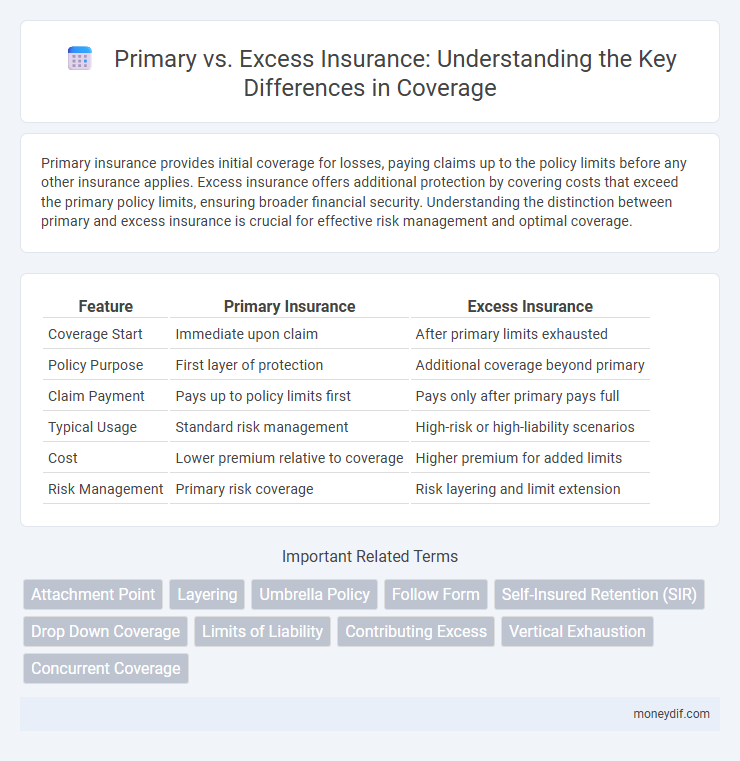

Primary insurance provides initial coverage for losses, paying claims up to the policy limits before any other insurance applies. Excess insurance offers additional protection by covering costs that exceed the primary policy limits, ensuring broader financial security. Understanding the distinction between primary and excess insurance is crucial for effective risk management and optimal coverage.

Table of Comparison

| Feature | Primary Insurance | Excess Insurance |

|---|---|---|

| Coverage Start | Immediate upon claim | After primary limits exhausted |

| Policy Purpose | First layer of protection | Additional coverage beyond primary |

| Claim Payment | Pays up to policy limits first | Pays only after primary pays full |

| Typical Usage | Standard risk management | High-risk or high-liability scenarios |

| Cost | Lower premium relative to coverage | Higher premium for added limits |

| Risk Management | Primary risk coverage | Risk layering and limit extension |

Understanding Primary Insurance Coverage

Primary insurance coverage serves as the first line of defense by paying claims up to the policy limits before any other insurance applies, ensuring immediate financial protection. This type of insurance typically covers damages or losses directly related to the insured's risks, setting the foundation for additional layers like excess insurance. Knowing the scope and limits of primary insurance is essential to avoid coverage gaps and coordinate benefits effectively in complex claims scenarios.

The Essentials of Excess Insurance

Excess insurance provides coverage beyond the limits of a primary insurance policy, protecting policyholders from catastrophic financial losses. It activates only after the primary insurance limits are exhausted, offering an additional layer of risk management. Understanding the coordination between primary and excess insurance policies is essential for maximizing protection and avoiding coverage gaps.

Key Differences Between Primary and Excess Insurance

Primary insurance provides initial coverage and pays claims first up to its policy limits, whereas excess insurance only activates after the primary policy limits are exhausted. Excess insurance extends protection by covering amounts beyond the primary policy, often without providing broader coverage terms. Key differences include the order of payment responsibility, coverage scope, and premium structure, with primary policies typically more comprehensive and excess policies designed solely for additional financial protection.

How Primary and Excess Insurance Work Together

Primary insurance provides the initial layer of financial protection by covering claims up to its policy limits, while excess insurance activates only after the primary policy is exhausted. This tandem ensures that policyholders benefit from extended coverage, safeguarding against high-cost claims that exceed primary limits. Coordinating both policies optimizes risk management by minimizing gaps and overlapping liabilities in insurance claims.

Cost Implications: Primary vs Excess Insurance

Primary insurance typically involves higher premium costs due to its role as the first layer of coverage that responds to claims immediately. Excess insurance, positioned above the primary policy, generally offers more affordable premiums since it only activates after primary limits are exhausted. Understanding these cost differences is crucial for optimizing insurance budgets and managing financial risk effectively.

Claims Process: Primary vs Excess Insurance

In the claims process, primary insurance pays first up to its policy limits and handles the initial claim settlement, while excess insurance only responds after the primary coverage limits are exhausted. Primary insurers evaluate, adjust, and settle claims directly with the insured, ensuring swift resolution. Excess insurance provides an additional layer of financial protection, activating only when the primary insurer's payout is insufficient to cover the total loss.

