Moral hazard arises when insured individuals engage in riskier behavior because they are protected from the consequences, while morale hazard involves carelessness or indifference to risk due to the presence of insurance. Both hazards increase the likelihood of claims but differ in motivation: moral hazard is deliberate, whereas morale hazard stems from negligence. Insurers manage these risks through policy design, monitoring, and incentives to promote responsible behavior.

Table of Comparison

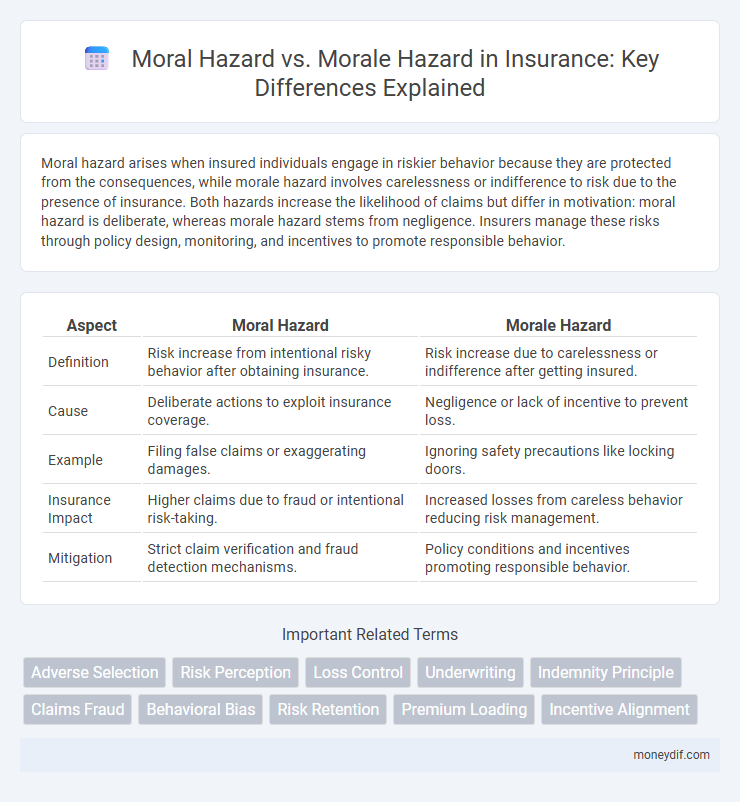

| Aspect | Moral Hazard | Morale Hazard |

|---|---|---|

| Definition | Risk increase from intentional risky behavior after obtaining insurance. | Risk increase due to carelessness or indifference after getting insured. |

| Cause | Deliberate actions to exploit insurance coverage. | Negligence or lack of incentive to prevent loss. |

| Example | Filing false claims or exaggerating damages. | Ignoring safety precautions like locking doors. |

| Insurance Impact | Higher claims due to fraud or intentional risk-taking. | Increased losses from careless behavior reducing risk management. |

| Mitigation | Strict claim verification and fraud detection mechanisms. | Policy conditions and incentives promoting responsible behavior. |

Understanding Moral Hazard in Insurance

Moral hazard in insurance occurs when the insured party engages in riskier behavior because they are protected against losses, potentially leading to higher claim frequencies and increased costs for insurers. Insurers mitigate moral hazard through carefully designed policy terms, deductibles, and monitoring mechanisms to align incentives between the insurer and insured. Understanding moral hazard is crucial for effective underwriting and risk management in property, health, and liability insurance sectors.

Defining Morale Hazard: Key Differences

Morale hazard refers to the increased risk of loss due to an insured individual's careless or indifferent behavior, knowing they have insurance coverage. Unlike moral hazard, which involves intentional actions to cause a loss, morale hazard stems from negligence or lack of precaution. Understanding morale hazard is essential for insurers to design policies that encourage responsible behavior and reduce avoidable claims.

Origins of Moral and Morale Hazard

Moral hazard originates from asymmetric information where the insured party may engage in riskier behavior after obtaining insurance, knowing losses are covered. Morale hazard stems from an individual's carelessness or indifference toward risk due to insurance, influenced by personal attitudes rather than intentional deceit. Both concepts highlight different behavioral risks that insurers assess to price policies accurately and mitigate potential losses.

Real-World Examples of Moral Hazard

Moral hazard occurs when individuals take greater risks because they are protected by insurance, such as a homeowner neglecting fire safety after purchasing comprehensive fire coverage. In car insurance, drivers may drive less cautiously, knowing that damages will be covered, which exemplifies moral hazard through increased risk-taking behavior. These behaviors contrast with morale hazard, where carelessness arises from indifference rather than intentional risk-seeking.

Illustrating Morale Hazard with Practical Cases

Morale hazard occurs when an insured party's careless or indifferent behavior increases the risk of loss, such as leaving doors unlocked or neglecting maintenance due to the comfort of having insurance coverage. For example, a homeowner might delay fixing a leaky roof because they know the insurance will cover water damage, leading to more extensive property deterioration. In auto insurance, a driver may take more risks like speeding or parking in unsafe areas, believing claims will mitigate any potential losses.

