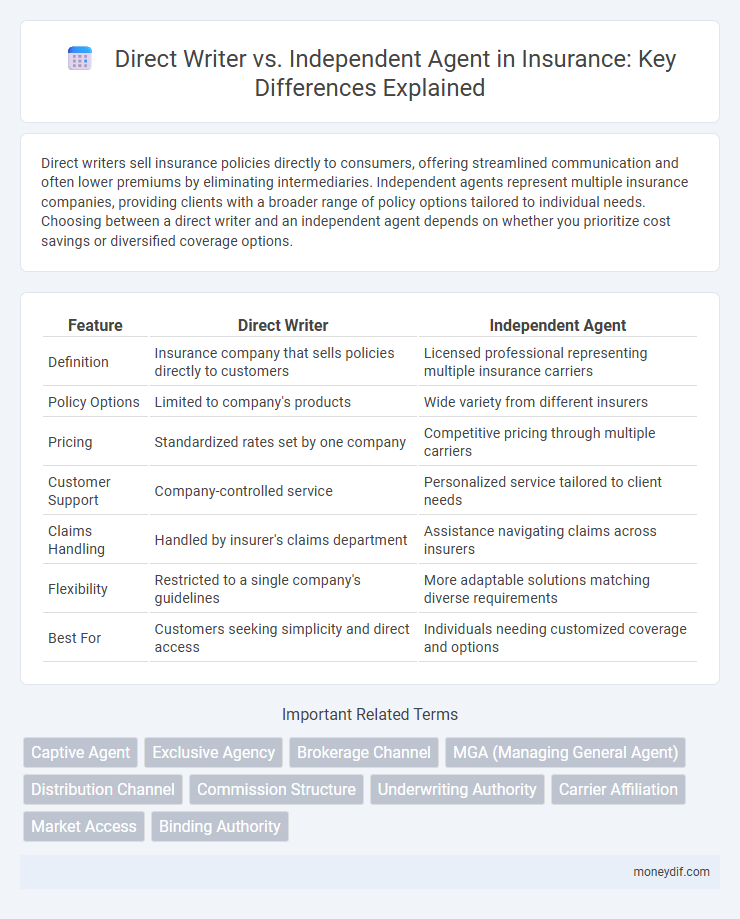

Direct writers sell insurance policies directly to consumers, offering streamlined communication and often lower premiums by eliminating intermediaries. Independent agents represent multiple insurance companies, providing clients with a broader range of policy options tailored to individual needs. Choosing between a direct writer and an independent agent depends on whether you prioritize cost savings or diversified coverage options.

Table of Comparison

| Feature | Direct Writer | Independent Agent |

|---|---|---|

| Definition | Insurance company that sells policies directly to customers | Licensed professional representing multiple insurance carriers |

| Policy Options | Limited to company's products | Wide variety from different insurers |

| Pricing | Standardized rates set by one company | Competitive pricing through multiple carriers |

| Customer Support | Company-controlled service | Personalized service tailored to client needs |

| Claims Handling | Handled by insurer's claims department | Assistance navigating claims across insurers |

| Flexibility | Restricted to a single company's guidelines | More adaptable solutions matching diverse requirements |

| Best For | Customers seeking simplicity and direct access | Individuals needing customized coverage and options |

Understanding Direct Writers in Insurance

Direct writers in insurance are companies that sell policies exclusively through their own employees or online platforms, bypassing independent agents. This model enhances control over pricing, underwriting, and customer service, often resulting in streamlined policy issuance and potentially lower premiums. Direct writers prioritize uniformity in coverage options but may offer limited flexibility compared to policies sourced through independent agents who represent multiple insurers.

Who Are Independent Insurance Agents?

Independent insurance agents are licensed professionals who represent multiple insurance carriers, offering clients a wide range of policy options tailored to their individual needs. Unlike direct writers, who work exclusively for a single insurer, independent agents provide unbiased advice and compare coverage, pricing, and terms from various companies. Their ability to shop the market helps clients find competitive rates and customized solutions across auto, home, life, and commercial insurance sectors.

Key Differences Between Direct Writers and Independent Agents

Direct writers sell insurance policies exclusively for one company, offering streamlined services and often lower premiums due to company-specific underwriting. Independent agents represent multiple insurers, providing clients with a wider range of policy options tailored to diverse needs and competitive pricing. The primary difference lies in choice and flexibility: direct writers limit customers to their company's products, while independent agents deliver personalized comparisons across various carriers.

Pros and Cons of Choosing a Direct Writer

Choosing a direct writer in insurance offers benefits such as lower premiums due to reduced overhead and streamlined communication by dealing directly with the insurer. However, direct writers provide limited product options and lack personalized advice compared to independent agents who offer multiple carriers and tailored coverage solutions. This trade-off impacts customer flexibility and the ability to shop competitively across the insurance market.

Advantages and Disadvantages of Independent Agents

Independent agents offer the advantage of representing multiple insurance carriers, providing clients with a broader range of coverage options and competitive pricing tailored to diverse needs. They possess expertise in customizing policies and maintaining personalized client relationships, which enhances customer satisfaction and loyalty. However, independent agents may face limitations in access to certain exclusive products or carriers, and their commissions might be influenced by the carriers they represent, potentially affecting objectivity.