When to Choose Excess Insurance Coverage

Excess insurance coverage is ideal when the primary policy's limits are insufficient to cover large or multiple claims, providing an additional layer of financial protection. Businesses facing high liability risks or industries prone to catastrophic losses often choose excess insurance to safeguard their assets beyond their primary policy limits. This coverage activates only after the primary insurance is exhausted, ensuring extended security without duplicating the primary policy's terms.

Industry Applications: Primary and Excess Insurance

Primary insurance provides first-dollar coverage for claims up to policy limits, making it essential for industries with frequent, lower-severity risks such as retail and manufacturing. Excess insurance offers additional coverage beyond primary policy limits, commonly utilized in high-risk sectors like construction, transportation, and energy to protect against catastrophic losses. Combining primary and excess insurance enables businesses to tailor risk management strategies that balance cost efficiency with comprehensive protection.

Common Misconceptions About Excess Insurance

Excess insurance is often mistaken for secondary or backup insurance, but it actually provides additional coverage beyond the primary insurance limits rather than replacing it. Many believe excess insurance covers different risks, yet it only extends the financial limit for the same risks covered under the primary policy. Understanding that excess insurance activates only after the primary policy's limits are exhausted is crucial for accurate risk management and financial protection.

Choosing the Right Coverage: Primary vs Excess Insurance

Selecting between primary and excess insurance depends on the scope of risk exposure and coverage limits required. Primary insurance provides the first layer of coverage up to its policy limits, while excess insurance offers additional protection once those limits are exhausted. Businesses and individuals should evaluate their liability exposure and financial risk tolerance to determine the appropriate balance between primary and excess policies for comprehensive protection.

Important Terms

Attachment Point

The attachment point in insurance defines the threshold at which excess insurance coverage begins, activating only after the primary insurance limits are exhausted. Primary insurance covers claims up to its limit, while excess insurance provides additional protection beyond that attachment point, mitigating higher risk exposures.

Layering

Layering in insurance divides coverage into multiple levels, starting with primary insurance that covers initial losses up to its policy limit, followed by excess insurance that provides additional coverage beyond the primary limits. This structured approach enhances risk management by ensuring broader protection and optimizing premium costs across different layers.

Umbrella Policy

An umbrella policy provides additional liability coverage beyond the limits of primary insurance policies, such as auto or homeowners insurance, serving as excess insurance that kicks in only after the underlying policy limits are exhausted. This supplemental coverage protects against significant claims or lawsuits by covering gaps and extending financial protection beyond primary insurance policy thresholds.

Follow Form

Follow form insurance strictly mirrors the terms and conditions of the primary insurance policy, providing automatic excess coverage beyond the primary limits. This alignment ensures seamless coordination in claims handling and prevents coverage gaps between primary and excess insurance layers.

Self-Insured Retention (SIR)

Self-Insured Retention (SIR) represents the amount a policyholder must pay out-of-pocket before the primary insurance coverage begins, effectively acting as a deductible but applied differently within the insurance structure. In contrast to excess insurance, which provides additional coverage beyond the primary policy limits once those limits are exhausted, SIR requires the insured to handle initial losses, influencing risk management strategies and claims handling processes.

Drop Down Coverage

Drop down coverage activates once the primary insurance limits are exhausted, providing additional protection under the excess insurance policy. This mechanism ensures continuity of coverage by filling gaps when the primary insurer denies a claim or coverage is excluded, effectively extending the insured's financial safeguard.

Limits of Liability

Limits of liability define the maximum amount an insurer will pay for a covered loss, varying significantly between primary and excess insurance policies. Primary insurance provides the initial coverage up to its limit, while excess insurance applies only after primary limits are exhausted, extending overall coverage but not replacing the primary insurer's obligations.

Contributing Excess

Contributing Excess refers to the portion of a claim amount shared between primary and excess insurance policies before the excess layer fully covers the remaining loss; it ensures that the primary insurer pays up to its limit before the excess insurer contributes, optimizing risk distribution. This mechanism prevents overlap and duplication of payments, maintaining clear boundaries between the primary policy's responsibility and the excess insurance's coverage threshold.

Vertical Exhaustion

Vertical exhaustion occurs when the limits of primary insurance are fully utilized before excess insurance coverage begins to respond, effectively requiring claimants to exhaust the primary policy's limits vertically up to its maximum. This principle ensures that excess insurance acts as a secondary layer of protection, providing additional coverage only after all available primary policy funds are exhausted.

Concurrent Coverage

Concurrent coverage occurs when two or more insurance policies provide overlapping protection for the same risk, leading to potential conflicts in claim payments. Primary insurance pays first up to its limits, while excess insurance covers remaining costs beyond the primary policy's limits, ensuring broader financial protection.

Primary vs Excess Insurance Infographic

moneydif.com

moneydif.com