A deductible is the amount a policyholder pays out-of-pocket before the insurance company covers the remaining claim costs, directly reducing the insurer's liability. Self-insured retention (SIR) requires the insured to handle claims and expenses up to a specified limit before the insurer's involvement begins, often requiring the policyholder to manage claim administration. Understanding the difference between deductible and SIR is crucial for businesses to effectively control risk exposure and insurance costs.

Table of Comparison

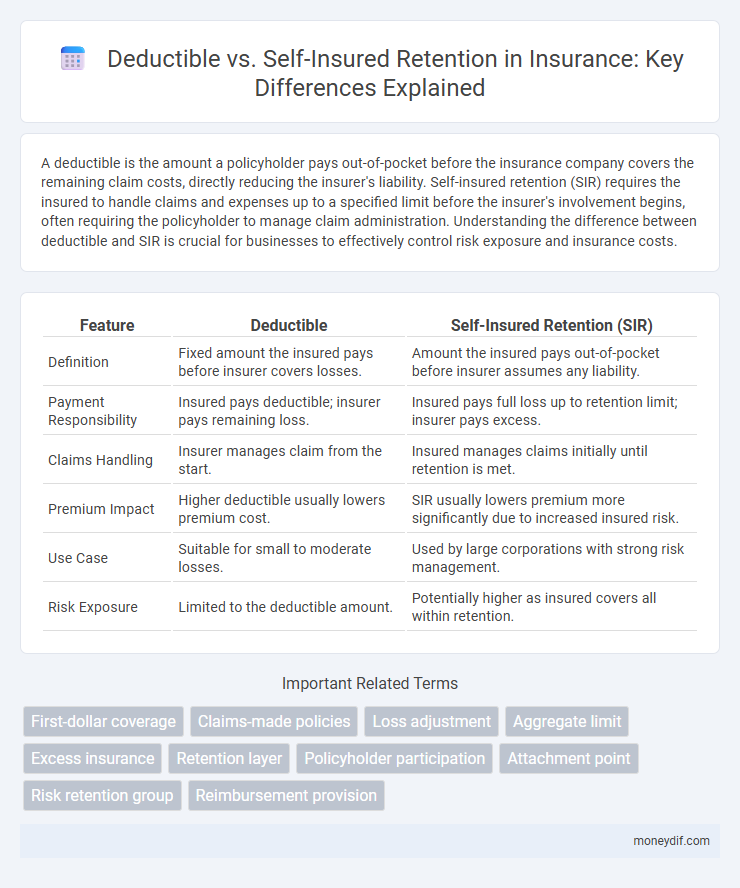

| Feature | Deductible | Self-Insured Retention (SIR) |

|---|---|---|

| Definition | Fixed amount the insured pays before insurer covers losses. | Amount the insured pays out-of-pocket before insurer assumes any liability. |

| Payment Responsibility | Insured pays deductible; insurer pays remaining loss. | Insured pays full loss up to retention limit; insurer pays excess. |

| Claims Handling | Insurer manages claim from the start. | Insured manages claims initially until retention is met. |

| Premium Impact | Higher deductible usually lowers premium cost. | SIR usually lowers premium more significantly due to increased insured risk. |

| Use Case | Suitable for small to moderate losses. | Used by large corporations with strong risk management. |

| Risk Exposure | Limited to the deductible amount. | Potentially higher as insured covers all within retention. |

Understanding Deductibles in Insurance

A deductible is the fixed amount a policyholder must pay out-of-pocket before an insurance company covers a claim, reducing the insurer's risk and premium costs. Unlike self-insured retention (SIR), where the policyholder is responsible for all losses up to a certain threshold and the insurer steps in afterward, deductibles are typically paid directly to the insurer at the time of the claim. Understanding deductible amounts and their impact on premium pricing is essential for optimizing coverage and managing financial exposure in insurance policies.

What is Self-Insured Retention (SIR)?

Self-Insured Retention (SIR) is the amount a policyholder must pay out-of-pocket before their insurance coverage kicks in, functioning similarly to a deductible but often involving the insurer's prior knowledge and consent for claims. Unlike a deductible, where the insurer pays losses immediately and then deducts the amount from the claim payment, SIR requires the policyholder to manage and pay initial claim costs directly, increasing their risk exposure. SIR is commonly used in commercial insurance policies to encourage risk management and reduce premium costs by shifting initial financial responsibility to the insured.

Key Differences Between Deductible and SIR

Deductible and self-insured retention (SIR) both refer to amounts the insured must pay before coverage applies, but deductibles are paid by the insurer on the insured's behalf, whereas SIR requires the insured to directly handle and pay for claims up to the retention limit. Deductibles typically reduce the insurer's liability by a fixed amount, while SIRs often involve the insured managing claim payments and claims handling initially, potentially leading to more control but increased administrative responsibility. Key differences include payment timing, claims management responsibilities, and the impact on premium costs, with SIRs generally resulting in lower premiums but higher risk exposure for the insured.

Pros and Cons of Deductibles

Deductibles reduce premium costs by requiring policyholders to pay a set amount before insurance coverage begins, encouraging responsible claims management and lowering small claim frequency. However, high deductibles can lead to significant out-of-pocket expenses and potential financial strain during unexpected losses, limiting immediate access to funds. Deductibles offer predictable cost-sharing but may discourage filing smaller claims, impacting overall risk mitigation effectiveness.

