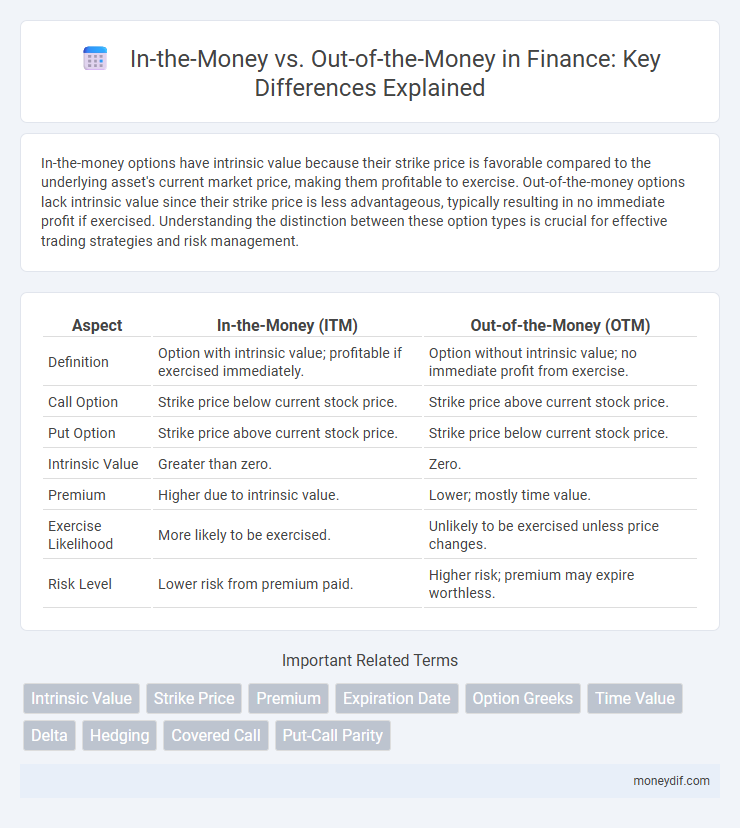

In-the-money options have intrinsic value because their strike price is favorable compared to the underlying asset's current market price, making them profitable to exercise. Out-of-the-money options lack intrinsic value since their strike price is less advantageous, typically resulting in no immediate profit if exercised. Understanding the distinction between these option types is crucial for effective trading strategies and risk management.

Table of Comparison

| Aspect | In-the-Money (ITM) | Out-of-the-Money (OTM) |

|---|---|---|

| Definition | Option with intrinsic value; profitable if exercised immediately. | Option without intrinsic value; no immediate profit from exercise. |

| Call Option | Strike price below current stock price. | Strike price above current stock price. |

| Put Option | Strike price above current stock price. | Strike price below current stock price. |

| Intrinsic Value | Greater than zero. | Zero. |

| Premium | Higher due to intrinsic value. | Lower; mostly time value. |

| Exercise Likelihood | More likely to be exercised. | Unlikely to be exercised unless price changes. |

| Risk Level | Lower risk from premium paid. | Higher risk; premium may expire worthless. |

Understanding In-the-Money and Out-of-the-Money Options

In-the-money options have intrinsic value because the underlying asset's price is favorable compared to the option's strike price, meaning call options are in-the-money when the asset price exceeds the strike price, while put options are in-the-money when the asset price is below the strike price. Out-of-the-money options, conversely, lack intrinsic value since the underlying asset's price is unfavorable relative to the strike price; call options are out-of-the-money if the asset price is below the strike price, and put options are out-of-the-money if the asset price exceeds the strike price. Understanding these distinctions is crucial for assessing option profitability, risk management, and strategic trading decisions in financial markets.

Key Differences Between ITM and OTM Options

In-the-money (ITM) options have intrinsic value as the underlying asset's price is favorable compared to the strike price, while out-of-the-money (OTM) options lack intrinsic value because the strike price is not advantageous relative to the current market price. ITM options typically exhibit higher premiums due to their intrinsic worth, whereas OTM options are cheaper, reflecting only time value and volatility expectations. Traders prefer ITM options for immediate profitability potential, whereas OTM options serve speculative strategies with lower upfront cost but higher risk.

How Moneyness Affects Option Pricing

Moneyness significantly impacts option pricing by determining an option's intrinsic value and time value, which directly influence its premium. In-the-money options have positive intrinsic value, leading to higher premiums due to increased likelihood of profitability at expiration. Out-of-the-money options possess no intrinsic value, relying solely on time value and volatility, resulting in lower premiums but higher leverage potential in risk-reward scenarios.

Pros and Cons of Trading ITM vs OTM Options

Trading in-the-money (ITM) options offers higher intrinsic value and a greater probability of profit, providing a lower-risk strategy for investors seeking more predictable outcomes. Conversely, out-of-the-money (OTM) options require a smaller initial investment and offer higher leverage, but they carry increased risk due to the need for significant price movement to become profitable. Understanding the balance between ITM's stability and OTM's speculative potential is crucial for optimizing option trading strategies.

Risk-Reward Profiles: ITM versus OTM

In-the-money (ITM) options carry a higher premium but provide a greater probability of profit and intrinsic value, making their risk-reward profile more conservative compared to out-of-the-money (OTM) options. OTM options are cheaper with lower upfront costs but require a more substantial price movement to become profitable, resulting in higher risk and potentially higher reward. Investors choose ITM options for more secure gains and OTM options for leveraged exposure with greater profit potential but increased volatility and risk.

