Waiver of subrogation and hold harmless clauses both serve to manage liability risks in insurance contracts but operate differently. A waiver of subrogation prevents an insurer from pursuing a third party to recover claim costs after a loss, while a hold harmless agreement requires one party to assume liability for certain damages or losses, protecting the other party from claims. Understanding these distinctions is crucial for effectively allocating risk and minimizing legal exposure in insurance agreements.

Table of Comparison

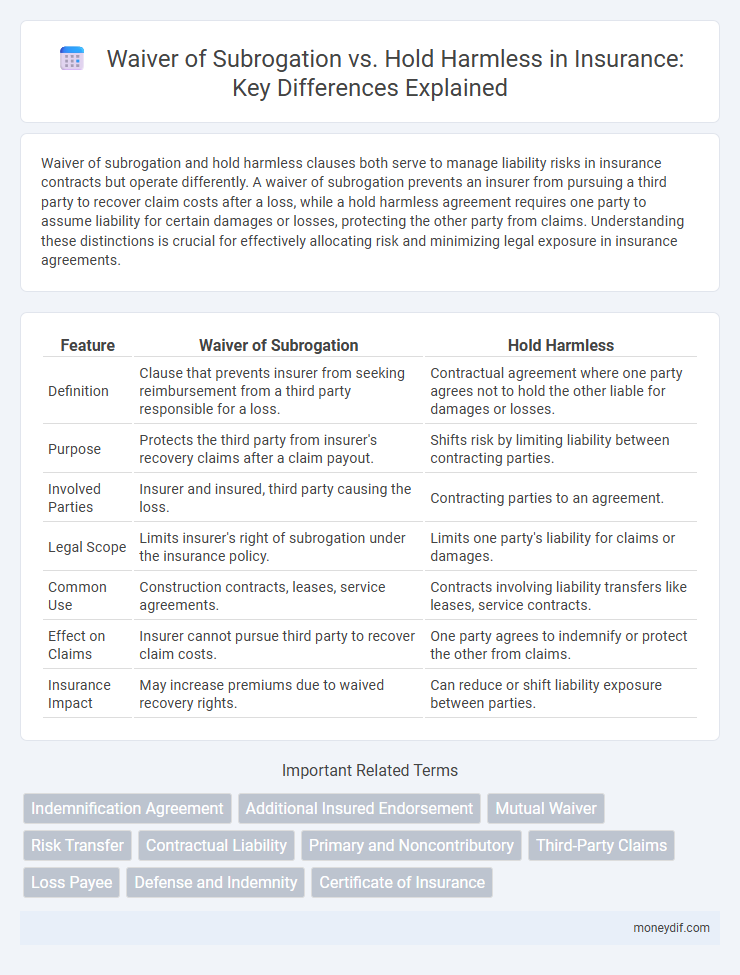

| Feature | Waiver of Subrogation | Hold Harmless |

|---|---|---|

| Definition | Clause that prevents insurer from seeking reimbursement from a third party responsible for a loss. | Contractual agreement where one party agrees not to hold the other liable for damages or losses. |

| Purpose | Protects the third party from insurer's recovery claims after a claim payout. | Shifts risk by limiting liability between contracting parties. |

| Involved Parties | Insurer and insured, third party causing the loss. | Contracting parties to an agreement. |

| Legal Scope | Limits insurer's right of subrogation under the insurance policy. | Limits one party's liability for claims or damages. |

| Common Use | Construction contracts, leases, service agreements. | Contracts involving liability transfers like leases, service contracts. |

| Effect on Claims | Insurer cannot pursue third party to recover claim costs. | One party agrees to indemnify or protect the other from claims. |

| Insurance Impact | May increase premiums due to waived recovery rights. | Can reduce or shift liability exposure between parties. |

Understanding Waiver of Subrogation

Waiver of Subrogation in insurance prevents an insurer from pursuing recovery from a third party responsible for a loss, protecting the insured from potential litigation. It is commonly included in contracts to maintain business relationships and avoid costly disputes after claims. Understanding this clause helps policyholders manage risk and negotiate more favorable insurance agreements.