Advantages and Disadvantages of SIR

Self-Insured Retention (SIR) allows policyholders to control claims management and reduce premium costs by retaining a specific amount before insurance coverage applies, offering potential cash flow benefits and enhanced risk management. However, SIR exposes organizations to higher financial risk and cash flow impact due to the responsibility of paying initial claims out-of-pocket, which can strain budgets and delay claim settlements. Unlike deductibles, SIR often requires the insured to handle claim investigations and defense costs, increasing administrative burdens but allowing greater oversight over claims processes.

Impact on Premiums: Deductible vs SIR

Deductibles typically lower insurance premiums by shifting a portion of the initial claim cost to the insured, incentivizing risk management and reducing insurer exposure. Self-Insured Retentions (SIRs) usually result in even greater premium reductions compared to deductibles because insureds handle claim settlements up to the SIR amount before insurer involvement. The larger the deductible or SIR, the more significant the premium impact, reflecting the risk assumed by policyholders.

Claims Handling: Deductible vs Self-Insured Retention

In claims handling, a deductible requires the insurance company to manage the entire claim from the start, with the insured paying a set amount before coverage applies. With self-insured retention (SIR), the insured assumes responsibility for claim investigation, defense, and settlement up to the retention limit, only involving the insurer after that threshold. This difference impacts how claims are processed, the insured's control level, and the insurer's engagement timing.

When to Choose Deductible Over SIR

Choosing a deductible over a self-insured retention (SIR) is ideal for businesses seeking straightforward claims payment where the insurer handles defense costs from the first dollar. Deductibles simplify risk management by reducing upfront financial exposure while maintaining an insurer's control over claims processes. This option suits companies preferring predictable out-of-pocket expenses and less administrative responsibility compared to the extensive claims handling required under SIR policies.

Ideal Scenarios for Self-Insured Retention

Self-Insured Retention (SIR) is ideal for organizations with strong risk management capabilities and sufficient cash flow to cover initial claim costs before insurance coverage kicks in. Companies facing frequent, low-severity claims benefit from SIR by reducing premium expenses while retaining control over claims handling. Large corporations with robust claims departments often prefer SIR to customize risk management strategies and optimize long-term cost savings.

Which Option is Best for Your Business?

Choosing between a deductible and a self-insured retention (SIR) depends on your business's risk tolerance and cash flow. Deductibles require you to pay a fixed amount upfront before insurance coverage kicks in, offering more predictable out-of-pocket costs. Self-insured retention involves covering losses up to a higher threshold before the insurer pays, often benefiting businesses with strong claims management and sufficient reserves to handle larger, less frequent claims.

Important Terms

First-dollar coverage

First-dollar coverage eliminates out-of-pocket costs by paying claims from the first dollar without applying a deductible or self-insured retention, unlike policies with deductibles or self-insured retentions that require initial cost-sharing by the insured.

Claims-made policies

Claims-made policies often apply deductibles that the insurer pays before coverage begins, whereas self-insured retention (SIR) requires the insured to cover losses up to the retention limit before the insurer's obligation commences.

Loss adjustment

Loss adjustment involves determining claim costs after the deductible is paid by the insured, whereas self-insured retention requires the insured to cover losses up to the retention limit before insurance coverage applies.

Aggregate limit

The aggregate limit caps the total insurance payout within a policy period, while the deductible is the insured's initial out-of-pocket expense per claim and the self-insured retention (SIR) is the amount the insured must pay before the insurer's obligation begins, often influencing overall risk retention strategies.

Excess insurance

Excess insurance provides coverage beyond the limits of the underlying policy, activating only after the primary policy's limit is exhausted, whereas a deductible requires the insured to pay a specified amount before the insurer pays. Self-Insured Retention (SIR) functions similarly to a deductible but must be paid by the insured before the insurer is obligated to defend or indemnify, often resulting in different claims handling and reporting obligations.

Retention layer

The retention layer in insurance refers to the portion of risk covered by the policyholder through a deductible or a self-insured retention, where deductibles are paid per claim and self-insured retentions apply before insurer payment begins.

Policyholder participation

Policyholder participation in claims management differs as deductibles require payment from the insured before insurer coverage applies, while self-insured retention involves the insured covering all losses up to a specified amount before the insurer's obligation begins.

Attachment point

The attachment point is the threshold at which an insurance policy begins to pay, differing between deductible and self-insured retention (SIR) structures where the insured covers losses up to this amount before the insurer's liability activates. In deductible policies, insurers pay claims immediately and recover the deductible from the insured, whereas with SIR, the insured retains control and pays losses directly until the attachment point is met.

Risk retention group

A Risk Retention Group (RRG) typically uses a Self-Insured Retention (SIR) rather than a deductible, meaning the group retains and manages losses above a certain threshold before insurance coverage applies.

Reimbursement provision

Reimbursement provisions differ as deductibles require payers to cover claims up to a set amount before insurance applies, whereas self-insured retention mandates payers to manage and pay claims entirely until a retention limit is reached, impacting risk exposure and cash flow.

Deductible vs Self-Insured Retention Infographic

moneydif.com

moneydif.com