Concealment in insurance involves intentionally withholding material information that could influence the insurer's decision to cover a risk, whereas misrepresentation entails providing false or misleading information about facts that affect the policy terms. Both actions can lead to policy voidance or denial of claims, as insurers rely on accurate disclosures to assess risk properly. Understanding the difference between concealment and misrepresentation helps policyholders maintain transparency and avoid legal complications.

Table of Comparison

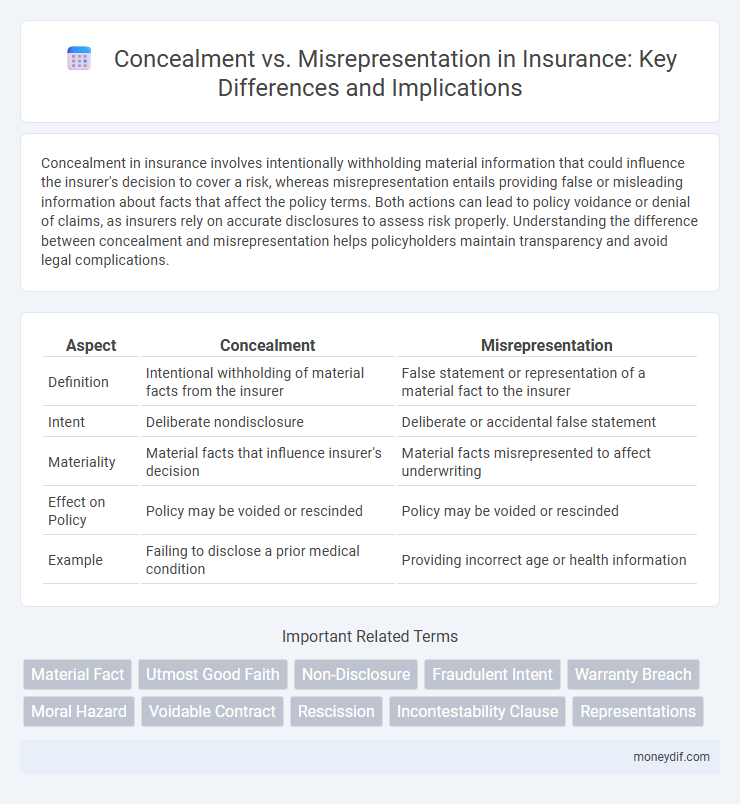

| Aspect | Concealment | Misrepresentation |

|---|---|---|

| Definition | Intentional withholding of material facts from the insurer | False statement or representation of a material fact to the insurer |

| Intent | Deliberate nondisclosure | Deliberate or accidental false statement |

| Materiality | Material facts that influence insurer's decision | Material facts misrepresented to affect underwriting |

| Effect on Policy | Policy may be voided or rescinded | Policy may be voided or rescinded |

| Example | Failing to disclose a prior medical condition | Providing incorrect age or health information |

Introduction to Concealment and Misrepresentation in Insurance

Concealment in insurance occurs when a policyholder intentionally withholds critical information that could influence the insurer's decision to accept risk, while misrepresentation involves providing false or inaccurate statements to obtain favorable terms. Both concealment and misrepresentation undermine the principle of utmost good faith (uberrimae fidei), essential for accurate risk assessment and contract validity. Identifying these behaviors is crucial for insurers to prevent claim denials, policy rescissions, and legal disputes.

Defining Concealment in Insurance Contracts

Concealment in insurance contracts refers to the intentional withholding of material facts by the insured, which, if disclosed, would influence the insurer's decision to accept the risk or the terms of the policy. Unlike misrepresentation, which involves false statements, concealment is characterized by the failure to provide pertinent information that impacts the underwriting process. Courts often void policies or deny claims when concealment is proven, emphasizing the duty of utmost good faith in insurance agreements.

Understanding Misrepresentation in Insurance Policies

Misrepresentation in insurance policies occurs when an applicant provides false or incomplete information that influences the insurer's decision to accept the risk or set premiums. Unlike concealment, which involves withholding material facts, misrepresentation involves actively stating incorrect information, such as misstating income, health conditions, or property details. Insurance companies rely on accurate disclosures to assess risk accurately, and misrepresentation can lead to policy denial, cancellation, or claim denial.

Key Differences Between Concealment and Misrepresentation

Concealment involves intentionally withholding material facts that are crucial to the insurance contract, whereas misrepresentation entails providing false or inaccurate information, whether intentional or unintentional. The insurer's ability to void a policy often depends on proving the intent behind concealment or misrepresentation, impacting contract validity and claims. Understanding these distinctions is essential for assessing policy enforceability and insurer liabilities under law.

Legal Implications of Concealment in Insurance

Concealment in insurance involves intentionally withholding material facts that affect the underwriting decision, leading to potential policy voidance or denial of claims. Legal implications include rescission of the policy, refusal to pay claims, and possible allegations of insurance fraud. Courts often scrutinize the insured's duty of disclosure to determine whether concealment materially impacted the insurer's risk assessment.

