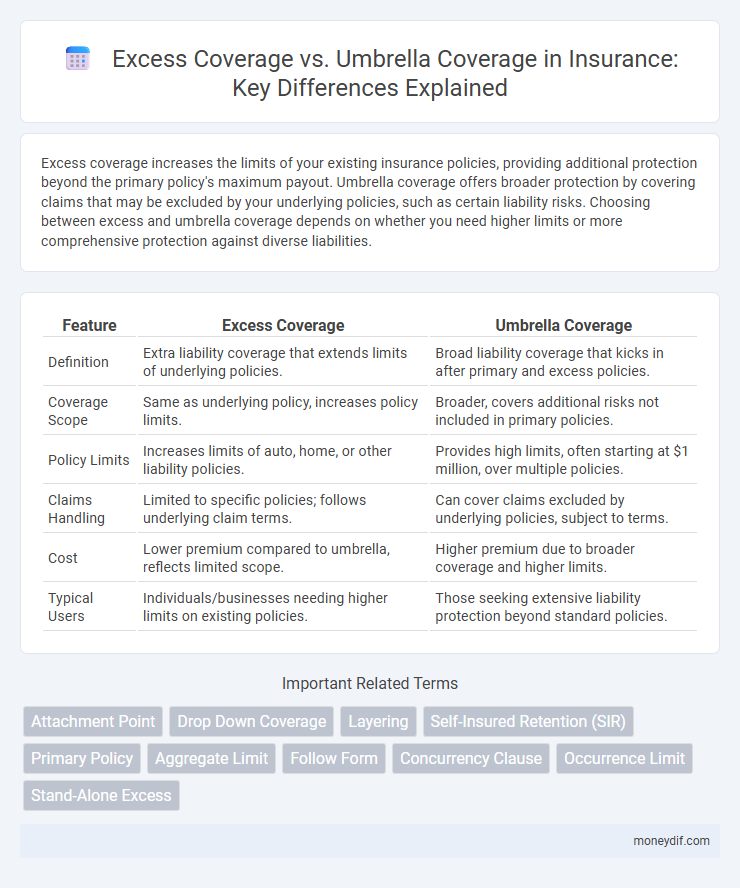

Excess coverage increases the limits of your existing insurance policies, providing additional protection beyond the primary policy's maximum payout. Umbrella coverage offers broader protection by covering claims that may be excluded by your underlying policies, such as certain liability risks. Choosing between excess and umbrella coverage depends on whether you need higher limits or more comprehensive protection against diverse liabilities.

Table of Comparison

| Feature | Excess Coverage | Umbrella Coverage |

|---|---|---|

| Definition | Extra liability coverage that extends limits of underlying policies. | Broad liability coverage that kicks in after primary and excess policies. |

| Coverage Scope | Same as underlying policy, increases policy limits. | Broader, covers additional risks not included in primary policies. |

| Policy Limits | Increases limits of auto, home, or other liability policies. | Provides high limits, often starting at $1 million, over multiple policies. |

| Claims Handling | Limited to specific policies; follows underlying claim terms. | Can cover claims excluded by underlying policies, subject to terms. |

| Cost | Lower premium compared to umbrella, reflects limited scope. | Higher premium due to broader coverage and higher limits. |

| Typical Users | Individuals/businesses needing higher limits on existing policies. | Those seeking extensive liability protection beyond standard policies. |

Understanding Excess Coverage: Key Features

Excess coverage provides additional protection by extending the limits of your primary insurance policy, such as auto or homeowners insurance, offering higher liability limits beyond the base policy's maximum. It typically matches the underlying policy's terms and conditions, activating when those limits are exhausted, ensuring comprehensive financial protection against large claims or lawsuits. This type of coverage is essential for individuals seeking to safeguard assets from unexpected, high-cost claims without purchasing multiple separate policies.

What Is Umbrella Coverage? Core Components

Umbrella coverage provides an extra layer of liability protection beyond the limits of underlying insurance policies such as auto, home, or renters insurance. Core components include higher liability limits, broader coverage of claims not covered by primary policies, and protection against lawsuits, property damage, and personal injury. This coverage is essential for safeguarding assets and providing peace of mind against large or unexpected liability claims.

Main Differences Between Excess and Umbrella Policies

Excess coverage provides additional limits beyond the underlying policy, applying strictly to the same types of claims and risks covered by the base policy. Umbrella coverage offers broader protection, extending beyond underlying policy limits and often covering claims not included in primary insurance, such as libel or slander. While excess insurance increases coverage limits, umbrella policies add both extra limits and wider scope of liability protection.

Coverage Scope: Excess vs. Umbrella Insurance

Excess coverage extends the limits of your existing primary insurance policies, offering additional protection only after those policy limits are exhausted. Umbrella coverage provides broader protection by filling gaps in liability coverage across multiple policies and offers increased limits for claims that may not be covered by underlying policies. Understanding the distinct coverage scopes helps policyholders choose appropriate protection tailored to complex risk exposures.

When to Choose Excess Liability Insurance

Excess liability insurance is ideal when your primary policy limits are sufficient for most claims but occasionally require additional coverage for severe or unexpected losses, especially in industries with high-risk exposures. It provides an extra layer of protection by extending the limits of your underlying liability policies without broadening coverage scopes, making it cost-effective for businesses or individuals needing higher limits. Choose excess coverage when you seek greater liability limits for specific policies without changing terms or adding new coverage types, ensuring focused financial security against large claims.

Scenarios Suited for Umbrella Insurance

Umbrella insurance is ideal for individuals with significant assets or high liability risks that exceed the limits of standard policies, such as homeowners, landlords, or those with multiple vehicles. It provides extra liability coverage in scenarios like severe car accidents, major property damage, or personal injury claims where basic insurance limits are insufficient. This coverage is crucial for professionals, business owners, and those facing potential lawsuits to protect their financial stability beyond primary policy thresholds.

