The coinsurance clause requires policyholders to pay a specified percentage of covered medical expenses after the deductible is met, sharing costs between the insurer and insured. The copayment clause, however, mandates a fixed fee for certain services or prescriptions regardless of the total cost. Understanding the differences helps policyholders manage out-of-pocket expenses and choose suitable health insurance plans.

Table of Comparison

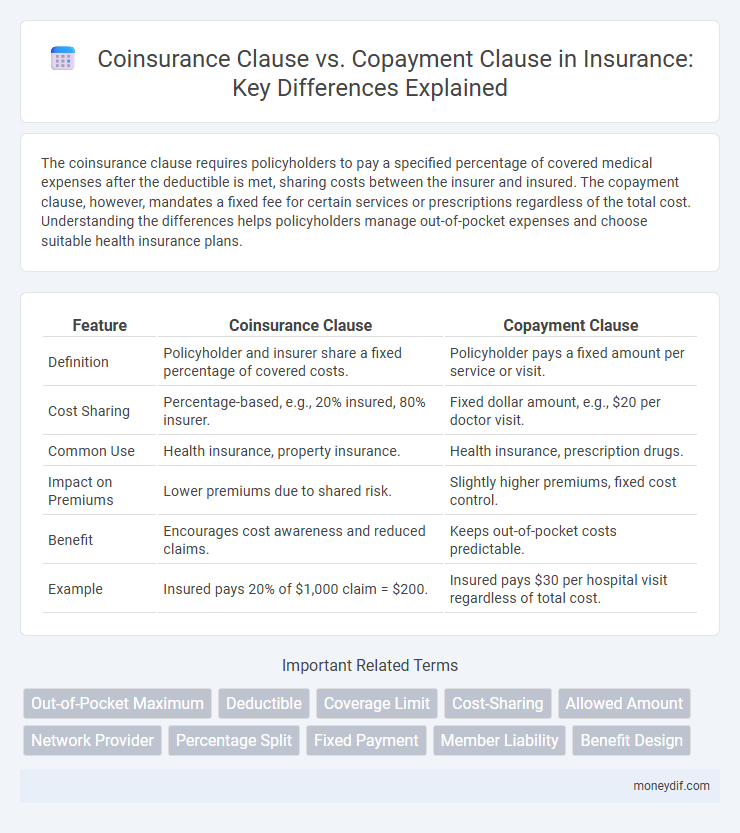

| Feature | Coinsurance Clause | Copayment Clause |

|---|---|---|

| Definition | Policyholder and insurer share a fixed percentage of covered costs. | Policyholder pays a fixed amount per service or visit. |

| Cost Sharing | Percentage-based, e.g., 20% insured, 80% insurer. | Fixed dollar amount, e.g., $20 per doctor visit. |

| Common Use | Health insurance, property insurance. | Health insurance, prescription drugs. |

| Impact on Premiums | Lower premiums due to shared risk. | Slightly higher premiums, fixed cost control. |

| Benefit | Encourages cost awareness and reduced claims. | Keeps out-of-pocket costs predictable. |

| Example | Insured pays 20% of $1,000 claim = $200. | Insured pays $30 per hospital visit regardless of total cost. |

Introduction to Coinsurance and Copayment Clauses

Coinsurance and copayment clauses are essential components of insurance policies that determine how costs are shared between the insurer and the insured. Coinsurance requires the insured to pay a percentage of covered expenses, often after the deductible is met, promoting shared financial responsibility and reducing moral hazard. Copayment clauses specify fixed amounts the insured must pay for particular services, such as doctor visits or prescriptions, simplifying cost predictability for policyholders.

Defining Coinsurance Clause in Insurance

Coinsurance clause in insurance requires policyholders to share a percentage of the insured loss, promoting risk-sharing between the insurer and insured. It typically mandates the insured to maintain coverage equal to a specified percentage of the property's value to avoid penalty during claims. This clause helps prevent underinsurance by incentivizing adequate coverage and balancing claim payouts.

Understanding Copayment Clause in Insurance

Copayment clause in insurance requires the insured to pay a fixed amount for covered services at the time of care, promoting shared cost responsibility and reducing insurer risk. Unlike coinsurance, which is a percentage of the incurred cost, copayments are predetermined fixed fees that do not fluctuate with service price. Understanding copayment clauses helps policyholders anticipate out-of-pocket expenses and manage healthcare budgets effectively.

Key Differences Between Coinsurance and Copayment

Coinsurance clause requires the insured to pay a percentage of the covered expenses after the deductible is met, typically ranging from 10% to 30%, while the insurer covers the remaining balance. Copayment clause involves a fixed dollar amount paid by the insured for each specific service, such as $20 per doctor's visit, regardless of the total cost. Key differences include coinsurance's percentage-based cost-sharing versus copayment's flat fee structure, affecting out-of-pocket expenses and how costs are distributed between insurer and insured.

How Coinsurance Affects Out-of-Pocket Costs

Coinsurance requires policyholders to pay a fixed percentage of covered expenses after the deductible is met, directly impacting out-of-pocket costs by increasing the amount paid for larger claims. This percentage typically ranges from 10% to 30%, meaning insured individuals share the risk with the insurer, influencing the overall financial responsibility. Understanding the coinsurance clause is essential, as it can lead to higher expenses compared to a copayment clause, which mandates a fixed fee per service regardless of the total charge.

Impact of Copayment on Policyholders’ Expenses

Copayment clauses require policyholders to pay a fixed amount per service, directly influencing out-of-pocket expenses and promoting cost-conscious healthcare utilization. In contrast, coinsurance clauses involve sharing a percentage of the cost after deductibles, leading to variable expenses based on service costs. The copayment structure provides predictability in budgeting healthcare expenses but may result in higher cumulative payments for frequent care seekers compared to coinsurance.

