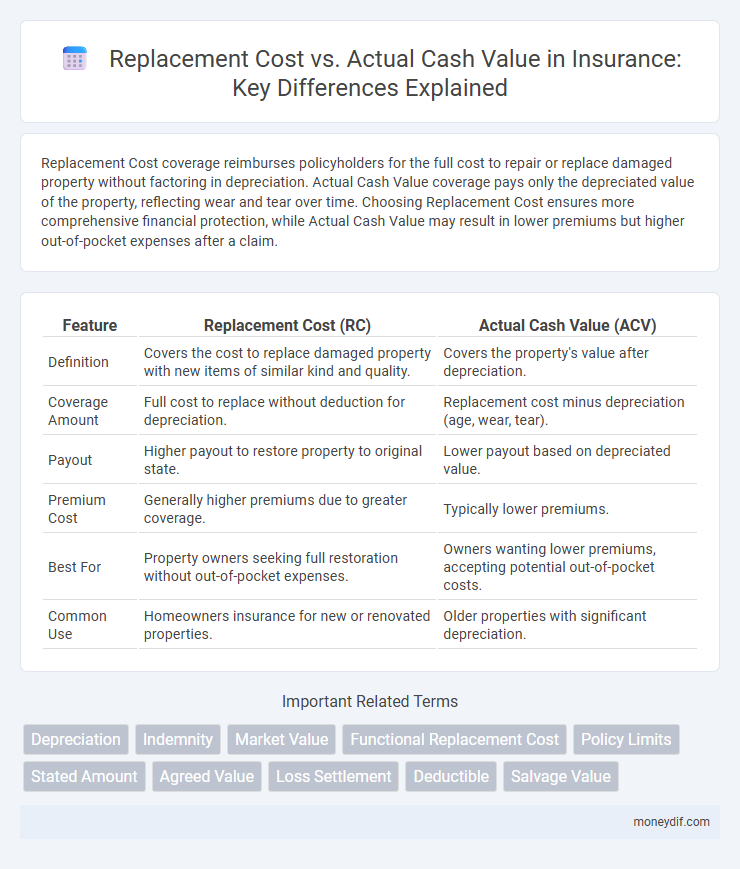

Replacement Cost coverage reimburses policyholders for the full cost to repair or replace damaged property without factoring in depreciation. Actual Cash Value coverage pays only the depreciated value of the property, reflecting wear and tear over time. Choosing Replacement Cost ensures more comprehensive financial protection, while Actual Cash Value may result in lower premiums but higher out-of-pocket expenses after a claim.

Table of Comparison

| Feature | Replacement Cost (RC) | Actual Cash Value (ACV) |

|---|---|---|

| Definition | Covers the cost to replace damaged property with new items of similar kind and quality. | Covers the property's value after depreciation. |

| Coverage Amount | Full cost to replace without deduction for depreciation. | Replacement cost minus depreciation (age, wear, tear). |

| Payout | Higher payout to restore property to original state. | Lower payout based on depreciated value. |

| Premium Cost | Generally higher premiums due to greater coverage. | Typically lower premiums. |

| Best For | Property owners seeking full restoration without out-of-pocket expenses. | Owners wanting lower premiums, accepting potential out-of-pocket costs. |

| Common Use | Homeowners insurance for new or renovated properties. | Older properties with significant depreciation. |

Understanding Replacement Cost and Actual Cash Value

Replacement Cost insurance reimburses the full amount needed to repair or replace damaged property without any deduction for depreciation, ensuring policyholders receive a payout that covers the current market price of materials and labor. Actual Cash Value (ACV) policies compensate for the damaged items based on their replacement cost minus depreciation, reflecting the item's depreciated value at the time of loss. Understanding the distinction between Replacement Cost and ACV is crucial for selecting the right coverage to adequately protect assets and avoid out-of-pocket expenses.

Key Differences Between Replacement Cost and Actual Cash Value

Replacement Cost covers the expense to repair or replace damaged property with new materials of similar kind and quality, without deducting depreciation. Actual Cash Value reimburses the current market value of the damaged item, factoring in depreciation based on age, wear, and tear. Policyholders selecting Replacement Cost coverage typically receive higher claim payouts compared to Actual Cash Value due to differences in valuation methods.

Pros and Cons of Replacement Cost Policies

Replacement Cost policies cover the full expense to repair or replace damaged property without deducting depreciation, ensuring complete restoration after loss. These policies typically result in higher premiums compared to Actual Cash Value plans but offer more comprehensive protection and peace of mind. The key drawback is the increased cost, which may not be cost-effective for older properties with lower replacement value.

Advantages and Drawbacks of Actual Cash Value Coverage

Actual Cash Value (ACV) coverage calculates claims based on the item's current market value, factoring in depreciation, resulting in lower premiums compared to Replacement Cost coverage. This approach minimizes upfront insurance costs but may leave policyholders with substantial out-of-pocket expenses when replacing damaged or stolen property. The primary drawback of ACV is that it often does not provide sufficient funds to purchase new items of similar quality, potentially leading to financial strain after a loss.

How Insurers Calculate Replacement Cost

Insurers calculate replacement cost by determining the amount needed to repair or replace damaged property with materials of similar kind and quality, without deducting depreciation. This value is based on current construction costs, labor rates, and local pricing factors to reflect the true cost of restoring the asset. Replacement cost ensures policyholders receive funds sufficient to rebuild or repair property at today's market rates rather than the depreciated value.

How Actual Cash Value is Determined

Actual Cash Value (ACV) in insurance is determined by subtracting depreciation from the replacement cost of an item at the time of the loss. Depreciation accounts for factors such as age, wear and tear, and market value reduction over time. This method ensures policyholders receive compensation reflecting the item's current worth rather than its original purchase price.