Choosing the Right Option: When to Go ITM or OTM

Choosing the right option between in-the-money (ITM) and out-of-the-money (OTM) depends on investment goals and risk tolerance. ITM options have intrinsic value and higher premiums, offering greater likelihood of profit but requiring larger upfront costs. OTM options are cheaper with no intrinsic value, suitable for investors seeking leverage and higher potential percentage gains despite lower probabilities of expiring profitable.

Impact of Moneyness on Option Strategies

Moneyness significantly influences option strategies by determining whether an option has intrinsic value, with in-the-money options providing immediate exercise value and greater sensitivity to price movements. Traders prefer in-the-money options for conservative strategies due to their higher delta and lower time decay risk, while out-of-the-money options appeal to speculative strategies offering higher leverage but increased risk. The choice between in-the-money and out-of-the-money options affects hedging effectiveness, premium costs, and potential profitability in various market conditions.

Real-World Examples of ITM and OTM Trades

Real-world examples of in-the-money (ITM) trades include purchasing a call option on Apple Inc. stock with a strike price below the current market price, allowing immediate profitable exercise, or buying a put option on Tesla shares with a strike price above the market price, providing intrinsic value. Out-of-the-money (OTM) trades occur when traders buy call options on Amazon at strike prices above the current market price, anticipating future price increases, or buy put options on Google with strike prices below market price, speculating on a decline. These examples illustrate how ITM options hold intrinsic value, while OTM options rely solely on potential future price movements for profitability.

Moneyness and Option Expiry: What Investors Need to Know

Moneyness determines whether an option is in-the-money (ITM) or out-of-the-money (OTM) based on the relationship between the underlying asset's current price and the option's strike price, critical for assessing intrinsic value. At option expiry, ITM options have intrinsic value and are likely to be exercised, resulting in potential profit for investors, while OTM options expire worthless, leading to a total loss of the premium paid. Understanding the dynamics of moneyness and option expiry helps investors optimize trading strategies and manage risk effectively in options markets.

Common Mistakes with ITM and OTM Options

Traders frequently confuse In-the-Money (ITM) options with Out-of-the-Money (OTM) options, leading to misguided investment strategies and potential losses. A common mistake is assuming ITM options are always profitable without considering time decay and implied volatility, which can erode option value quickly. Overlooking the intrinsic versus extrinsic value distinction often causes mispricing errors, especially when evaluating OTM options with no intrinsic value but significant speculative potential.

Important Terms

Intrinsic Value

Intrinsic value represents the real, quantifiable profit in an option if exercised immediately, calculated as the difference between the underlying asset's current price and the option's strike price. In-the-money options have positive intrinsic value, while out-of-the-money options hold zero intrinsic value and rely solely on time value and volatility for potential gains.

Strike Price

Strike price determines whether an option is In-the-Money (ITM) or Out-of-the-Money (OTM) by comparing it to the underlying asset's current market price; for call options, ITM occurs when the market price exceeds the strike price, while for put options, ITM happens when the market price is below the strike price. Conversely, call options are OTM when the market price is below the strike price, and put options are OTM when the market price is above the strike price, influencing an option's intrinsic value and potential profitability.

Premium

Premiums for in-the-money options are higher due to intrinsic value, while out-of-the-money options have premiums primarily composed of time value and implied volatility.

Expiration Date

Expiration date determines whether an option is in-the-money or out-of-the-money by comparing the underlying asset's price to the strike price at that specific time.

Option Greeks

Option Greeks like Delta and Gamma vary significantly between In-the-money and Out-of-the-money options, with In-the-money options exhibiting higher Delta values and greater sensitivity to underlying asset price changes.

Time Value

Time value represents the portion of an option's premium exceeding its intrinsic value, reflecting the probability of favorable price movement before expiration; in-the-money options possess intrinsic value, whereas out-of-the-money options consist solely of time value until they potentially become profitable. The time decay accelerates as expiration approaches, causing out-of-the-money options to lose value rapidly compared to in-the-money options with higher intrinsic components.

Delta

Delta measures the sensitivity of an option's price to changes in the underlying asset's price, typically approaching 1 for deep in-the-money call options and near 0 for out-of-the-money calls.

Hedging

Hedging strategies often involve options that are either in-the-money (ITM), providing intrinsic value and immediate protection, or out-of-the-money (OTM), which offer lower premiums but serve as cost-effective insurance against adverse market movements. ITM options deliver more reliable downside risk mitigation, while OTM options are favored for speculative hedging with limited upfront costs.

Covered Call

A covered call strategy involves holding a long position in an asset while selling call options on the same asset to generate income. In-the-money covered calls have a strike price below the current stock price, providing higher premiums but limiting upside potential, whereas out-of-the-money covered calls have a strike price above the current stock price, offering lower premiums with greater profit potential if the stock price rises.

Put-Call Parity

Put-Call Parity establishes a fundamental relationship between the prices of European call and put options with the same strike price and expiration date, ensuring no arbitrage opportunities exist. In-the-money options, where the strike price is favorable relative to the underlying asset's spot price, exhibit intrinsic value influencing the parity balance compared to out-of-the-money options, which rely primarily on time value and volatility.

In-the-money vs Out-of-the-money Infographic

moneydif.com

moneydif.com