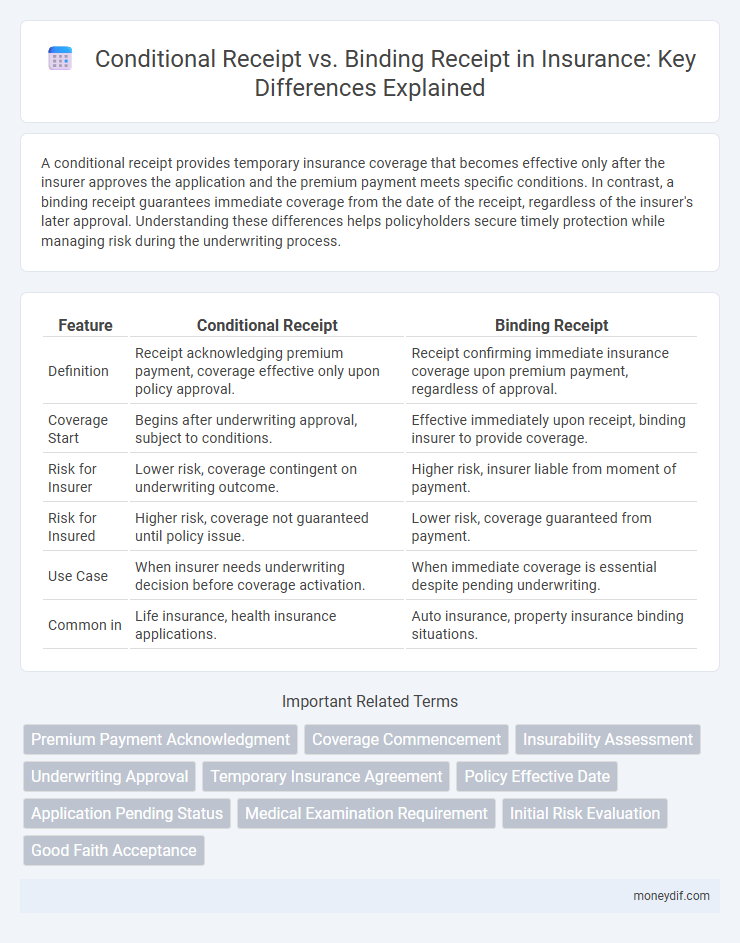

A conditional receipt provides temporary insurance coverage that becomes effective only after the insurer approves the application and the premium payment meets specific conditions. In contrast, a binding receipt guarantees immediate coverage from the date of the receipt, regardless of the insurer's later approval. Understanding these differences helps policyholders secure timely protection while managing risk during the underwriting process.

Table of Comparison

| Feature | Conditional Receipt | Binding Receipt |

|---|---|---|

| Definition | Receipt acknowledging premium payment, coverage effective only upon policy approval. | Receipt confirming immediate insurance coverage upon premium payment, regardless of approval. |

| Coverage Start | Begins after underwriting approval, subject to conditions. | Effective immediately upon receipt, binding insurer to provide coverage. |

| Risk for Insurer | Lower risk, coverage contingent on underwriting outcome. | Higher risk, insurer liable from moment of payment. |

| Risk for Insured | Higher risk, coverage not guaranteed until policy issue. | Lower risk, coverage guaranteed from payment. |

| Use Case | When insurer needs underwriting decision before coverage activation. | When immediate coverage is essential despite pending underwriting. |

| Common in | Life insurance, health insurance applications. | Auto insurance, property insurance binding situations. |

Definition of Conditional Receipt

A conditional receipt is a type of insurance receipt given to the applicant once the initial premium is paid, indicating coverage becomes effective only if specific conditions, such as insurability underwriting approval, are met. This receipt protects the applicant by providing temporary coverage while the insurer evaluates the application. Unlike a binding receipt, a conditional receipt does not guarantee immediate coverage regardless of underwriting results.

Definition of Binding Receipt

A binding receipt in insurance guarantees temporary coverage from the moment the premium is paid until the policy is formally issued, ensuring the applicant is protected against covered risks during this interim period. Unlike a conditional receipt, which only provides coverage upon meeting specific conditions such as passing a medical exam, a binding receipt instantaneously activates insurance protection. This type of receipt is crucial in high-risk scenarios where immediate coverage is essential for the insured's peace of mind.

Key Differences Between Conditional and Binding Receipts

Conditional receipts activate coverage only after the applicant fulfills specific conditions, such as passing a medical exam or providing accurate information, ensuring protection begins if those terms are met. Binding receipts guarantee immediate temporary coverage from the moment of application, regardless of further underwriting approval, offering applicants instant but short-term insurance protection. The key difference lies in timing and certainty: conditional receipts depend on meeting predefined criteria, while binding receipts provide immediate coverage pending formal policy issuance.

How Conditional Receipts Work in Insurance

Conditional receipts in insurance provide temporary coverage starting from the date of application, contingent upon specific conditions such as the applicant passing the required medical exam or the insurer approving the risk. This type of receipt ensures that if the policy is subsequently issued as applied for, the coverage is effective from the date of the conditional receipt rather than the policy issue date. Coverage may be voided if the conditions are not met, highlighting the importance of fulfilling underwriting requirements promptly.

How Binding Receipts Operate in Insurance

Binding receipts in insurance provide immediate temporary coverage from the moment the applicant submits the payment and application, ensuring protection until the official policy is issued or declined. These receipts guarantee that the insurer is bound to cover losses occurring during the binding period, subject to the terms and conditions specified. This mechanism is crucial for high-risk applications where waiting for policy approval could leave the insured exposed to potential claims.

