Indemnity in insurance refers to the compensation provided to restore the insured to their original financial position after a loss, while liability pertains to the legal responsibility for damages or injuries caused to others. Indemnity policies aim to cover the actual loss amount, whereas liability insurance protects against claims and legal judgments for which the insured is found responsible. Understanding the distinction between indemnity and liability is crucial for selecting appropriate coverage that aligns with risk management needs.

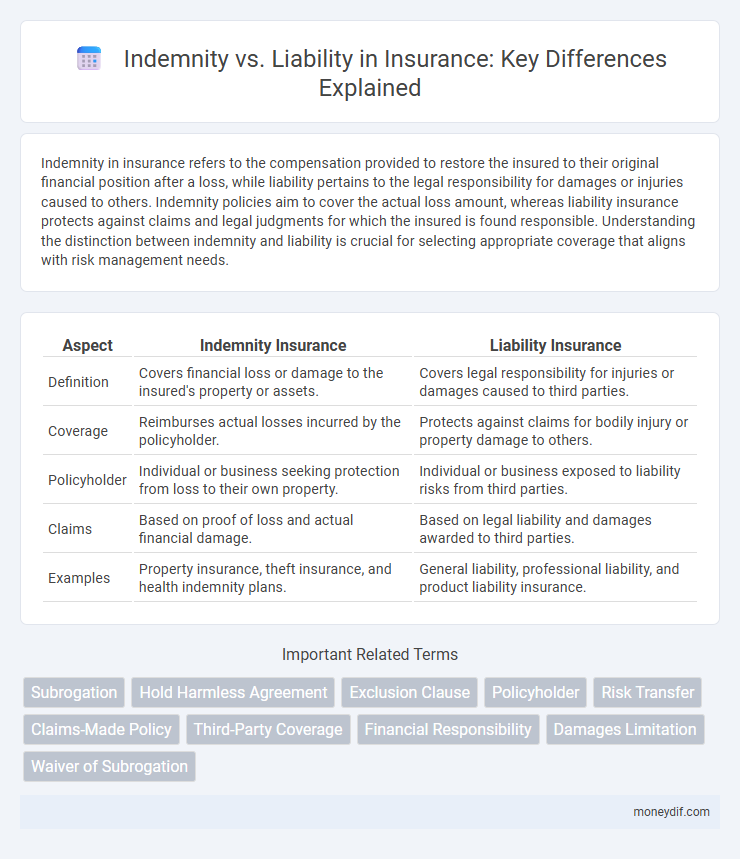

Table of Comparison

| Aspect | Indemnity Insurance | Liability Insurance |

|---|---|---|

| Definition | Covers financial loss or damage to the insured's property or assets. | Covers legal responsibility for injuries or damages caused to third parties. |

| Coverage | Reimburses actual losses incurred by the policyholder. | Protects against claims for bodily injury or property damage to others. |

| Policyholder | Individual or business seeking protection from loss to their own property. | Individual or business exposed to liability risks from third parties. |

| Claims | Based on proof of loss and actual financial damage. | Based on legal liability and damages awarded to third parties. |

| Examples | Property insurance, theft insurance, and health indemnity plans. | General liability, professional liability, and product liability insurance. |

Understanding Indemnity and Liability in Insurance

Indemnity in insurance ensures policyholders are compensated for actual financial losses incurred due to covered events, restoring them to their pre-loss position. Liability insurance protects against legal obligations arising from claims of negligence, bodily injury, or property damage caused to third parties. Understanding the difference between indemnity's focus on loss reimbursement and liability's role in legal defense and settlement is crucial for selecting appropriate coverage.

Key Differences Between Indemnity and Liability Coverage

Indemnity coverage reimburses the insured for losses or damages suffered, ensuring financial restoration after a covered event, while liability coverage protects the insured from legal responsibility for injury or property damage caused to others. Indemnity typically applies to first-party claims involving direct loss, whereas liability addresses third-party claims arising from negligence or fault. Indemnity limits are often based on the actual value of the loss, contrasting with liability coverage limits, which are defined by policy terms covering legal defense and settlements.

How Indemnity Insurance Works

Indemnity insurance provides financial protection by reimbursing policyholders for losses or damages incurred, ensuring they are restored to their pre-loss financial position. It covers expenses related to property damage, theft, or medical costs, up to the policy limits, without granting profit from the claim. This type of insurance contrasts with liability insurance, which safeguards against legal responsibilities arising from injuries or damages caused to third parties.

How Liability Insurance Protects Policyholders

Liability insurance protects policyholders by covering legal expenses and damages if they are found responsible for injuries or property damage to others. This coverage ensures individuals and businesses avoid financial hardship from lawsuits, including settlement costs and court fees. Unlike indemnity insurance, liability insurance specifically addresses third-party claims, safeguarding assets against liability risks.

Common Scenarios for Indemnity Claims

Common scenarios for indemnity claims often arise when policyholders face financial losses due to property damage, theft, or natural disasters, triggering indemnity provisions in property insurance. In professional liability insurance, indemnity claims frequently occur when a client sues for errors, omissions, or negligence causing financial harm, requiring the insurer to cover defense costs and settlements. Automobile insurance policies commonly generate indemnity claims after accidents result in vehicle damage or bodily injury, where the insurer compensates the insured or third parties according to policy limits.

