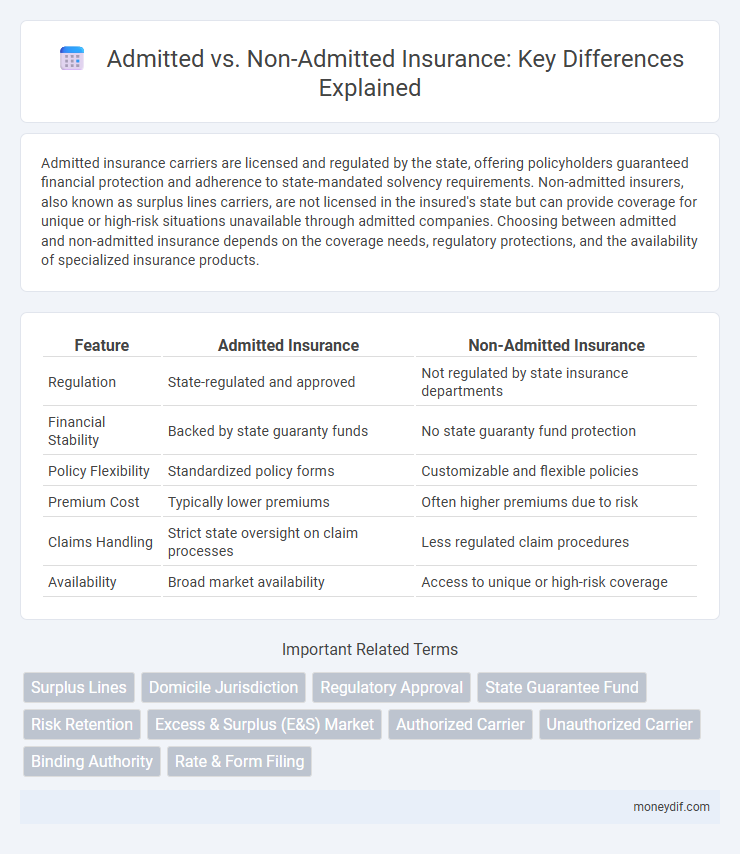

Admitted insurance carriers are licensed and regulated by the state, offering policyholders guaranteed financial protection and adherence to state-mandated solvency requirements. Non-admitted insurers, also known as surplus lines carriers, are not licensed in the insured's state but can provide coverage for unique or high-risk situations unavailable through admitted companies. Choosing between admitted and non-admitted insurance depends on the coverage needs, regulatory protections, and the availability of specialized insurance products.

Table of Comparison

| Feature | Admitted Insurance | Non-Admitted Insurance |

|---|---|---|

| Regulation | State-regulated and approved | Not regulated by state insurance departments |

| Financial Stability | Backed by state guaranty funds | No state guaranty fund protection |

| Policy Flexibility | Standardized policy forms | Customizable and flexible policies |

| Premium Cost | Typically lower premiums | Often higher premiums due to risk |

| Claims Handling | Strict state oversight on claim processes | Less regulated claim procedures |

| Availability | Broad market availability | Access to unique or high-risk coverage |

Understanding Admitted vs Non-Admitted Insurance

Admitted insurance companies are licensed and regulated by the state's insurance department, offering policyholders guaranteed protections such as claim dispute resolution and coverage compliance. Non-admitted insurers, also known as surplus lines carriers, are not licensed in the insured's state but provide specialized coverage for high-risk or unique situations that admitted insurers may decline. Understanding the differences between admitted and non-admitted insurance helps consumers assess regulatory safeguards, coverage availability, and potential cost variations.

Key Differences Between Admitted and Non-Admitted Carriers

Admitted carriers are licensed by the state insurance department and must comply with all state regulations, including offering policy forms approved by the state and participating in state guaranty funds. Non-admitted carriers, also known as surplus lines insurers, are not licensed in the insured's state but are authorized to provide coverage for unique or high-risk situations that admitted carriers will not cover. The key differences include regulatory oversight, market availability, consumer protections, and coverage flexibility, with admitted carriers offering more consumer protections and non-admitted carriers providing broader coverage options for specialized risks.

Regulatory Oversight: Admitted vs Non-Admitted Policies

Admitted insurance carriers are fully licensed and regulated by state insurance departments, ensuring compliance with state-mandated solvency and consumer protection standards. Non-admitted insurers, however, operate without state licensing and are subject to less regulatory oversight, often leading to fewer consumer protections but greater flexibility in risk underwriting. Regulatory oversight differences impact policyholder recourse options, with admitted policies typically offering state guarantee funds while non-admitted policies lack such safety nets.

Benefits of Choosing Admitted Insurance

Admitted insurance companies are licensed and regulated by state insurance departments, ensuring compliance with state laws and consumer protection standards. Policyholders benefit from access to state guaranty funds, which provide financial safety nets if the insurer becomes insolvent. This regulatory oversight and financial security make admitted insurance a reliable choice for comprehensive and legally compliant coverage.

Advantages of Non-Admitted Insurance Solutions

Non-admitted insurance solutions offer increased flexibility in policy terms and coverage customization, enabling businesses to access specialized risks not available through admitted carriers. These solutions often provide broader capacity and quicker turnaround times, essential for industries requiring tailored or high-risk insurance. Regulatory requirements are less stringent, facilitating innovative insurance products and competitive pricing.

