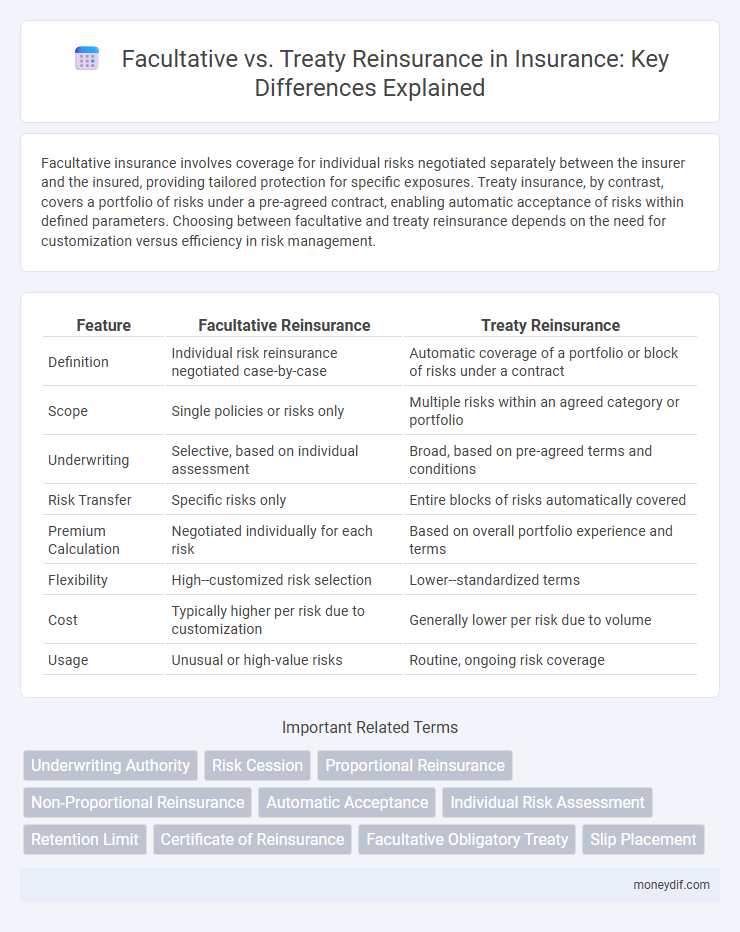

Facultative insurance involves coverage for individual risks negotiated separately between the insurer and the insured, providing tailored protection for specific exposures. Treaty insurance, by contrast, covers a portfolio of risks under a pre-agreed contract, enabling automatic acceptance of risks within defined parameters. Choosing between facultative and treaty reinsurance depends on the need for customization versus efficiency in risk management.

Table of Comparison

| Feature | Facultative Reinsurance | Treaty Reinsurance |

|---|---|---|

| Definition | Individual risk reinsurance negotiated case-by-case | Automatic coverage of a portfolio or block of risks under a contract |

| Scope | Single policies or risks only | Multiple risks within an agreed category or portfolio |

| Underwriting | Selective, based on individual assessment | Broad, based on pre-agreed terms and conditions |

| Risk Transfer | Specific risks only | Entire blocks of risks automatically covered |

| Premium Calculation | Negotiated individually for each risk | Based on overall portfolio experience and terms |

| Flexibility | High--customized risk selection | Lower--standardized terms |

| Cost | Typically higher per risk due to customization | Generally lower per risk due to volume |

| Usage | Unusual or high-value risks | Routine, ongoing risk coverage |

Understanding Facultative and Treaty Reinsurance

Facultative reinsurance involves the ceding insurer transferring risk on a case-by-case basis, allowing tailored coverage for specific policies or risks, which provides flexibility and selective risk management. Treaty reinsurance is a standing agreement where the reinsurer accepts a defined portion of all policies within a specified class, ensuring consistent protection and streamlined underwriting processes. Understanding the strategic application of facultative versus treaty reinsurance enables insurers to optimize risk transfer, balance portfolio exposure, and enhance capital efficiency.

