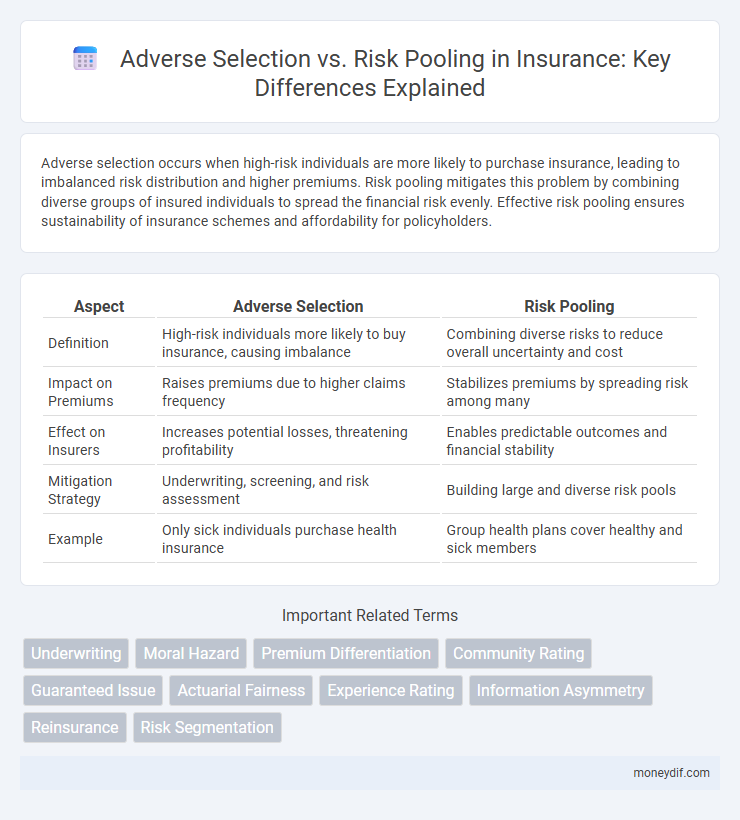

Adverse selection occurs when high-risk individuals are more likely to purchase insurance, leading to imbalanced risk distribution and higher premiums. Risk pooling mitigates this problem by combining diverse groups of insured individuals to spread the financial risk evenly. Effective risk pooling ensures sustainability of insurance schemes and affordability for policyholders.

Table of Comparison

| Aspect | Adverse Selection | Risk Pooling |

|---|---|---|

| Definition | High-risk individuals more likely to buy insurance, causing imbalance | Combining diverse risks to reduce overall uncertainty and cost |

| Impact on Premiums | Raises premiums due to higher claims frequency | Stabilizes premiums by spreading risk among many |

| Effect on Insurers | Increases potential losses, threatening profitability | Enables predictable outcomes and financial stability |

| Mitigation Strategy | Underwriting, screening, and risk assessment | Building large and diverse risk pools |

| Example | Only sick individuals purchase health insurance | Group health plans cover healthy and sick members |

Understanding Adverse Selection in Insurance

Adverse selection in insurance occurs when individuals with higher risk are more likely to purchase coverage, leading to a disproportionate number of high-risk policyholders in the insurance pool. This imbalance results in increased claims, higher premiums, and potential market inefficiencies, challenging insurers to accurately price policies. Effective risk pooling aims to mitigate adverse selection by diversifying risk across a broad group, ensuring premium stability and sustainable coverage availability.

The Concept of Risk Pooling Explained

Risk pooling in insurance involves combining risks from multiple policyholders to reduce the financial impact of individual losses. By distributing the cost of claims across a broad group, insurance companies can stabilize premiums and provide coverage more affordably. This concept counters adverse selection by encouraging a diverse mix of low- and high-risk individuals, balancing risk and maintaining the sustainability of insurance pools.

Key Differences Between Adverse Selection and Risk Pooling

Adverse selection occurs when individuals with higher risk are more likely to purchase insurance, leading to an imbalance that increases premiums for all policyholders. Risk pooling, on the other hand, involves combining a large group of insured individuals to spread risk evenly, reducing the impact of high-cost claims on the overall group. The key difference lies in adverse selection causing market inefficiencies due to information asymmetry, while risk pooling enhances stability and affordability by mitigating individual risk variability.

How Adverse Selection Impacts Insurance Premiums

Adverse selection occurs when high-risk individuals are more likely to purchase insurance, causing insurers to face higher average claim costs. This imbalance leads insurance companies to increase premiums to cover the elevated payout risks associated with these riskier policyholders. Consequently, higher premiums may drive low-risk individuals away, further exacerbating adverse selection and destabilizing the risk pool.

The Role of Risk Pooling in Stabilizing Insurance Markets

Risk pooling plays a crucial role in stabilizing insurance markets by aggregating diverse risks from multiple policyholders, which minimizes the impact of high-cost claims on the overall pool. This mechanism mitigates adverse selection by balancing the distribution of low-risk and high-risk individuals, ensuring premiums remain affordable and sustainable. Effective risk pooling enhances market stability, promotes equitable premium pricing, and reduces the likelihood of insurer insolvency.

