Occurrence insurance policies cover incidents that happen during the policy period, regardless of when the claim is filed, ensuring long-term protection against past events. Claims-made policies provide coverage only if the claim is reported during the active policy term, emphasizing timely notification of potential liabilities. Choosing between these depends on risk exposure, with occurrence offering broader coverage and claims-made often being more cost-effective.

Table of Comparison

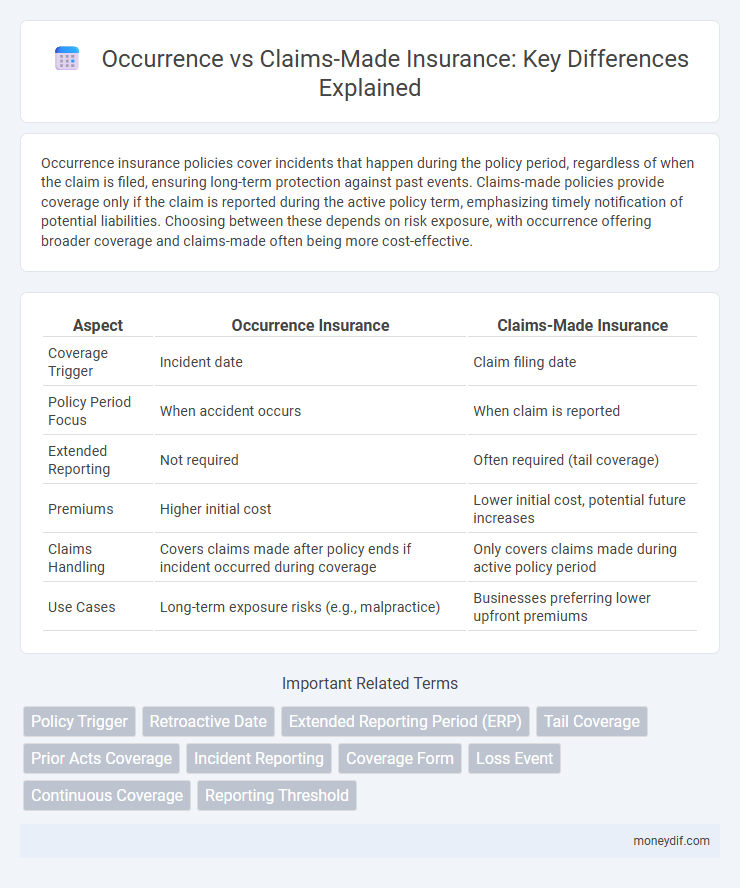

| Aspect | Occurrence Insurance | Claims-Made Insurance |

|---|---|---|

| Coverage Trigger | Incident date | Claim filing date |

| Policy Period Focus | When accident occurs | When claim is reported |

| Extended Reporting | Not required | Often required (tail coverage) |

| Premiums | Higher initial cost | Lower initial cost, potential future increases |

| Claims Handling | Covers claims made after policy ends if incident occurred during coverage | Only covers claims made during active policy period |

| Use Cases | Long-term exposure risks (e.g., malpractice) | Businesses preferring lower upfront premiums |

Understanding Occurrence and Claims-Made Policies

Occurrence policies provide coverage for incidents that happen during the policy period, regardless of when the claim is filed, offering long-term protection against past events. Claims-made policies require the claim to be reported while the policy is active, typically covering only those claims made during the coverage period, which often makes them more affordable but limits retrospective protection. Understanding the difference is crucial for selecting the right insurance product that aligns with risk exposure and financial planning strategies.

Key Differences: Occurrence vs Claims-Made

Occurrence insurance covers incidents that happen during the policy period, regardless of when the claim is filed, providing long-term protection for events occurring on or after the policy's effective date. Claims-made insurance requires both the incident and the claim to occur while the policy is active, making it essential to maintain continuous coverage or purchase tail coverage to protect against delayed claims. Key differences include the timing of coverage activation and risk management strategies, with occurrence policies offering broader temporal coverage and claims-made policies emphasizing claim reporting within the policy term.

How Coverage Periods Work

Occurrence policies provide coverage for incidents that happen during the policy period, regardless of when the claim is filed, ensuring protection even if the claim arises years later. Claims-made policies cover only claims reported during the policy period, requiring continuous coverage or tail coverage to protect against delayed claims. Understanding the differences in coverage periods is essential for selecting the right insurance based on long-term liability risks.

Premium Costs: What to Expect

Occurrence policies generally have higher initial premium costs because they cover incidents that happen during the policy period, regardless of when the claim is filed. Claims-made policies typically feature lower upfront premiums but require continuous coverage to avoid gaps, which may increase costs over time. Understanding the premium structure helps businesses budget effectively while managing long-term risk exposure.

Retroactive Dates Explained

Retroactive dates in claims-made insurance policies determine the earliest point at which an incident can occur and still be covered, ensuring protection for past events reported during the policy period. Unlike occurrence policies that cover any incident happening during the policy regardless of claim filing time, claims-made policies rely on retroactive dates to limit coverage to claims arising from specified timeframes. Understanding retroactive dates is essential for accurately assessing coverage gaps and managing long-tail liabilities in professional liability and malpractice insurance.

