Soft dollars refer to the non-cash benefits investment managers receive from brokers in exchange for executing client trades, often covering research and analytics. Hard dollars are direct payments made by a firm or individual for services or products, reflecting transparent and explicit costs. Understanding the distinction between soft and hard dollars is crucial for evaluating the true cost of investment management and regulatory compliance.

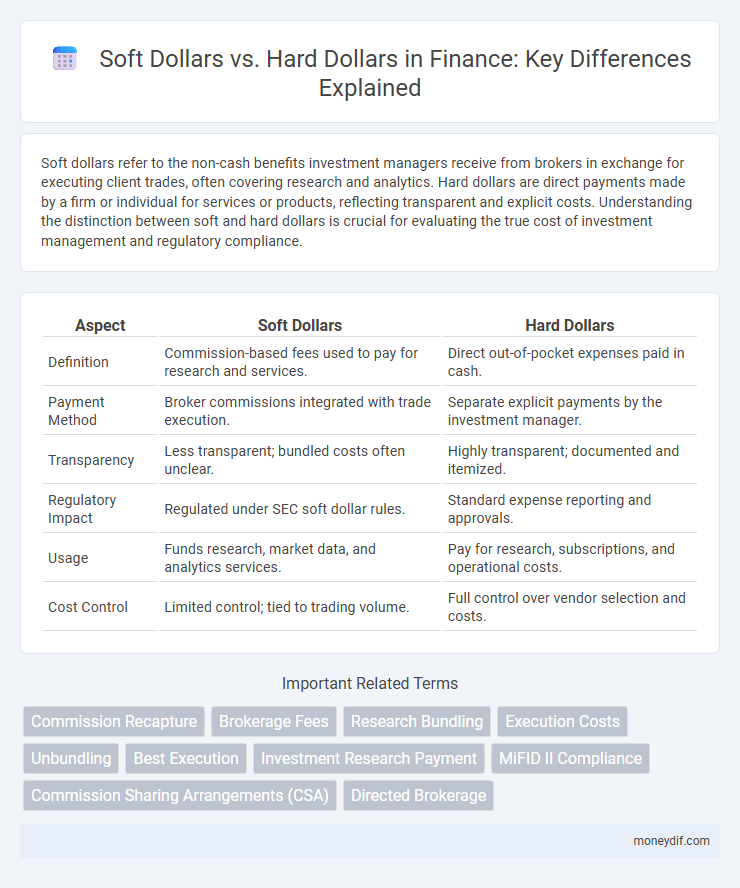

Table of Comparison

| Aspect | Soft Dollars | Hard Dollars |

|---|---|---|

| Definition | Commission-based fees used to pay for research and services. | Direct out-of-pocket expenses paid in cash. |

| Payment Method | Broker commissions integrated with trade execution. | Separate explicit payments by the investment manager. |

| Transparency | Less transparent; bundled costs often unclear. | Highly transparent; documented and itemized. |

| Regulatory Impact | Regulated under SEC soft dollar rules. | Standard expense reporting and approvals. |

| Usage | Funds research, market data, and analytics services. | Pay for research, subscriptions, and operational costs. |

| Cost Control | Limited control; tied to trading volume. | Full control over vendor selection and costs. |

Understanding Soft Dollars: Definition and Mechanism

Soft dollars refer to commission-based arrangements where investment managers receive research and other services from brokers in exchange for trades executed on behalf of clients, rather than paying directly in cash. This mechanism enables portfolio managers to access valuable market analysis, data, and technology without incurring explicit out-of-pocket expenses, effectively bundling research costs within trading commissions. Understanding soft dollar arrangements is critical for ensuring transparency, regulatory compliance, and aligning client interests in asset management.

Hard Dollars Explained: Direct Payments in Finance

Hard dollars refer to direct payments made by investors or clients to financial service providers, covering explicit costs such as commissions, fees, and expenses. These out-of-pocket expenses are fully transparent and deducted directly from the investor's account, reflecting true costs of transactions or services rendered. Unlike soft dollars, hard dollars do not involve any indirect benefits or credits and represent a straightforward cash outflow in portfolio management.

Key Differences Between Soft Dollars and Hard Dollars

Soft dollars represent commission-based arrangements where investment managers receive research or services from brokers, indirectly paid through trading commissions. Hard dollars involve direct cash payments from a firm's budget to vendors or service providers, reflecting straightforward expenses. The key difference lies in the payment method: soft dollars tie costs to trading activity, while hard dollars are explicit, out-of-pocket expenses.

Regulatory Environment: Compliance and Disclosure

In the regulatory environment, compliance for soft dollars requires adherence to specific rules under the Investment Advisers Act of 1940, mandating transparent disclosure of how client commissions are used to cover research costs. Hard dollars involve direct payments for services, simplifying compliance but necessitating precise accounting to ensure fees align with client agreements. Regulators emphasize clear, consistent disclosure to protect investors and maintain trust in financial advisory practices.

