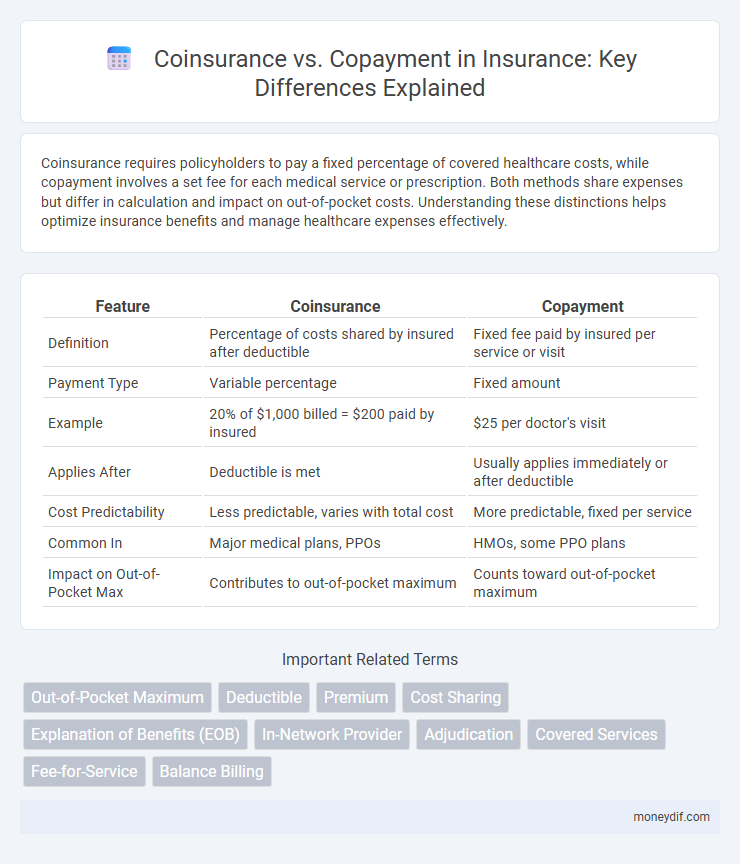

Coinsurance requires policyholders to pay a fixed percentage of covered healthcare costs, while copayment involves a set fee for each medical service or prescription. Both methods share expenses but differ in calculation and impact on out-of-pocket costs. Understanding these distinctions helps optimize insurance benefits and manage healthcare expenses effectively.

Table of Comparison

| Feature | Coinsurance | Copayment |

|---|---|---|

| Definition | Percentage of costs shared by insured after deductible | Fixed fee paid by insured per service or visit |

| Payment Type | Variable percentage | Fixed amount |

| Example | 20% of $1,000 billed = $200 paid by insured | $25 per doctor's visit |

| Applies After | Deductible is met | Usually applies immediately or after deductible |

| Cost Predictability | Less predictable, varies with total cost | More predictable, fixed per service |

| Common In | Major medical plans, PPOs | HMOs, some PPO plans |

| Impact on Out-of-Pocket Max | Contributes to out-of-pocket maximum | Counts toward out-of-pocket maximum |

Understanding Coinsurance and Copayment

Coinsurance is the percentage of medical costs a policyholder pays after meeting their deductible, typically ranging from 10% to 30%, while the insurer covers the remaining amount. Copayment is a fixed amount paid for specific healthcare services, such as $20 for a doctor's visit or $10 for a prescription, regardless of the total cost. Both coinsurance and copayments are essential components of health insurance plans that affect out-of-pocket expenses and overall coverage structure.

Key Differences Between Coinsurance and Copayment

Coinsurance requires policyholders to pay a fixed percentage of the cost for covered healthcare services after meeting the deductible, typically ranging from 10% to 30%, while copayment involves a fixed dollar amount paid for specific services like doctor visits or prescriptions. Coinsurance costs vary based on the total service price, affecting out-of-pocket expenses differently across treatments, whereas copayments remain consistent regardless of service cost. Understanding these distinctions helps insured individuals manage healthcare expenses effectively by anticipating variable coinsurance charges or predictable copayments.

How Coinsurance Works in Health Insurance

Coinsurance in health insurance requires policyholders to pay a fixed percentage of covered medical expenses after meeting their deductible, which helps share costs between the insurer and insured. For example, with a 20% coinsurance rate on a $1,000 hospital bill, the patient pays $200 while the insurer covers $800. This cost-sharing structure encourages careful use of healthcare services and varies depending on specific policy terms and network providers.

How Copayment Functions in Insurance Plans

Copayment in insurance plans functions as a fixed amount a policyholder pays for covered healthcare services at the time of receiving care, such as doctor's visits or prescription medications. This predetermined fee differs from coinsurance, which is a percentage of the total cost shared between the insurer and the insured after deductible fulfillment. Copayments help manage out-of-pocket expenses by providing predictable, set charges for routine medical services, enhancing budget planning for insured individuals.

