Admitted carriers are insurance companies fully licensed and regulated by a state's insurance department, offering policies that comply with state laws and guarantee claim payments through state protections. Non-admitted carriers operate without state licensing, providing coverage often for unique or high-risk situations but without the same regulatory oversight or guaranties. Choosing between admitted and non-admitted carriers depends on the specific insurance needs, risk tolerance, and the availability of coverage options.

Table of Comparison

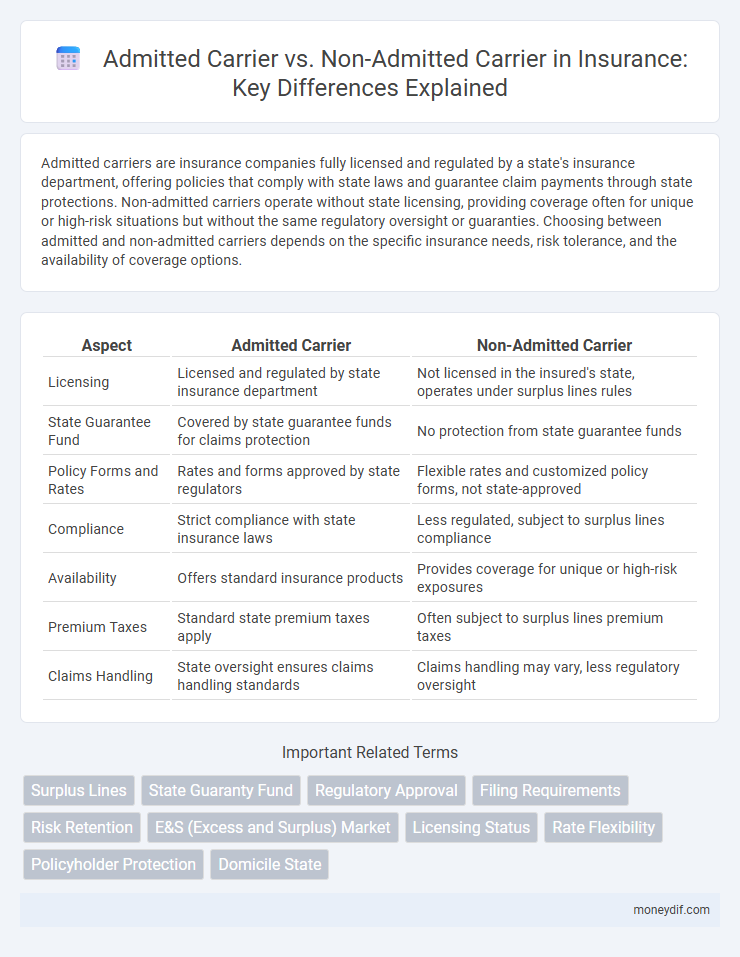

| Aspect | Admitted Carrier | Non-Admitted Carrier |

|---|---|---|

| Licensing | Licensed and regulated by state insurance department | Not licensed in the insured's state, operates under surplus lines rules |

| State Guarantee Fund | Covered by state guarantee funds for claims protection | No protection from state guarantee funds |

| Policy Forms and Rates | Rates and forms approved by state regulators | Flexible rates and customized policy forms, not state-approved |

| Compliance | Strict compliance with state insurance laws | Less regulated, subject to surplus lines compliance |

| Availability | Offers standard insurance products | Provides coverage for unique or high-risk exposures |

| Premium Taxes | Standard state premium taxes apply | Often subject to surplus lines premium taxes |

| Claims Handling | State oversight ensures claims handling standards | Claims handling may vary, less regulatory oversight |

Understanding Admitted and Non-Admitted Carriers

Admitted carriers are insurance companies licensed and regulated by the state, ensuring they comply with state-specific financial and operational standards to protect policyholders. Non-admitted carriers, also known as surplus lines insurers, are not licensed in the state but can provide coverage for specialized or high-risk situations where admitted carriers may not offer policies. Understanding the difference helps consumers evaluate coverage reliability, claims handling, and regulatory protections when selecting insurance providers.

Key Differences Between Admitted and Non-Admitted Insurance

Admitted carriers are insurance companies licensed and regulated by state insurance departments, offering policies backed by state guaranty funds that protect policyholders in case of insolvency. Non-admitted carriers, also known as surplus lines insurers, are not subject to state regulations or guaranty funds, allowing them to provide coverage for high-risk or unique situations typically declined by admitted markets. The key differences lie in regulatory oversight, consumer protections, and the types of risks each carrier can insure.

Regulatory Oversight: How Carriers Are Governed

Admitted carriers are fully licensed and regulated by the state insurance department, ensuring compliance with state laws and consumer protection standards. Non-admitted carriers operate without a state license and are subject to less stringent regulatory oversight, often filling gaps in coverage for unique or high-risk policies. State guaranty funds protect policyholders of admitted carriers but typically do not cover claims from non-admitted insurers, emphasizing the regulatory and financial risk differences between the two.

State Guarantee Funds: Are You Protected?

State Guarantee Funds provide policyholder protection when dealing with admitted carriers, ensuring claims are paid even if the insurer becomes insolvent. Non-admitted carriers, however, operate without state licensing, so policies issued by them are typically not covered by these funds, increasing risk for policyholders. Understanding the distinctions between these carriers and the protections offered by state guarantee funds is crucial for informed insurance decisions.