Real-Life Examples of Liability Claims

Liability insurance covers damages or injuries a policyholder causes to others, exemplified by a driver at fault in a car accident paying for the other party's medical bills and property repairs. Indemnity insurance, often found in professional contexts like medical malpractice, reimburses the insured for losses or claims from negligent acts rather than third-party damages. Real-life liability claims often involve slip-and-fall incidents in retail stores or dog bite cases where the property owner or pet owner is held financially responsible.

Advantages and Limitations of Indemnity Insurance

Indemnity insurance offers the advantage of reimbursement for actual financial losses, ensuring policyholders are restored to their prior position without profiting from the claim, which promotes fairness and reduces fraud risk. It provides flexibility by covering a wide range of losses based on actual damages incurred, but its limitations include potential disputes over claim valuation and delays in payouts due to the need for damage assessment. Unlike liability insurance, indemnity insurance typically does not cover legal defense costs or third-party claims, focusing solely on compensating direct losses to the insured.

Pros and Cons of Liability Insurance

Liability insurance offers protection against claims resulting from injuries and damage to people or property, minimizing financial risk for policyholders. Its main advantage is coverage for legal fees and settlements, which can be substantial in lawsuits, but it often excludes intentional damage and may have policy limits that leave some losses uncovered. The cost-effectiveness and peace of mind it provides are weighed against possible premium increases following claims and potential exclusions in the coverage.

Choosing the Right Coverage: Indemnity vs Liability

Choosing the right insurance coverage requires understanding the key differences between indemnity and liability policies. Indemnity insurance reimburses policyholders for losses or damages incurred, commonly used in professional and medical sectors to cover claims related to errors or negligence. Liability insurance, on the other hand, protects against legal claims arising from bodily injury or property damage, making it essential for businesses and individuals exposed to third-party risks.

Factors to Consider When Selecting Insurance Policies

When selecting insurance policies, it is essential to consider whether the coverage focuses on indemnity or liability, as indemnity policies reimburse actual losses while liability policies protect against legal claims and damages owed to third parties. Key factors include the nature of potential risks, the scope of coverage limits, and the financial impact of claims or lawsuits specific to the insured's industry or personal circumstances. Understanding policy terms like exclusions, deductibles, and claim settlement processes helps ensure the chosen insurance aligns with risk exposure and financial protection needs.

Important Terms

Subrogation

Subrogation allows an insurer to recover costs from a third party responsible for a loss after indemnifying the insured, effectively transferring the insured's legal rights to pursue reimbursement. This principle distinguishes indemnity, which compensates the insured for loss, from liability, which establishes legal responsibility for causing the loss.

Hold Harmless Agreement

A Hold Harmless Agreement shifts liability from one party to another by requiring the indemnifying party to cover potential damages, effectively minimizing legal exposure for the indemnified party. This contract differs from general indemnity clauses by explicitly specifying the scope of liability protection, ensuring clarity in risk allocation between involved entities.

Exclusion Clause

An exclusion clause limits or excludes liability under a contract, often reducing the scope of indemnity obligations by specifying circumstances where indemnification is not applicable. Understanding the distinction between indemnity, which involves compensation for loss, and liability, the legal responsibility for damages, is critical when drafting or enforcing exclusion clauses.

Policyholder

Policyholder protections under indemnity insurance involve reimbursement for covered losses, ensuring financial recovery without direct admission of fault, whereas liability insurance addresses legal obligations for damages or injuries caused to third parties, protecting the policyholder from lawsuits and claims. Understanding the distinctions between indemnity and liability coverage is crucial for policyholders to select appropriate insurance solutions tailored to risk exposure.

Risk Transfer

Risk transfer involves shifting potential financial loss from one party to another, primarily through indemnity agreements and liability clauses that define responsibility for damages. Indemnity focuses on compensation for losses incurred, while liability establishes legal obligation for harm caused, both playing crucial roles in risk management strategies.

Claims-Made Policy

A Claims-Made Policy provides coverage for claims reported during the policy period, focusing on the timing of the claim rather than the incident date, which contrasts with occurrence policies. Indemnity refers to the insurer's obligation to compensate the insured for losses, while liability represents the legal responsibility for damages caused to others, both critical in determining policy limits and coverage scope.

Third-Party Coverage

Third-party coverage protects an insured party by covering claims made by others for damages or injuries, focusing on liability rather than indemnity. Indemnity involves compensating the insured for losses, whereas liability coverage addresses the insured's legal responsibility to third parties.

Financial Responsibility

Financial responsibility in indemnity involves a party agreeing to compensate for specific losses or damages, ensuring protection against potential claims. Liability imposes a legal obligation to repay damages or injuries caused, often resulting in direct financial accountability under insurance or contractual terms.

Damages Limitation

Damages limitation in indemnity versus liability clauses defines the maximum financial exposure parties agree to, often capping recoverable losses to manage risk in contracts. Indemnity provisions typically require one party to cover specific damages or losses incurred by another, while liability limitations restrict overall damages each party must pay regardless of fault or indemnity obligations.

Waiver of Subrogation

Waiver of Subrogation prevents an insurer from seeking reimbursement from the responsible third party after indemnifying the insured, effectively shifting financial responsibility away from the indemnified party. This differs from liability, which assigns legal responsibility for damages, as waiver of subrogation primarily affects post-loss recovery rights rather than establishing fault.

Indemnity vs Liability Infographic

moneydif.com

moneydif.com