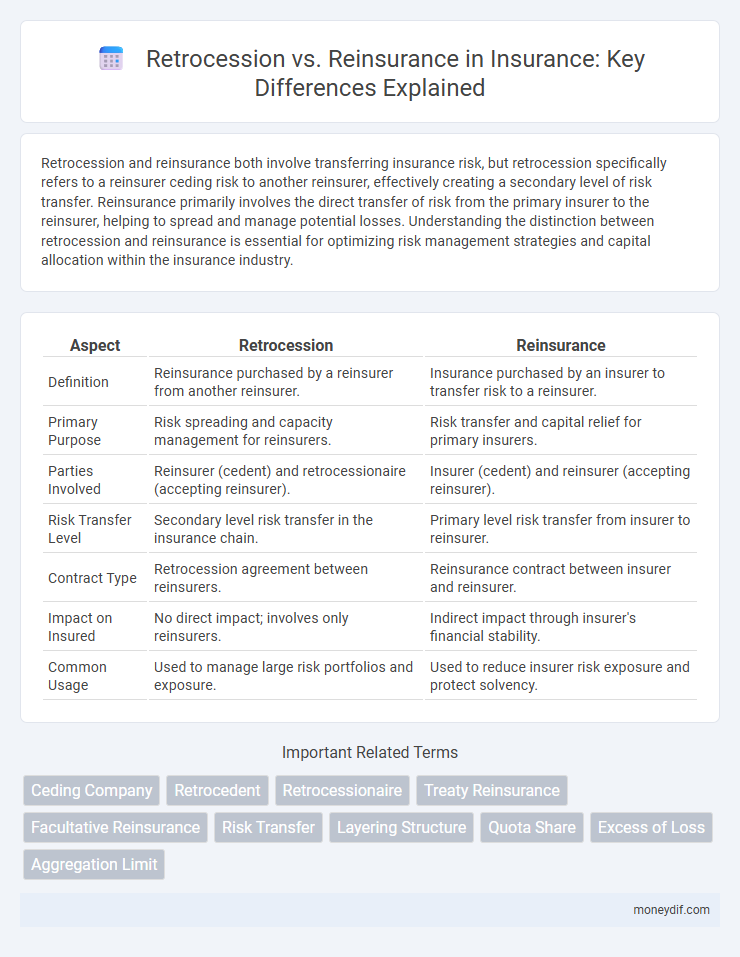

Retrocession and reinsurance both involve transferring insurance risk, but retrocession specifically refers to a reinsurer ceding risk to another reinsurer, effectively creating a secondary level of risk transfer. Reinsurance primarily involves the direct transfer of risk from the primary insurer to the reinsurer, helping to spread and manage potential losses. Understanding the distinction between retrocession and reinsurance is essential for optimizing risk management strategies and capital allocation within the insurance industry.

Table of Comparison

| Aspect | Retrocession | Reinsurance |

|---|---|---|

| Definition | Reinsurance purchased by a reinsurer from another reinsurer. | Insurance purchased by an insurer to transfer risk to a reinsurer. |

| Primary Purpose | Risk spreading and capacity management for reinsurers. | Risk transfer and capital relief for primary insurers. |

| Parties Involved | Reinsurer (cedent) and retrocessionaire (accepting reinsurer). | Insurer (cedent) and reinsurer (accepting reinsurer). |

| Risk Transfer Level | Secondary level risk transfer in the insurance chain. | Primary level risk transfer from insurer to reinsurer. |

| Contract Type | Retrocession agreement between reinsurers. | Reinsurance contract between insurer and reinsurer. |

| Impact on Insured | No direct impact; involves only reinsurers. | Indirect impact through insurer's financial stability. |

| Common Usage | Used to manage large risk portfolios and exposure. | Used to reduce insurer risk exposure and protect solvency. |

Understanding Retrocession and Reinsurance

Retrocession and reinsurance are risk management tools used by insurance companies to mitigate potential losses by transferring portions of risk. Reinsurance involves an insurer ceding part of its risk portfolio to another insurer, while retrocession occurs when a reinsurer further passes on the risk to another reinsurer. Both practices enhance capital efficiency and stabilize loss experience for primary insurers and reinsurers through risk diversification and capacity expansion.

