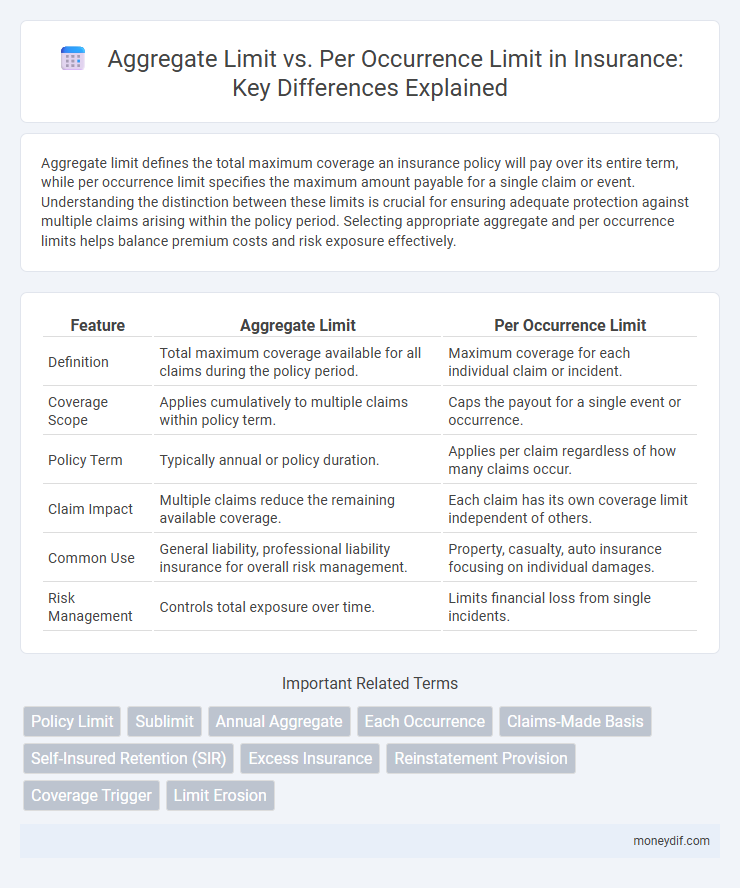

Aggregate limit defines the total maximum coverage an insurance policy will pay over its entire term, while per occurrence limit specifies the maximum amount payable for a single claim or event. Understanding the distinction between these limits is crucial for ensuring adequate protection against multiple claims arising within the policy period. Selecting appropriate aggregate and per occurrence limits helps balance premium costs and risk exposure effectively.

Table of Comparison

| Feature | Aggregate Limit | Per Occurrence Limit |

|---|---|---|

| Definition | Total maximum coverage available for all claims during the policy period. | Maximum coverage for each individual claim or incident. |

| Coverage Scope | Applies cumulatively to multiple claims within policy term. | Caps the payout for a single event or occurrence. |

| Policy Term | Typically annual or policy duration. | Applies per claim regardless of how many claims occur. |

| Claim Impact | Multiple claims reduce the remaining available coverage. | Each claim has its own coverage limit independent of others. |

| Common Use | General liability, professional liability insurance for overall risk management. | Property, casualty, auto insurance focusing on individual damages. |

| Risk Management | Controls total exposure over time. | Limits financial loss from single incidents. |

Understanding Aggregate Limit in Insurance

The aggregate limit in insurance defines the maximum total amount an insurer will pay for all covered claims during a policy period, providing a cap on overall liability exposure. It differs from the per occurrence limit, which sets the maximum payout for a single claim or incident. Understanding the aggregate limit is crucial for policyholders to assess their total risk coverage and ensure sufficient protection against multiple claims within one policy term.

Defining Per Occurrence Limit

The Per Occurrence Limit in insurance defines the maximum amount an insurer will pay for a single claim or event during the policy period. This limit applies to each individual loss incident, regardless of the total number of claims filed. Understanding the Per Occurrence Limit is crucial for assessing coverage scope compared to the Aggregate Limit, which caps total claims over the policy term.

Key Differences Between Aggregate and Per Occurrence Limits

Aggregate limits represent the maximum total coverage an insurance policy will pay over its entire term, whereas per occurrence limits cap the payout for each individual claim or incident. The aggregate limit controls the overall exposure of the insurer during the policy period, while the per occurrence limit manages risk on a claim-by-claim basis. Understanding these distinctions is crucial for assessing coverage adequacy, especially in liability insurance policies.

How Aggregate Limits Impact Your Coverage

Aggregate limits define the maximum total coverage an insurance policy will pay during the policy period, capping the overall payout regardless of the number of claims filed. This total cap influences risk management strategies, as reaching the aggregate limit may leave remaining claims uninsured. Understanding aggregate limits is crucial for businesses to ensure adequate protection across multiple incidents, unlike per occurrence limits that reset with each separate claim.

