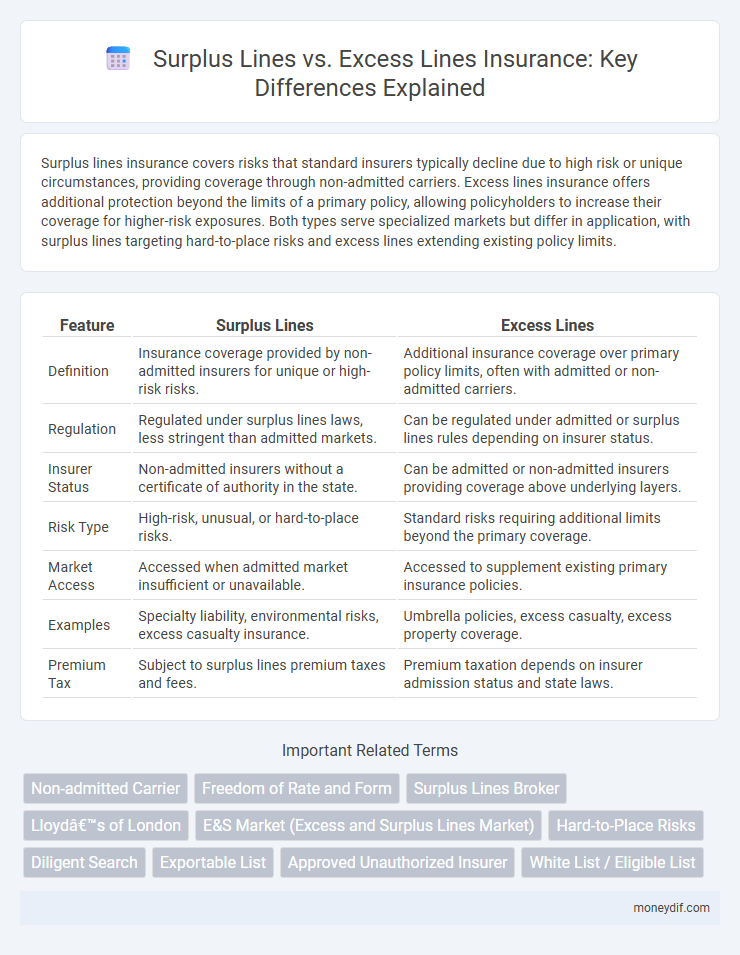

Surplus lines insurance covers risks that standard insurers typically decline due to high risk or unique circumstances, providing coverage through non-admitted carriers. Excess lines insurance offers additional protection beyond the limits of a primary policy, allowing policyholders to increase their coverage for higher-risk exposures. Both types serve specialized markets but differ in application, with surplus lines targeting hard-to-place risks and excess lines extending existing policy limits.

Table of Comparison

| Feature | Surplus Lines | Excess Lines |

|---|---|---|

| Definition | Insurance coverage provided by non-admitted insurers for unique or high-risk risks. | Additional insurance coverage over primary policy limits, often with admitted or non-admitted carriers. |

| Regulation | Regulated under surplus lines laws, less stringent than admitted markets. | Can be regulated under admitted or surplus lines rules depending on insurer status. |

| Insurer Status | Non-admitted insurers without a certificate of authority in the state. | Can be admitted or non-admitted insurers providing coverage above underlying layers. |

| Risk Type | High-risk, unusual, or hard-to-place risks. | Standard risks requiring additional limits beyond the primary coverage. |

| Market Access | Accessed when admitted market insufficient or unavailable. | Accessed to supplement existing primary insurance policies. |

| Examples | Specialty liability, environmental risks, excess casualty insurance. | Umbrella policies, excess casualty, excess property coverage. |

| Premium Tax | Subject to surplus lines premium taxes and fees. | Premium taxation depends on insurer admission status and state laws. |

Understanding Surplus Lines Insurance

Surplus lines insurance provides coverage for risks that standard insurance markets deem too high or unusual, often offered by non-admitted carriers not licensed in the insured's state but permitted to operate under specific regulations. This type of insurance is essential for businesses facing unique or hard-to-place risks, such as specialized construction projects or innovative technology ventures, where traditional insurers may decline coverage. Understanding surplus lines insurance involves recognizing its role in filling gaps left by the admitted market, compliance requirements for brokers, and the importance of ensuring proper risk placement to protect policyholders.

What Are Excess Lines Insurance Policies?

Excess lines insurance policies provide coverage for risks that standard insurers are unwilling or unable to underwrite, typically involving higher risk or unique situations. These policies are issued by non-admitted insurers not licensed in the policyholder's state but legally allowed to offer coverage through surplus lines brokers. Excess lines insurance fills critical gaps in the market by covering specialized risks, such as high-value properties, unusual liability exposures, or emerging industries, ensuring protection when traditional insurance markets decline.

Key Differences Between Surplus Lines and Excess Lines

Surplus lines insurance covers unique, high-risk, or hard-to-place risks that standard carriers refuse, operating outside state-mandated insurance markets with non-admitted insurers. Excess lines insurance provides additional coverage limits beyond the underlying policy, typically issued by surplus lines carriers to extend protection without altering the original policy terms. The key difference lies in surplus lines addressing insurability challenges, while excess lines focus on increasing coverage limits above primary policies.

Regulatory Framework: Surplus vs. Excess Lines

Surplus lines insurance operates under a distinct regulatory framework allowing coverage for risks not typically accepted by standard insurers, with surplus lines brokers required to comply with specific state filing and tax obligations. Excess lines insurance, often treated interchangeably but technically a subset of surplus lines, pertains to coverage that exceeds the limits of standard policies, subject to strict regulatory approval and reporting in most jurisdictions. Understanding the nuances in state regulations, such as eligibility criteria and market conduct rules, is crucial for proper classification and compliance in surplus versus excess lines transactions.

