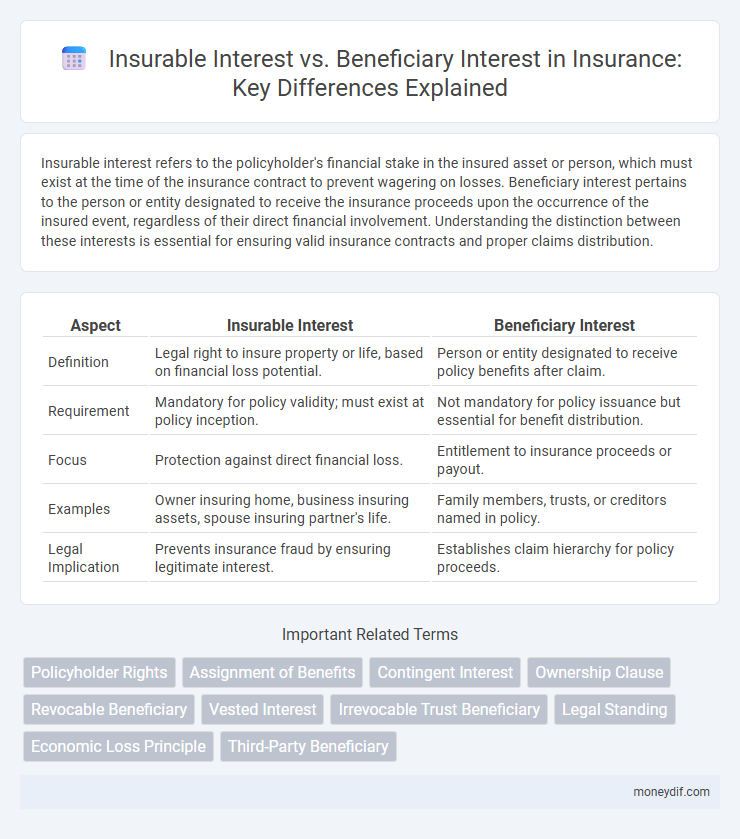

Insurable interest refers to the policyholder's financial stake in the insured asset or person, which must exist at the time of the insurance contract to prevent wagering on losses. Beneficiary interest pertains to the person or entity designated to receive the insurance proceeds upon the occurrence of the insured event, regardless of their direct financial involvement. Understanding the distinction between these interests is essential for ensuring valid insurance contracts and proper claims distribution.

Table of Comparison

| Aspect | Insurable Interest | Beneficiary Interest |

|---|---|---|

| Definition | Legal right to insure property or life, based on financial loss potential. | Person or entity designated to receive policy benefits after claim. |

| Requirement | Mandatory for policy validity; must exist at policy inception. | Not mandatory for policy issuance but essential for benefit distribution. |

| Focus | Protection against direct financial loss. | Entitlement to insurance proceeds or payout. |

| Examples | Owner insuring home, business insuring assets, spouse insuring partner's life. | Family members, trusts, or creditors named in policy. |

| Legal Implication | Prevents insurance fraud by ensuring legitimate interest. | Establishes claim hierarchy for policy proceeds. |

Defining Insurable Interest

Insurable interest refers to the legal right of a policyholder to purchase insurance on a subject, such as property or life, where they would suffer a financial loss if the insured event occurs. This concept ensures that insurance policies are tied to a legitimate economic stake, preventing wagering or speculative contracts. Defining insurable interest is crucial as it validates the policyholder's claim and safeguards the integrity of the insurance contract.

Understanding Beneficiary Interest

Beneficiary interest in insurance refers to the rights and benefits a named beneficiary receives from a policy upon the insured's death or specified event, distinct from the insurable interest held by the policyholder who must demonstrate a legitimate stake in the insured subject. The beneficiary interest ensures that proceeds are directed according to the insured's wishes, providing financial security to individuals or entities named in the policy. Understanding beneficiary interest is crucial for estate planning and claims processing, as it defines who legally receives the insurance payout and under what conditions.

Legal Foundations of Insurable Interest

Insurable interest is a fundamental legal principle requiring that the policyholder must have a legitimate stake in the insured subject to prevent wagering on losses. It ensures the insured party suffers a financial loss or legal detriment upon the occurrence of the insured event, underpinning contract validity and enforceability. The beneficiary interest, by contrast, relates to the right to receive proceeds under the policy and does not independently establish insurable interest.

Types of Beneficiaries in Insurance

Types of beneficiaries in insurance include primary, contingent, and tertiary beneficiaries, each with distinct rights to policy proceeds. Primary beneficiaries receive benefits first upon the insured event, while contingent beneficiaries inherit only if the primary beneficiary is deceased or disclaims the benefit. Policyholders designate these beneficiaries to ensure the insured sum is allocated according to their intentions, reflecting an essential aspect of beneficiary interest separate from insurable interest.

Key Differences Between Insurable and Beneficiary Interest

Insurable interest refers to the policyholder's financial stake in the insured subject, ensuring they suffer a loss if damage occurs, while beneficiary interest involves the rights of the designated beneficiary to receive policy proceeds upon the insured event. The key difference lies in insurable interest being a prerequisite for policy validity at inception, whereas beneficiary interest governs the entitlement to insurance benefits during claim settlement. Insurable interest safeguards against moral hazard, whereas beneficiary interest ensures proper distribution of insurance payments.

Importance of Insurable Interest in Policy Creation

Insurable interest is a fundamental requirement in insurance policy creation, ensuring the policyholder stands to suffer a financial loss from the insured event. This legal and financial stake prevents gambling on risks and protects against moral hazard, guaranteeing the legitimacy of the insurance contract. Beneficiary interest, while important, depends on the established insurable interest at inception, making insurable interest critical for policy validity and claim enforcement.

