The retroactive date in insurance determines the earliest point from which claims are covered, meaning incidents occurring before this date are not protected under the policy. The extended reporting period allows insured parties to report claims made after the policy ends but triggered by incidents during the coverage period, often providing vital protection against delayed claims. Understanding the distinction between these two features is essential for ensuring continuous liability coverage and avoiding gaps in protection.

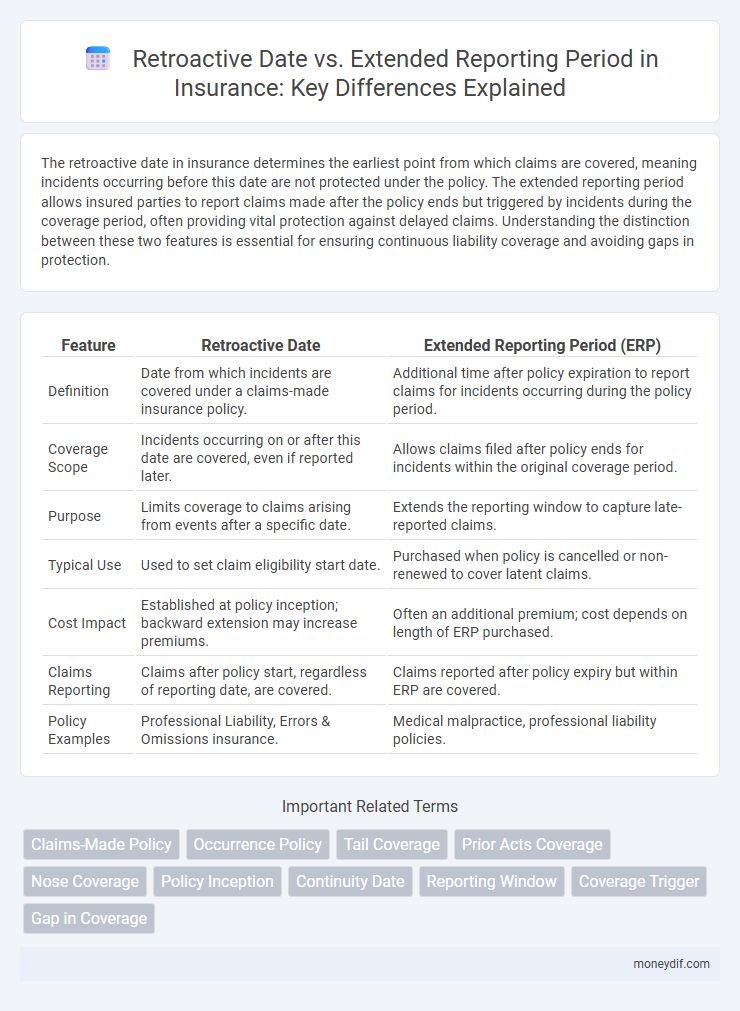

Table of Comparison

| Feature | Retroactive Date | Extended Reporting Period (ERP) |

|---|---|---|

| Definition | Date from which incidents are covered under a claims-made insurance policy. | Additional time after policy expiration to report claims for incidents occurring during the policy period. |

| Coverage Scope | Incidents occurring on or after this date are covered, even if reported later. | Allows claims filed after policy ends for incidents within the original coverage period. |

| Purpose | Limits coverage to claims arising from events after a specific date. | Extends the reporting window to capture late-reported claims. |

| Typical Use | Used to set claim eligibility start date. | Purchased when policy is cancelled or non-renewed to cover latent claims. |

| Cost Impact | Established at policy inception; backward extension may increase premiums. | Often an additional premium; cost depends on length of ERP purchased. |

| Claims Reporting | Claims after policy start, regardless of reporting date, are covered. | Claims reported after policy expiry but within ERP are covered. |

| Policy Examples | Professional Liability, Errors & Omissions insurance. | Medical malpractice, professional liability policies. |

Understanding Retroactive Date in Insurance Policies

The retroactive date in insurance policies specifies the earliest point in time an incident must occur for coverage to apply, ensuring claims relate to events after this date. This date plays a critical role in claims-made policies, as it limits coverage to occurrences post-retroactive date, excluding prior incidents. Understanding the retroactive date helps policyholders manage exposure to prior events and align coverage with risk periods effectively.

What is an Extended Reporting Period (ERP)?

An Extended Reporting Period (ERP) is a provision in claims-made insurance policies that allows policyholders to report claims after the policy has expired, covering incidents that occurred during the policy period but were not reported before its end. ERPs are essential for managing long-tail liabilities in professional liability, errors and omissions (E&O), and directors and officers (D&O) insurance. This extension provides additional time to notify insurers of claims, mitigating the risk of uncovered liabilities after policy termination.

Key Differences Between Retroactive Date and ERP

The Retroactive Date specifies the earliest point in time when an incident can occur to be covered under a claims-made insurance policy, effectively limiting coverage to events after that date. The Extended Reporting Period (ERP) allows policyholders to report claims arising from incidents that occurred before the policy's expiration, extending the reporting window beyond the policy term. While the Retroactive Date defines coverage eligibility, the ERP provides additional time to report claims, ensuring protection against delayed discovery of incidents.

