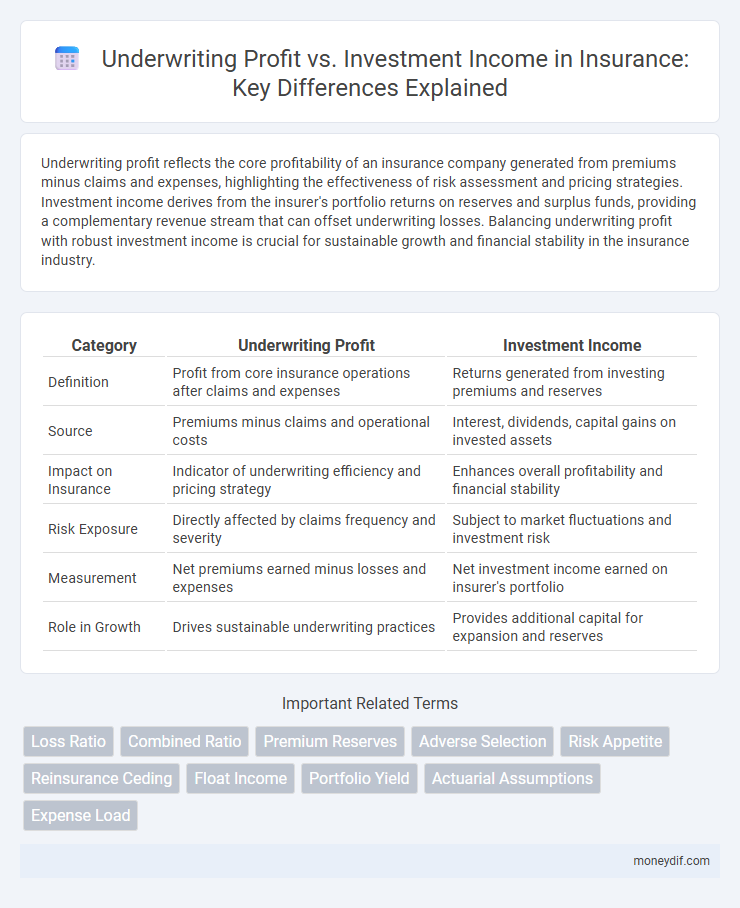

Underwriting profit reflects the core profitability of an insurance company generated from premiums minus claims and expenses, highlighting the effectiveness of risk assessment and pricing strategies. Investment income derives from the insurer's portfolio returns on reserves and surplus funds, providing a complementary revenue stream that can offset underwriting losses. Balancing underwriting profit with robust investment income is crucial for sustainable growth and financial stability in the insurance industry.

Table of Comparison

| Category | Underwriting Profit | Investment Income |

|---|---|---|

| Definition | Profit from core insurance operations after claims and expenses | Returns generated from investing premiums and reserves |

| Source | Premiums minus claims and operational costs | Interest, dividends, capital gains on invested assets |

| Impact on Insurance | Indicator of underwriting efficiency and pricing strategy | Enhances overall profitability and financial stability |

| Risk Exposure | Directly affected by claims frequency and severity | Subject to market fluctuations and investment risk |

| Measurement | Net premiums earned minus losses and expenses | Net investment income earned on insurer's portfolio |

| Role in Growth | Drives sustainable underwriting practices | Provides additional capital for expansion and reserves |

Understanding Underwriting Profit in Insurance

Underwriting profit in insurance refers to the surplus earned when premiums collected exceed the total claims paid and underwriting expenses, providing a clear measure of an insurer's core operational success. This profit indicates effective risk assessment and pricing strategies, distinguishing the insurer's primary business performance from fluctuating investment income generated by premium reserves. Understanding underwriting profit is critical for evaluating an insurance company's financial health and long-term sustainability independent of investment market conditions.

The Role of Investment Income for Insurers

Investment income plays a critical role in enhancing insurers' overall profitability by offsetting underwriting losses and stabilizing earnings during underwriting cycles. Insurers rely on returns from their investment portfolios, typically comprising bonds, equities, and real estate, to supplement underwriting profits and improve capital efficiency. Effective management of investment income allows insurers to offer competitive premiums while maintaining financial resilience and meeting long-term policyholder obligations.

Key Differences Between Underwriting Profit and Investment Income

Underwriting profit refers to the financial gain an insurance company earns from its core business of underwriting policies, calculated as the difference between premiums collected and claims paid plus underwriting expenses. Investment income, on the other hand, is generated from investing the premiums received in various assets such as bonds, stocks, and real estate, providing a supplemental revenue stream independent of underwriting results. The key difference lies in underwriting profit reflecting operational efficiency and risk assessment, while investment income depends on market performance and asset management strategies.

How Insurers Generate Underwriting Profit

Insurers generate underwriting profit by carefully assessing and pricing risks through rigorous risk selection and policy underwriting processes, ensuring premiums exceed the expected claims and expenses. Effective claims management and expense control further enhance underwriting results by minimizing payout variability and operational costs. Maintaining a balanced portfolio of policies with diversified risk profiles also contributes to sustainable underwriting profitability.

The Importance of Investment Returns in Insurance Operations

Investment returns play a critical role in insurance operations by enhancing overall profitability beyond underwriting outcomes. While underwriting profit directly reflects the insurer's ability to price risk and control claims, robust investment income provides financial stability and surplus capital for growth. High-quality portfolios and strategic asset management significantly contribute to sustaining long-term solvency and competitive advantage in the insurance market.

