Subrogation allows an insurer to pursue a third party responsible for a loss to recover the amount paid to the insured, ensuring the recovery of claim costs. Contribution involves multiple insurers sharing the payment of a claim proportionally when the insured is covered by more than one policy for the same risk. Understanding the distinction between subrogation and contribution is crucial for efficient claims management and preventing duplicate payments.

Table of Comparison

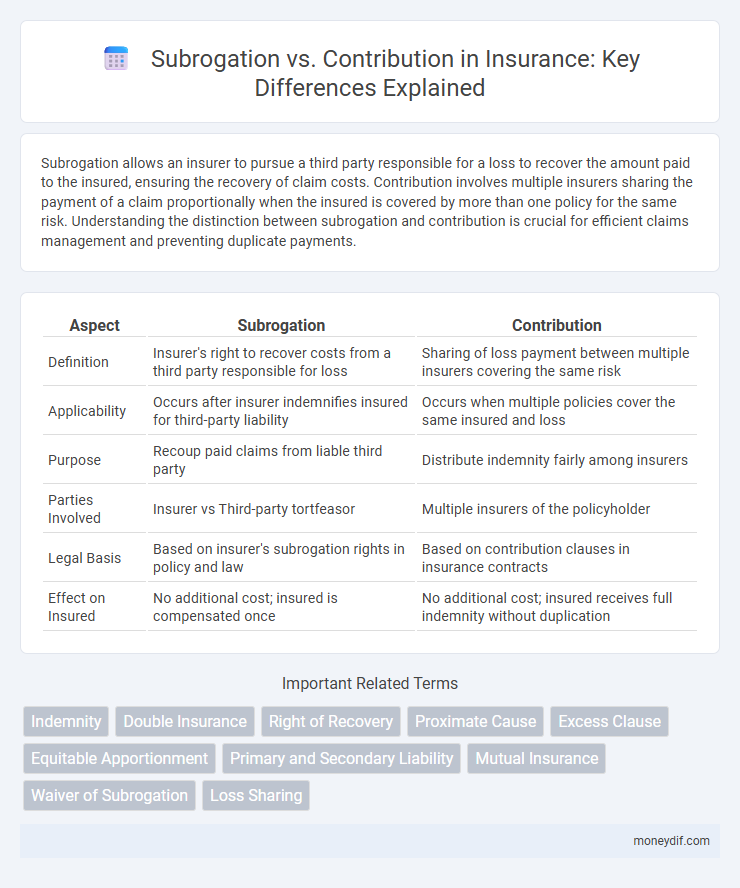

| Aspect | Subrogation | Contribution |

|---|---|---|

| Definition | Insurer's right to recover costs from a third party responsible for loss | Sharing of loss payment between multiple insurers covering the same risk |

| Applicability | Occurs after insurer indemnifies insured for third-party liability | Occurs when multiple policies cover the same insured and loss |

| Purpose | Recoup paid claims from liable third party | Distribute indemnity fairly among insurers |

| Parties Involved | Insurer vs Third-party tortfeasor | Multiple insurers of the policyholder |

| Legal Basis | Based on insurer's subrogation rights in policy and law | Based on contribution clauses in insurance contracts |

| Effect on Insured | No additional cost; insured is compensated once | No additional cost; insured receives full indemnity without duplication |

Understanding Subrogation in Insurance

Subrogation in insurance allows an insurer to pursue a third party responsible for a loss payment made to the insured, recovering the amount paid under the policy. This process helps insurers mitigate losses by shifting the financial burden to the at-fault party, ensuring that the insured does not receive double compensation. Understanding subrogation is essential for maximizing claim recovery and maintaining fair premium costs within the insurance industry.

Key Concepts of Contribution in Insurance

Contribution in insurance ensures multiple insurers covering the same risk share the claim payout proportionately, preventing the insured from profit or loss due to overlapping policies. It operates on the principle of equity, allowing insurers who have paid more than their fair share to recover the excess from others liable. This mechanism maintains balance among insurers by distributing the financial burden fairly based on coverage limits and policy terms.

Differences Between Subrogation and Contribution

Subrogation involves an insurer stepping into the shoes of the insured to recover costs from a third party responsible for a loss, whereas contribution pertains to multiple insurers sharing the indemnity payment on a single claim to avoid overcompensation. In subrogation, only the responsible third party is pursued for reimbursement, while contribution allocates liability proportionally among insurers covering the same risk. The key difference lies in subrogation's recovery from external parties versus contribution's internal cost-sharing among insurers.

Legal Foundations of Subrogation

Subrogation is rooted in equitable principles that allow an insurer to assume the insured's legal rights to pursue recovery from a third party responsible for a loss. This legal foundation ensures the insurer indemnified the insured without unjust enrichment, maintaining fairness in risk distribution. Unlike contribution, which involves shared liability among multiple insurers, subrogation specifically transfers recovery rights after indemnification.

Principles Governing Contribution

Principles governing contribution in insurance ensure that when multiple insurers cover the same risk, each pays its fair share of the loss, preventing the insured from recovering more than the total damage. Contribution relies on the principle of equity, distributing the indemnity proportionally among insurers based on their respective policy limits and liability periods. This system contrasts with subrogation, where one insurer seeks reimbursement from another party responsible for the loss.

When Does Subrogation Apply?

