Captive insurance offers businesses a tailored risk management solution by creating a licensed insurance company owned by the insured, providing control over policies and potential cost savings. Self-insurance involves retaining risk internally without transferring it to an insurer, requiring sufficient financial reserves and risk management expertise to cover potential losses. Choosing between captive insurance and self-insurance depends on a company's risk tolerance, financial capacity, and long-term strategic goals.

Table of Comparison

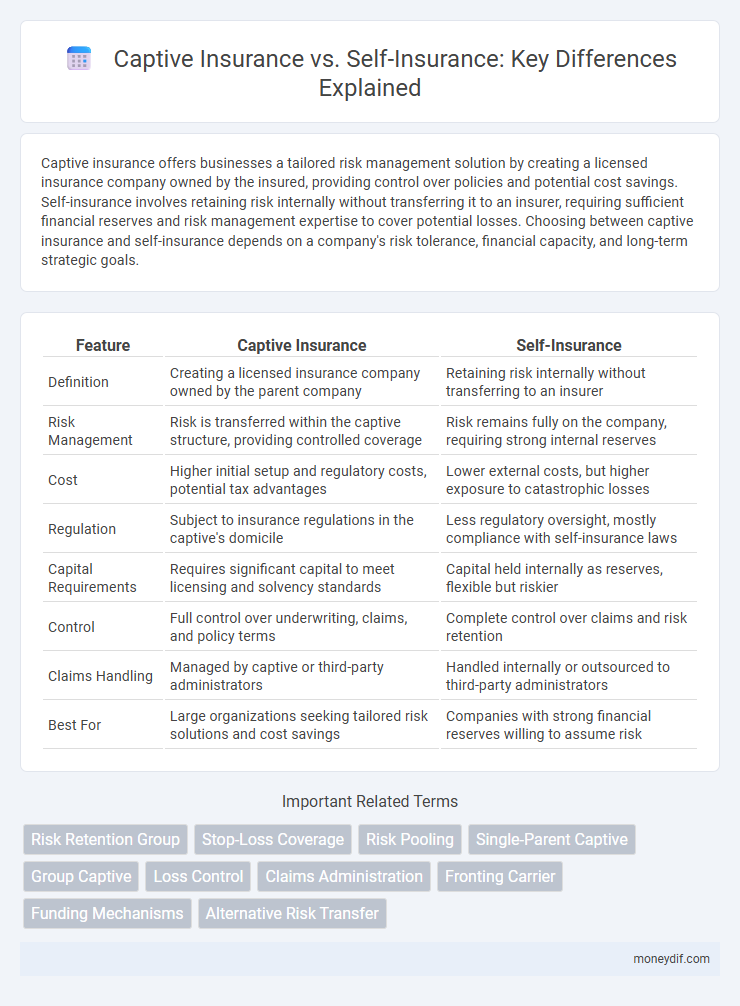

| Feature | Captive Insurance | Self-Insurance |

|---|---|---|

| Definition | Creating a licensed insurance company owned by the parent company | Retaining risk internally without transferring to an insurer |

| Risk Management | Risk is transferred within the captive structure, providing controlled coverage | Risk remains fully on the company, requiring strong internal reserves |

| Cost | Higher initial setup and regulatory costs, potential tax advantages | Lower external costs, but higher exposure to catastrophic losses |

| Regulation | Subject to insurance regulations in the captive's domicile | Less regulatory oversight, mostly compliance with self-insurance laws |

| Capital Requirements | Requires significant capital to meet licensing and solvency standards | Capital held internally as reserves, flexible but riskier |

| Control | Full control over underwriting, claims, and policy terms | Complete control over claims and risk retention |

| Claims Handling | Managed by captive or third-party administrators | Handled internally or outsourced to third-party administrators |

| Best For | Large organizations seeking tailored risk solutions and cost savings | Companies with strong financial reserves willing to assume risk |

Understanding Captive Insurance: Definition and Structure

Captive insurance is a risk management strategy where a company creates a licensed insurance company to insure its own risks, providing greater control over coverage and premiums. This structure typically involves a parent company and its subsidiaries forming the captive, allowing tailored policies and potential tax advantages. Unlike traditional self-insurance, captive insurance operates under formal regulatory frameworks, offering a hybrid solution between self-insurance and commercial insurance markets.