Policy Limitations: What’s Excluded?

Excess coverage extends the limits of an underlying insurance policy but inherits its exclusions, leaving gaps in protection for risks like intentional acts or certain liabilities excluded by the base policy. Umbrella coverage offers broader protection by filling gaps and covering claims excluded from other policies, including libel, slander, and false arrest, subject to its own specific exclusions. Both policies typically exclude coverage for business liabilities, punitive damages in some states, and losses arising from criminal activities.

Cost Comparison: Excess vs. Umbrella Coverage

Excess coverage generally costs less than umbrella coverage because it extends limits on a single underlying policy, such as auto or homeowners insurance, without broadening protection across multiple policies. Umbrella coverage, while more expensive, offers higher liability limits and broader protection that covers various underlying policies, including liabilities not covered by excess insurance. Evaluating premiums, umbrella policies typically start around $150 to $300 annually for $1 million in coverage, whereas excess policies can be significantly cheaper depending on the base policy and risk factors.

Integrating Coverage—Can You Have Both?

Excess coverage and umbrella coverage can be integrated to provide layered financial protection beyond your primary insurance limits. Excess coverage extends the limits of a specific underlying policy, such as auto or home insurance, while umbrella coverage offers broader liability protection that supplements multiple policies. Combining both enhances overall risk management by covering high-cost claims and gaps that standard policies may not address.

Deciding the Best Fit for Your Risk Profile

Excess coverage provides higher limits beyond your existing policy, ideal for those seeking extended protection within the same coverage scope, while umbrella coverage offers broader liability protection that can cover multiple policies and additional risks. Assess your risk profile by evaluating potential liability exposures, asset value, and the likelihood of claims exceeding your primary policy limits. Choosing between excess and umbrella coverage depends on whether you require increased limits on specific policies or comprehensive liability protection across various policies.

Important Terms

Attachment Point

Attachment point in excess coverage refers to the threshold limit where the excess insurance policy begins to pay after the underlying primary insurance is exhausted, often set higher than standard umbrella coverage which kicks in after primary and any excess policies are depleted. Umbrella coverage provides broader liability protection beyond the attachment point, covering gaps that excess policies may exclude, such as certain personal injury claims or defense costs outside the primary policy scope.

Drop Down Coverage

Drop down coverage activates when the limits of an underlying policy, such as an auto or homeowners policy, are exhausted, providing secondary liability protection that excess coverage does not offer. Unlike umbrella coverage which supplements primary policies upon a catastrophic loss, drop down coverage fills gaps by becoming primary when underlying coverage limits are depleted or excluded.

Layering

Layering in insurance involves stacking multiple policies to achieve higher limits, where excess coverage provides additional limits above the primary policy but only covers the same risks, while umbrella coverage offers broader protection, filling gaps by covering claims excluded by underlying policies. Excess coverage strictly follows the underlying policy terms, whereas umbrella coverage extends to cover additional liabilities and can protect against catastrophic losses beyond the limits of primary and excess policies.

Self-Insured Retention (SIR)

Self-Insured Retention (SIR) represents the amount a policyholder must pay before excess coverage or umbrella coverage begins to provide indemnity, typically focusing on large, infrequent losses in excess policies. In contrast, umbrella coverage generally offers broader protection beyond underlying policy limits and may have a lower or no SIR, while excess coverage strictly applies after all underlying insurance limits are exhausted and usually incorporates a specific SIR threshold.

Primary Policy

Primary policy provides initial liability coverage before Excess Coverage or Umbrella Coverage activates, covering claims up to its policy limits. Excess Coverage extends the limits of the primary policy without altering its terms, while Umbrella Coverage offers broader protection by filling gaps and covering claims excluded by the primary and excess policies.

Aggregate Limit

Aggregate limit defines the maximum total amount an insurance policy will pay for all claims during the policy period, significantly impacting Excess Coverage and Umbrella Coverage policies by capping their combined liability. Excess Coverage typically applies higher limits above the underlying policy without extending coverage scope, while Umbrella Coverage provides broader protection with its own aggregate limit, filling gaps and offering additional liability beyond primary and Excess policies.

Follow Form

Follow Form coverage extends the terms and limits of an underlying policy, providing excess coverage that mirrors the primary policy's conditions without creating gaps, while Umbrella Coverage offers broader protection that may include additional risks, higher limits, and fewer exclusions beyond the base policies. Excess Coverage strictly follows the underlying policy's terms, whereas Umbrella Coverage enhances and fills coverage gaps, often covering liabilities not included in the primary insurance.

Concurrency Clause

The concurrency clause ensures that excess coverage and umbrella coverage policies respond simultaneously to claims within overlapping limits, preventing gaps or duplication in protection. Understanding how this clause coordinates benefits between primary, excess, and umbrella layers is critical for optimizing total liability coverage and avoiding unexpected out-of-pocket expenses.

Occurrence Limit

Occurrence limit defines the maximum payout per claim under excess coverage policies, ensuring protection beyond the underlying primary insurance up to a specified amount. In contrast, umbrella coverage typically features higher occurrence limits that provide broader liability protection by filling gaps not covered by underlying excess or primary policies.

Stand-Alone Excess

Stand-Alone Excess provides higher liability limits by extending the underlying policy without offering additional coverage types, making it ideal for clients needing increased limits but not new coverage triggers. Excess Coverage differs from Umbrella Coverage in that umbrellas offer broader protection with additional coverage scope and lower self-insured retentions, while stand-alone excess policies strictly follow the terms of the underlying policies.

Excess Coverage vs Umbrella Coverage Infographic

moneydif.com

moneydif.com