Loss ratio measures the percentage of claims paid out compared to the premiums earned, reflecting an insurer's claim-paying performance. Expense ratio evaluates the proportion of operating costs relative to earned premiums, indicating efficiency in managing business expenses. Understanding the balance between loss ratio and expense ratio is critical for assessing overall profitability and underwriting effectiveness in the insurance industry.

Table of Comparison

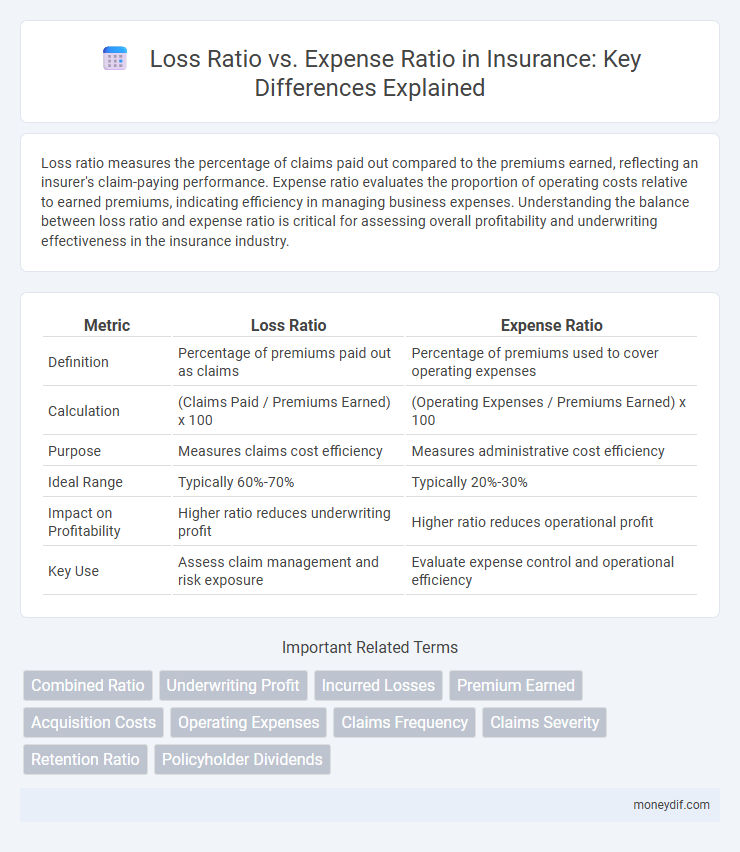

| Metric | Loss Ratio | Expense Ratio |

|---|---|---|

| Definition | Percentage of premiums paid out as claims | Percentage of premiums used to cover operating expenses |

| Calculation | (Claims Paid / Premiums Earned) x 100 | (Operating Expenses / Premiums Earned) x 100 |

| Purpose | Measures claims cost efficiency | Measures administrative cost efficiency |

| Ideal Range | Typically 60%-70% | Typically 20%-30% |

| Impact on Profitability | Higher ratio reduces underwriting profit | Higher ratio reduces operational profit |

| Key Use | Assess claim management and risk exposure | Evaluate expense control and operational efficiency |

Understanding Loss Ratio and Expense Ratio

Loss ratio measures the percentage of claims paid out relative to earned premiums, indicating an insurer's underwriting profitability by showing how much is spent on claims. Expense ratio represents the proportion of operating expenses to earned premiums, reflecting the efficiency of an insurer's management and administrative costs. Analyzing both ratios provides insight into an insurer's overall financial health and operational effectiveness.

Key Differences Between Loss Ratio and Expense Ratio

Loss ratio measures the percentage of claims paid out compared to premiums earned, directly reflecting underwriting profitability, while expense ratio quantifies the insurer's operating costs relative to earned premiums. The loss ratio highlights risk management efficiency by showing the cost of claims, whereas the expense ratio emphasizes administrative and operational cost control. Understanding these key differences helps insurers optimize pricing strategies and maintain financial stability.

How Loss Ratio is Calculated

Loss ratio is calculated by dividing the total incurred losses by the total earned premiums within a specific period, expressed as a percentage. This metric measures the proportion of premiums paid out in claims, providing insight into an insurer's underwriting performance and risk exposure. An accurate loss ratio calculation helps insurance companies assess pricing adequacy and financial stability.

Calculating the Expense Ratio in Insurance

Calculating the Expense Ratio in insurance involves dividing underwriting expenses by the net written premiums, providing insight into operational efficiency. Underwriting expenses typically include commissions, administrative costs, and other overhead related to policy issuance and maintenance. A lower expense ratio indicates better expense management and higher profitability in an insurance company.

Significance of Loss Ratio for Insurers

The loss ratio measures the proportion of claims paid to premiums earned, providing critical insight into an insurer's underwriting performance and risk management effectiveness. A low loss ratio indicates profitable underwriting, while a high loss ratio may signal underwriting losses or inadequate premium pricing. Insurers rely on loss ratio analysis to set competitive premiums, maintain financial stability, and meet regulatory capital requirements.

Importance of Expense Ratio in Financial Performance

Expense ratio directly impacts an insurance company's profitability by measuring the proportion of premiums allocated to operational costs such as underwriting, commissions, and administrative expenses. Maintaining a low expense ratio is critical for sustaining competitive pricing and ensuring sufficient reserves for claims payments. A balanced expense ratio, alongside a favorable loss ratio, enhances overall financial performance and long-term solvency in the insurance sector.