Key Differences Between Facultative and Treaty Reinsurance

Facultative reinsurance involves covering a single risk or specific policy, allowing the insurer to underwrite individual exposures with tailored terms, whereas treaty reinsurance provides automatic, pre-agreed coverage for a portfolio of policies, spreading risk across multiple contracts. Facultative reinsurance offers flexibility and detailed risk assessment but requires separate underwriting for each risk, while treaty reinsurance ensures continuous coverage, enhancing operational efficiency and stability. The choice between facultative and treaty reinsurance impacts risk management strategies, premium negotiation, and claims handling in the insurance industry.

When to Use Facultative vs Treaty Reinsurance

Facultative reinsurance offers tailored coverage for high-risk or unique policies that exceed treaty limits or require individual underwriting, making it suitable for large or unusual risks. Treaty reinsurance provides automatic, pre-agreed coverage for a defined portfolio of policies, streamlining risk management and ensuring consistent capacity for standard risk classes. Selecting facultative vs treaty depends on the insurer's need for flexibility, risk appetite, and the nature of the underlying policies.

Advantages of Facultative Reinsurance

Facultative reinsurance offers precise risk selection by allowing insurers to cede specific individual risks, enhancing portfolio control and reducing exposure to high-risk policies. This method provides flexibility in underwriting, enabling tailored coverage and premium negotiation for unique or complex risks that may not fit within treaty parameters. Facultative reinsurance also strengthens insurer solvency by mitigating potential large losses through selective, case-by-case coverage.

Benefits of Treaty Reinsurance Agreements

Treaty reinsurance agreements provide insurers with automatic coverage for a defined portfolio of risks, enabling consistent risk management and improved underwriting capacity. These agreements enhance financial stability by spreading risk across multiple parties and ensuring predictable premium income. The efficiency of treaty reinsurance reduces administrative costs and accelerates claims handling, benefiting both insurers and their clients.

Risk Assessment in Facultative and Treaty Reinsurance

Facultative reinsurance involves the insurer ceding individual risks to the reinsurer, enabling detailed, case-by-case risk assessment for highly specific or unusual exposures. Treaty reinsurance covers a portfolio of risks under a pre-agreed contract, relying on aggregate risk evaluation and historical loss data rather than individual risk analysis. This distinction highlights the tailored risk scrutiny in facultative agreements versus the broader risk distribution approach in treaty reinsurance.

Cost Implications: Facultative vs Treaty Approaches

Facultative reinsurance typically incurs higher administrative and underwriting costs due to case-by-case risk assessment, making it more expensive per individual policy. Treaty reinsurance spreads risk over a portfolio, reducing per-policy costs through bulk negotiation and standardized terms. This cost efficiency often makes treaty reinsurance more economical for insurers managing large volumes of homogeneous risks.

Claims Handling in Facultative and Treaty Reinsurance

Claims handling in facultative reinsurance involves personalized assessment and negotiation for each individual risk, ensuring detailed attention to complex or high-value claims. Treaty reinsurance streamlines claims processing by applying agreed-upon terms across a portfolio of risks, facilitating faster settlements and consistent claim management. Effective coordination between ceding insurers and reinsurers in both facultative and treaty arrangements is crucial for timely and accurate claims resolution.

Real-World Examples of Facultative and Treaty Reinsurance

A real-world example of facultative reinsurance occurs when an insurance company cedes a high-value commercial property risk to a reinsurer on a case-by-case basis, ensuring tailored risk sharing for unique exposures. Treaty reinsurance is exemplified by an insurer entering into an annual quota share treaty, automatically ceding a fixed percentage of its entire portfolio of automobile insurance policies to a reinsurer, providing consistent risk distribution. These approaches demonstrate facultative reinsurance's flexibility versus treaty reinsurance's efficiency in managing large portfolios.

Choosing the Right Reinsurance Method for Your Insurance Portfolio

Selecting the appropriate reinsurance method depends on the risk profile and portfolio size of the insurance company. Facultative reinsurance offers tailored coverage for individual, high-risk policies, providing flexibility and specific risk assessment. Treaty reinsurance involves ceding a block of policies under a pre-agreed arrangement, ensuring consistent risk transfer and streamlined management for larger or homogeneous portfolios.

