounting for securities and derivatives. |

| Impact on Financials | Affects available capital due to collateral requirements. | Impacts reported profits/losses daily. |

| Frequency | Usually initial and maintenance margin calls. | Updated daily based on market prices. |

| Risk Management | Prevents default by requiring upfront collateral. | Provides transparent valuation and risk exposure. |

Understanding Margin in Finance

Margin in finance represents the collateral or funds that investors must deposit to open or maintain positions in leveraged trading or derivatives markets, ensuring sufficient coverage against potential losses. It acts as a safeguard, enabling brokers to mitigate credit risk by requiring a percentage of the trade's value upfront, often expressed as initial or maintenance margin. Understanding margin is crucial for managing leverage, controlling risk exposure, and maintaining liquidity in trading accounts.

What is Mark-to-Market Accounting?

Mark-to-market accounting is a financial method that records the value of an asset based on its current market price rather than its historical cost, providing a real-time assessment of an investment's worth. This approach is essential for accurately reflecting the fluctuations in the value of financial instruments like securities and derivatives on balance sheets. Mark-to-market accounting enhances transparency and allows investors to understand the true economic value of their portfolios amid volatile market conditions.

Key Differences Between Margin and Mark-to-Market

Margin refers to the collateral funds an investor must deposit to open or maintain a leveraged position, acting as a financial buffer against potential losses. Mark-to-market is the process of revaluing assets or liabilities to their current market prices, reflecting real-time profit or loss on open positions. The key difference lies in margin managing credit risk by requiring upfront capital, while mark-to-market ensures continuous valuation alignment with market fluctuations.

Importance of Margin in Trading

Margin plays a critical role in trading by allowing investors to leverage capital, increasing their potential returns while managing risk through collateral requirements. It ensures that traders maintain sufficient funds to cover potential losses, reducing default risk and enhancing market stability. Effective margin management supports liquidity and enables continuous trading, preventing forced liquidations and financial contagion.

Mark-to-Market: Role in Financial Reporting

Mark-to-market (MTM) accounting provides a real-time valuation of financial assets, reflecting their current market value rather than historical cost, which enhances transparency and accuracy in financial reporting. MTM plays a critical role in risk management by enabling firms to assess their exposure to market fluctuations daily, ensuring investors receive up-to-date information. This method is particularly vital for derivatives and trading portfolios, where frequent price changes directly impact financial statements and regulatory compliance.

Margin Requirements and Calculations

Margin requirements represent the minimum amount of equity an investor must maintain in a margin account to cover potential losses, typically expressed as a percentage of the total trade value and set by regulatory bodies like FINRA or exchanges such as CME. Mark-to-market calculations adjust the value of a portfolio daily to reflect current market prices, determining gains or losses that directly impact the margin balance and may trigger margin calls if the equity falls below required thresholds. Accurate margin requirement assessments and timely mark-to-market valuations are essential to managing risk exposure and ensuring compliance with brokerage or clearinghouse rules.

Daily Settlement: How Mark-to-Market Works

Mark-to-market involves the daily revaluation of open positions to reflect current market prices, ensuring profits and losses are settled every trading day. This process adjusts margin accounts by crediting or debiting the difference between the previous day's and the current day's market values, maintaining accurate exposure and reducing default risk. Daily settlement through mark-to-market enhances transparency and liquidity management in futures and derivatives markets.

Risks Associated with Margin Trading

Margin trading involves borrowing funds to increase position size, amplifying both potential gains and losses, which can lead to margin calls if the account value falls below maintenance requirements. Mark-to-market accounting recalculates asset values daily based on current market prices, reflecting unrealized gains or losses and triggering immediate adjustments in required margin. The risk in margin trading lies in volatile market conditions that can rapidly erode equity, forcing forced liquidation and magnifying losses beyond initial investments.

Regulatory Frameworks for Margin and Mark-to-Market

Regulatory frameworks for margin and mark-to-market practices are governed by bodies such as the Basel Committee on Banking Supervision and the International Accounting Standards Board (IASB), ensuring financial institutions maintain sufficient collateral to mitigate counterparty risk. Margin requirements are enforced under regulations like the Dodd-Frank Act in the U.S. and EMIR in the EU, mandating initial and variation margin for over-the-counter derivatives to promote transparency and systemic stability. Mark-to-market accounting follows IFRS 13 and US GAAP standards, requiring assets and liabilities to be recorded at fair value, enhancing accurate risk assessment and financial reporting consistency.

Practical Examples: Margin vs Mark-to-Market

Margin represents the collateral a trader deposits to open or maintain a position, such as $10,000 in a futures contract account. Mark-to-Market reflects the daily revaluation of these positions based on market prices, resulting in gains or losses, for example, a $500 gain if the contract value increases. Understanding the difference is crucial for risk management, as margin ensures the ability to cover potential losses, while mark-to-market updates the position's value to reflect current market conditions.

Important Terms

Initial Margin

Initial Margin represents the upfront collateral required to cover potential future exposure before mark-to-market adjustments reflect current market value changes.

Maintenance Margin

Maintenance Margin represents the minimum equity level an investor must maintain in a margin account to avoid a margin call, calculated by comparing the margin balance to the Mark-to-Market value of the securities.

Variation Margin

Variation Margin is the amount exchanged between parties to cover daily mark-to-market losses, ensuring that margin obligations reflect current market valuations.

Margin Call

Margin Call occurs when the margin balance falls below the maintenance margin due to adverse Mark-to-Market valuations reflecting current market prices.

Unrealized P&L

Unrealized P&L represents the profit or loss on open positions calculated using Mark-to-Market valuation, which directly impacts Margin requirements by reflecting current market values.

Settlement Price

Settlement price determines the final value used to calculate margin requirements and mark-to-market adjustments in futures trading.

Leverage Ratio

Leverage ratio measures the proportion of borrowed funds relative to equity, impacting margin requirements and magnifying mark-to-market gains or losses in trading positions.

Daily Revaluation

Daily Revaluation adjusts margins based on mark-to-market valuations to reflect current market risk accurately.

Exposure Adjustment

Exposure adjustment quantifies the difference between margin requirements and mark-to-market valuations to manage counterparty risk more effectively.

Collateralization

Collateralization mitigates credit risk by requiring margin deposits that adjust with mark-to-market valuations to ensure sufficient coverage of potential losses.

Margin vs Mark-to-Market Infographic

moneydif.com

moneydif.com