The Importance of Tail Coverage

Tail coverage is essential in claims-made insurance policies as it protects the insured against claims reported after the policy period for incidents that occurred during the coverage period. This type of coverage ensures that professionals and businesses are not exposed to financial losses from delayed claims, particularly in fields like medical malpractice and legal services. Without tail coverage, policyholders might face significant out-of-pocket expenses to cover claims arising from previous policy periods.

Pros and Cons: Which Policy Suits You?

Occurrence insurance policies cover incidents that happen during the policy period, regardless of when the claim is filed, offering long-term protection but often at higher premiums. Claims-made policies cover claims filed during the policy period, providing lower initial costs and flexibility but requiring continuous coverage to avoid gaps. Choosing between occurrence and claims-made depends on factors like budget, risk tolerance, and the potential for future claims related to past activities.

Switching from Claims-Made to Occurrence

Switching from a claims-made insurance policy to an occurrence policy provides coverage for incidents that happen during the policy period, regardless of when the claim is filed, ensuring long-term protection against latent claims. This transition often requires purchasing tail coverage to extend reporting rights on prior claims-made coverage, preventing gaps in liability protection. Policyholders must evaluate risk exposure and cost differences, as occurrence policies generally carry higher premiums but offer more comprehensive claim coverage over time.

Common Industries Using Each Policy Type

Construction and manufacturing industries commonly use occurrence policies to cover long-tail liabilities arising from property damage or bodily injury during project execution. Healthcare and professional services sectors often prefer claims-made policies to manage risks related to malpractice or errors arising from ongoing professional activities. These policy types align with the distinct exposure timelines and legal requirements prevalent in each industry.

Choosing the Right Coverage for Your Needs

Occurrence policies provide coverage for incidents that happen during the policy period, regardless of when the claim is filed, offering long-term protection. Claims-made policies cover claims only if the incident and claim occur while the policy is active, often requiring tail coverage for future claims. Selecting the right coverage depends on factors like risk exposure duration, budget, and claims reporting preferences to ensure adequate protection.

Important Terms

Policy Trigger

Policy triggers define the point at which coverage begins for insurance claims, distinguishing between occurrence-based policies that cover incidents happening during the policy period and claims-made policies that require the claim to be filed within the policy period regardless of when the incident occurred. Understanding the differences between occurrence and claims-made triggers is critical for managing liability risks and ensuring appropriate coverage timelines in professional liability and general liability insurance.

Retroactive Date

The Retroactive Date in a claims-made insurance policy specifies the earliest date an incident can occur and still be covered, distinguishing it from occurrence policies that cover incidents happening during the policy period regardless of claim timing. This date limits coverage to claims arising from incidents after it, ensuring defense and indemnity only for events within that defined timeframe.

Extended Reporting Period (ERP)

The Extended Reporting Period (ERP) allows policyholders on a claims-made insurance policy to report claims after the policy has expired, covering incidents that occurred during the policy period. Unlike occurrence policies, which provide coverage for incidents occurring during the policy regardless of when the claim is made, claims-made policies rely on ERP to extend the time frame for filing claims.

Tail Coverage

Tail coverage extends protection for claims-made insurance policies by covering incidents reported after the policy ends, unlike occurrence policies that cover incidents during the policy period regardless of when claims are filed. This type of coverage is essential for ensuring long-term liability protection when switching insurers or retiring, safeguarding against delayed claim reporting.

Prior Acts Coverage

Prior Acts Coverage protects against claims arising from incidents that occurred before the policy's inception date, typically critical in claims-made policies which only cover claims reported during the policy period. In contrast, occurrence policies provide coverage for incidents that occur during the policy period regardless of when the claim is filed, reducing reliance on prior acts coverage for past incidents.

Incident Reporting

Incident reporting in the context of occurrence versus claims-made policies is crucial for effective insurance coverage, as occurrence policies cover incidents based on the event date, while claims-made policies rely on when the claim is filed. Timely and accurate incident documentation ensures proper legal protection and facilitates claims processing according to the specific policy terms.

Coverage Form

Coverage forms define the scope and type of insurance protection, with occurrence policies covering incidents that happen during the policy period regardless of when the claim is filed, while claims-made policies provide coverage only if the claim is reported during the policy period. Understanding the distinction between occurrence and claims-made coverage forms is critical for managing long-tail liability risks and ensuring appropriate claims reporting and reporting period alignment.

Loss Event

Loss events under occurrence policies cover incidents that happen during the coverage period regardless of when the claim is filed, whereas claims-made policies only cover claims reported during the active policy period. Distinguishing between occurrence and claims-made coverage is essential for accurately managing risk exposure and determining claim eligibility.

Continuous Coverage

Continuous Coverage ensures uninterrupted insurance protection, essential in Claims-Made policies where coverage depends on policy activation during the incident and claim reporting period. Occurrence policies provide coverage for claims from incidents occurring during the policy period, regardless of when the claim is filed, reducing reliance on continuous coverage but often at higher premium costs.

Reporting Threshold

The reporting threshold in insurance determines when an event must be reported under occurrence and claims-made policies, with occurrence policies covering incidents that happen during the policy period regardless of claim timing, while claims-made policies require claims to be reported within the policy period to trigger coverage. Understanding the reporting threshold impacts risk management and claims handling because claims-made policies necessitate continuous coverage and timely reporting to avoid coverage gaps.

Occurrence vs Claims-Made Infographic

moneydif.com

moneydif.com