Deductible and excess both refer to the amount a policyholder pays out-of-pocket before the insurance coverage kicks in, but their usage varies by region. A deductible is commonly used in the United States to describe this initial payment, while excess is the preferred term in the United Kingdom and Australia. Understanding the difference helps policyholders manage their premiums and potential claims more effectively.

Table of Comparison

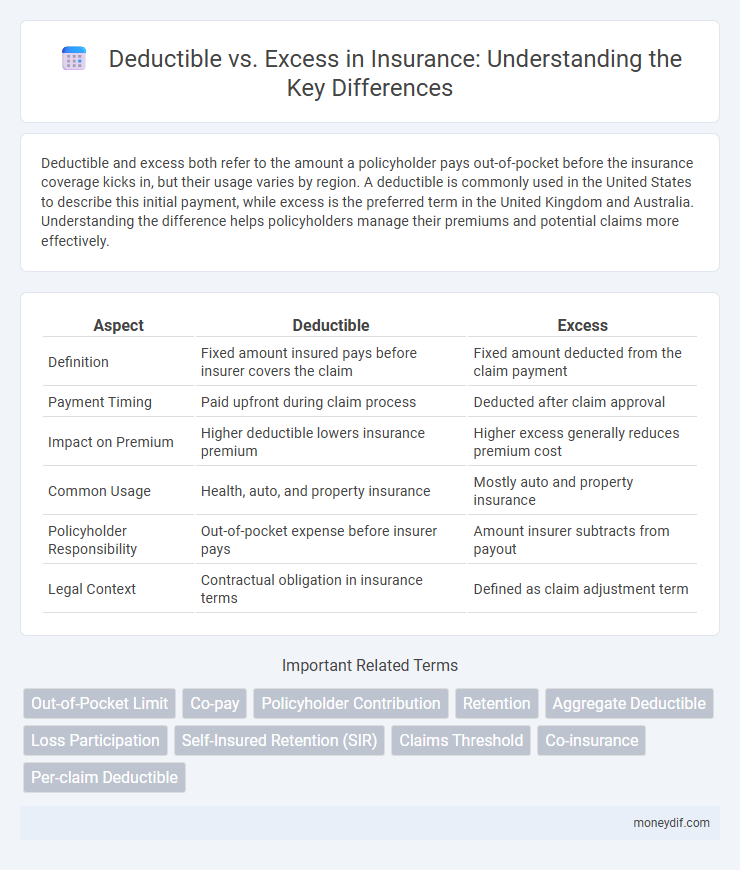

| Aspect | Deductible | Excess |

|---|---|---|

| Definition | Fixed amount insured pays before insurer covers the claim | Fixed amount deducted from the claim payment |

| Payment Timing | Paid upfront during claim process | Deducted after claim approval |

| Impact on Premium | Higher deductible lowers insurance premium | Higher excess generally reduces premium cost |

| Common Usage | Health, auto, and property insurance | Mostly auto and property insurance |

| Policyholder Responsibility | Out-of-pocket expense before insurer pays | Amount insurer subtracts from payout |

| Legal Context | Contractual obligation in insurance terms | Defined as claim adjustment term |

Understanding Deductible and Excess in Insurance

Deductible and excess both refer to the amount a policyholder must pay out-of-pocket before an insurance company covers a claim, though terminology varies by region--deductible is common in the US, while excess is used in the UK and Australia. Understanding the specific deductible or excess amount is crucial for managing potential financial liability and choosing the right insurance policy to balance premium costs with out-of-pocket expenses. Higher deductibles or excesses typically result in lower premiums but increase the initial cost burden during a claim event.

Key Differences Between Deductible and Excess

Deductible and excess are insurance terms referring to the amount a policyholder pays out-of-pocket before the insurer covers a claim, but deductible is commonly used in the United States while excess is prevalent in the United Kingdom and Australia. A deductible is a fixed sum specified in the insurance contract, whereas excess can include voluntary and compulsory components that vary depending on the claim. Understanding these key differences impacts claim costs and premium calculations across various insurance types such as health, auto, and property policies.

How Deductible Works in Insurance Policies

A deductible in insurance policies refers to the fixed amount a policyholder must pay out-of-pocket before the insurer covers any expenses. This predetermined sum reduces the insurer's risk and often results in lower premium costs for the insured. Understanding how deductibles function helps policyholders manage claim expenses and choose coverage options that align with their financial situation.

What is Excess in Insurance?

Excess in insurance refers to the amount a policyholder must pay out of pocket before the insurer covers the remaining claim costs. It is a fixed sum agreed upon in the policy terms and serves to reduce minor claims and manage risk for the insurer. High excess levels can lead to lower premium payments, but increase the insured's financial responsibility during a claim.

Why Insurers Use Deductibles and Excess Amounts

Insurers use deductibles and excess amounts to reduce moral hazard by encouraging policyholders to share the risk and minimize small claims, which helps keep premium costs lower. These financial thresholds also streamline claims processing by filtering out minor losses, allowing insurers to focus resources on significant claims. By implementing deductibles and excesses, insurers maintain more sustainable underwriting practices and promote responsible behavior among insured individuals.