Strategies Insurers Use to Mitigate Adverse Selection

Insurers implement underwriting techniques and use detailed applicant data to accurately assess risk and prevent adverse selection by identifying high-risk individuals early. Offering differentiated premium rates and policy options encourages a balanced mix of low- and high-risk policyholders, enhancing risk pooling effectiveness. Mandatory coverage requirements and waiting periods are also employed to reduce the likelihood of adverse selection by discouraging individuals from enrolling only when they anticipate high claims.

Benefits of Effective Risk Pooling for Policyholders

Effective risk pooling in insurance spreads the financial risk across a large group of policyholders, reducing the impact of high-cost claims on individual members. This collective approach minimizes adverse selection by balancing the risk profile and ensuring more predictable premium costs. As a result, policyholders benefit from greater affordability, improved access to coverage, and increased financial security.

Real-World Examples: Adverse Selection vs Risk Pooling

Adverse selection occurs when high-risk individuals disproportionately purchase insurance, as seen in health insurance markets before mandatory coverage laws, leading to increased premiums and market instability. Risk pooling mitigates this by combining diverse risk profiles, exemplified by employer-sponsored group health plans that spread costs across healthy and sick employees, stabilizing premiums. The Affordable Care Act's establishment of health insurance exchanges enhanced risk pooling and reduced adverse selection by requiring coverage, fostering balanced risk distribution.

Regulatory Approaches to Address Adverse Selection

Regulatory approaches to address adverse selection in insurance often mandate community rating and guaranteed issue policies to ensure that high-risk individuals cannot be excluded or charged excessively. States implement risk adjustment mechanisms that redistribute funds among insurers to balance costs associated with enrolling high-risk policyholders. These measures promote equitable risk pooling, stabilizing premiums and preventing market segmentation.

Future Trends in Managing Risk in Insurance Markets

Future trends in managing risk in insurance markets emphasize advanced data analytics and artificial intelligence to mitigate adverse selection by enhancing risk assessment precision. Increasing reliance on dynamic risk pooling through real-time data integration enables insurers to diversify risk more effectively and offer personalized premiums. Blockchain technology also promises greater transparency and trust, reducing information asymmetry and improving market efficiency.

Important Terms

Underwriting

Underwriting mitigates adverse selection by carefully evaluating individual risk profiles to prevent high-risk applicants from disproportionately entering the risk pool, thereby maintaining balance and fairness in premium pricing. Effective risk pooling spreads individual risks across a larger group, reducing the financial impact of high-risk participants and stabilizing overall insurance costs.

Moral Hazard

Moral hazard arises when individuals engage in riskier behavior after obtaining insurance, influencing adverse selection by exacerbating information asymmetry between insurers and insured parties. Effective risk pooling mitigates these impacts by spreading risk across diverse groups, reducing the likelihood that only high-risk individuals dominate the insured pool.

Premium Differentiation

Premium differentiation helps mitigate adverse selection by adjusting insurance rates based on individual risk profiles, ensuring high-risk individuals pay higher premiums. This approach contrasts with risk pooling, which averages costs across a diverse group to spread risk and maintain affordability.

Community Rating

Community rating mitigates adverse selection by requiring insurers to charge uniform premiums regardless of individual health risks, fostering balanced risk pooling across diverse populations. This approach prevents high-risk individuals from facing prohibitively expensive rates while stabilizing premiums through shared risk distribution.

Guaranteed Issue

Guaranteed Issue insurance policies eliminate underwriting barriers, allowing all applicants to obtain coverage regardless of health status, which increases the likelihood of adverse selection as higher-risk individuals are more inclined to enroll. Effective risk pooling requires a balanced mix of low-risk and high-risk participants to stabilize premiums and spread costs equitably across the insured population.

Actuarial Fairness

Actuarial fairness ensures insurance premiums accurately reflect individual risk levels, mitigating adverse selection by preventing high-risk individuals from disproportionately influencing costs. Effective risk pooling balances diverse risk profiles, enhancing fairness by spreading costs evenly across insured populations while maintaining incentives for accurate risk assessment.

Experience Rating

Experience rating adjusts insurance premiums based on an individual's or group's historical claims, which mitigates adverse selection by aligning costs with actual risk levels. This approach contrasts with risk pooling, where premiums are averaged across a broad population to spread risk and reduce the financial impact of high-cost claims.

Information Asymmetry

Information asymmetry occurs when one party has more or better information than the other, leading to adverse selection where high-risk individuals are more likely to participate, skewing the risk pool. Effective risk pooling mitigates adverse selection by aggregating diverse risk profiles to balance costs and protect against information gaps.

Reinsurance

Reinsurance mitigates adverse selection by spreading risk across multiple insurers, enhancing portfolio diversification and stabilizing loss experience. Effective risk pooling in reinsurance reduces individual insurer exposure to high-risk policyholders, promoting financial resilience and premium adequacy.

Risk Segmentation

Risk segmentation distinguishes individuals based on their risk levels to develop targeted insurance strategies, contrasting with risk pooling, which combines diverse risk profiles to stabilize premiums and reduce adverse selection. Adverse selection occurs when higher-risk individuals disproportionately join insurance pools, undermining risk pooling effectiveness by raising overall claims and premiums.

Adverse Selection vs Risk Pooling Infographic

moneydif.com

moneydif.com