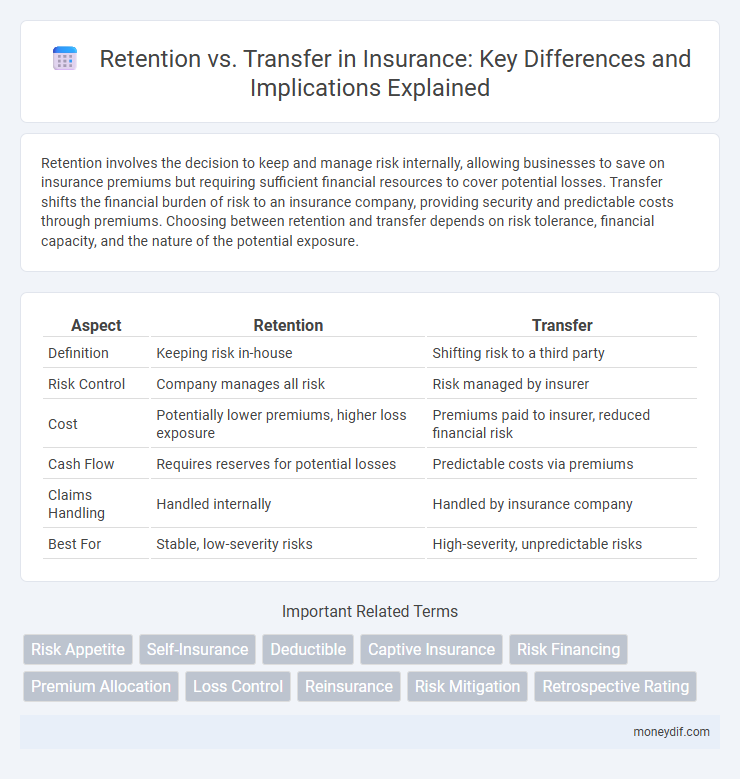

Retention involves the decision to keep and manage risk internally, allowing businesses to save on insurance premiums but requiring sufficient financial resources to cover potential losses. Transfer shifts the financial burden of risk to an insurance company, providing security and predictable costs through premiums. Choosing between retention and transfer depends on risk tolerance, financial capacity, and the nature of the potential exposure.

Table of Comparison

| Aspect | Retention | Transfer |

|---|---|---|

| Definition | Keeping risk in-house | Shifting risk to a third party |

| Risk Control | Company manages all risk | Risk managed by insurer |

| Cost | Potentially lower premiums, higher loss exposure | Premiums paid to insurer, reduced financial risk |

| Cash Flow | Requires reserves for potential losses | Predictable costs via premiums |

| Claims Handling | Handled internally | Handled by insurance company |

| Best For | Stable, low-severity risks | High-severity, unpredictable risks |

Understanding Retention and Transfer in Insurance

Retention in insurance refers to the portion of risk that a company or individual absorbs internally, managing potential losses through reserves or risk control measures. Transfer involves shifting risk to a third party, typically an insurance company, by purchasing coverage that safeguards against financial impact from specified perils. Understanding retention and transfer enables policyholders to balance risk exposure and cost, optimizing protection and financial stability.

Key Differences Between Retention and Transfer

Retention involves a company assuming financial responsibility for certain risks, keeping potential losses within its own reserves, while transfer shifts the risk to an insurer through policies such as liability or property insurance. Key differences include the financial impact, where retention exposes the business to direct loss costs, whereas transfer limits exposure to premium payments. Retention suits predictable, lower-cost risks, whereas transfer is preferred for high-severity, uncertain risks to protect organizational solvency.

When to Choose Risk Retention

Risk retention is advisable when the potential losses are financially manageable and the probability of occurrence is low, allowing companies to save on premium costs and maintain greater control over claims handling. Organizations with strong cash flow and effective risk management systems can benefit from retaining minor risks while transferring only catastrophic exposures through insurance policies. Retaining risk enhances incentive for loss prevention and facilitates better alignment between risk exposure and corporate objectives.

When to Opt for Risk Transfer

Risk transfer is optimal when potential losses exceed an organization's financial capacity or when the risk has high uncertainty and volatility that could threaten business stability. Transferring risk through insurance policies ensures predictable cash flow by converting uncertain losses into fixed premium payments. Businesses facing regulatory requirements, contractual obligations, or high-impact events like natural disasters typically benefit from risk transfer to safeguard assets and maintain operational continuity.

Benefits of Retaining Risk

Retaining risk allows businesses to maintain greater control over their loss prevention strategies and claim handling processes, leading to more tailored risk management solutions. Financially, retention can reduce insurance premiums and administrative costs, improving cash flow and profitability by avoiding third-party insurer fees. Companies also benefit from enhanced awareness of their risk profile, which supports more informed decision-making and long-term risk mitigation planning.