Key Differences Between Retrocession and Reinsurance

Retrocession involves an insurance company ceding risks to another reinsurer to manage exposure, while reinsurance is the primary transfer of risk from the insurer to a reinsurer. Key differences include the parties involved: reinsurance occurs between the insurer and the reinsurer, whereas retrocession happens between reinsurers themselves. Retrocession typically addresses further risk distribution and capital relief beyond traditional reinsurance agreements.

The Role of Reinsurers and Retrocessionaires

Reinsurers assume portions of risk from primary insurers to stabilize their portfolios and enhance capital efficiency, while retrocessionaires provide an additional layer of risk transfer by accepting risk shares from reinsurers, improving overall market capacity. This hierarchical risk distribution allows for more effective management of large or catastrophic exposures, ensuring financial resilience across the insurance chain. The collaboration between reinsurers and retrocessionaires supports risk diversification, capital optimization, and the sustainability of insurance operations globally.

How Retrocession Complements Reinsurance

Retrocession complements reinsurance by providing an additional layer of risk distribution, allowing reinsurers to mitigate their exposure to large or catastrophic losses. This secondary transfer of risk helps stabilize the primary reinsurer's portfolio and enhances overall financial resilience. By leveraging retrocession agreements, insurance markets improve capital efficiency and maintain better capacity for underwriting new risks.

Risk Management Strategies: Retrocession vs Reinsurance

Retrocession and reinsurance are critical risk management strategies used by insurance companies to mitigate potential losses by transferring portions of risk to other parties. Reinsurance involves an insurer ceding risk to a reinsurer to protect against large claims or catastrophic events, while retrocession occurs when a reinsurer further transfers risk to another reinsurer, spreading exposure across multiple layers. Effective utilization of both retrocession and reinsurance enhances capital efficiency, stabilizes loss experience, and ensures solvency in volatile markets.

Market Structure and Participants

Retrocession involves reinsurance companies transferring portions of their risk portfolios to other reinsurers, creating a secondary risk market distinct from primary reinsurance between insurers and reinsurers. The retrocession market features key participants such as retrocedents (reinsurers seeking to manage accumulated risk) and retrocessionaires (entities providing additional risk capacity), operating through brokers, syndicates, and specialized platforms. This layered structure enhances risk diversification, capital efficiency, and market liquidity, differentiating retrocession's risk-sharing mechanisms from direct reinsurance contracts.

Common Types of Reinsurance and Retrocession Agreements

Common types of reinsurance agreements include proportional treaties such as quota share and surplus share, where risks and premiums are shared between the insurer and reinsurer based on agreed proportions. Non-proportional reinsurance, including excess of loss and stop loss, provides coverage once losses exceed specified thresholds, protecting insurers from catastrophic events. Retrocession agreements occur when reinsurers cede part of their accepted risks to other reinsurers, spreading exposure through similar proportional and non-proportional contracts to maintain solvency and risk diversification.

Regulatory Considerations for Retrocession and Reinsurance

Regulatory considerations for retrocession and reinsurance differ mainly in jurisdictional oversight and capital requirements, where reinsurers are directly regulated under insurance laws, while retrocessionaires often face less stringent scrutiny due to their indirect role. Retrocession agreements must comply with local regulatory frameworks regarding risk transfer and solvency margins to ensure retrocessionaires manage assumed risks responsibly. Reinsurers typically encounter stricter reporting obligations and licensing conditions to maintain market stability and protect ceding insurers and policyholders.

Challenges and Opportunities in Retrocession and Reinsurance

Retrocession and reinsurance both play critical roles in risk management for insurance companies but present distinct challenges such as pricing complexity, limited market capacity, and counterparty risk. Opportunities in retrocession include enhanced risk diversification and capital optimization, while reinsurance offers access to additional underwriting expertise and financial stability. Navigating regulatory compliance and technological advancements remains essential for maximizing benefits in both retrocession and reinsurance markets.