Impact of Deductible and Excess on Premiums

Higher deductibles and excess amounts generally result in lower insurance premiums because the policyholder assumes more initial financial responsibility in the event of a claim. Insurers reduce premium costs as the likelihood of small claims decreases, minimizing their administrative expenses and risk exposure. Choosing between deductible and excess levels directly affects premium affordability and the overall cost-benefit balance of an insurance policy.

Choosing the Right Deductible or Excess Value

Choosing the right deductible or excess value in insurance policies significantly impacts premium costs and out-of-pocket expenses during claims. A higher deductible or excess typically lowers premiums but increases financial risk, while a lower amount provides greater claim coverage with higher premiums. Policyholders must balance affordability with potential claim scenarios to optimize protection and cost-efficiency.

Pros and Cons of Higher vs Lower Deductible/Excess

A higher deductible or excess typically lowers premium costs, making insurance more affordable but increases out-of-pocket expenses during a claim. Conversely, a lower deductible or excess results in higher premiums but reduces immediate financial burden when filing a claim. Choosing the right balance depends on personal risk tolerance and financial capacity to pay upfront costs versus regular premium payments.

Claims Process: When Deductible or Excess Applies

In the claims process, a deductible is the fixed amount the policyholder must pay out-of-pocket before the insurer covers the remaining costs, while excess is the portion deducted from the claim payment. Deductibles often apply to prevent small or frequent claims, ensuring policyholders share initial costs, whereas excess specifically reduces payout amounts after claim approval. Understanding whether a deductible or excess applies is crucial for accurate claim settlements and managing financial responsibilities during insurance payouts.

Tips for Managing Deductible and Excess Costs

Managing deductible and excess costs effectively requires understanding policy terms and choosing coverage that balances premium affordability with out-of-pocket expenses. Opt for higher deductibles to lower premium payments if you can comfortably cover potential expenses, and maintain an emergency fund specifically for unexpected claims. Regularly review and compare insurance policies to find options with flexible excess structures that suit your financial situation.

Important Terms

Out-of-Pocket Limit

The Out-of-Pocket Limit caps the total amount a policyholder pays for deductibles, copayments, and coinsurance within a policy period, protecting against excessive healthcare expenses; deductibles are the fixed initial amounts paid before insurance coverage begins, while excess refers to a predefined sum the insured must pay per claim or incident. Understanding the distinction helps optimize insurance benefits and manage financial risk effectively.

Co-pay

Co-pay is a fixed amount paid by the insured for a covered service, often differing from the deductible, which is the total out-of-pocket expense before insurance benefits begin. Unlike excess, commonly used in auto insurance as the portion paid after a claim, co-pay applies per service and does not reduce the deductible balance.

Policyholder Contribution

Policyholder contribution refers to the amount a policyholder must pay out-of-pocket when filing an insurance claim, which can be structured as either a deductible or an excess. Deductible typically applies per claim and reduces the insurer's liability, while excess often applies once annually or per incident, influencing premiums and claim frequency management in insurance policies.

Retention

Retention represents the portion of a loss that the insured is responsible for before the insurer pays, often set as a dollar amount similar to a deductible; however, unlike an excess, which is an amount the insured must pay first on top of the claim, retention can be viewed as a risk the insured deliberately keeps to reduce premium costs. Deductibles reduce the insurer's liability by the insured bearing initial loss costs, while excess typically comes into play in liability insurance, serving as a threshold that must be surpassed before coverage begins.

Aggregate Deductible

An aggregate deductible represents the total amount a policyholder must pay out-of-pocket for all claims within a policy period before insurance coverage begins, differing from individual deductibles applied to each claim. In contrast, an excess refers to the portion of a claim the insured pays, often fixed per claim, highlighting the distinct financial responsibilities under deductible versus excess mechanisms.

Loss Participation

Loss participation refers to the portion of a claim amount that the insured is responsible for before the insurer pays, typically structured as either a deductible or an excess. While a deductible is fixed and subtracted from the claim payout, an excess is an amount the insured must pay initially, influencing premium costs and risk-sharing in insurance policies.

Self-Insured Retention (SIR)

Self-Insured Retention (SIR) is a risk management mechanism where the insured assumes financial responsibility for losses up to a specified amount before the insurer's coverage begins, often higher than a traditional deductible. Unlike deductibles, SIRs require the insured to manage and pay claims directly within the retention limit, whereas excess coverage applies after the underlying policy limits are exhausted.

Claims Threshold

The claims threshold determines the minimum amount for which a policyholder can file a claim, directly impacting the choice between deductible and excess in insurance policies. A higher claims threshold often aligns with a larger deductible or excess, reducing premium costs but increasing out-of-pocket expenses during a claim.

Co-insurance

Co-insurance requires the policyholder to pay a fixed percentage of the claim amount after the deductible is met, differing from excess, which is a fixed monetary amount paid before the insurer covers the remaining costs. This distinction impacts out-of-pocket expenses, where deductible sets a threshold to initiate claims and excess dictates a consistent upfront payment regardless of claim size.

Per-claim Deductible

A per-claim deductible specifies the amount an insured must pay out-of-pocket for each individual claim before the insurance coverage applies, differing from an excess which typically applies once during the entire policy period. Understanding the distinction between deductible and excess is crucial for accurately assessing liability and overall financial responsibility in insurance contracts.

Deductible vs Excess Infographic

moneydif.com

moneydif.com