Licensing Requirements for Carriers

Admitted carriers are insurance companies licensed and regulated by a state's insurance department, ensuring compliance with local laws and consumer protection standards. Non-admitted carriers, also known as surplus lines insurers, operate without state licensing but are allowed to provide coverage for high-risk or unique situations not covered by admitted carriers. Licensing requirements for admitted carriers include meeting financial solvency standards, submitting policy forms for approval, and maintaining market conduct oversight, while non-admitted carriers are subject to less stringent state regulations but must register as surplus lines providers.

Pros and Cons of Admitted Carriers

Admitted carriers are insurance companies licensed and regulated by the state insurance department, ensuring compliance with local laws and the backing of state guaranty funds that protect policyholders in case of insolvency. Their pros include financial stability, regulated rates, and consumer protection, while cons involve potentially higher premiums and less flexibility in policy terms compared to non-admitted carriers. Non-admitted carriers offer more customized coverage options but lack the same regulatory oversight and guaranty fund protections.

Benefits and Risks of Non-Admitted Carriers

Non-admitted carriers offer greater flexibility in underwriting and can provide coverage for unique or high-risk exposures that admitted carriers may decline, making them essential for specialized insurance needs. However, risks include limited regulatory oversight, lack of state-guaranteed protections, and potential challenges in claims handling, which can increase uncertainty for policyholders. Choosing a non-admitted carrier requires careful evaluation of their financial stability and reputation to balance coverage benefits against the inherent risks.

Claims Handling: What Policyholders Should Expect

Admitted carriers, licensed and regulated by the state insurance department, offer policyholders more reliable claims handling with guaranteed financial solvency and access to state guaranty funds, ensuring claims are processed swiftly and fairly. Non-admitted carriers operate without state approval, which can result in less predictable claims handling practices, limited regulatory oversight, and no protection from guaranty funds, potentially causing delays or disputes in claims resolution. Policyholders should carefully evaluate the claims process reliability and regulatory protections when choosing between admitted and non-admitted carriers to protect their financial interests during a claim.

Suitability: Which Carrier Type Fits Your Needs?

Admitted carriers are licensed by state insurance departments, offering policyholder protection through state guaranty funds, making them suitable for individuals seeking regulatory oversight and financial security. Non-admitted carriers, also known as surplus lines insurers, provide coverage for unique or high-risk situations not typically covered by admitted insurers, fitting businesses with specialized or hard-to-place risks. Choosing between these carriers depends on the need for regulatory safeguards versus flexibility and access to customized insurance solutions.

Making an Informed Choice: Admitted vs. Non-Admitted Insurance

Choosing between admitted and non-admitted carriers requires understanding key differences in regulatory oversight, financial stability, and claims handling. Admitted carriers are licensed and regulated by state insurance departments, offering policyholders guaranteed protection under state guaranty funds, while non-admitted carriers operate without state approval and may provide coverage for unique or high-risk situations but carry higher risk exposure. Evaluating insurer financial ratings, coverage needs, and regulatory safeguards ensures an informed insurance decision aligned with risk tolerance and compliance requirements.

Important Terms

Surplus Lines

Surplus lines insurance allows coverage through non-admitted carriers when admitted carriers cannot provide adequate protection, offering flexibility but with less regulatory oversight.

State Guaranty Fund

State Guaranty Funds protect policyholders by covering claims from insolvent admitted carriers, while non-admitted carriers are typically excluded from these protections.

Regulatory Approval

Regulatory approval determines whether an admitted carrier meets state insurance requirements and benefits from state-guaranteed protections, while non-admitted carriers operate without such approval, offering flexibility but less regulatory oversight.

Filing Requirements

Admitted carriers are required to file rates, policies, and financial statements with state insurance departments, whereas non-admitted carriers generally do not have these filing obligations.

Risk Retention

Risk retention involves accepting potential losses internally, with admitted carriers offering regulatory compliance and guaranteed claims payment, while non-admitted carriers provide flexible coverage options but lack state-guaranteed protections.

E&S (Excess and Surplus) Market

The E&S market primarily serves risks declined by admitted carriers, with non-admitted carriers offering flexible underwriting and coverage options not bound by state filing regulations.

Licensing Status

Licensing status determines whether an insurance provider is an admitted carrier, officially authorized and regulated by the state's insurance department, or a non-admitted carrier, operating without state approval but often offering specialized or excess coverage. Admitted carriers comply with state-mandated financial solvency and consumer protection standards, while non-admitted carriers typically provide coverage for high-risk or unique exposures not served by admitted insurers.

Rate Flexibility

Rate flexibility is typically higher with non-admitted carriers as they are not bound by state-approved rate regulations, unlike admitted carriers who must adhere to state insurance department's rate filings and approvals.

Policyholder Protection

Policyholder protection is enhanced with admitted carriers due to state insurance department regulation and guaranty fund coverage, whereas non-admitted carriers lack these safeguards but may offer specialized or surplus lines coverage.

Domicile State

Domicile state regulations determine whether an insurance company qualifies as an admitted carrier authorized to operate under state insurance laws or as a non-admitted carrier operating without such authorization.

Admitted Carrier vs Non-Admitted Carrier Infographic

moneydif.com

moneydif.com