Advantages of Transferring Risk

Transferring risk through insurance mitigates potential financial losses by shifting liability to an insurer, ensuring business continuity and protecting assets. It provides predictable expenses by converting uncertain potential losses into fixed premium payments, facilitating better budgeting and financial planning. Risk transfer also enables access to expert loss prevention services and legal support offered by insurance companies, enhancing overall risk management strategies.

Financial Implications of Retention vs Transfer

Retention involves bearing the risk internally, resulting in predictable cash flow impacts and potentially lower immediate expenses but greater exposure to large losses. Transfer shifts risk to an insurer, creating upfront premium costs that provide financial protection and limit volatility in a company's balance sheet. Careful analysis of loss frequency, severity, and capital costs guides the optimal decision between retention and risk transfer for financial stability.

Factors Influencing the Retention vs Transfer Decision

Key factors influencing the retention versus transfer decision in insurance include the organization's risk tolerance, financial capacity, and the potential impact of loss on operational stability. Evaluating the probability and severity of risks alongside cost-benefit analysis of premiums versus potential claims guides firms in determining whether to self-insure or purchase coverage. Regulatory requirements and market conditions also play crucial roles in shaping retention and transfer strategies.

Real-World Examples of Retention and Transfer

Retention in insurance involves a company or individual assuming the financial risk of potential losses, exemplified by businesses self-insuring for minor property damage to save on premium costs. Transfer occurs when the financial risk is shifted to an insurer, such as purchasing commercial general liability insurance to cover lawsuits and property damage claims. A practical example of retention is a small business setting a high deductible on its policy, while transfer is evident when corporations buy reinsurance to mitigate exposure to catastrophic events.

Best Practices for Balancing Retention and Transfer

Effective risk management in insurance hinges on balancing retention and transfer to optimize financial outcomes and protect company solvency. Best practices include conducting thorough risk assessments, setting retention limits aligned with the insurer's risk appetite, and purchasing reinsurance to transfer excessive exposure. Regularly reviewing risk portfolios and leveraging data analytics enhances decision-making to maintain an optimal retention-transfer mix.

Important Terms

Risk Appetite

Risk appetite defines the level of risk an organization is willing to accept when deciding between retention and transfer strategies. Retention involves absorbing potential losses internally, while transfer mitigates exposure by shifting risk to third parties such as insurers.

Self-Insurance

Self-insurance involves retaining the financial risk of potential losses internally rather than transferring it to an insurance company, which allows organizations to control claim costs and cash flow more effectively. Choosing retention over transfer depends on factors such as risk appetite, financial capacity, and the predictability of losses, often making it suitable for companies with sufficient reserves to cover potential claims.

Deductible

Deductible represents the amount a policyholder must pay out-of-pocket before insurance coverage begins, directly impacting retention by increasing the insured's financial responsibility. Choosing a higher deductible effectively transfers more risk to the insured, while a lower deductible shifts greater financial burden to the insurer.

Captive Insurance

Captive insurance enables organizations to retain risk by forming their own insurance company, minimizing reliance on external carriers and reducing premium costs. This strategic retention contrasts with risk transfer, where companies shift potential losses to third-party insurers to protect against significant financial exposure.

Risk Financing

Risk financing involves choosing between retention, where an organization absorbs potential losses internally, and transfer, which shifts risk to third parties through mechanisms like insurance. Effective risk management balances retention to control costs and transfer to protect against catastrophic losses, optimizing financial resilience.

Premium Allocation

Premium allocation in insurance balances retention and transfer by determining the portion of premiums retained by the insurer versus those allocated for risk transfer through reinsurance contracts. Optimizing this allocation enhances capital efficiency and risk management, ultimately improving the insurer's financial stability and underwriting capacity.

Loss Control

Loss control strategies focus on minimizing risks through prevention and mitigation, directly impacting the choice between risk retention and risk transfer. Effective loss control reduces the frequency and severity of claims, making retention more viable while lowering insurance premiums and enhancing overall risk management efficiency.

Reinsurance

Reinsurance strategically balances retention and transfer by allowing insurers to retain manageable risk levels while transferring excess exposure to reinsurers, optimizing capital efficiency and solvency margins. Effective retention thresholds and transfer agreements mitigate potential large losses, enhancing risk distribution and financial stability across insurance portfolios.

Risk Mitigation

Risk mitigation strategies often involve a critical decision between retention and transfer, where retention accepts the potential loss internally to maintain control and minimize costs, while transfer shifts the risk to third parties such as insurers or outsourcing providers to protect assets and stabilize financial exposure. Evaluating factors like risk appetite, financial capacity, and impact severity guides organizations in choosing optimal retention levels versus risk transfer mechanisms to enhance resilience and operational continuity.

Retrospective Rating

Retrospective rating in insurance adjusts premiums based on actual loss experience, influencing employee retention by aligning costs with workplace safety improvements. Enhanced retention through effective training boosts transfer of knowledge, reducing claims frequency and promoting a safer work environment.

Retention vs Transfer Infographic

moneydif.com

moneydif.com