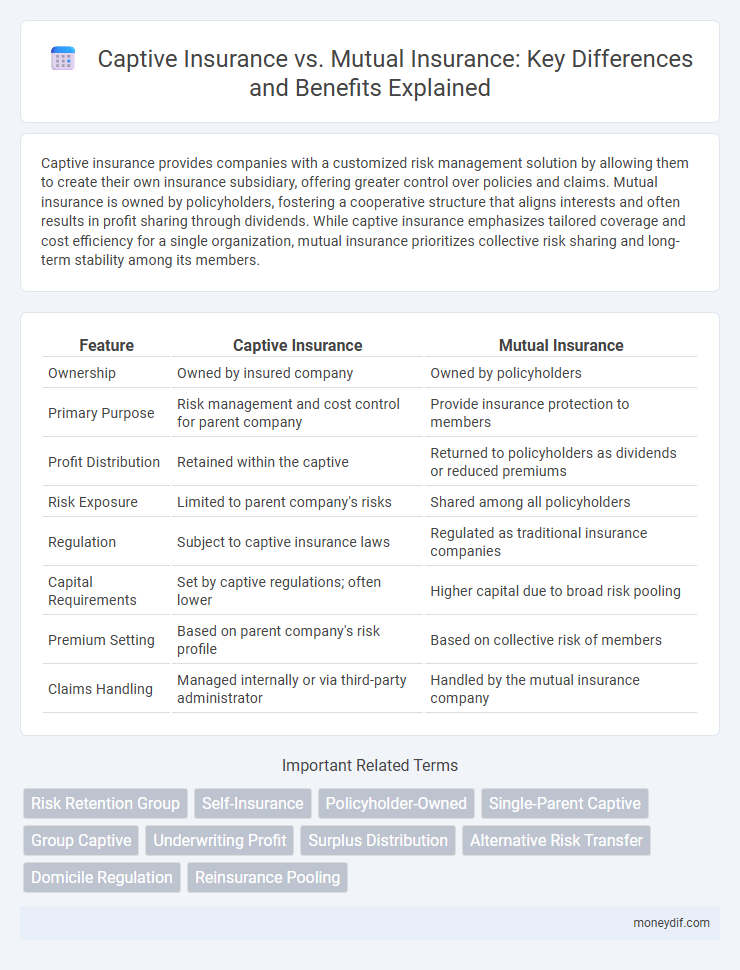

Captive insurance provides companies with a customized risk management solution by allowing them to create their own insurance subsidiary, offering greater control over policies and claims. Mutual insurance is owned by policyholders, fostering a cooperative structure that aligns interests and often results in profit sharing through dividends. While captive insurance emphasizes tailored coverage and cost efficiency for a single organization, mutual insurance prioritizes collective risk sharing and long-term stability among its members.

Table of Comparison

| Feature | Captive Insurance | Mutual Insurance |

|---|---|---|

| Ownership | Owned by insured company | Owned by policyholders |

| Primary Purpose | Risk management and cost control for parent company | Provide insurance protection to members |

| Profit Distribution | Retained within the captive | Returned to policyholders as dividends or reduced premiums |

| Risk Exposure | Limited to parent company's risks | Shared among all policyholders |

| Regulation | Subject to captive insurance laws | Regulated as traditional insurance companies |

| Capital Requirements | Set by captive regulations; often lower | Higher capital due to broad risk pooling |

| Premium Setting | Based on parent company's risk profile | Based on collective risk of members |

| Claims Handling | Managed internally or via third-party administrator | Handled by the mutual insurance company |

Understanding Captive Insurance

Captive insurance involves a company creating its own licensed insurance subsidiary to cover its specific risks, offering enhanced control over policies and potentially reducing costs compared to traditional insurance. Unlike mutual insurance, where policyholders collectively own the insurer and share profits, captive insurance allows the parent company to retain underwriting profits and tailor coverage to unique operational needs. This model provides strategic risk management benefits, particularly for businesses with specialized or high-risk exposures.

What Is Mutual Insurance?

Mutual insurance is a type of insurance company owned entirely by its policyholders, who share in the profits and losses. This structure aligns the interests of the insurer and insured, as policyholders have voting rights and receive dividends based on the company's performance. Mutual insurance companies typically focus on long-term stability and customer-centric service, distinguishing them from shareholder-owned insurers.

Key Differences Between Captive and Mutual Insurance

Captive insurance is a risk management solution where a company creates its own insurance subsidiary to cover specific risks, offering greater control and cost savings, whereas mutual insurance operates as a cooperative policyholder-owned company sharing risk among its members. Captive insurance typically provides tailored coverage and tax advantages, while mutual insurance emphasizes collective risk pooling and policyholder dividends. Key distinctions include ownership structure, risk retention, and regulatory requirements, with captives enjoying more flexibility but mutuals benefiting from broader risk diversification.

Advantages of Captive Insurance

Captive insurance offers significant advantages including customized coverage tailored to a parent company's specific risk profile, which enhances risk management and control over claims. It often results in cost savings through reduced premiums and retained underwriting profits, while providing access to reinsurance markets and improved cash flow management. Captive insurance also facilitates greater flexibility in policy design and regulatory compliance compared to mutual insurance structures.