Benefits and Risks of Soft Dollar Arrangements

Soft dollar arrangements offer investment managers access to valuable research and brokerage services without direct cash payments, enhancing portfolio performance through improved market insights and execution quality. However, these arrangements can create conflicts of interest, as managers may prioritize brokers who provide soft dollar benefits over those offering the best trade prices, potentially increasing overall trading costs. Regulatory scrutiny and transparency requirements mitigate risks but do not entirely eliminate concerns about fiduciary duty and the potential for inefficient capital allocation.

Impact on Investment Performance and Costs

Soft dollars allow investment managers to pay for research and services with client commissions rather than direct payments, potentially reducing explicit costs but obscuring true expenses and impacting transparency. Hard dollars involve direct, out-of-pocket payments for research and services, offering clearer cost allocation but increasing explicit expenses that may weigh on investment returns. The choice between soft and hard dollars affects the overall cost structure, influencing net investment performance and the accuracy of performance attribution.

Examples of Soft Dollar and Hard Dollar Transactions

Soft dollar transactions include brokerage commissions used to pay for research reports, market data, and investment analysis tools provided by brokers. Examples of hard dollar transactions involve direct payment from a firm's budget for expenses such as custody fees, regulatory filings, and external auditing services. Soft dollar arrangements enhance portfolio management resources without immediate cash outflow, while hard dollar payments reflect explicit costs directly charged to the firm's operating expenses.

Industry Best Practices for Managing Research Payments

Industry best practices for managing research payments emphasize transparent documentation and clear allocation between soft dollars and hard dollars to ensure compliance with regulatory standards. Investment firms typically use soft dollar arrangements to pay for research services through brokerage commissions, while hard dollar payments involve direct cash outflows from operating budgets. Effective management includes rigorous internal controls, regular audits, and detailed disclosure to clients to maintain fiduciary responsibility and optimize research budgeting.

Investor Perspective: Transparency and Accountability

Soft dollars often obscure true transaction costs for investors, making it challenging to assess the actual fees paid and potentially compromising transparency. Hard dollars provide clearer visibility into expenses as they involve direct payment for services, enhancing accountability and allowing investors to evaluate the cost-effectiveness of their investments. Investors prioritize hard dollar arrangements to ensure transparent disclosures and maintain trust in financial management practices.

Future Trends in Soft Dollar vs Hard Dollar Practices

Future trends in soft dollar and hard dollar practices indicate increasing regulatory scrutiny and greater demand for transparency in asset management fees. Advances in technology and data analytics are enabling more precise allocation of costs between research and execution, potentially reducing reliance on soft dollars. Market participants are also moving towards fee structures that align closely with performance, emphasizing hard dollar payments to ensure clearer value for investment services.

Important Terms

Commission Recapture

Commission recapture maximizes trading efficiency by reinvesting hard dollar commissions into research or services typically acquired through soft dollars, optimizing investment costs and value.

Brokerage Fees

Brokerage fees incurred through soft dollars involve using client commissions to pay for research and services, whereas hard dollars are direct, transparent cash payments for brokerage services.

Research Bundling

Research bundling involves aggregating multiple research services under a single payment, impacting the allocation between soft dollars, which use commission fees, and hard dollars, which are direct cash payments.

Execution Costs

Execution costs in trading are influenced by soft dollars, which cover research and brokerage services indirectly, versus hard dollars, representing direct payment for trade commissions and fees.

Unbundling

Unbundling in investment management separates brokerage services to clarify the use of soft dollars, which involve trading commissions for research, from hard dollars that are paid directly from budgeted funds.

Best Execution

Best Execution mandates brokers prioritize client trade quality by balancing Soft Dollar benefits like research access against Hard Dollar costs for transparent, cost-effective investment decisions.

Investment Research Payment

Investment research payments can be made using soft dollars, which are commission-based funds, or hard dollars, which are direct cash payments from assets.

MiFID II Compliance

MiFID II compliance mandates transparent disclosure and strict segregation between soft dollar arrangements, where brokerage commissions are used to pay for research, and hard dollar payments, which are direct cash expenses, to ensure investor protection and conflict-free financial services.

Commission Sharing Arrangements (CSA)

Commission Sharing Arrangements (CSA) enable asset managers to allocate hard dollar commissions to pay for research and soft dollar services, optimizing transaction costs while complying with regulatory standards.

Directed Brokerage

Directed brokerage allows investment managers to allocate trades through specific brokers to earn soft dollar benefits, whereas hard dollars involve direct payment for brokerage services without receiving additional research or services.

Soft Dollars vs Hard Dollars Infographic

moneydif.com

moneydif.com