Impact of Moral Hazard on Insurance Premiums

Moral hazard significantly influences insurance premiums as it involves the insured party engaging in riskier behavior due to the protection provided by the policy, increasing the likelihood of claims. Insurers raise premiums to offset the heightened risk and potential losses associated with this deliberate risk-taking. This adjustment ensures the sustainability of insurance pools and maintains equilibrium between risk exposure and cost for all policyholders.

How Morale Hazard Influences Claims Behavior

Morale hazard influences claims behavior by affecting an insured individual's attitude toward risk and carelessness after obtaining coverage, leading to higher frequency or severity of claims. Unlike moral hazard, which involves intentional fraud or deception, morale hazard stems from indifference or reduced effort to prevent loss, resulting in increased claims costs for insurers. Understanding morale hazard helps insurers design policies and incentives to encourage responsible behavior and reduce unnecessary claims.

Mitigating Moral Hazard: Strategies for Insurers

Insurers mitigate moral hazard by implementing strict underwriting guidelines, requiring detailed disclosures from policyholders, and incorporating deductibles or co-payments to align incentives. Data analytics and continuous monitoring help identify suspicious claims, ensuring early detection of fraudulent or negligent behavior. Education programs promote responsible policyholder behavior, reducing the risk of intentional loss or carelessness.

Addressing Morale Hazard through Policy Design

Morale hazard arises from an insured party's careless or indifferent behavior, increasing the likelihood of loss due to negligence rather than intentional acts. Insurance policy design can mitigate morale hazard by incorporating clear terms that incentivize risk-aware behavior, such as deductibles, co-payments, and premium adjustments tied to policyholder conduct. Implementing regular risk assessments and behavior-based rewards further encourages responsible actions, reducing moral complacency and lowering overall claim frequency.

Moral Hazard vs. Morale Hazard: A Comparative Analysis

Moral hazard arises when insured individuals deliberately alter their behavior to increase the likelihood or magnitude of a claim, such as driving recklessly after purchasing car insurance. Morale hazard involves indifference or carelessness stemming from the mere presence of insurance coverage, like neglecting home maintenance because damage costs are insured. Understanding the distinction between moral and morale hazards is critical for insurance companies to design effective risk management strategies and pricing models that minimize potential losses.

Important Terms

Adverse Selection

Adverse selection arises from asymmetric information before a transaction, whereas moral hazard involves changes in behavior after a contract is signed, and morale hazard stems from carelessness or indifference affecting risk.

Risk Perception

Risk perception influences decision-making by differentiating moral hazard, where individuals take more risks due to insurance coverage, from morale hazard, which involves carelessness or indifference increasing risk regardless of insurance.

Loss Control

Loss control strategies effectively mitigate risks by addressing both moral hazard, which involves intentional risky behavior due to insurance coverage, and morale hazard, characterized by carelessness or indifference after obtaining insurance. Implementing rigorous monitoring systems and promoting a culture of responsibility reduces fraudulent activities and negligent actions, thereby minimizing potential losses and enhancing overall risk management.

Underwriting

Underwriting evaluates risk by distinguishing moral hazard, where intentional deception affects insured losses, from morale hazard, involving carelessness or indifference increasing loss probability.

Indemnity Principle

The Indemnity Principle in insurance mitigates Moral Hazard by ensuring compensation only restores losses without profit, unlike Morale Hazard, which arises from insured individuals' carelessness or indifference.

Claims Fraud

Claims fraud involves intentional deception by policyholders to receive undeserved insurance benefits, reflecting a moral hazard where individuals exploit asymmetric information for personal gain. Morale hazard differs as it stems from policyholders' carelessness or indifference to loss prevention, increasing the likelihood of claims without deliberate fraudulent intent.

Behavioral Bias

Behavioral bias influences individuals' risk-taking decisions by lowering vigilance in moral hazard situations while sustaining caution in morale hazard contexts.

Risk Retention

Risk retention minimizes moral hazard by encouraging responsible behavior, whereas morale hazard arises from carelessness despite retained risks.

Premium Loading

Premium loading is an insurance practice where higher premiums are charged to policyholders perceived as higher risk, directly addressing moral hazard by discouraging reckless behavior; it contrasts with morale hazard, which stems from insured individuals' carelessness or indifference rather than intentional risk-taking. By adjusting premiums based on risk assessments, insurers mitigate moral hazard effects but must also consider the subtle influence of morale hazard on claim frequency and loss severity.

Incentive Alignment

Incentive alignment mitigates moral hazard by ensuring agents act in principals' best interests, while morale hazard involves diminished effort due to psychological attitudes despite aligned incentives.

Moral Hazard vs Morale Hazard Infographic

moneydif.com

moneydif.com