When Does Beneficiary Interest Arise?

Beneficiary interest arises when a designated individual or entity is named in an insurance policy to receive benefits upon the insured event, such as death or loss, occurring. This interest is established legally once the policyholder assigns the beneficiary, regardless of whether the beneficiary has a direct financial stake in the insured property or life. Unlike insurable interest, which must be present at the inception of the policy, beneficiary interest becomes effective upon the event triggering the insurance claim.

Common Scenarios: Insurable vs Beneficiary Interest

In insurance, insurable interest refers to the policyholder's financial stake in the insured asset, ensuring the motive to prevent loss, such as owning a home or business. Beneficiary interest pertains to the individual designated to receive benefits upon the insured event, commonly seen in life insurance policies where family members are named. Common scenarios include homeowners insuring their property (insurable interest) and naming a spouse or child as beneficiaries who will collect proceeds after the policyholder's death (beneficiary interest).

Legal Implications of Lack of Insurable Interest

Lack of insurable interest in an insurance policy renders the contract void and unenforceable as a matter of law, preventing the policyholder from claiming benefits. Courts generally require policyholders to possess a demonstrable financial stake in the insured property or life to prevent wagering and moral hazard. Without insurable interest, legal disputes often arise over the legitimacy of beneficiaries' claims, leading to policy rescission or denial of payouts.

Impact on Claims and Payouts

Insurable interest ensures the policyholder has a legitimate financial stake in the insured subject, directly influencing the validity of claims and payouts. Beneficiary interest determines who receives the policy benefits but does not affect the legitimacy of the claim itself. Without insurable interest, insurance claims are typically denied, while beneficiary interest governs the distribution of proceeds after a valid claim is paid.

Important Terms

Policyholder Rights

Policyholder rights establish that only parties with a legitimate insurable interest in the insured property or person at the policy's inception can initiate or maintain an insurance contract, ensuring the prevention of wagering on unrelated risks. Beneficiary interest, distinct from insurable interest, pertains to the designated individual or entity entitled to receive policy proceeds upon the insured event, with rights governed by the policy terms rather than ownership or financial stake in the insured subject.

Assignment of Benefits

Assignment of Benefits (AOB) enables policyholders to transfer their insurance claim rights to a third party, typically a contractor or service provider, allowing direct payment from the insurer. This process hinges on the insured's insurable interest in the property, whereas beneficiary interest pertains to a designated individual entitled to receive policy proceeds upon the insured's loss or death.

Contingent Interest

Contingent interest arises when a party's entitlement to a benefit depends on a specific event, contrasting with insurable interest, which requires a demonstrable financial loss or stake in the insured subject, while beneficiary interest denotes the right to receive benefits from a policy without necessarily holding insurable interest. In insurance law, insurable interest validates the policy, contingent interest dictates conditional future entitlements, and beneficiary interest ensures payout allocation.

Ownership Clause

An Ownership Clause in insurance policies defines the rights and control held by the policyowner, distinguishing it from the insurable interest, which requires the policyowner to have a legitimate financial stake in the insured property or person at the policy's inception. Beneficiary interest pertains to the rights of the named beneficiary to receive policy proceeds, which are separate from both the ownership rights and the insurable interest held by the policyowner.

Revocable Beneficiary

A revocable beneficiary designation allows the policyholder to change the beneficiary without consent, which contrasts with insurable interest where the policyholder must have a valid financial or emotional stake in the insured to prevent wagering on lives. Beneficiary interest refers to the rights of the named individual to receive the policy proceeds, but it does not require the same insurable interest at the time of naming if the beneficiary is revocable.

Vested Interest

Vested interest refers to a guaranteed, non-forfeitable right to benefits in a financial or insurance contract, contrasting with insurable interest, which is the legal requirement proving a financial stake in the insured subject to prevent wagering. Beneficiary interest pertains to the right of a designated individual to receive proceeds from a policy, which may exist regardless of insurable interest but depends on the vested interest to ensure entitlement.

Irrevocable Trust Beneficiary

An irrevocable trust beneficiary holds a vested interest in trust assets, distinct from insurable interest which is required by insurance law to prevent wagering on life or property. Insurable interest must exist at the policy inception but does not automatically confer beneficiary rights, as the trust's irrevocable nature secures the beneficiary's equitable interest separate from insurance contracts.

Legal Standing

Legal standing in insurance law hinges on insurable interest, which requires the policyholder to demonstrate a legitimate financial or emotional stake in the insured subject to prevent wagering; beneficiary interest, by contrast, pertains to the rights of the designated individual to receive policy benefits upon the insured event without necessarily having an insurable interest. Courts strictly enforce insurable interest at policy inception to validate claims, while beneficiary interest governs the distribution of proceeds post-loss.

Economic Loss Principle

The Economic Loss Principle limits insurance recovery to actual financial harm, emphasizing that insurable interest must exist at policy inception to prevent moral hazard. Beneficiary interest differs as it determines who receives the policy proceeds, but does not create insurable interest where none existed initially.

Third-Party Beneficiary

A Third-Party Beneficiary in insurance holds a legally recognized interest allowing them to receive policy benefits without owning the insurable interest, which is the insured's stake in the insured property or life. Insurable interest ensures the policyholder faces a genuine loss, whereas beneficiary interest defines who is entitled to claim proceeds, highlighting their distinct roles in contract enforceability and claims processing.

Insurable Interest vs Beneficiary Interest Infographic

moneydif.com

moneydif.com