Eligibility Criteria for Surplus Lines and Excess Lines

Surplus lines insurance accommodates risks that standard carriers typically reject, requiring the insured to demonstrate that coverage is unavailable from licensed insurers in the admitted market. Eligibility criteria for surplus lines include insuring nonstandard or high-risk exposures, often necessitating a diligent search for coverage within the admitted market before surplus lines acceptance. Excess lines insurance provides additional coverage limits above an underlying policy, with eligibility dependent on the existence of a primary policy and a gap in coverage that surpasses standard policy limits.

Advantages of Surplus Lines Coverage

Surplus lines coverage offers access to specialized insurance products not available in the standard market, providing tailored protection for high-risk or unique exposures. It allows insurers flexibility in underwriting, enabling coverage for risks that admitted insurers may decline, often resulting in more comprehensive risk management. Policyholders benefit from competitive pricing and coverage options that address niche or complex risks effectively.

Risks and Limitations of Excess Lines Insurance

Excess lines insurance covers high-risk or unusual exposures that standard markets decline, but it carries limitations such as lack of state-guaranteed funds backing claims and restricted regulatory oversight. Risks include potential difficulty in claims recovery if the insurer becomes insolvent, and possibly higher premiums due to the unregulated nature of the market. Policyholders must carefully evaluate the insurer's financial stability and understand that excess lines policies are often non-admitted, which can affect consumer protections.

How Placement Processes Differ: Surplus Versus Excess

Surplus lines insurance involves coverage placed with non-admitted carriers that operate outside standard market regulations, requiring brokers to follow a stringent due diligence process and often obtain a surplus lines license. Excess lines insurance, a subset of surplus lines, covers risks exceeding the limits of primary policies or standard coverage, necessitating precise placement to ensure compliance with state-specific excess lines laws. Both processes demand thorough documentation and adherence to regulatory filings, but surplus lines emphasize market access where standard insurance is unavailable, while excess lines focus on layered risk extensions beyond primary limits.

Common Myths About Surplus and Excess Lines

Common myths about surplus lines insurance include the misconception that it only applies to high-risk or illegal coverage, while it actually covers unique or hard-to-place risks not serviced by standard insurers. Excess lines are often confused with surplus lines, but excess lines refer specifically to coverage that starts after a policy limit of a primary insurance is exhausted. Understanding that surplus lines brokers are licensed and regulated ensures compliance with state insurance laws, dispelling the notion that surplus lines operate outside the law.

Choosing Between Surplus Lines and Excess Lines

Choosing between surplus lines and excess lines insurance depends on the nature of the risk and market availability; surplus lines insurers provide coverage for high-risk or unusual exposures not catered to by standard carriers. Excess lines brokers must navigate regulatory requirements and ensure the insured qualifies for coverage outside the admitted market. Evaluating the insurer's financial stability, policy terms, and the risk profile is crucial for selecting the appropriate excess or surplus lines product.

Important Terms

Non-admitted Carrier

Non-admitted carriers provide surplus lines insurance when risks are uninsurable in the admitted market, whereas excess lines specifically cover additional limits beyond standard policy coverage.

Freedom of Rate and Form

Freedom of Rate and Form allows surplus lines insurers to set customized rates and policy forms without state-imposed restrictions, differentiating them from excess lines carriers that must adhere more closely to filed rates and standardized forms. This flexibility in surplus lines supports tailored coverage solutions for high-risk or unique exposures not adequately addressed by excess lines insurance.

Surplus Lines Broker

A Surplus Lines Broker specializes in placing insurance with non-admitted carriers, distinguishing Surplus Lines from Excess Lines by offering coverage for unique or high-risk exposures not typically covered by standard or excess insurance policies.

Lloyd’s of London

Lloyd's of London specializes in underwriting Surplus Lines insurance, which covers high-risk or unique exposures that standard Excess Lines policies often cannot accommodate.

E&S Market (Excess and Surplus Lines Market)

The E&S Market (Excess and Surplus Lines Market) specializes in providing insurance coverage for high-risk or non-standard exposures that standard insurers typically reject or exclude. Surplus Lines refer to insurers authorized to write risks outside the admitted market under regulatory guidelines, whereas Excess Lines specifically cover amounts exceeding the limits of standard insurance policies.

Hard-to-Place Risks

Hard-to-place risks often require coverage through surplus lines insurers, which operate outside standard markets unlike excess lines that provide coverage above preset limits within admitted insurers.

Diligent Search

Diligent search in the context of surplus lines insurance involves thoroughly verifying that coverage cannot be obtained from licensed admitted carriers before placing risk with non-admitted insurers. This process ensures compliance with regulatory requirements distinguishing surplus lines--non-admitted insurers authorized to cover high-risk or unique exposures--from excess lines, which provide additional coverage beyond primary policy limits.

Exportable List

The Exportable List identifies surplus lines insurers eligible to underwrite risks not covered by standard insurers, differentiating surplus lines from excess lines based on regulatory approval and exportability criteria.

Approved Unauthorized Insurer

Approved unauthorized insurers provide surplus lines coverage by offering insurance options outside standard markets without complying with state licensing, while excess lines insurers sell coverage only after traditional insurers decline the risk.

White List / Eligible List

The White List or Eligible List defines authorized insurers for Surplus Lines coverage, distinguishing them from Excess Lines insurers who operate outside standard market eligibility criteria.

Surplus Lines vs Excess Lines Infographic

moneydif.com

moneydif.com