Important Terms

Underwriting Authority

Underwriting authority refers to the delegated power granted to underwriters to accept, modify, or reject insurance risks, with facultative authority applying to individual risks handled on a case-by-case basis and treaty authority covering a portfolio of risks under a pre-agreed arrangement. Facultative underwriting requires specific approval for each risk, whereas treaty underwriting allows automatic acceptance of risks within the defined terms, optimizing efficiency and risk management in reinsurance.

Risk Cession

Risk cession in facultative reinsurance involves transferring specific individual risks from the ceding insurer to the reinsurer, allowing tailored coverage and pricing for each risk. In treaty reinsurance, risk cession applies to a portfolio of risks under a pre-agreed contract, enabling automated and continuous coverage without individual risk assessment.

Proportional Reinsurance

Proportional reinsurance involves the ceding insurer and reinsurer sharing premiums and losses in agreed proportions, distinguishing itself from facultative reinsurance which covers individual risks, and treaty reinsurance which covers a portfolio of risks automatically. Facultative reinsurance offers tailored risk-by-risk coverage, while treaty reinsurance provides continuous risk transfer for defined classes, optimizing risk management and capital efficiency for insurers.

Non-Proportional Reinsurance

Non-proportional reinsurance involves the reinsurer covering losses exceeding a specified retention, primarily used in excess of loss treaties, whereas facultative reinsurance pertains to individual risks negotiated separately, offering flexibility for unique or high-risk exposures. Treaty reinsurance, often non-proportional, automatically covers a portfolio of risks under agreed terms, contrasting with facultative arrangements that require case-by-case acceptance.

Automatic Acceptance

Automatic acceptance in reinsurance refers to a treaty agreement where the ceding company transfers risk to the reinsurer without individual underwriting approval, contrasting with facultative reinsurance that requires case-by-case acceptance. Treaty reinsurance provides broader risk coverage and streamlined processing, while facultative reinsurance allows for selective risk evaluation and customized terms.

Individual Risk Assessment

Individual Risk Assessment evaluates specific exposures in facultative reinsurance, allowing tailored coverage and pricing for unique risks, while treaty reinsurance involves automatic acceptance of a portfolio of risks under predefined terms without individual evaluation. Facultative assessment demands detailed analysis of each risk's characteristics, whereas treaty relies on aggregated risk profiles and historical data for broader risk management.

Retention Limit

Retention limit in facultative reinsurance refers to the maximum amount of risk the ceding insurer retains before ceding the excess to the reinsurer on a case-by-case basis, whereas in treaty reinsurance, it defines the agreed-upon threshold for automatic risk sharing across a portfolio of policies. Facultative reinsurance offers flexibility for individual risk assessment beyond the retention limit, while treaty reinsurance provides continuous coverage within pre-set retention limits, enhancing overall risk management efficiency.

Certificate of Reinsurance

A Certificate of Reinsurance serves as documented proof that a reinsurer assumes a portion of the risk under either a facultative or treaty reinsurance agreement, detailing terms and coverage limits. Facultative reinsurance applies to individual risks negotiated separately, while treaty reinsurance covers a portfolio or block of policies automatically under predefined conditions.

Facultative Obligatory Treaty

A Facultative Obligatory Treaty entails commitments where parties may selectively accept certain obligations, blending elements of optional participation with binding treaty provisions. This contrasts with purely Facultative treaties, which allow parties to choose whether to be bound, and standard Treaty arrangements that impose comprehensive, mandatory obligations on all signatories involved.

Slip Placement

Slip placement in facultative reinsurance involves individually negotiated coverage for specific risks, providing tailored protection, whereas treaty reinsurance automatically covers a portfolio of risks as per pre-agreed terms, ensuring consistent risk transfer. Efficient slip placement optimizes risk allocation, enhances underwriting accuracy, and supports strategic capacity deployment in both facultative and treaty arrangements.

Facultative vs Treaty Infographic

moneydif.com

moneydif.com