The Role of Per Occurrence Limits in Claim Payouts

Per occurrence limits define the maximum amount an insurer will pay for a single claim or incident within a policy period, directly impacting the payout for individual claims. These limits control the insurer's exposure by capping payments per event, ensuring financial predictability and risk management in claim settlements. Understanding per occurrence limits is crucial for policyholders to assess coverage adequacy when multiple claims arise from separate events.

Real-World Examples: Aggregate Limit vs Per Occurrence Limit

Aggregate limits cap the total insurance payout for all claims during a policy period, exemplified by a commercial general liability policy with a $2 million aggregate limit that covers multiple incidents throughout the year. Per occurrence limits set the maximum payout for a single claim or event, such as a $500,000 per occurrence limit that applies to each individual accident under the same policy. In real-world applications, a construction company might deplete its per occurrence limits after a major site accident but still have coverage available under the aggregate limit for subsequent smaller claims.

Pros and Cons of Aggregate Limits

Aggregate limits cap the total amount an insurer will pay for all claims during a policy term, providing clear budget control and predictable maximum liability for policyholders. A key advantage is cost savings on premiums compared to per occurrence limits, but the downside is the risk of depleting coverage early in the policy term from multiple small claims, leaving insufficient protection for subsequent larger losses. Aggregate limits suit businesses with lower frequency risks but can expose high-frequency, high-severity risk profiles to gaps in coverage when claims accumulate rapidly.

Advantages and Drawbacks of Per Occurrence Limits

Per occurrence limits in insurance provide specific coverage limits for each individual claim or event, allowing for clear and predictable financial exposure per incident. These limits can prevent a single large loss from depleting the entire policy limit, offering protection across multiple claims during the policy period. However, per occurrence limits may result in insufficient coverage if multiple smaller claims accumulate, potentially leading to higher out-of-pocket costs once the per incident cap is reached.

Choosing the Right Limit Structure for Your Policy

Selecting the appropriate limit structure in insurance depends on the nature of potential claims and the organization's risk exposure. Aggregate limits cap the total payout for all claims within the policy period, ideal for multiple small claims, while per occurrence limits set a maximum payout for each individual claim, better suited for high-severity but less frequent losses. Evaluating historical claim frequency and severity helps determine whether aggregate or per occurrence limits provide optimal financial protection and cost-effectiveness.

Frequently Asked Questions: Aggregate vs Per Occurrence Limits

Aggregate limit defines the maximum amount an insurer will pay for all claims during the policy period, while per occurrence limit specifies the maximum payout for a single claim or incident. Policyholders often ask how these limits impact coverage when multiple claims arise from one event or several separate incidents. Understanding the difference helps assess risk exposure and ensures adequate protection against large or repeated losses within the insurance policy term.

Important Terms

Policy Limit

Policy limit defines the maximum payout an insurer will cover, with aggregate limits capping total claims within the policy period and per occurrence limits restricting payout for each individual claim.

Sublimit

Sublimit defines a specific coverage cap within an insurance policy, distinguishing the Aggregate Limit as the total maximum payable during the policy term, while the Per Occurrence Limit restricts the payout for a single event.

Annual Aggregate

The Annual Aggregate Limit represents the total maximum coverage available for all claims within a policy year, whereas the Per Occurrence Limit specifies the maximum payout for a single incident.

Each Occurrence

Each Occurrence coverage defines the maximum payout per individual claim, while Aggregate Limit caps the total payout for all claims within the policy period.

Claims-Made Basis

Claims-Made Basis policies feature aggregate limits that cap total claims within the policy period, while per occurrence limits restrict coverage for each individual incident.

Self-Insured Retention (SIR)

Self-Insured Retention (SIR) requires the insured to cover losses up to a specified amount before insurance pays, differing from Per Occurrence Limits which cap payment per incident, while Aggregate Limits set the maximum total payout over the policy period.

Excess Insurance

Excess insurance provides coverage beyond the per occurrence limit by extending protection up to the aggregate limit, ensuring higher policy limits for multiple claims within the policy period.

Reinstatement Provision

The reinstatement provision allows policyholders to restore the aggregate limit after a claim, ensuring coverage resets to full capacity rather than being permanently reduced by the per occurrence limit.

Coverage Trigger

Coverage Trigger determines whether claims reduce the Aggregate Limit or apply separately under the Per Occurrence Limit in insurance policies.

Limit Erosion

Limit erosion occurs when cumulative payments under the per occurrence limit reduce the aggregate limit, diminishing the total available coverage in an insurance policy.

Aggregate Limit vs Per Occurrence Limit Infographic

moneydif.com

moneydif.com