What is Self-Insurance? Key Concepts Explained

Self-insurance is a risk management strategy where a company sets aside funds internally to cover potential losses instead of purchasing traditional insurance policies. Key concepts include risk retention, where the business assumes financial responsibility for claims, and claim administration, which involves managing and paying claims directly. This approach often reduces insurance premiums and provides greater control over coverage, but it requires sufficient capital reserves and expertise in risk assessment.

Major Differences Between Captive and Self-Insurance

Captive insurance involves establishing a licensed insurer owned by the parent company to underwrite its risks, offering tailored risk management and potential tax advantages. Self-insurance, in contrast, means the company retains risk internally without transferring it to an insurer, typically funding claims directly from reserves or cash flow. Key differences include regulatory oversight, capital requirements, and control over risk management strategies, with captives subject to insurance regulations and self-insurance relying heavily on the company's financial strength and risk tolerance.

Advantages of Captive Insurance for Businesses

Captive insurance offers businesses enhanced risk management control and potential cost savings by underwriting their own risks while retaining underwriting profits. It provides tax advantages through deductible premiums and the ability to tailor coverage specifically to the company's unique exposures. Businesses benefit from improved cash flow and greater flexibility in claim handling compared to self-insurance, which often requires significant capital reserves and external administration.

Benefits and Drawbacks of Self-Insurance

Self-insurance allows organizations to directly manage and control their risk retention, providing potential cost savings by avoiding traditional insurance premiums and reducing administrative overhead. However, self-insurance also exposes businesses to greater financial risks if claims exceed anticipated reserves, requiring robust risk management practices and sufficient capital to cover potential losses. Companies must carefully evaluate their cash flow stability and claims variability before adopting self-insurance as a risk financing strategy.

Financial Implications: Cost Comparison

Captive insurance involves the formation of a licensed insurance company, requiring significant initial capital investment and ongoing regulatory compliance costs, but offers potential tax advantages and risk retention benefits. Self-insurance eliminates premium payments to third-party insurers but demands substantial reserve funds to cover potential claims and increased exposure to financial volatility. Analyzing total cost of risk, captive insurance may provide predictable expenses and long-term savings, while self-insurance requires careful cash flow management to address unpredictable claim costs and administrative burden.

Regulatory Requirements for Captive vs Self-Insurance

Captive insurance companies are subject to stringent regulatory requirements including licensing, capital adequacy, and periodic financial reporting imposed by state insurance departments. Self-insurance programs generally face fewer regulatory burdens but must comply with specific state mandates such as proof of financial stability and reserve funding to cover potential claims. Regulatory frameworks for captives often demand comprehensive solvency and risk management standards, while self-insurance regulations emphasize risk retention limits and administrative oversight.

Risk Management Strategies: Captive vs Self-Insurance

Captive insurance provides companies with a structured risk management strategy by creating a licensed insurance company to underwrite their risks, allowing for customized coverage and financial control. Self-insurance, however, involves retaining risk internally without transferring it to an insurer, requiring significant capital reserves and rigorous risk assessment to absorb potential losses. Companies often choose captive insurance for predictable risk financing and regulatory benefits, while self-insurance suits organizations with strong cash flow and risk tolerance to manage claims directly.

Choosing the Right Approach: Factors to Consider

Choosing between captive insurance and self-insurance involves evaluating risk tolerance, financial capacity, and regulatory compliance. Captive insurance provides tailored risk management and potential tax benefits but requires significant initial investment and ongoing administration. Self-insurance offers direct control over claims and cash flow but demands robust risk assessment and sufficient reserves to cover losses.

Case Studies: Real-World Examples of Captive and Self-Insurance

Case studies reveal that companies like Walmart leveraging captive insurance have achieved tailored risk management with enhanced cost control and regulatory benefits, while firms opting for self-insurance, such as some mid-sized manufacturers, demonstrate significant short-term savings by retaining risk internally but face potential volatility in claim expenses. Captive insurance enables entities to customize policies and access reinsurance markets directly, as evidenced by multinational corporations, whereas self-insurance suites best businesses with stable, predictable risk profiles due to its reliance on internal reserves to cover losses. Real-world examples underscore the strategic choice between captive and self-insurance depends on factors like company size, risk tolerance, and financial capacity to manage claims and premiums.