What Is a Hold Harmless Agreement?

A Hold Harmless Agreement is a legal contract in insurance where one party agrees not to hold the other responsible for any liability or damages that may arise during an activity or contract. This agreement protects one party from being sued or held financially responsible for certain risks, shifting potential loss to the other party. Unlike Waiver of Subrogation, which prevents insurers from seeking compensation after a claim, Hold Harmless Agreements directly protect contractual parties from claims and lawsuits.

Key Differences Between Waiver of Subrogation and Hold Harmless

Waiver of Subrogation prevents an insurer from seeking reimbursement from a third party responsible for a loss, effectively waiving the insurer's right to pursue subrogation. Hold Harmless agreements shift liability from one party to another, ensuring that one party agrees not to hold the other liable for damages or claims arising from a specific event. The key difference lies in Waiver of Subrogation focusing on the insurer's rights, while Hold Harmless clauses allocate risk and liability between contractual parties.

Legal Implications for Insurance Policies

Waiver of subrogation prevents an insurer from seeking recovery from a third party responsible for a loss, shifting the financial burden to the insurer and limiting legal liability exposure for the insured. Hold harmless agreements require one party to assume responsibility for damages or legal claims, protecting the other party from financial loss and affecting indemnity obligations within insurance policies. Understanding these legal implications is critical for drafting contracts, as they directly influence risk allocation, claim processes, and potential litigation outcomes in insurance coverage.

Impact on Risk Management Strategies

Waiver of Subrogation limits an insurer's right to pursue recovery from a third party, shifting the financial burden directly to the insured, which reduces litigation risks and promotes smoother claim settlements. Hold Harmless agreements transfer liability between contracting parties, effectively managing potential exposure by clearly defining responsibilities and minimizing disputes. Integrating these clauses strategically enhances risk management by aligning contractual obligations with insurance coverage, thereby optimizing loss prevention and control measures.

Common Industries Using These Clauses

Construction, real estate, and manufacturing industries commonly utilize waiver of subrogation and hold harmless clauses to manage risk and liability. These clauses protect parties from financial loss by preventing insurance carriers from pursuing recovery after a claim and shifting responsibility for damages. Healthcare and technology sectors also incorporate these agreements to safeguard against third-party claims and contractual liabilities.

Contract Drafting: Waiver of Subrogation vs Hold Harmless

In contract drafting, Waiver of Subrogation prevents an insurer from pursuing recovery from a third party, protecting the other party from claims after a loss. Hold Harmless clauses shift liability by requiring one party to indemnify and defend the other against claims or damages. Differentiating these provisions clearly is essential to allocate risk appropriately and avoid overlapping responsibilities in insurance agreements.

Potential Pitfalls and Liability Concerns

Waiver of Subrogation limits an insurer's right to recover costs from a third party, potentially increasing liability exposure by shifting risk to the insured party. Hold Harmless agreements transfer liability between parties, but overly broad language can unintentionally waive essential legal rights or impose unforeseen responsibilities. Both clauses require precise drafting to avoid ambiguous interpretations that could lead to significant financial and legal pitfalls.

Best Practices for Policyholders and Insured Parties

Policyholders and insured parties should carefully review waiver of subrogation and hold harmless clauses to avoid relinquishing critical recovery rights or assuming unintended liabilities. Waiver of subrogation prevents an insurer from pursuing third parties to recover losses, while hold harmless clauses shift liability away from one party, often requiring explicit negotiation to align with the policy terms. Best practices include consulting insurance professionals to ensure clear, mutually agreeable contracts that protect financial interests without compromising legal protections.

Choosing the Right Clause for Your Business

Choosing the right clause for your business involves understanding the distinct protections offered by Waiver of Subrogation and Hold Harmless agreements. Waiver of Subrogation prevents an insurer from pursuing recovery from a third party after paying a claim, while Hold Harmless clauses allocate risk by requiring one party to assume liability for certain damages or losses. Evaluating contract specifics, industry risks, and insurance policies ensures optimal risk management and financial protection tailored to your business needs.