Impact of Coinsurance on Out-of-Pocket Costs

Coinsurance directly influences out-of-pocket costs by requiring insured individuals to pay a fixed percentage of covered medical expenses, making total expenses variable based on service costs. Higher coinsurance rates result in increased financial responsibility during significant medical treatments, unlike copayments which are fixed amounts per service. Understanding the percentage coinsurance rate is crucial for budgeting healthcare expenses and comparing insurance plans effectively.

Copayment and Predictable Healthcare Expenses

Copayment is a fixed amount paid by the insured at the time of receiving healthcare services, providing predictability in managing healthcare expenses. Unlike coinsurance, which is a percentage of the total cost and can vary, copayments offer a consistent and transparent cost structure for doctor visits, prescriptions, and specialist care. This predictability helps individuals budget their medical costs more effectively, reducing financial uncertainty in routine healthcare management.

Pros and Cons: Coinsurance vs Copayment

Coinsurance requires patients to pay a percentage of the total cost of services, which can lead to lower premiums but higher out-of-pocket expenses for expensive treatments. Copayments involve fixed fees for specific services, providing predictable costs but often resulting in higher monthly premiums. Choosing between coinsurance and copayment depends on prioritizing cost predictability versus potential savings on premiums.

Choosing Between Coinsurance and Copayment Plans

Choosing between coinsurance and copayment plans depends on your healthcare usage and financial preferences. Coinsurance requires paying a percentage of the costs, making it beneficial for low-frequency care but potentially costly for extensive treatments. Copayments offer fixed fees per service, providing predictable expenses ideal for those with regular medical visits or prescriptions.

Factors to Consider When Comparing Coinsurance and Copayment

When comparing coinsurance and copayment, consider the impact on out-of-pocket costs, as coinsurance involves paying a percentage of the service cost while copayment requires a fixed fee. Evaluate the predictability of expenses, since copayments offer fixed amounts that simplify budgeting, whereas coinsurance costs can vary with the total charges. Assess coverage limits and plan details, including maximum out-of-pocket thresholds and service types, to determine which cost-sharing method aligns better with your healthcare usage and financial situation.

Frequently Asked Questions About Coinsurance and Copayment

Coinsurance requires policyholders to pay a percentage of covered medical costs, typically ranging from 10% to 30%, after meeting their deductible, while copayment involves a fixed fee for specific services such as doctor visits or prescriptions. Frequently asked questions address how each affects out-of-pocket expenses, with coinsurance impacting costs proportionally and copayments providing predictable charges. Understanding the differences helps insured individuals effectively manage healthcare budgets and avoid unexpected bills.

Important Terms

Out-of-Pocket Maximum

The Out-of-Pocket Maximum limits total expenses by capping combined Coinsurance payments, which are percentage-based, and Copayments, which are fixed amounts, ensuring insured individuals do not pay beyond a set threshold in a policy period.

Deductible

Deductible is the amount you pay out-of-pocket before insurance covers costs, while coinsurance is a percentage of remaining expenses you share with the insurer, and copayment is a fixed fee for specific services.

Premium

Premiums represent the fixed monthly cost paid for insurance coverage, while coinsurance requires paying a percentage of medical expenses after the deductible is met, contrasting with copayments which are fixed fees for specific services. Understanding the distinction between coinsurance and copayment helps policyholders anticipate out-of-pocket costs beyond the premium, optimizing budget management in health plans.

Cost Sharing

Coinsurance requires paying a percentage of medical costs after deductible, while copayment is a fixed fee for specific services, both forms of cost sharing in health insurance.

Explanation of Benefits (EOB)

Explanation of Benefits (EOB) details how coinsurance--a percentage of costs shared by the insured--and copayment--a fixed fee per service--are applied to medical bills, clarifying patient financial responsibility.

In-Network Provider

In-network providers often require coinsurance, a percentage of costs paid after deductible, whereas copayments are fixed fees per visit or service.

Adjudication

Adjudication in health insurance determines payment responsibilities between coinsurance, where a percentage of costs is shared, and copayment, which involves a fixed fee for services.

Covered Services

Covered services under health insurance plans require patients to pay coinsurance, a percentage of the service cost, or a fixed copayment amount, depending on the policy terms.

Fee-for-Service

Fee-for-Service health insurance typically involves coinsurance, where patients pay a percentage of costs, and copayments, which are fixed fees per service, both contributing to out-of-pocket expenses.

Balance Billing

Balance billing occurs when providers charge patients the difference between their total service cost and the amount covered by coinsurance or copayment under their insurance plan.

Coinsurance vs Copayment Infographic

moneydif.com

moneydif.com