Common Insurance Policies Using Coinsurance and Copayment

Common insurance policies using coinsurance clauses include health insurance, property insurance, and some commercial liability policies, where policyholders share a fixed percentage of the covered expenses after the deductible is met. Copayment clauses are frequently found in health insurance plans, prescription drug plans, and dental insurance, requiring insured individuals to pay a fixed amount per service or visit. Both coinsurance and copayment clauses help manage risk and control costs by distributing expenses between the insurer and the insured.

Advantages and Disadvantages of Coinsurance Clause

The coinsurance clause requires policyholders to share a percentage of the covered expenses, promoting cost awareness and preventing overutilization of insurance benefits. Advantages include lower premium costs and encouragement of responsible healthcare spending, while disadvantages involve potential high out-of-pocket costs during expensive treatments. Unlike copayment clauses with fixed fees, coinsurance can lead to unpredictable expenses, making budgeting more challenging for insured individuals.

Pros and Cons of Copayment Clause

The copayment clause requires insured individuals to pay a fixed amount for healthcare services, which helps control insurance costs by reducing minor claims and encouraging responsible use of medical services. However, it may lead to higher out-of-pocket expenses for frequent users, potentially deterring necessary medical visits and impacting overall health outcomes. While promoting cost-sharing, the copayment clause can create financial barriers for low-income policyholders, contrasting with the proportional risk-sharing nature of coinsurance clauses.

Choosing the Right Clause for Your Insurance Needs

Choosing the right clause between coinsurance and copayment depends on your healthcare usage and financial preferences. Coinsurance requires you to pay a percentage of costs after the deductible, benefiting those who prefer risk-sharing, while copayment involves a fixed fee per service, ideal for predictable expenses. Analyzing your medical service frequency and budget helps optimize your insurance coverage and out-of-pocket expenses effectively.

Important Terms

Out-of-Pocket Maximum

The Out-of-Pocket Maximum limits total expenses an insured must pay, encompassing coinsurance and copayment amounts under the policy's cost-sharing structure. Coinsurance clauses require a percentage of costs shared after deductibles, while copayment clauses impose fixed fees per service, both contributing toward reaching the Out-of-Pocket Maximum.

Deductible

The deductible represents the fixed amount a policyholder must pay before insurance coverage begins, influencing the application of both coinsurance and copayment clauses by determining initial out-of-pocket costs. Coinsurance clauses require the insured to pay a percentage of covered expenses after the deductible is met, whereas copayment clauses mandate a fixed fee per service regardless of the deductible status.

Coverage Limit

Coverage limit defines the maximum amount an insurer will pay for a covered loss under a policy, influencing the financial responsibility split governed by the coinsurance and copayment clauses; the coinsurance clause requires the insured to cover a specified percentage of losses after the deductible until the coverage limit is reached, whereas the copayment clause mandates a fixed payment amount for each service regardless of the total cost. Understanding these distinctions optimizes policyholder expense management within the coverage limit framework.

Cost-Sharing

Cost-sharing mechanisms in insurance policies include coinsurance clauses, which require insured individuals to pay a fixed percentage of covered expenses after deductible fulfillment, and copayment clauses, where insured parties pay a predetermined fixed amount per service or prescription; coinsurance often affects the overall out-of-pocket maximum, while copayments offer predictable costs. Understanding the distinctions between these clauses helps policyholders manage healthcare expenses effectively and insurers balance risk distribution.

Allowed Amount

Allowed Amount refers to the maximum fee a health insurer agrees to pay for a covered service under a policy, directly affecting patient costs in Coinsurance and Copayment Clauses. In a Coinsurance Clause, the patient pays a percentage of the Allowed Amount after the deductible, while in a Copayment Clause, the patient pays a fixed dollar amount regardless of the Allowed Amount.

Network Provider

Network providers often negotiate coinsurance clauses requiring patients to pay a percentage of covered services, while copayment clauses mandate a fixed fee per service; understanding the distinction impacts out-of-pocket costs and network utilization. Coinsurance typically applies to major medical services under in-network plans, whereas copayments are common for routine visits and prescriptions, influencing patient financial responsibility and provider reimbursement.

Percentage Split

Percentage split under a coinsurance clause typically requires the insured to pay a fixed percentage of each claim after the deductible, often ranging between 20% to 30%, while the insurer covers the remaining balance. In contrast, a copayment clause mandates a fixed dollar amount per service or visit, such as $20 to $50, regardless of the total charge, influencing out-of-pocket expenses without affecting the overall claim percentage.

Fixed Payment

Fixed payment structures differ significantly between coinsurance clauses and copayment clauses in health insurance policies; coinsurance requires insured individuals to pay a fixed percentage of covered expenses, whereas copayment mandates a set fixed amount per service or visit. Understanding these distinctions is crucial for accurately assessing out-of-pocket costs and optimizing insurance benefits management.

Member Liability

Member liability under the coinsurance clause requires insured individuals to pay a defined percentage of covered expenses after deductible fulfillment, promoting shared risk between insurer and member. In contrast, the copayment clause mandates fixed dollar amounts for specific services, providing predictable out-of-pocket costs regardless of total charges.

Benefit Design

Benefit design in health insurance often differentiates between coinsurance and copayment clauses to manage cost-sharing effectively; coinsurance requires policyholders to pay a percentage of the covered expenses, whereas copayment mandates a fixed dollar amount per service. Understanding these distinctions impacts out-of-pocket costs, influences provider network utilization, and affects overall plan affordability and member satisfaction.

Coinsurance Clause vs Copayment Clause Infographic

moneydif.com

moneydif.com