Benefits of Mutual Insurance

Mutual insurance companies provide policyholders with ownership rights, enabling them to benefit directly from the company's profits through dividends or reduced premiums. They often prioritize policyholder interests, resulting in more personalized service and aligned incentives compared to captive insurance firms, which primarily serve a single parent entity. The mutual structure fosters long-term stability and financial strength by pooling risks among a broader membership base.

Structure and Ownership Models

Captive insurance companies are privately owned by the insured entities, allowing policyholders to tailor coverage specifically to their risk profiles while retaining underwriting profits. Mutual insurance companies operate under a policyholder-owned structure, where the insured parties hold ownership rights and share in the company's profits through dividends or reduced premiums. The distinct ownership models influence governance, risk management strategies, and financial accountability in both captive and mutual insurance frameworks.

Cost Considerations: Captive vs Mutual

Captive insurance often offers lower overall costs by allowing policyholders to retain underwriting profits and reduce external insurer overhead, while mutual insurance involves shared risk and potential dividends but typically includes higher premiums due to administrative expenses. Captive arrangements provide tailored risk management and potential tax benefits that can significantly reduce total cost of risk compared to mutual insurers where costs are spread across all members. Evaluating the upfront capital requirements and ongoing administrative costs is essential when comparing captive insurance to mutual insurance from a cost-efficiency perspective.

Risk Management in Captive and Mutual Insurance

Captive insurance enables companies to manage risk through tailored underwriting and direct control of claims, often resulting in cost savings and enhanced risk mitigation. Mutual insurance pools risk among policyholders, fostering shared responsibility and collaborative risk management strategies. Both models provide distinct mechanisms for risk retention and loss prevention, with captives offering customization and mutuals emphasizing collective risk sharing.

Regulatory and Compliance Factors

Captive insurance companies operate under regulatory frameworks that often offer more flexibility and tailored compliance requirements compared to mutual insurance companies, which are subject to stricter oversight due to their broad policyholder base. Mutual insurers must comply with extensive regulatory standards that emphasize policyholder protections and solvency requirements, reflecting their collective ownership structure. Regulatory authorities frequently scrutinize mutual insurers to ensure transparency, reserve adequacy, and fair treatment of members, whereas captives benefit from jurisdictions with favorable regulatory environments optimized for risk management and cost control.

Choosing the Right Insurance Solution

Captive insurance offers businesses customized risk management with potential cost savings by retaining premiums, while mutual insurance provides policyholders collective ownership and profit-sharing benefits. Evaluating company size, risk tolerance, and capital availability is essential when choosing between a captive and a mutual insurance model. Selecting the optimal insurance structure aligns risk financing strategies with long-term financial goals and operational needs.

Important Terms

Risk Retention Group

A Risk Retention Group (RRG) offers liability coverage primarily for its members, functioning similarly to captive insurance by providing tailored risk management, whereas mutual insurance involves a broader policyholder-owned structure covering diverse risks beyond just liability.

Self-Insurance

Self-insurance involves a company retaining risk internally, whereas captive insurance creates a subsidiary to insure risks, and mutual insurance pools risk among members collectively.

Policyholder-Owned

Policyholder-owned captive insurance companies provide tailored risk management solutions with direct policyholder control, contrasting with mutual insurance companies where policyholders collectively own and govern the insurer.

Single-Parent Captive

A Single-Parent Captive is a captive insurance company wholly owned by one parent company, differing from mutual insurance where policyholders collectively own the insurer.

Group Captive

Group Captive insurance combines risk-sharing among multiple companies with the regulatory advantages of Captive Insurance, offering tailored coverage unlike Mutual Insurance which operates as a collective risk pool owned by policyholders.

Underwriting Profit

Captive insurance companies often achieve higher underwriting profit by directly controlling risk exposure and reducing third-party costs compared to mutual insurance companies, which typically share profits among policyholders and operate with collective risk pools.

Surplus Distribution

Surplus distribution in captive insurance allows policyholders to receive excess funds based on underwriting profits, whereas mutual insurance typically redistributes surplus as dividends or reduced premiums to policyholders due to their ownership stake.

Alternative Risk Transfer

Alternative Risk Transfer (ART) involves innovative risk financing strategies that extend beyond traditional insurance models such as Captive Insurance and Mutual Insurance. Captive Insurance enables companies to create their own licensed insurance subsidiaries for tailored risk management, whereas Mutual Insurance operates on a cooperative basis where policyholders collectively assume risk, highlighting distinct mechanisms and financial structures within the ART spectrum.

Domicile Regulation

Domicile regulations for captive insurance often provide tailored favorable tax and regulatory environments compared to mutual insurance, which typically operates under broader, more standardized state insurance laws.

Reinsurance Pooling

Reinsurance pooling optimizes risk-sharing by aggregating liabilities among multiple insurers, enhancing capital efficiency for both captive insurance and mutual insurance structures. Captive insurance benefits from reinsurance pools by reducing individual exposure, while mutual insurance leverages pooling to strengthen collective financial stability and claims-paying capacity.

Captive Insurance vs Mutual Insurance Infographic

moneydif.com

moneydif.com