Future Trends in Retrocession and Reinsurance

Future trends in retrocession and reinsurance indicate a growing reliance on advanced data analytics, artificial intelligence, and blockchain technologies to enhance risk assessment and claims management. Market dynamics reveal increased collaboration between primary insurers and retrocessionaires to diversify risk portfolios amid rising natural disasters and climate-related events. Regulatory developments are expected to promote greater transparency and capital efficiency, driving innovation in customized retrocession and reinsurance solutions.

Important Terms

Ceding Company

A ceding company transfers a portion of its insurance risk to a reinsurer to mitigate potential losses, while retrocession involves the reinsurer further passing on that risk to other reinsurers to diversify exposure. This layered risk management process enhances capital efficiency and stabilizes underwriting results within the insurance industry.

Retrocedent

Retrocedent refers to the insurance company that transfers risk to another insurer through retrocession, which is the practice of ceding reinsurance coverage to a third party beyond the primary reinsurer. Unlike reinsurance, where risk is ceded from an insurer to a reinsurer, retrocession involves the reinsurer (retrocedent) passing on portions of that assumed risk to other reinsurers (retrocessionaires) to further distribute exposure.

Retrocessionaire

A retrocessionaire is a company that accepts risk from a reinsurer through retrocession agreements, effectively providing a secondary layer of risk transfer beyond primary reinsurance. While reinsurance involves ceding risk from an insurer to a reinsurer, retrocession allows reinsurers to manage their risk exposure by transferring portions of that risk to retrocessionaires.

Treaty Reinsurance

Treaty reinsurance involves an agreement where the reinsurer accepts all risks from the ceding insurer's portfolio, differing from retrocession where a reinsurer transfers portions of its assumed risk to another reinsurer, effectively managing risk exposure and capital requirements. Retrocession serves as a secondary layer of risk distribution, enhancing financial stability beyond primary reinsurance treaties.

Facultative Reinsurance

Facultative reinsurance involves the ceding insurer transferring specific risks individually to a reinsurer, providing tailored risk coverage compared to automatic treaty arrangements. Retrocession refers to a reinsurer further ceding portions of assumed risks to other reinsurers, enhancing risk distribution beyond primary reinsurance layers.

Risk Transfer

Risk transfer in insurance involves shifting potential losses to another party, with reinsurance representing a primary method where insurers transfer portions of risk to reinsurers. Retrocession operates as a secondary layer, where reinsurers further transfer risks to retrocessionaires, enhancing risk distribution and capital management across the insurance chain.

Layering Structure

Layering structure in insurance involves arranging multiple layers of risk retention and transfer, where retrocession serves as a form of reinsurance for reinsurers, allowing them to cede part of their assumed risks to other parties; this hierarchical distribution enhances risk management efficiency. Distinguishing retrocession from direct reinsurance clarifies that retrocession operates exclusively within the reinsurance market, enabling reinsurers to maintain balance sheets and limit large exposures through carefully structured layers.

Quota Share

Quota share is a type of reinsurance where the insurer cedes a fixed percentage of its premiums and losses to the reinsurer; retrocession occurs when the reinsurer further transfers portions of this risk to another reinsurer, effectively spreading exposure across multiple layers. This mechanism enhances risk management by diversifying liabilities and improving capital efficiency within the insurance industry.

Excess of Loss

Excess of Loss is a reinsurance structure where the reinsurer covers losses exceeding a set retention limit, protecting the insurer from high severity claims. Retrocession involves a reinsurer ceding part of its risk to another reinsurer, effectively creating a secondary layer of Excess of Loss protection to manage catastrophic exposure.

Aggregation Limit

Aggregation limit defines the maximum exposure an insurer or reinsurer will cover under a retrocession or reinsurance agreement, preventing excessive loss accumulation from a single event or series of related events. In retrocession, this limit helps retrocedents manage their risk exposure transferred from primary reinsurers, whereas in reinsurance, it caps the ceding insurer's retained risk after passing excess losses to the reinsurer.

Retrocession vs Reinsurance Infographic

moneydif.com

moneydif.com