Important Terms

Indemnification Agreement

An Indemnification Agreement often includes clauses such as Waiver of Subrogation and Hold Harmless provisions that allocate risk between parties; the Waiver of Subrogation prevents an insurer from seeking reimbursement from the indemnified party after a claim, while the Hold Harmless clause requires one party to assume liability for certain damages or losses, protecting the other from legal responsibility. These terms are critical in contracts to minimize litigation and clarify financial responsibility in case of third-party claims or property damage.

Additional Insured Endorsement

An Additional Insured Endorsement extends coverage to a third party, while a Waiver of Subrogation prevents the insurer from pursuing recovery against that party. Hold Harmless agreements transfer risk by contractually requiring one party to assume liability, differing from insurance endorsements that modify coverage scope.

Mutual Waiver

Mutual waiver involves both parties agreeing to relinquish subrogation rights, preventing either from pursuing recovery against the other, which differs from a hold harmless clause where one party agrees to indemnify the other against specified liabilities. Waiver of subrogation specifically targets insurance claim recoveries, while hold harmless provisions broaden liability protection beyond insurance contexts.

Risk Transfer

Risk transfer mechanisms such as Waiver of Subrogation and Hold Harmless agreements serve distinct roles in shifting liability and financial responsibility between parties. Waiver of Subrogation prevents an insurer from pursuing recovery from a third party, while Hold Harmless clauses shift indemnity for damages directly between contracting parties, minimizing litigation risks.

Contractual Liability

Contractual liability specifies obligations each party assumes under a contract, often involving indemnification clauses where the waiver of subrogation prevents insurers from pursuing recovery from the other party, while hold harmless agreements require one party to protect the other from claims or damages. Understanding these legal distinctions is critical for risk allocation in contracts, as waiver of subrogation limits insurer rights whereas hold harmless transfers risk responsibility directly to a party.

Primary and Noncontributory

Primary and noncontributory insurance clauses ensure that the primary insurer pays claims without seeking contribution from other insurers, protecting the insured party's interests in Waiver of Subrogation and Hold Harmless agreements. Waiver of Subrogation prevents the insurer from pursuing recovery against third parties, while Hold Harmless agreements require one party to assume liability, making primary and noncontributory clauses critical for clarifying responsibility and risk allocation.

Third-Party Claims

Third-party claims often involve disputes where a waiver of subrogation prevents the insurer from pursuing recovery against a third party, while a hold harmless agreement shifts liability directly to one party, protecting the other from legal responsibility. Both mechanisms serve to allocate risk but differ in that waiver of subrogation limits insurer actions, whereas hold harmless agreements contractually assign indemnity between parties.

Loss Payee

Loss Payee clauses protect lenders or financiers by ensuring insurance claims are paid to them in case of damage or loss, while Waiver of Subrogation prevents an insurer from pursuing recovery from the loss payee, aligning interests to avoid litigation. Hold Harmless agreements shift liability away from one party, typically protecting the indemnitee from claims, which differs from Loss Payee stipulations that focus on claim payment priorities rather than indemnity responsibilities.

Defense and Indemnity

Defense and indemnity clauses allocate responsibility for legal costs and damages, while waiver of subrogation prevents an insurer from seeking recovery from a third party; hold harmless agreements require one party to assume liability for claims or losses incurred by another. Understanding these distinctions is critical in contract law to ensure proper risk management and liability protection.

Certificate of Insurance

A Certificate of Insurance (COI) documents coverage details and may include a Waiver of Subrogation endorsement, which prevents the insurer from pursuing a third party for damages paid under the policy. The Hold Harmless agreement shifts liability and indemnifies one party against claims, complementing COI by protecting contractual partners beyond insurance limitations.

Waiver of Subrogation vs Hold Harmless Infographic

moneydif.com

moneydif.com