Advantages of Conditional Receipts

Conditional receipts provide immediate coverage upon payment of the initial premium, offering policyholders protection before the formal underwriting process is complete. They allow insurers to evaluate risk without committing to full coverage, reducing exposure to high-risk applicants. This flexibility enhances customer trust by bridging the gap between application submission and policy approval.

Advantages of Binding Receipts

Binding receipts provide immediate temporary insurance coverage, protecting the insured from potential losses during the underwriting process, unlike conditional receipts which depend on subsequent approval. They enhance customer trust by guaranteeing coverage from the moment of application submission, reducing gaps in protection. Binding receipts also streamline the claims process by establishing clear coverage terms upfront, minimizing disputes and delays.

Risks Associated with Each Receipt Type

Conditional receipts carry the risk that coverage only begins once the applicant meets specific conditions, such as passing a medical exam, potentially leaving gaps in protection if the conditions are unmet. Binding receipts provide immediate temporary coverage from the date of application, but this coverage may lapse if the insurer later denies the policy, exposing applicants to financial uncertainty. Understanding these distinctions is crucial for assessing the timing and certainty of risk protection in insurance contracts.

Real-World Examples: Conditional vs Binding Receipt

In insurance, a conditional receipt typically activates coverage once specific conditions, such as passing a medical exam, are met, illustrated when a life insurance applicant's policy begins only after underwriting approval. A binding receipt, by contrast, provides immediate temporary coverage from the moment an application is submitted and the initial premium is paid, as seen when auto insurance binds coverage on the spot during a car purchase. Real-world cases highlight that conditional receipts often limit early risk exposure, whereas binding receipts offer instant protection but may carry higher risk for the insurer.

Which Receipt Is Best for Policyholders?

Conditional receipts offer policyholders coverage beginning only after meeting specific conditions, such as passing a medical exam, which can delay protection but ensures risk assessment accuracy. Binding receipts guarantee immediate temporary coverage upon payment, providing instant security but potentially leading to higher premiums if unforeseen risks emerge. Choosing the best receipt hinges on a policyholder's need for immediate protection versus thorough risk evaluation before coverage starts.

Important Terms

Premium Payment Acknowledgment

Premium Payment Acknowledgment serves as proof of initial payment in insurance transactions, differentiating Conditional Receipt, which provides temporary coverage pending underwriting approval, from a Binding Receipt that guarantees coverage from the payment date regardless of underwriting outcome. Insurers issue Conditional Receipts to limit liability until policy issuance, while Binding Receipts create immediate contractual obligations based on the premium receipt.

Coverage Commencement

Coverage commencement differs between conditional receipt and binding receipt; conditional receipts provide temporary insurance coverage starting only after specified conditions such as payment verification or medical exam completion are met. Binding receipts guarantee immediate interim protection from the application date, regardless of underwriting approval, ensuring no coverage gap during policy issuance.

Insurability Assessment

Insurability assessment determines risk eligibility before policy issuance, with a Conditional Receipt providing temporary coverage only if the applicant qualifies medically, whereas a Binding Receipt guarantees immediate coverage regardless of underwriting results. Understanding the differences between these receipts is crucial for both insurers and applicants to manage risk exposure and coverage timing effectively.

Underwriting Approval

Underwriting approval determines the risk acceptance criteria before policy issuance, where a conditional receipt provides temporary coverage contingent on meeting underwriting requirements, while a binding receipt guarantees immediate coverage regardless of final underwriting decisions. Understanding the distinction between conditional and binding receipts is crucial for managing liability exposure and ensuring proper risk assessment in insurance contracts.

Temporary Insurance Agreement

A Temporary Insurance Agreement provides immediate, short-term coverage while the insurer reviews the application, often through a Conditional Receipt that requires specific conditions to be met for coverage to be effective. Unlike a Binding Receipt, which guarantees coverage from the moment of payment regardless of underwriting results, a Conditional Receipt only activates coverage if the application meets underwriting criteria and payment is received.

Policy Effective Date

The Policy Effective Date for a Conditional Receipt typically begins on the date of application submission, contingent on the applicant meeting specific conditions such as medical exams or premium payment. In contrast, a Binding Receipt guarantees immediate coverage with the Policy Effective Date set as the date of application or payment, regardless of underwriting outcomes.

Application Pending Status

Application Pending Status occurs when an insurance application is under review and coverage is not yet effective; a Conditional Receipt provides temporary coverage contingent on certain conditions being met, while a Binding Receipt guarantees immediate coverage from the date of application regardless of further underwriting outcomes. Understanding the distinctions between these receipts is crucial for applicants to know when their risk is covered during the underwriting process.

Medical Examination Requirement

The Medical Examination Requirement typically impacts the issuance of Conditional Receipts, which provide temporary coverage pending the completion of a medical exam, whereas Binding Receipts offer immediate full coverage regardless of medical examination results. Insurers issue Conditional Receipts contingent on satisfactory medical exam outcomes, but Binding Receipts guarantee coverage from the application date, even if the exam subsequently reveals health issues.

Initial Risk Evaluation

Initial Risk Evaluation involves assessing potential liabilities when issuing insurance receipts, where a Conditional Receipt activates coverage only upon policy approval and premium payment, whereas a Binding Receipt guarantees immediate temporary coverage regardless of later underwriting decisions. Proper differentiation ensures accurate risk management by clarifying the insurer's obligations during the policy approval process.

Good Faith Acceptance

Good Faith Acceptance ensures that the insurer acknowledges the application or initial payment without binding coverage, typically associated with a Conditional Receipt that activates coverage only upon meeting specific underwriting criteria. Binding Receipts guarantee immediate coverage from the date of issuance regardless of underwriting outcomes, reflecting a higher insurer commitment but lesser flexibility compared to Conditional Receipts.

Conditional Receipt vs Binding Receipt Infographic

moneydif.com

moneydif.com