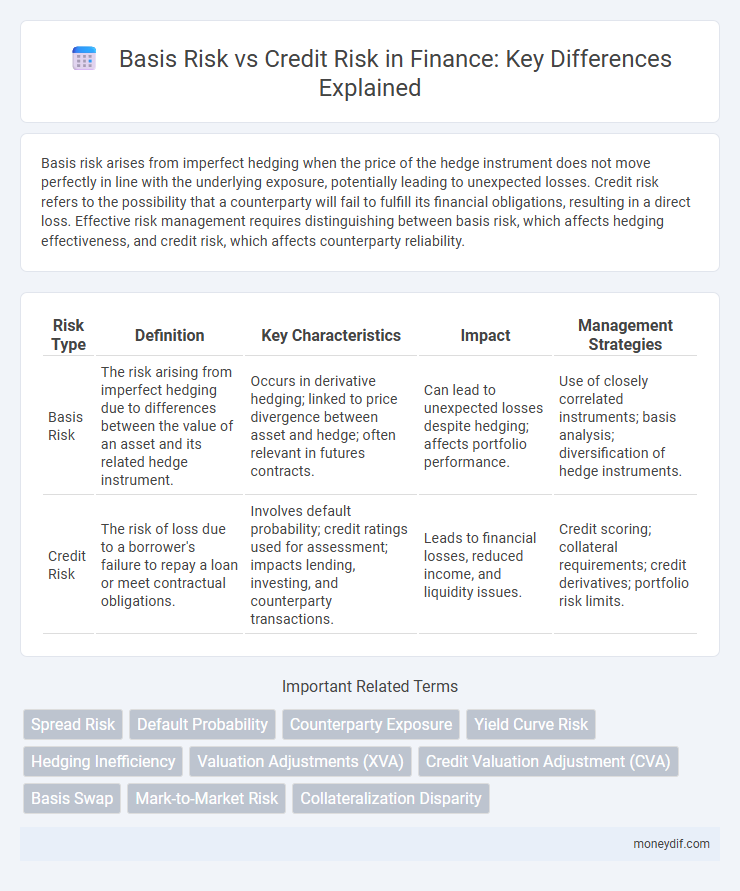

Basis risk arises from imperfect hedging when the price of the hedge instrument does not move perfectly in line with the underlying exposure, potentially leading to unexpected losses. Credit risk refers to the possibility that a counterparty will fail to fulfill its financial obligations, resulting in a direct loss. Effective risk management requires distinguishing between basis risk, which affects hedging effectiveness, and credit risk, which affects counterparty reliability.

Table of Comparison

| Risk Type | Definition | Key Characteristics | Impact | Management Strategies |

|---|---|---|---|---|

| Basis Risk | The risk arising from imperfect hedging due to differences between the value of an asset and its related hedge instrument. | Occurs in derivative hedging; linked to price divergence between asset and hedge; often relevant in futures contracts. | Can lead to unexpected losses despite hedging; affects portfolio performance. | Use of closely correlated instruments; basis analysis; diversification of hedge instruments. |

| Credit Risk | The risk of loss due to a borrower's failure to repay a loan or meet contractual obligations. | Involves default probability; credit ratings used for assessment; impacts lending, investing, and counterparty transactions. | Leads to financial losses, reduced income, and liquidity issues. | Credit scoring; collateral requirements; credit derivatives; portfolio risk limits. |

Understanding Basis Risk and Credit Risk

Basis risk arises from the imperfect correlation between the price of a hedging instrument and the underlying asset, causing potential mismatches in hedge effectiveness, while credit risk pertains to the possibility of a counterparty defaulting on debt obligations, impacting financial solvency. Effective risk management requires distinguishing basis risk's market-driven price divergence from credit risk's counterparty creditworthiness issues. Quantitative models often analyze basis risk using correlation coefficients and track price spreads, whereas credit risk assessment relies on credit ratings, default probabilities, and exposure at default metrics.