Impact of Loss and Expense Ratios on Premium Pricing

Loss ratio and expense ratio are critical metrics influencing premium pricing in insurance underwriting. A higher loss ratio signals increased claim payouts, prompting insurers to raise premiums to maintain profitability. Conversely, an elevated expense ratio, reflecting administrative and operational costs, also drives adjustments in premium rates to cover insurer overhead while balancing competitive pricing.

Industry Benchmarks for Loss and Expense Ratios

Insurance industry benchmarks typically indicate a loss ratio between 60% and 70%, reflecting the proportion of claims paid relative to premiums earned. Expense ratios generally range from 25% to 35%, representing underwriting and operational costs as a percentage of premium income. Maintaining a combined ratio (loss ratio plus expense ratio) below 100% signals profitability and operational efficiency in property and casualty insurance.

Strategies to Improve Loss and Expense Ratios

Implementing predictive analytics enhances underwriting accuracy, reducing claim frequency and severity, which directly improves the loss ratio. Streamlining operational processes and leveraging automation decreases administrative costs, thereby lowering the expense ratio. Regularly auditing claims and adjusting pricing models based on real-time data ensure balanced profitability and sustainable ratio management.

Loss Ratio vs Expense Ratio: Choosing the Right Focus

Loss Ratio measures the percentage of claims paid out compared to premiums earned, reflecting underwriting profitability, while Expense Ratio indicates the proportion of operating expenses to premiums, highlighting cost efficiency. Insurers aiming for sustainable growth must balance lowering the Loss Ratio to reduce claims costs with managing the Expense Ratio to ensure operational efficiency. Prioritizing one ratio over the other depends on the company's strategic goals, market conditions, and underwriting discipline.

Important Terms

Combined Ratio

The combined ratio is a key insurance metric calculated by adding the loss ratio, which measures claims paid relative to premiums earned, and the expense ratio, which represents underwriting and operational costs as a percentage of premiums. A combined ratio below 100% indicates underwriting profitability, whereas a ratio above 100% suggests a loss.

Underwriting Profit

Underwriting profit is achieved when the loss ratio, representing claims paid versus premiums earned, remains lower than the sum of the expense ratio, which covers underwriting and administrative costs, and the combined ratio stays below 100%. Maintaining a low loss ratio compared to the expense ratio indicates efficient risk assessment and cost control, directly contributing to profitable underwriting in insurance companies.

Incurred Losses

Incurred losses represent the total claims and associated costs an insurer must pay, directly impacting the loss ratio, which measures claims expenses against earned premiums. The expense ratio assesses operational costs related to underwriting and administration, with both ratios combined influencing an insurer's overall profitability and financial stability.

Premium Earned

Premium Earned represents the revenue an insurer recognizes from written premiums over a specific period and directly impacts the Loss Ratio, which measures claims paid relative to earned premiums, indicating underwriting profitability. Maintaining a balanced Expense Ratio, the percentage of premium used for operational costs, alongside a controlled Loss Ratio ensures overall underwriting effectiveness and sustainable profitability.

Acquisition Costs

Acquisition costs directly impact the expense ratio by increasing underwriting expenses, which in turn can influence the loss ratio if higher acquisition expenses lead to stricter underwriting or reduced claims. Managing acquisition costs strategically helps maintain a balanced loss ratio and optimizes overall insurance profitability.

Operating Expenses

Operating expenses directly impact the Expense Ratio, which measures the proportion of premiums used to cover these costs, while the Loss Ratio reflects the portion paid out in claims. A balanced comparison of Loss Ratio versus Expense Ratio is crucial for insurers to maintain profitability and ensure sustainable underwriting performance.

Claims Frequency

Claims frequency directly impacts the loss ratio by increasing the total claims paid relative to earned premiums, while the expense ratio remains influenced primarily by operational and administrative costs. A rising claims frequency typically elevates the loss ratio without proportionally affecting the expense ratio, highlighting the need for effective risk management to control underwriting profitability.

Claims Severity

Claims severity directly impacts the loss ratio by increasing the total losses paid relative to premiums earned, which can deteriorate underwriting profitability when loss severity rises disproportionately. Higher claims severity also pressures expense ratios as insurers may incur increased adjustment and investigation costs, necessitating strategic management to balance both ratios for sustainable financial performance.

Retention Ratio

Retention Ratio measures the proportion of premiums an insurer retains after paying reinsurance costs, directly impacting overall profitability by balancing Loss Ratio and Expense Ratio. A lower Retention Ratio may reduce risk exposure but can increase the Expense Ratio due to higher ceding commissions, while a higher Retention Ratio increases risk retention, influencing the Loss Ratio through greater claims responsibility.

Policyholder Dividends

Policyholder dividends are influenced by the loss ratio and expense ratio, as a lower combined ratio indicates higher profitability allowing insurers to distribute dividends to policyholders. When the loss ratio remains below the expense ratio, insurers maintain underwriting profits that contribute to surplus growth, enabling consistent dividend payments.

Loss Ratio vs Expense Ratio Infographic

moneydif.com

moneydif.com