Common Scenarios: Replacement Cost vs Actual Cash Value

Replacement Cost insurance covers the full expense to repair or replace damaged property without deduction for depreciation, commonly seen in home or auto claims after accidents or natural disasters. Actual Cash Value policies pay the item's depreciated value at the time of loss, often applied in cases where property has aged or sustained partial damage. Choosing Replacement Cost is beneficial in scenarios involving newer property, while Actual Cash Value may suffice for older items with significant depreciation.

Factors Affecting Insurance Payouts

Insurance payouts depend heavily on whether the policy covers Replacement Cost or Actual Cash Value, influencing the amount reimbursed for damaged or lost property. Factors affecting these payouts include depreciation, item age, condition, and policy limits, with Replacement Cost ignoring depreciation and Actual Cash Value deducting it. Understanding these variables ensures accurate expectations for claim settlements and sufficient coverage for property restoration.

Which Option is Best for Homeowners?

Homeowners choosing between Replacement Cost and Actual Cash Value insurance should consider their financial goals and risks. Replacement Cost policies cover the full cost to rebuild or repair a home without deducting depreciation, offering better protection and peace of mind in case of significant damage. Actual Cash Value provides lower premiums but reimburses only the depreciated value, which may lead to higher out-of-pocket expenses after a loss.

Tips for Choosing the Right Coverage Type

Evaluate your property's current market value and depreciation to determine whether replacement cost or actual cash value coverage offers better financial protection; replacement cost covers rebuilding expenses without depreciation, while actual cash value reimburses the depreciated value. Consider your budget, risk tolerance, and potential out-of-pocket expenses during claim settlements to select coverage aligning with your needs. Consult with insurance professionals to review policy details and rider options ensuring optimal protection against loss.

Important Terms

Depreciation

Depreciation plays a crucial role in calculating Replacement Cost versus Actual Cash Value, where Replacement Cost reflects the expense to replace an asset without accounting for depreciation, while Actual Cash Value deducts accumulated depreciation to represent the asset's current market worth. Understanding this distinction is essential for accurate insurance claims and asset valuation, ensuring fair compensation based on asset wear and age.

Indemnity

Indemnity in insurance often involves choosing between Replacement Cost, which reimburses the full cost to replace damaged property without depreciation, and Actual Cash Value, which deducts depreciation based on the property's age and condition. Understanding this distinction ensures accurate claims settlement aligned with the policyholder's financial recovery needs.

Market Value

Market Value represents the estimated price a property would fetch in a competitive sale, often exceeding Replacement Cost, which calculates the expense to rebuild the property with similar materials. Actual Cash Value deducts depreciation from Replacement Cost, reflecting the property's current worth rather than its market or replacement expense.

Functional Replacement Cost

Functional Replacement Cost measures the expense to replace an asset with a new one that performs the same function but may use modern materials and methods, typically lower than Replacement Cost, which reflects the full, current cost of replacing the property exactly. Unlike Actual Cash Value that accounts for depreciation and wear, Functional Replacement Cost focuses on cost-efficiency by considering improvements and updates rather than restoring original features.

Policy Limits

Policy limits define the maximum amount an insurer will pay on a claim, directly impacting coverage under Replacement Cost and Actual Cash Value (ACV) policies. Replacement Cost policies reimburse the cost to replace damaged property without depreciation, while ACV policies pay the depreciated value, often resulting in lower claim payouts within the same policy limit.

Stated Amount

Stated Amount insurance provides coverage up to the declared value of the property, bridging the gap between Replacement Cost and Actual Cash Value by offering a predetermined limit that may not reflect depreciation like Actual Cash Value but also may not fully cover the Replacement Cost. This method helps policyholders avoid penalties from underinsurance while potentially saving on premiums compared to full Replacement Cost coverage.

Agreed Value

Agreed Value is a pre-determined insurance amount agreed upon by both the insurer and the insured, providing full payment without depreciation, unlike Actual Cash Value which deducts depreciation. Replacement Cost covers the expense to repair or replace property with new materials of similar kind and quality, often exceeding the lower Actual Cash Value, making Agreed Value beneficial for assets with fluctuating market prices or unique characteristics.

Loss Settlement

Loss settlement involves determining compensation based on Replacement Cost, which reflects the expense to rebuild or replace property without depreciation, versus Actual Cash Value, calculated by subtracting depreciation from the replacement cost, thus representing the property's current market value; insurers often offer Replacement Cost coverage to provide full recovery, while Actual Cash Value settlements result in lower payouts aligned with wear and age. Choosing between Replacement Cost and Actual Cash Value directly impacts claim payouts, affecting the insured's ability to restore damaged property to its original condition after a loss.

Deductible

The deductible in insurance policies affects the out-of-pocket cost when filing a claim, differing in impact between Replacement Cost and Actual Cash Value (ACV) coverage types. Replacement Cost policies reimburse the full cost to replace damaged property minus the deductible, whereas ACV policies pay the depreciated value of the item after subtracting the deductible, often resulting in lower claim payments.

Salvage Value

Salvage value represents the estimated residual worth of an asset at the end of its useful life, playing a crucial role in calculating depreciation under both Replacement Cost and Actual Cash Value (ACV) methods. Replacement Cost measures the expense to replace an asset without depreciation, while ACV deducts accumulated depreciation from the Replacement Cost, often considering salvage value as the asset's anticipated end value.

Replacement Cost vs Actual Cash Value Infographic

moneydif.com

moneydif.com