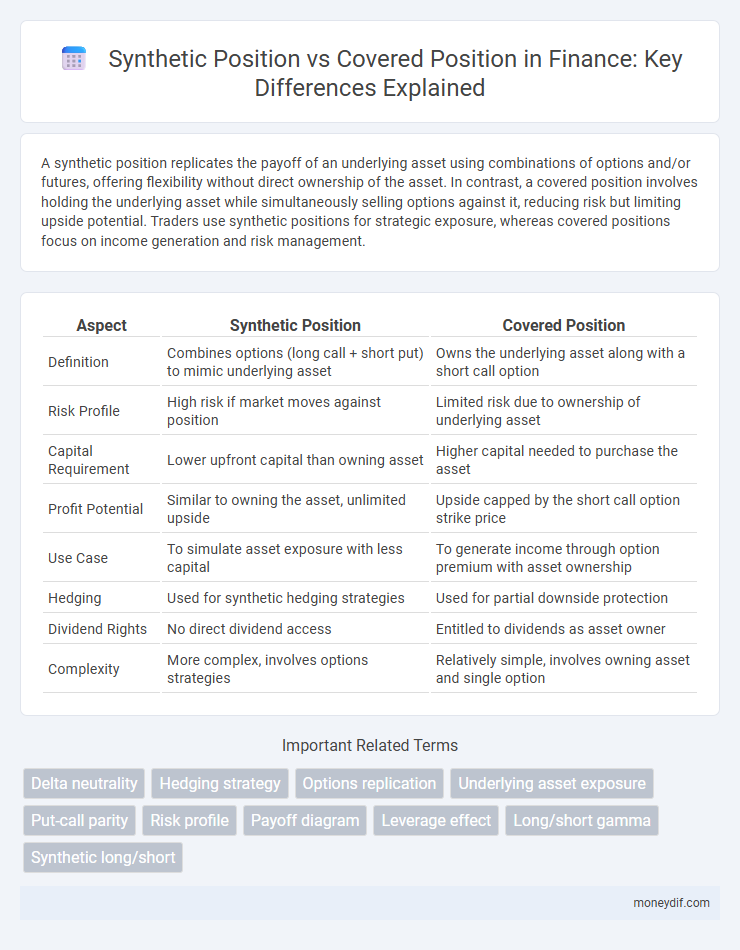

A synthetic position replicates the payoff of an underlying asset using combinations of options and/or futures, offering flexibility without direct ownership of the asset. In contrast, a covered position involves holding the underlying asset while simultaneously selling options against it, reducing risk but limiting upside potential. Traders use synthetic positions for strategic exposure, whereas covered positions focus on income generation and risk management.

Table of Comparison

| Aspect | Synthetic Position | Covered Position |

|---|---|---|

| Definition | Combines options (long call + short put) to mimic underlying asset | Owns the underlying asset along with a short call option |

| Risk Profile | High risk if market moves against position | Limited risk due to ownership of underlying asset |

| Capital Requirement | Lower upfront capital than owning asset | Higher capital needed to purchase the asset |

| Profit Potential | Similar to owning the asset, unlimited upside | Upside capped by the short call option strike price |

| Use Case | To simulate asset exposure with less capital | To generate income through option premium with asset ownership |

| Hedging | Used for synthetic hedging strategies | Used for partial downside protection |

| Dividend Rights | No direct dividend access | Entitled to dividends as asset owner |

| Complexity | More complex, involves options strategies | Relatively simple, involves owning asset and single option |

Definition of Synthetic Positions in Finance

Synthetic positions in finance are strategies that replicate the payoff profiles of other positions through the use of derivatives such as options and futures, without owning the underlying asset. They enable investors to simulate long or short exposure by combining options contracts, such as creating a synthetic long stock position through a long call and a short put with the same strike price and expiration. These positions offer flexibility for hedging, speculation, and arbitrage while potentially reducing capital requirements compared to holding actual securities.

Understanding Covered Positions

A covered position in finance involves holding an offsetting asset to mitigate risk, such as owning underlying shares while writing options. This strategy limits potential losses compared to synthetic positions, which replicate exposure using derivatives without owning the underlying asset. Understanding the protective nature of covered positions is essential for risk management and capital efficiency.

Key Differences Between Synthetic and Covered Positions

Synthetic positions replicate the payoff of an underlying asset using options strategies, offering flexibility without owning the asset, whereas covered positions involve holding the asset alongside options to hedge risk. Synthetic positions typically require less capital but can introduce complex risk profiles compared to the more straightforward risk management in covered positions. Understanding the distinctions in leverage, risk exposure, and capital requirements is crucial for effective portfolio strategy in finance.

Advantages of Utilizing Synthetic Positions

Synthetic positions offer enhanced flexibility by replicating the payoff of underlying assets without actual ownership, reducing capital requirements and increasing leverage. They enable precise risk management and strategic exposure, facilitating tailored hedging techniques against market volatility. This approach also allows easier adjustment of positions with lower transaction costs compared to covered positions.

Benefits of Covered Positions for Investors

Covered positions offer investors enhanced risk management by holding the underlying asset alongside derivative contracts, reducing exposure to unlimited losses common in synthetic positions. This strategy provides steady income through dividends or interest while maintaining control over potential downside risks, promoting portfolio stability. Investors benefit from clearer tax treatment and regulatory compliance, simplifying financial reporting and increasing transparency.