Legal Consequences of Misrepresentation in Insurance

Legal consequences of misrepresentation in insurance can include policy voidance, denial of claims, and potential legal penalties such as fines or fraud charges. Insurers may rescind the contract if material facts are falsely stated or omitted, leading to loss of coverage and financial liability for the insured. Courts often enforce strict scrutiny on intentional misrepresentation, emphasizing the duty of utmost good faith in insurance contracts.

How Insurers Detect Concealment and Misrepresentation

Insurers detect concealment and misrepresentation through thorough underwriting processes, including detailed applicant questionnaires and verification of submitted information against external databases such as medical records and credit reports. Advanced data analytics and fraud detection software analyze inconsistencies and risk patterns in application data to identify potential fraudulent behavior. Regular audits and post-claim investigations further help insurers uncover hidden facts or false statements that impact policy validity.

Real-Life Examples of Concealment and Misrepresentation

Concealment occurs when an insured party intentionally withholds critical information, such as failing to disclose a pre-existing medical condition on a health insurance application, which can lead to claim denial or policy cancellation. Misrepresentation involves providing false or inaccurate information, like falsely stating the mileage on a vehicle for auto insurance, resulting in premium adjustments or claim refusals. Both concealment and misrepresentation can significantly impact insurance claims and coverage enforcement.

Preventing Concealment and Misrepresentation in Applications

Preventing concealment and misrepresentation in insurance applications involves thorough verification processes and clear communication of disclosure responsibilities to applicants. Insurers employ detailed questionnaires, cross-check applicant information with third-party databases, and emphasize the legal consequences of false statements to ensure accuracy and transparency. Training agents to recognize red flags and implementing automated fraud detection systems further reduce the risk of incomplete or misleading disclosures during underwriting.

Impact on Claims: Denials and Policy Voidance

Concealment in insurance refers to the intentional withholding of material information, often resulting in claim denials and policy voidance due to breaches of good faith. Misrepresentation involves providing false or inaccurate information, leading insurers to deny claims or rescind policies based on the materiality of the misstatement. Both actions significantly undermine the validity of insurance contracts, impacting claim outcomes and exposing policyholders to financial risk.

Important Terms

Material Fact

Material fact refers to any information significant enough to influence a party's decision-making in a contract, where concealment involves intentionally hiding such facts, and misrepresentation entails providing false or misleading statements about them. Both concealment and misrepresentation can render a contract voidable due to the distortion of critical facts affecting the validity of the agreement.

Utmost Good Faith

Utmost Good Faith demands full disclosure of all material facts in insurance contracts, where concealment involves intentionally withholding important information, while misrepresentation refers to providing false or inaccurate details. Insurers rely on this principle to assess risk accurately, and any breach can invalidate the policy or lead to claim denial.

Non-Disclosure

Non-Disclosure involves the deliberate withholding of critical information, distinguishing it from Misrepresentation where false information is actively conveyed to deceive. In legal contexts, Concealment under Non-Disclosure can lead to breaches of contract if hidden facts materially affect the agreement's terms or outcomes.

Fraudulent Intent

Fraudulent intent involves deliberate deception to secure unfair or unlawful gain, often manifested through concealment or misrepresentation. Concealment entails hiding material facts, while misrepresentation involves providing false information, both undermining trust and contractual obligations.

Warranty Breach

Warranty breach involves the failure to fulfill a promise about a product's condition or performance, often distinguished by concealment or misrepresentation. Concealment occurs when a seller intentionally hides a defect, while misrepresentation involves providing false information, both leading to legal liabilities under warranty claims.

Moral Hazard

Moral hazard arises when individuals or entities engage in risky behavior because they do not bear the full consequences, often linked to concealment, which involves hiding crucial information, and misrepresentation, where false or misleading statements are made intentionally to gain unfair advantage. Both concealment and misrepresentation distort risk assessment and undermine trust in insurance contracts and financial transactions, increasing the likelihood of losses.

Voidable Contract

A voidable contract occurs when one party is induced to enter the agreement based on concealment or misrepresentation, which undermines genuine consent. Concealment involves intentionally withholding material facts, whereas misrepresentation consists of false statements that lead to the contract being voidable at the injured party's option.

Rescission

Rescission is a legal remedy that voids a contract due to concealment or misrepresentation, where concealment involves intentionally withholding material facts, and misrepresentation consists of providing false information to induce agreement. Courts grant rescission to restore parties to their original positions when the misled party justifiably relied on inaccurate or hidden facts pivotal to their consent.

Incontestability Clause

An Incontestability Clause in insurance contracts limits the insurer's ability to void the policy after a specified period, typically two years, except in cases of fraud or intentional concealment, which differ from mere misrepresentation that may allow denial within the contestability period. Concealment involves intentionally withholding material information, directly impacting policy validity, whereas misrepresentation refers to false statements, which may be corrected or cause policy rescission only if material to risk assessment.

Representations

Representations involve statements or disclosures made to induce a contract, where concealment refers to intentionally withholding material facts, whereas misrepresentation entails providing false or misleading information. Legal distinctions between concealment and misrepresentation affect remedies, with misrepresentation often allowing contract rescission or damages, while concealment can lead to claims of fraud requiring proof of intent.

Concealment vs Misrepresentation Infographic

moneydif.com

moneydif.com