Cost Comparison: Direct Writer vs Independent Agent

Direct writers often offer lower premiums because they eliminate commissions paid to agents, resulting in more competitive pricing for policyholders. Independent agents provide access to multiple insurance carriers, which can lead to tailored coverage options that may initially appear pricier but offer long-term value through customized risk management. Evaluating total cost involves comparing upfront rates from direct writers with potential savings derived from independent agents' expertise in identifying optimal policies.

Customer Service: Which Model Performs Better?

Direct writers offer streamlined customer service through centralized support teams, ensuring consistent policy handling and quicker claim processing. Independent agents provide personalized service by representing multiple insurers, allowing tailored advice and flexible coverage options for diverse customer needs. Customer satisfaction often depends on the preference for standardized efficiency versus customized guidance in insurance interactions.

Which Offers More Policy Options?

Independent agents offer a broader range of policy options by representing multiple insurance carriers, allowing clients to compare various coverage plans and prices tailored to their specific needs. Direct writers are typically tied to a single company, limiting the variety of available policies and potentially affecting the customization of insurance solutions. Consumers seeking diverse coverage choices and competitive rates often benefit more from independent agents' extensive market access.

How Claims Handling Differs Between Direct Writers and Independent Agents

Direct writers process claims through centralized company-managed systems, ensuring uniform claim handling and faster settlements due to streamlined procedures. Independent agents act as intermediaries who advocate on behalf of policyholders, providing personalized claims support and facilitating communication with multiple insurance carriers. The key difference lies in direct writers offering standardized claim experience while independent agents deliver tailored assistance and flexibility based on clients' insurance portfolios.

Choosing the Right Insurance Channel for Your Needs

Direct writers offer lower premiums by selling insurance policies directly from the company, ensuring streamlined communication and faster claims processing. Independent agents provide access to multiple insurance carriers, enabling personalized coverage options tailored to diverse needs and competitive pricing. Selecting the right insurance channel requires evaluating preferences for price savings, variety of policy options, and the level of personalized service desired.

Important Terms

Captive Agent

A Captive Agent exclusively represents one insurance company, offering products solely from that direct writer, which often provides streamlined underwriting and sales processes. Independent Agents work with multiple insurers, enabling them to compare various policies and deliver customized coverage options to clients.

Exclusive Agency

Exclusive Agency insurance policies grant agents the right to sell policies for one insurer, contrasting with independent agents who represent multiple carriers, including direct writers who operate under a single company structure without intermediaries. Direct writers emphasize streamlined communication and pricing efficiency, while exclusive agents leverage brand allegiance, and independent agents provide consumers a comparative selection from diverse insurers.

Brokerage Channel

Brokerage channels leverage independent agents who offer a wide range of insurance products from multiple carriers, providing clients with diversified options and tailored coverage solutions. Direct writers, in contrast, sell insurance policies exclusively through company-employed agents or online platforms, often focusing on standardized products and streamlined customer service.

MGA (Managing General Agent)

An MGA (Managing General Agent) acts as an intermediary between insurance carriers and agents, often holding underwriting authority to bind coverage, which contrasts with direct writers who sell insurance exclusively for one company without agent intermediaries. Independent agents represent multiple insurers and rely on MGAs for access to specialized markets, whereas direct writers bypass agents to streamline underwriting and sales processes.

Distribution Channel

A distribution channel in insurance involves the pathway through which policies reach customers, where direct writers sell policies exclusively through company-employed agents ensuring consistent branding and control, while independent agents represent multiple insurers, offering clients diverse options and competitive pricing. Understanding the efficiency and customer reach of direct writers versus the broader market access provided by independent agents is crucial for optimizing sales strategies and customer satisfaction.

Commission Structure

Direct writers typically operate under a fixed salary or have a lower commission rate paid directly by the insurance company, resulting in more predictable but potentially limited earnings. Independent agents earn higher commissions from multiple insurers by selling various policies, offering greater income potential and flexibility in client options.

Underwriting Authority

Underwriting authority determines the extent to which Direct Writers or Independent Agents can assess and approve insurance applications without carrier approval, with Direct Writers typically having more centralized underwriting control. Independent Agents often operate under limited underwriting authority, relying on carrier guidelines and obtaining approvals to customize insurance solutions for diverse clients.

Carrier Affiliation

Carrier affiliation determines whether an insurance professional acts as a direct writer, representing a single insurer with exclusive policies, or as an independent agent, offering products from multiple carriers to provide clients with diverse coverage options. Direct writers benefit from proprietary underwriting tools and streamlined claims services, while independent agents leverage their multi-carrier relationships to tailor solutions and compare rates across the market.

Market Access

Market access strategies differ significantly between direct writers and independent agents, with direct writers focusing on proprietary distribution channels to control pricing and customer experience, while independent agents leverage their network to provide clients with a diverse range of insurance products from multiple carriers. Choosing between these models affects underwriting efficiency, risk segmentation, and customer acquisition costs, influencing competitive positioning in the insurance industry.

Binding Authority

Binding authority allows a direct writer to issue insurance policies and bind coverage on behalf of an insurer, streamlining the underwriting process. Independent agents typically lack binding authority, requiring insurer approval before finalizing coverage, which can impact turnaround time and client service efficiency.

Direct Writer vs Independent Agent Infographic

moneydif.com

moneydif.com