Coverage Flexibility: Comparing Policy Options

Admitted insurance carriers are subject to state regulations and offer standardized policies with limited customization, ensuring regulatory oversight and consumer protections. Non-admitted carriers provide greater coverage flexibility by allowing tailored policy options that address unique or high-risk situations not covered by admitted markets. Policyholders seeking specialized coverage often turn to non-admitted insurers for customizable solutions beyond standard offerings.

Claims Handling: What to Expect from Each Type

Admitted insurers, licensed and regulated by the state, offer claims handling processes that follow strict compliance standards, ensuring policyholder protections and prompt resolution. Non-admitted insurers, operating without state licensure, provide more flexible claims handling but may lack the financial guarantees and regulatory oversight found with admitted carriers. Policyholders can expect greater consumer safeguards and standardized claims procedures with admitted insurers, while non-admitted insurers might offer specialized coverage with potentially variable claim payment practices.

State Guarantee Funds and Consumer Protection

Admitted insurers are backed by state guarantee funds, offering policyholders financial protection if the insurer becomes insolvent, whereas non-admitted insurers do not participate in these funds and thus lack this safety net. State guarantee funds ensure consumers have recourse to claims payments, reinforcing trust and stability in the admitted insurance market. Consumers should consider the presence of state guarantee fund coverage as a critical factor when selecting between admitted and non-admitted insurance providers.

When to Consider Non-Admitted Insurance

Non-admitted insurance becomes a viable option when coverage needs exceed the limitations of admitted carriers, often for unique or high-risk businesses lacking standard policy options. Businesses operating in specialized industries or regions with strict regulatory requirements may turn to surplus lines insurers authorized to provide tailored, flexible coverage. This approach balances risk management by accessing broader underwriting capacity outside state-approved markets while ensuring compliance with surplus lines laws.

Frequently Asked Questions: Admitted vs Non-Admitted Insurance

Admitted insurance companies are licensed and regulated by the state insurance department, offering policyholder protections such as state guaranty funds and strict financial oversight. Non-admitted insurers, also known as surplus lines, operate without state licenses but provide coverage for unique or high-risk situations that admitted carriers may decline. Policyholders should verify the regulatory status of their insurer due to differences in consumer protections, claims handling, and premium tax obligations.

Important Terms

Surplus Lines

Surplus lines insurance refers to coverage provided by non-admitted insurers that are not licensed in the insured's state but are authorized to sell policies through surplus lines brokers when admitted markets cannot meet specific risk needs. Unlike admitted carriers, surplus lines insurers do not offer policyholder protections such as state guaranty funds but enable access to specialized or high-risk coverages unavailable in the admitted market.

Domicile Jurisdiction

Domicile jurisdiction determines the legal authority governing insurance policies, impacting whether an insurer is admitted or non-admitted in that state. Admitted insurers comply with domicile jurisdiction regulations, offering policyholder protections, while non-admitted insurers operate outside these mandates, often providing coverage in specialty or surplus lines markets.

Regulatory Approval

Regulatory approval for admitted insurance carriers involves compliance with state-specific licensing and solvency standards, ensuring consumer protection and market stability. Non-admitted insurers operate without state approval but provide coverage for unique or high-risk scenarios, often requiring brokers to file surplus lines reports to regulators.

State Guarantee Fund

State Guarantee Funds typically cover claims from admitted insurers licensed and regulated within the state, providing consumer protection in case of insurer insolvency. Non-admitted insurers, not subject to state licensing, generally do not contribute to or receive coverage from these guarantee funds, limiting state-backed claim recovery options.

Risk Retention

Risk retention refers to an insurer's capacity to absorb losses from claims directly, which is a key factor distinguishing admitted insurers, who are licensed and regulated within a state, from non-admitted insurers that are not subject to the same regulatory oversight. Admitted insurers often have limitations on risk retention imposed by state laws, while non-admitted carriers, operating in the surplus lines market, typically retain higher levels of risk due to fewer regulatory constraints.

Excess & Surplus (E&S) Market

The Excess & Surplus (E&S) market specializes in insuring high-risk or unique exposures that standard admitted carriers decline, operating with fewer regulatory restrictions and offering customized policy terms. Unlike admitted insurers, E&S carriers are non-admitted and not backed by state guarantee funds, providing flexibility but requiring careful consideration of coverage and claims handling.

Authorized Carrier

Authorized carriers are insurance companies licensed and regulated by the state, aligning with admitted carriers that comply with local insurance laws and offer protections such as state guaranty funds. Non-admitted carriers operate without state approval, providing surplus lines coverage often for unique or high-risk risks but without the same regulatory oversight or consumer protections as admitted carriers.

Unauthorized Carrier

Unauthorized carriers operate without regulatory approval, posing significant risks compared to admitted carriers who comply with state insurance department regulations and offer policyholder protections. Unlike non-admitted carriers that have some exceptions for surplus lines, unauthorized carriers lack legal authorization to transact insurance, increasing exposure to financial instability and limited claims recourse.

Binding Authority

Binding Authority allows an insurer's representative to commit the insurer to coverage terms immediately, typically granted to admitted insurers who are licensed in the state, ensuring compliance with regulatory requirements. Non-admitted insurers, operating without state licensure, generally lack binding authority, limiting their ability to provide immediate coverage commitments.

Rate & Form Filing

Rate and form filing requirements differ significantly between admitted and non-admitted insurers, with admitted carriers mandated to file and gain approval from state insurance departments to ensure compliance with regulatory standards. Non-admitted insurers, often operating as surplus lines, are exempt from these stringent filing rules but must still adhere to applicable state-specific reporting and premium tax obligations.

Admitted vs Non-Admitted Infographic

moneydif.com

moneydif.com