Balancing Underwriting and Investment Strategies

Balancing underwriting profit and investment income is crucial for insurance companies to achieve sustainable growth and financial stability. Effective underwriting ensures that premium revenues exceed claim payouts, while strategic investment generates additional income from those premiums before claims are paid. Insurers optimize profitability by aligning risk assessment with investment portfolio management, minimizing underwriting losses and maximizing returns on invested assets.

Risks Impacting Underwriting Profitability

Underwriting profit is primarily influenced by the accuracy of risk assessment and loss reserving, with unexpected claims severity or frequency posing significant risks to profitability. Investment income, while providing financial stability, cannot fully offset underwriting losses caused by poor risk selection or adverse claims experience. Effective risk management and pricing strategies are crucial to maintaining underwriting profitability despite market volatility and emerging risk exposures.

Market Trends Affecting Investment Income

Market trends such as rising interest rates and volatile equity markets significantly impact insurers' investment income, influencing overall profitability beyond underwriting results. Shifts in fixed-income yields directly affect the returns on insurers' bond portfolios, while stock market fluctuations alter gains from equities held as part of investment strategies. Insurers increasingly focus on diversifying assets and adopting dynamic asset-liability management to stabilize investment income amid evolving economic conditions.

Measuring Success: Combined Ratio vs. Investment Yield

Underwriting profit is measured by the combined ratio, which evaluates an insurer's efficiency by comparing claims and expenses to premiums earned, with a ratio below 100% indicating profitability. Investment income is assessed through investment yield, reflecting the returns generated from the insurer's asset portfolio relative to invested premiums. A comprehensive analysis of an insurance company's financial health balances the combined ratio and investment yield to determine overall success and sustainability.

Future Outlook: Underwriting vs. Investment Income in Insurance

The future outlook for underwriting profit versus investment income in insurance highlights a shifting balance as rising claims volatility pressures underwriting margins, prompting insurers to innovate risk assessment and pricing strategies. Investment income faces uncertainty amid fluctuating interest rates and market volatility, emphasizing the need for diversified portfolios and dynamic asset allocation to sustain earnings. Strategic integration of underwriting discipline with investment management becomes crucial to optimize overall profitability in evolving economic conditions.

Important Terms

Loss Ratio

Loss ratio measures the proportion of claims paid to premiums earned, directly impacting underwriting profit, where a lower loss ratio indicates higher underwriting profitability. Investment income supplements underwriting results by generating additional earnings from premiums held before claims are paid, thereby enhancing overall insurer profitability beyond the loss ratio's scope.

Combined Ratio

The Combined Ratio measures underwriting profitability by comparing incurred losses and expenses to earned premiums, with a value below 100% indicating underwriting profit. Investment income supplements underwriting results by generating additional profit from the insurer's asset portfolio, often crucial for overall financial performance when the Combined Ratio is near or above 100%.

Premium Reserves

Premium reserves represent the portion of collected premiums set aside by insurers to cover future claim obligations, directly impacting underwriting profit by ensuring sufficient funds to meet liabilities. Investment income generated from these reserves enhances overall profitability, offsetting underwriting losses and contributing to the insurer's combined ratio and financial stability.

Adverse Selection

Adverse selection in underwriting leads to higher claims costs as insurers unintentionally attract higher-risk policyholders, reducing underwriting profit margins. Insurers often rely on investment income to offset underwriting losses caused by adverse selection and maintain overall profitability.

Risk Appetite

Risk appetite directly influences underwriting profit by determining the level of risk insurers are willing to assume in policy selections, thereby impacting loss ratios and premium adequacy. Balancing underwriting profit with investment income requires strategic allocation of capital, where a higher risk appetite may boost underwriting returns but necessitates robust investment income to offset potential claim volatility.

Reinsurance Ceding

Reinsurance ceding reduces underwriting risk exposure, allowing insurers to stabilize underwriting profit by transferring a portion of premiums and losses to reinsurers. This risk mitigation shifts focus toward investment income as a key revenue source, enhancing overall profitability through optimized capital allocation and asset management.

Float Income

Float income represents the funds insurers hold between premium collection and claim payments, crucial for generating investment income. Underwriting profit reflects the core insurance profitability excluding float income, highlighting the balance between underwriting results and investments in overall insurer earnings.

Portfolio Yield

Portfolio yield measures the total return generated by an investment portfolio, combining underwriting profit and investment income to reflect overall financial performance. Underwriting profit contributes through the efficient management of insurance risk and premiums, while investment income enhances yield by leveraging the invested premiums and reserves.

Actuarial Assumptions

Actuarial assumptions in underwriting profit focus on estimating future claims, premium adequacy, and policyholder behavior, directly impacting profitability accuracy. Investment income assumptions prioritize projected returns on invested premiums, balancing risk and yield to enhance the overall financial stability of an insurance portfolio.

Expense Load

Expense load directly impacts underwriting profit by increasing the cost base insurers must cover before generating profit, while investment income provides a crucial revenue stream that offsets these expenses and enhances overall profitability. Managing expense load efficiently enables insurers to maximize underwriting profit margins, which in combination with strong investment income, drives sustained financial performance.

Underwriting Profit vs Investment Income Infographic

moneydif.com

moneydif.com