Risks Associated with Synthetic vs Covered Strategies

Synthetic positions carry heightened risk due to their reliance on derivatives, exposing traders to counterparty risk and potential liquidity challenges, while covered positions typically involve holding the underlying asset, reducing exposure to drastic market swings. The risk profile of synthetic strategies also includes complexities such as margin calls and leverage amplification, which can exacerbate losses beyond initial investments. Conversely, covered positions offer a more straightforward risk management approach by offsetting option exposures with the underlying security, thereby limiting downside potential.

Real-World Applications: Synthetic vs Covered Positions

Synthetic positions replicate the payoff of a covered position using options without owning the underlying asset, enabling investors to gain exposure with less capital and increased flexibility in risk management. Covered positions involve holding the underlying asset while writing options on it, providing downside protection and income generation through premiums but requiring full ownership of the asset. Real-world applications include hedging strategies where synthetic positions allow for leverage and tailored risk profiles, whereas covered positions suit income-focused investors seeking to enhance returns while mitigating downside risk.

Cost Comparison: Synthetic Positions vs Covered Positions

Synthetic positions typically involve options strategies that can replicate the payoff of an underlying asset at a lower initial capital outlay compared to covered positions, which require owning the underlying security. The cost efficiency of synthetic positions arises from reduced capital requirements and lower margin collateral, while covered positions incur higher upfront costs due to asset acquisition. However, synthetic positions may involve higher transaction fees and time decay risks, influencing the overall cost-effectiveness in portfolio management.

Impact on Portfolio Diversification

Synthetic positions, created by combining options or derivatives to mimic the payoff of underlying assets, offer flexible exposure without requiring full asset ownership, thus enhancing portfolio diversification by enabling targeted risk-return profiles. Covered positions, involving holding the underlying asset along with options, provide limited downside risk but reduce diversification benefits due to concentrated exposure in the underlying security. Employing synthetic positions allows portfolio managers to access otherwise inaccessible market segments and strategies, improving overall diversification and risk management.

Choosing the Right Strategy: Synthetic or Covered Position

Choosing the right strategy between a synthetic position and a covered position depends on risk tolerance, capital availability, and market outlook. Synthetic positions offer leveraged exposure by combining options to replicate stock ownership without the need for full capital, suitable for traders seeking flexibility and higher returns with controlled risk. Covered positions involve owning the underlying asset while writing options, providing income through premiums and downside protection, ideal for conservative investors aiming for steady income with limited risk.

Important Terms

Delta neutrality

Delta neutrality is achieved by balancing a synthetic position, created using options, with a covered position in the underlying asset to offset directional risk.

Hedging strategy

A hedging strategy involves creating synthetic positions by combining options to replicate the payoff of underlying assets, enabling risk management without holding the actual securities. Covered positions, such as covered calls, involve owning the underlying asset while selling options to limit downside risk and generate income, offering a more direct hedging approach compared to synthetic alternatives.

Options replication

Options replication involves creating a synthetic position by combining underlying assets and options to mimic the payoff of a covered position, enabling tailored risk exposure without owning the asset outright. Synthetic positions can replicate covered calls or protective puts, offering flexibility in managing portfolio risk and potential returns with capital efficiency compared to traditional covered strategies.

Underlying asset exposure

Underlying asset exposure in synthetic positions involves derivative contracts that replicate the risks and returns of an actual asset without ownership, resulting in leveraged, flexible exposure. Covered positions entail holding the actual underlying asset alongside derivative instruments, providing direct exposure while mitigating risk through asset ownership.

Put-call parity

Put-call parity defines a fundamental relationship between the prices of European put and call options with the same strike price and expiration, enabling the construction of synthetic positions that replicate covered positions by combining options and underlying assets. This parity ensures no arbitrage opportunities exist, as a synthetic long call created by holding a long put and a long stock position must equal the price of a covered call, aligning the payoff structures in equity derivatives trading.

Risk profile

A synthetic position replicates the risk and return characteristics of an underlying asset through options strategies, exposing investors to similar market risk but often with higher leverage and potentially greater volatility compared to a covered position. Covered positions, involving holding the underlying asset alongside options, typically offer lower risk due to partial downside protection and reduced sensitivity to price swings.

Payoff diagram

A payoff diagram visually represents the potential profit and loss for synthetic and covered positions, illustrating how synthetic positions mimic the payoff of the underlying asset using options, while covered positions involve holding the underlying asset alongside options to limit risk. Synthetic positions often replicate long or short stock exposure using options strategies like long call and short put combinations, whereas covered positions combine stock ownership with short call options to generate income while capping upside potential.

Leverage effect

The leverage effect in synthetic positions arises from replicating the payoff of an asset using derivatives, creating higher exposure with less capital compared to covered positions that involve actual asset ownership combined with options. Synthetic positions amplify gains and losses due to this inherent leverage, while covered positions typically exhibit reduced volatility and lower risk by offsetting option risk with the underlying asset.

Long/short gamma

Long gamma positions, often achieved through synthetic setups such as long options combined with short underlying assets, benefit from increased convexity and profit as volatility rises, unlike covered positions that exhibit limited gamma exposure due to existing underlying asset holdings. Covered positions, including covered calls, provide downside protection but sacrifice the nonlinear payoff profile inherent in long gamma strategies, affecting responsiveness to rapid price changes.

Synthetic long/short

Synthetic long and short positions replicate the payoff of owning or shorting an asset using options, contrasting with covered positions that involve holding the underlying asset alongside options. A synthetic long position is created by buying call options and selling put options at the same strike price, while a synthetic short position is formed by selling call options and buying put options, enabling traders to gain exposure without owning the underlying asset.

synthetic position vs covered position Infographic

moneydif.com

moneydif.com