Subrogation applies when an insurer pays a claim on behalf of the insured and has the legal right to recover the amount from the third party responsible for the loss. This typically occurs after indemnifying the policyholder, allowing the insurer to pursue reimbursement to prevent the insured from receiving double compensation. Subrogation ensures that liability is ultimately assigned to the party at fault, safeguarding insurer interests and maintaining fairness in claim settlements.

Triggers for Contribution in Insurance Policies

Triggers for contribution in insurance policies arise when multiple insurers cover the same risk and a claim is made, requiring the sharing of liability among them. Contribution is typically initiated when two or more policies are valid, overlap in coverage, and the insured seeks to recover the full loss, prompting insurers to proportionally divide the claim payout. This mechanism ensures that no single insurer bears the entire financial burden while maintaining equitable indemnity principles.

Subrogation vs Contribution: Practical Examples

Subrogation occurs when an insurer seeks reimbursement from a third party responsible for a loss after paying the insured, such as an auto insurer recovering costs from the at-fault driver's insurer. Contribution involves multiple insurers sharing the payment for the same claim based on their respective policy limits, like when two health insurers coordinate to cover a medical bill. Practical examples highlight subrogation's role in shifting financial responsibility away from the insured, while contribution ensures equitable distribution of liability among multiple insurers.

Impact on Insured and Insurers

Subrogation allows insurers to recover costs from third parties responsible for a loss, reducing the financial burden on the insured by preventing double compensation. Contribution ensures fair apportionment of claim payments among multiple insurers covering the same risk, protecting insurers from disproportionate liability. Both mechanisms balance claim settlements, influencing insurer risk exposure and insured claim outcomes.

Resolving Conflicts: Subrogation and Contribution Claims

Subrogation allows an insurer to recover costs from a third party responsible for a loss, while contribution involves multiple insurers sharing the payment burden for the same claim. Resolving conflicts between subrogation and contribution claims requires clear policy language and coordination among insurers to avoid double recovery. Effective handling of these claims ensures equitable distribution of liability and prevents overlapping indemnity payments.

Important Terms

Indemnity

Indemnity involves one party compensating another for loss or damage, often triggered by subrogation, where an insurer steps into the shoes of the insured to recover costs from a third party responsible for the loss. Contribution requires multiple insurers to share the loss payment proportionally when more than one policy covers the same risk, ensuring fair distribution of liability among all parties involved.

Double Insurance

Double insurance occurs when the same risk is covered by multiple insurance policies, leading to overlapping claims. In subrogation, one insurer seeks reimbursement from another insurer after indemnifying the insured, while in contribution, multiple insurers share the claim proportionally to their policy limits.

Right of Recovery

Right of recovery allows an insurer to reclaim costs from a third party responsible for a loss, emphasizing subrogation where the insurer steps into the insured's shoes to pursue the third party's liability. Contribution involves multiple insurers sharing the indemnity burden proportionally when they cover the same risk to prevent overcompensation.

Proximate Cause

Proximate cause plays a crucial role in determining liability during subrogation and contribution claims, as it establishes the direct link between the defendant's actions and the plaintiff's loss. In subrogation, the insurer's right to recover is contingent upon proving the proximate cause of the loss, while in contribution, it determines the extent to which multiple parties are responsible for a shared obligation.

Excess Clause

The Excess Clause determines the order of liability by specifying which insurer pays after the primary coverage limits are exhausted, impacting the application of subrogation and contribution among multiple insurers. Subrogation allows an insurer to recover costs from a liable third party, while contribution involves insurers sharing the loss proportionally, with the Excess Clause influencing the allocation between primary and excess insurers.

Equitable Apportionment

Equitable apportionment ensures fair distribution of liability among parties in multi-state water disputes, balancing interests to prevent overuse or harm, while subrogation allows an insurer to step into the shoes of the insured to recover losses, differing from contribution which involves sharing payment burdens among co-obligors. Understanding the distinctions between subrogation and contribution under equitable apportionment principles is crucial in legal frameworks governing tort and insurance claims.

Primary and Secondary Liability

Primary liability refers to the direct responsibility of a party for a loss or damage, while secondary liability arises when a party becomes responsible only after the primary liable party fails to satisfy the obligation. In the context of subrogation versus contribution, subrogation allows an insurer to step into the shoes of the insured to recover losses from the primary liable party, whereas contribution involves multiple liable parties sharing the loss proportionally after payment has been made.

Mutual Insurance

Mutual insurance involves policyholders pooling resources to share risks and claims costs, where subrogation allows the insurer to recover expenses from a third party responsible for the loss, whereas contribution requires insurers who share liability to proportionally divide the compensation paid. Understanding the balance between subrogation and contribution is crucial in managing claims efficiently and minimizing losses for mutual insurance entities.

Waiver of Subrogation

Waiver of subrogation prevents an insurer from seeking recovery from a third party responsible for loss, thereby limiting the insurer's right to pursue subrogation claims. Unlike contribution, which involves multiple insurers sharing the liability for the same loss, waiver of subrogation specifically relinquishes the insurer's ability to recover damages from others, often to maintain contractual relationships or reduce litigation risks.

Loss Sharing

Loss sharing involves allocating financial responsibility among multiple parties, often seen in insurance claims where subrogation allows an insurer to recover costs from a third party responsible for the loss. Contribution, by contrast, requires multiple insurers covering the same risk to proportionately share the loss payment based on their coverage limits.

Subrogation vs Contribution Infographic

moneydif.com

moneydif.com