Key Differences Between Basis Risk and Credit Risk

Basis risk arises from fluctuations in the relationship between the price of a hedging instrument and the underlying asset, impacting the effectiveness of hedging strategies, whereas credit risk pertains to the potential loss due to a counterparty's failure to fulfill contractual obligations. Basis risk primarily affects market participants engaged in derivatives and hedging activities, while credit risk is crucial for lenders, bondholders, and financial institutions managing counterparty exposures. Understanding these distinctions is essential for effective risk management and strategic financial decision-making.

Sources of Basis Risk in Financial Markets

Basis risk in financial markets arises primarily from the imperfect correlation between the value of hedging instruments and the underlying asset or liability, driven by factors such as differences in contract specifications, market liquidity disparities, and temporal mismatches in maturity dates. Variations in interest rates, credit quality changes, and geographic or sectoral divergences also contribute to basis risk by causing deviations between spot and futures prices or between related credit instruments. Unlike credit risk, which pertains to counterparty default probability, basis risk specifically stems from the residual exposure when hedging strategies fail to perfectly offset underlying exposures due to these nuanced market imperfections.

Common Causes of Credit Risk

Common causes of credit risk include borrower default due to financial instability, economic downturns, and inadequate collateral coverage. Poor credit assessment and lack of timely monitoring increase exposure to potential loan losses. Understanding these factors helps financial institutions mitigate credit risk more effectively compared to basis risk, which involves price differences in financial instruments.

Measuring Basis Risk: Methods and Tools

Measuring basis risk involves quantifying the potential differential fluctuations between a hedging instrument and the underlying asset, commonly using statistical metrics such as the correlation coefficient, beta, and regression analysis to assess the strength and stability of their relationship. Tools like Value at Risk (VaR) models and scenario analysis further aid in evaluating the potential impact of basis risk on portfolio performance by simulating various market conditions. Advanced techniques include the use of copulas and stochastic modeling to capture non-linear dependencies and tail risks inherent in basis risk measurement.

Assessing Credit Risk: Techniques and Metrics

Assessing credit risk involves evaluating the likelihood of a borrower defaulting on debt obligations using techniques such as credit scoring models, financial statement analysis, and credit rating agencies' reports. Key metrics include probability of default (PD), loss given default (LGD), and exposure at default (EAD), which collectively help quantify potential losses. Unlike basis risk, which arises from imperfect hedging correlations, credit risk assessment focuses on the borrower's financial health and repayment capacity to manage potential default outcomes.

Impact of Basis Risk on Portfolio Performance

Basis risk, arising from imperfect hedging due to mismatches between the hedging instrument and the underlying asset, can lead to unexpected losses and increased portfolio volatility. This risk undermines the effectiveness of risk management strategies, resulting in greater uncertainty in returns and potential erosion of portfolio value. Managing basis risk is critical for maintaining portfolio stability and optimizing risk-adjusted performance in dynamic financial markets.

Managing and Mitigating Credit Risk

Managing credit risk involves assessing borrowers' creditworthiness through detailed financial analysis and credit scoring models to minimize default potential. Mitigating credit risk includes implementing collateral requirements, diversifying loan portfolios, and utilizing credit derivatives such as credit default swaps to transfer exposure. Continuous monitoring of counterparty credit ratings and market conditions enhances risk management effectiveness, reducing potential financial losses.

Real-World Examples: Basis Risk vs. Credit Risk

Basis risk occurs when a company hedges an exposure using a proxy instrument whose price movements do not perfectly correlate with the underlying asset, such as an airline hedging jet fuel prices with crude oil futures that can diverge due to regional supply differences. Credit risk emerges when a borrower or counterparty defaults on obligations, illustrated by the 2008 financial crisis where mortgage-backed securities lost value as homeowners defaulted. Real-world analysis of Enron's collapse highlights credit risk through its failure to meet debts, while basis risk affected energy companies hedging electricity prices with natural gas contracts that moved inconsistently.