Importance of Retroactive Date in Claims-Made Policies

The retroactive date in claims-made insurance policies defines the earliest point from which incidents can be reported for coverage, ensuring that only claims arising from events after this date are eligible. This date is critical because any claim related to incidents before the retroactive date will be denied, regardless of when the claim is reported. Understanding the retroactive date helps policyholders manage risk effectively and avoid coverage gaps between successive policies or reporting periods.

How Extended Reporting Periods Enhance Coverage

Extended reporting periods (ERPs) enhance insurance coverage by allowing claims to be reported after a policy expires, providing protection for incidents that occurred during the active policy term but were discovered later. This extended timeframe is crucial for claims-made policies, ensuring continuous coverage continuity and minimizing gaps in protection. ERPs complement retroactive dates by extending the reporting window while the retroactive date defines the earliest incident date covered under the policy.

Impact on Claims: Retroactive Date vs ERP

The Retroactive Date limits coverage to incidents that occur after a specified date, directly impacting claims by excluding prior acts from coverage. The Extended Reporting Period (ERP) allows policyholders to report claims made after the policy ends but arising from incidents prior to the termination date, expanding the window for claim submissions. Understanding the interplay between Retroactive Date and ERP is critical for managing claim exposure and ensuring protection against delayed claims.

When Do You Need an Extended Reporting Period?

An Extended Reporting Period (ERP) is necessary when a claims-made insurance policy is canceled or not renewed, providing coverage for claims made after the policy's expiration but arising from incidents that occurred during the policy period. The Retroactive Date limits coverage to incidents that happened on or after that specified date, making the ERP crucial for protecting against claims reported post-termination. Purchasing an ERP ensures continued protection for previously unreported claims within the retroactive period, safeguarding against potential financial liabilities.

Common Pitfalls: Retroactive Date and Coverage Gaps

Misunderstanding the retroactive date can create significant coverage gaps, as claims arising from incidents before this date are often excluded from the policy. Extended reporting periods (ERPs) attempt to bridge these gaps by allowing insureds to report claims after policy termination, but they do not change the retroactive date itself, leaving some earlier claims uncovered. A common pitfall is assuming the ERP provides retroactive coverage, which can lead to unexpected out-of-pocket expenses when uncovered claims emerge.

Choosing the Right Endorsement: Retroactive Date or ERP

Choosing between a Retroactive Date and an Extended Reporting Period (ERP) endorsement in professional liability insurance hinges on coverage timing and claims recognition. The Retroactive Date establishes the earliest point from which incidents are covered under a claims-made policy, ensuring protection for acts occurring after this date. In contrast, an ERP extends the timeframe to report claims after a policy expires or is canceled, allowing for coverage of claims made post-termination but related to incidents during the policy period.

Practical Examples: Retroactive Date vs Extended Reporting Period

In insurance claims, the Retroactive Date determines the earliest point an incident must occur for coverage to apply, meaning an event before this date is excluded from claims. The Extended Reporting Period (ERP) allows policyholders to report claims made after the policy expires, covering incidents that occurred during the active policy but were only discovered later. For example, if a professional liability policy retroactive date is January 1, 2020, claims for incidents before that date are denied, while purchasing an ERP after policy cancellation enables reporting claims discovered within the extension timeframe, typically 1-5 years.

Important Terms

Claims-Made Policy

A Claims-Made Policy with a Retroactive Date provides coverage for claims arising from incidents after that date, while the Extended Reporting Period allows reporting claims discovered after the policy expiration but occurring during the coverage period.

Occurrence Policy

Occurrence policies cover claims for incidents that happen during the policy period regardless of when reported, making the retroactive date irrelevant while extended reporting periods allow claims to be reported after the policy expires.

Tail Coverage

Tail coverage extends claims reporting beyond the retroactive date by providing an extended reporting period for incidents occurring before the policy expiration.

Prior Acts Coverage

Prior Acts Coverage protects claims arising from incidents before the policy inception date, where the Retroactive Date limits coverage to claims occurring after that date, and the Extended Reporting Period allows insureds to report claims made after policy expiration for acts occurring within the coverage period.

Nose Coverage

Nose coverage typically excludes claims arising from incidents occurring before the retroactive date, while the extended reporting period allows for claims to be reported after policy expiration for incidents that happened during the active policy period. Understanding the distinction ensures continuous protection against prior acts claims by aligning retroactive dates with appropriate extended reporting periods.

Policy Inception

Policy inception establishes the coverage start date, where the retroactive date limits claims to incidents occurring after a specified past date, while the extended reporting period allows reporting claims after policy expiration for incidents within the coverage period.

Continuity Date

The Continuity Date ensures uninterrupted coverage by linking the Retroactive Date, which sets the earliest covered claims, with the Extended Reporting Period that allows claims to be reported after the policy ends.

Reporting Window

The Reporting Window in claims management defines the timeframe during which incidents must be reported, with the Retroactive Date marking the earliest occurrence date covered and the Extended Reporting Period allowing claims to be reported after the policy expiration.

Coverage Trigger

Coverage Trigger determines whether claims are covered based on incidents occurring after the Retroactive Date or during the Extended Reporting Period, impacting liability insurance claim eligibility.

Gap in Coverage

The Gap in Coverage occurs when the Retroactive Date predates the Extended Reporting Period, leaving claims made between these periods uninsured.

Retroactive Date vs Extended Reporting Period Infographic

moneydif.com

moneydif.com