Important Terms

Risk Retention Group

A Risk Retention Group (RRG) functions as a liability insurance company owned by its members, offering a cost-effective alternative to traditional insurance by pooling risks within a homogeneous group, which differentiates it from captive insurance that is typically formed and owned by a single parent company to insure its own risks. Unlike self-insurance where entities retain risk internally without transferring it to an insurer, RRGs provide regulatory advantages and risk distribution benefits under the Liability Risk Retention Act, enabling members to share liability exposures while maintaining operational control.

Stop-Loss Coverage

Stop-loss coverage in captive insurance provides a financial safety net by limiting losses above a certain threshold, which is particularly advantageous compared to pure self-insurance by managing catastrophic risk while retaining more control over claims and underwriting. This approach enables businesses to balance risk retention with external protection, lowering volatility and enhancing cash flow predictability compared to fully self-insured models.

Risk Pooling

Risk pooling in captive insurance allows organizations to combine insurance risks across affiliated entities, optimizing premium stability and reducing individual exposure compared to self-insurance, where a single entity bears the full risk independently. Captive insurance structures leverage collective risk management and diversification benefits, whereas self-insurance relies solely on the individual's capital reserves and risk tolerance.

Single-Parent Captive

A Single-Parent Captive is a risk management tool where a company creates its own insurance subsidiary to cover specific risks, offering greater control and potential cost savings compared to traditional self-insurance. Unlike self-insurance, which entails retaining all risk internally, a Single-Parent Captive leverages formal insurance underwriting and regulatory advantages to optimize financial and risk management outcomes.

Group Captive

Group captive insurance pools risks among multiple organizations to lower premiums and enhance risk management compared to self-insurance, where a single company independently retains risk. This collective approach benefits companies lacking the capital or risk tolerance for standalone self-insurance by leveraging shared resources and regulatory advantages.

Loss Control

Loss control in captive insurance involves proactive risk management strategies tailored to the specific risks of the insured entity, leveraging captive structure benefits such as customized coverage and improved claims handling. Self-insurance relies heavily on an internal loss control program designed to minimize liabilities and reduce claim frequency through in-depth risk analysis, employee training, and safety initiatives without transferring risk to a third party.

Claims Administration

Claims administration in captive insurance involves managing claims within a company-owned insurance entity, allowing for tailored risk control and cost efficiency, whereas self-insurance requires companies to handle claims internally without a separate insurance structure, often resulting in higher administrative burden and financial exposure. Captive insurance offers enhanced claims data analytics and risk mitigation strategies, while self-insurance demands robust internal resources to manage claim adjudication and settlements effectively.

Fronting Carrier

Fronting carriers facilitate access to traditional insurance markets by issuing policies on behalf of captives or self-insured entities while transferring risk back to the captive or self-insurer through reinsurance agreements. This arrangement enables businesses to comply with regulatory requirements and secure necessary coverage without fully transferring risk, optimizing cost-efficiency and risk management in captive insurance or self-insurance programs.

Funding Mechanisms

Captive insurance funding mechanisms often involve capital contributions, underwriting profits, and reinsurance agreements that ensure financial stability and risk retention within a controlled entity. In contrast, self-insurance primarily relies on the organization's own reserves and risk management strategies to cover potential losses without transferring risk to an external insurer.

Alternative Risk Transfer

Alternative Risk Transfer (ART) strategies include Captive Insurance and Self-Insurance as key components, where Captive Insurance involves forming a licensed insurance company to underwrite risks internally, providing greater control over claims and premium usage. Self-Insurance, by contrast, entails retaining financial responsibility for risks without involving traditional insurers, optimizing cash flow and reducing administrative costs while increasing exposure to potential losses.

Captive Insurance vs Self-Insurance Infographic

moneydif.com

moneydif.com