Strategic Approaches to Risk Management in Finance

Basis risk arises from imperfect hedging relationships between the prices of related financial instruments, requiring dynamic strategies such as cross-hedging and continuous monitoring of market correlations to minimize exposure. Credit risk involves the potential for counterparty default, demanding rigorous credit assessment, diversified portfolios, and the use of credit derivatives like CDS to mitigate losses. Effective strategic risk management integrates both basis and credit risk considerations by employing advanced analytics, stress testing, and scenario analysis to enhance financial resilience and optimize risk-adjusted returns.

Important Terms

Spread Risk

Spread risk involves fluctuations in the difference between yields of two related financial instruments, frequently impacted by basis risk, which arises from imperfect hedging due to mismatched reference rates or instruments. Credit risk, however, pertains to the potential loss from a counterparty's default, affecting the credit spread component within the overall spread risk but distinct in its cause and implications.

Default Probability

Default probability quantifies the likelihood of a borrower failing to meet debt obligations, directly influencing credit risk, while basis risk arises from mismatches between the underlying asset and hedging instrument, potentially affecting the accuracy of default probability assessments.

Counterparty Exposure

Counterparty exposure measures the potential loss from a trading partner's default, directly impacting credit risk, whereas basis risk arises from imperfect hedging relationships between correlated but non-identical financial instruments. Effective risk management requires distinguishing credit risk associated with counterparty default from basis risk driven by market price divergences to optimize portfolio protection.

Yield Curve Risk

Yield curve risk primarily affects interest rate sensitive assets, causing valuation changes due to shifts in different maturities, while basis risk arises from imperfect hedging between related financial instruments, and credit risk pertains to potential losses from borrower default.

Hedging Inefficiency

Hedging inefficiency arises primarily from basis risk, which occurs when the hedge asset and the underlying exposure have imperfect price correlation, rather than from credit risk, which involves counterparty default risk.

Valuation Adjustments (XVA)

Valuation Adjustments (XVA) encompass a range of risk adjustments, including Credit Valuation Adjustment (CVA) which addresses counterparty credit risk, and Basis Valuation Adjustment that accounts for basis risk arising from discrepancies between derivative pricing curves and funding or collateral costs. These adjustments reflect market participants' need to incorporate both credit risk and the basis spread volatility into derivative pricing for accurate risk management and regulatory compliance.

Credit Valuation Adjustment (CVA)

Credit Valuation Adjustment (CVA) quantifies the counterparty credit risk embedded in over-the-counter derivatives by adjusting the derivative's fair value to reflect the risk of counterparty default. Basis risk arises when there is a mismatch between the underlying credit spreads used for CVA calculation and the actual exposure, whereas credit risk specifically concerns the probability of the counterparty's default impacting the derivative's value.

Basis Swap

A basis swap involves exchanging floating interest rate payments based on different reference rates, primarily addressing basis risk--the risk that the spread between these rates changes unexpectedly. Unlike credit risk, which concerns potential borrower default, basis risk in basis swaps arises from fluctuations in the relative value of the underlying indices, impacting the swap's valuation without credit event triggers.

Mark-to-Market Risk

Mark-to-Market Risk involves the potential losses from changes in the market value of assets or liabilities, directly influenced by basis risk--the divergence between the price of a hedging instrument and the underlying asset. Unlike credit risk, which pertains to counterparty default, basis risk affects valuation accuracy and can lead to unexpected profit and loss fluctuations despite stable credit conditions.

Collateralization Disparity

Collateralization disparity amplifies basis risk by creating mismatches between the collateral posted and the underlying exposure's value, which can lead to valuation discrepancies and potential liquidity shortfalls. This disparity differs from credit risk, as it primarily affects the efficiency of collateral management rather than the counterparty's default probability.

basis risk vs credit risk Infographic

moneydif.com

moneydif.com